- Home

- »

- Consumer F&B

- »

-

Frozen Dessert Market Size & Share, Industry Report, 2030GVR Report cover

![Frozen Dessert Market Size, Share & Trends Report]()

Frozen Dessert Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Ice Cream, Frozen Yogurt), By Distribution Channel, By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-916-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Frozen Dessert Market Summary

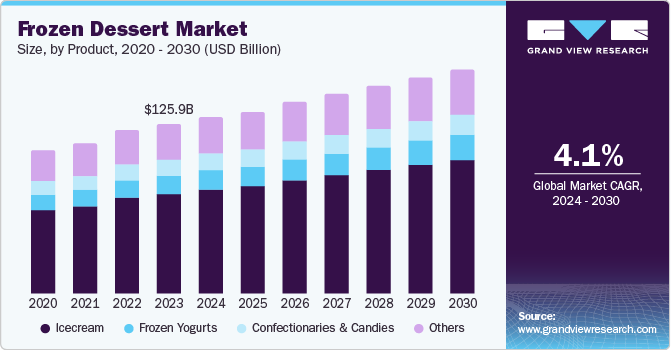

The global frozen dessert market size was estimated at USD 125.9 billion in 2023 and is projected to reach USD 166.7 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. This growth is attributed to rising disposable incomes and urbanization, particularly in developing regions such as Asia-Pacific.

Key Market Trends & Insights

- The North America frozen dessert market dominated the global market and accounted for the largest revenue share of 32.7% in 2023.

- The frozen dessert market in the U.S.is expected to grow significantly over the forecast period.

- By product, ice creams dominated the market and accounted for the largest revenue share of 58.8% in 2023.

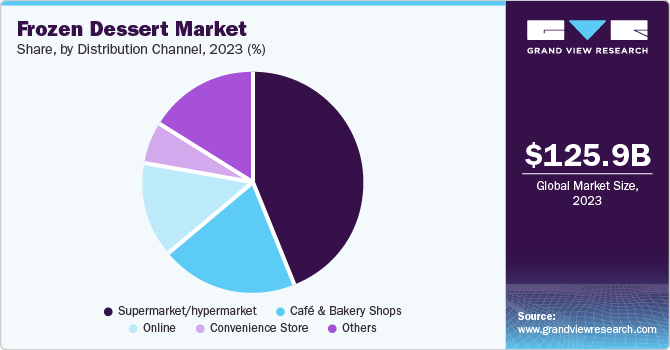

- By distribution channel, the supermarket/hypermarket led the market and accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 125.9 Billion

- 2030 Projected Market Size: USD 166.7 Billion

- CAGR (2024-2030): 4.1%

- North America: Largest market in 2023

Health-conscious consumers are increasingly seeking low-fat, low-sugar, and non-dairy options, while manufacturers innovate with unique flavors and premium ingredients. In addition, technological advancements in freezing and production processes enhance product quality, and sustainability concerns are shaping packaging and sourcing practices. Furthermore, the convenience of frozen desserts as standalone treats or in various desserts and beverages further fuels market expansion.

In addition, shifting consumer preferences toward convenient food options has played a crucial role in driving the market. Frozen desserts, including ice cream and frozen yogurt, are increasingly favored as meal accompaniments due to their diverse flavors and appealing taste profiles. Consumers have preferred customization options in their desserts to adjust toppings and flavors to suit their culinary preferences. Furthermore, market players have introduced innovative products with unique flavors and textures to meet consumer demand. Customizable scoops and diverse product offerings have increasingly attracted consumers, enhancing the market growth.

Moreover, the rising concerns about health and food choices owing to diabetes and obesity have resulted in consumers progressively consuming food items made from natural ingredients. The increasing consumer demand for sugar-free, fat-free frozen desserts has led major companies to invest heavily in research and development activities to manufacture products with natural ingredients and flavors. Manufacturers were further encouraged by consumers willing to pay premiums for natural ingredient-enhanced frozen desserts with their rising disposable incomes.

Product Insights

Ice creams dominated the market and accounted for the largest revenue share of 58.8% in 2023, owing to their large-scale popularity among all generations. Changing consumer tastes and health consciousness have driven demand for frozen desserts worldwide. Ice cream, being a popular choice, benefitted from this trend. People often consume ice cream after meals as an effective digestive aid. Sugar-free and handcrafted ice creams have gained huge popularity due to their health benefits. Furthermore, while taste and nutrition are important to ice cream consumers, the price, brand, and ambiance have played an important role in this market. Rising awareness about the health benefits of natural foods has led consumers to prefer ice cream made from natural ingredients and flavors. Companies such as Coca-Cola have expanded into frozen desserts, introducing low-calorie, vegan, and dairy-free options.

Frozen yogurt is expected to grow at the fastest CAGR during the forecast period. The growing consumer consciousness about health benefits drove demand for frozen yogurt as a more nutritious alternative to traditional ice cream. Due to its lower sugar and calorie content, people perceive it as a guilt-free dessert option. Furthermore, frozen yogurt offers a wide range of flavors and creative formulations. Consumers can add toppings and experiment with different tastes, enhancing their overall eating experience.

Distribution Channel Insights

The supermarket/hypermarket led the market and accounted for the largest revenue share in 2023. These markets are convenient one-stop destinations for grocery shopping. Their extensive reach and easy accessibility make them ideal for frozen dessert sales. Consumers can easily find a variety of frozen desserts, including ice creams, frozen yogurt, and other treats, during their routine shopping trips. These large retail outlets offer diverse frozen dessert brands, flavors, and packaging sizes. Shoppers can explore different options, compare prices, and make informed choices. The availability of various product categories attracts a broad customer base. Moreover, companies have increasingly invested in robust packaging to improve the shelf life of these frozen products.

Café and bakery shops are projected to grow at a CAGR of 4.3% during the forecast period. These establishments are strategically positioned in high-traffic areas, attracting footfall from diverse customer segments. They offer various frozen dessert options, including gelato and sorbet, specialty cakes, and parfaits. The variety appeals to different tastes and preferences, making them a popular choice for dessert lovers. Moreover, cafe and bakery shops prioritize freshness and quality. Consumers have increasingly preferred these outlets for freshly baked goods and artisanal frozen treats. The use of premium ingredients enhances the overall dessert experience.

Regional Insights

The North America frozen dessert market dominated the global market and accounted for the largest revenue share of 32.7% in 2023 attributed to the wider availability of various frozen dessert brands, ease of reading product labels, and convenience in comparing different products by consumers. Ice creams, in particular, emerged as the leading product category due to their diverse flavors and appeal. In addition, the rise in modern grocery retailing and online stores has fueled sales through of-trade channels.

U.S. Frozen Dessert Market Trends

The frozen dessert market in the U.S.is expected to grow significantly over the forecast period, owing to the shifting consumer tastes that increasingly favor frozen desserts, including ice cream and frozen yogurt. Customization options, diverse flavors, and easy availability have expanded the market. Furthermore, increasing demand for healthier options has led to the popularity of low-sugar and low-calorie desserts. Companies have increasingly introduced natural, chemical-free flavors, packaging, and formulation innovations.

Asia Pacific Frozen Dessert Market Trends

The Asia Pacific frozen dessert market is expected to grow at a CAGR of 5.3% over the forecast period. This growth is attributed to the growing urban population, changing lifestyles, rising disposable income, and changing weather conditions. The market witnessed a surge in innovative frozen dessert options, including exotic flavors and unique presentations from local and international brands. In addition, as health awareness spread, consumers sought out products aligned with their dietary goals. Protein-enriched desserts gained popularity among fitness enthusiasts, expanding the market.

China Pacific Frozen Dessert Market Trends

The frozen dessert market in China is expected to witness significant growth over the forecast period, owing to the rising population and changing lifestyle. Major companies have launched frozen dessert products in various flavors to improve their market penetration in the country. Furthermore, rising disposable income has resulted in consumers opting for frozen desserts made from premium and natural ingredients.

Europe Frozen Dessert Market Trends

The Europe frozen dessert market is expected to grow substantially over the forecast period. This growth is driven byconsumer preferences and authenticity. Specialty dessert shops gained prominence by emphasizing local and artisanal ingredients. Consumers have increasingly sought handmade and locally sourced products, favoring the quality and authenticity offered by these establishments. In addition, consumers have increasingly looked for frozen desserts with health benefits, including ingredients including probiotics, prebiotics, antioxidants, and protein. Simultaneously, others have favored artisanal and craft frozen desserts made from high-quality, locally sourced ingredients, emphasizing unique flavors and premium quality.

Key Frozen Dessert Company Insights

The global frozen dessert market is fairly fragmented. Some major companies in the frozen dessert market are Nestlé, Unilever, General Mills Inc., Dippin’ Dots LLC., Kellanova, and others. The presence of multiple brands and frequent product innovations is expected to create intense competition among major manufacturers due to moderate to high entry barriers. Companies have increasingly focused on launching new flavors by integrating different ingredients. They have heavily invested in marketing and distribution initiatives.

-

Blue Bell Creameries is an American food company specializing in ice cream. The company exclusively focuses on creating delicious frozen treats and sells over 250 frozen products. Blue Bell offers various flavors, including year-round favorites such as homemade vanilla, Dutch chocolate, and Southern Blackberry Cobbler.

-

Froneri is a global pure-play ice cream company operating in approximately 20 countries. It boasts a diverse portfolio of brands, including Häagen-Dazs, Oreo, and Cadbury. Its commitment to quality, sustainability, and consumer satisfaction drives its success.

Key Frozen Dessert Companies:

The following are the leading companies in the frozen dessert market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- Unilever

- General Mills Inc.

- Dippin’ Dots LLC.

- Kellanova

- China Mengniu Dairy Company Limited

- HANDEL'S HOMEMADE ICE CREAM

- Bassetts Ice Cream

- Froneri International Limited

- Blue Bell Creameries

Recent Developments

-

In May 2024, Blue Bell, a renowned ice cream company, launched a new flavor called A&W Root Beer Float Ice Cream. This product features a blend of rich vanilla ice cream and A&W Root Beer-flavored sherbet. Consumers can purchase the ice cream in half-gallon and pint sizes, which are currently sold in 23 states. Blue Bell offers nationwide shipping for those who wish to enjoy this flavor outside of the 23-state region.

-

In March 2024, Unilever announced its intention to expedite its Growth Action Plan (GAP) by divesting its ice cream business. The board’s rationale was that the ice cream sector provided the most effective platform for applying its innovation, marketing, and go-to-market capabilities.

Frozen Dessert Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 131.3 billion

Revenue forecast in 2030

USD 166.7 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Germany, Italy, Japan, India, Brazil, South Africa.

Key companies profiled

Nestlé; Unilever; General Mills Inc.; Dippin’ Dots LLC.; Kellanova; China Mengniu Dairy Company Limited; HANDEL'S HOMEMADE ICE CREAM; Bassetts Ice Cream; Froneri International Limited; Blue Bell Creameries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Frozen Dessert Market Report Segmentation

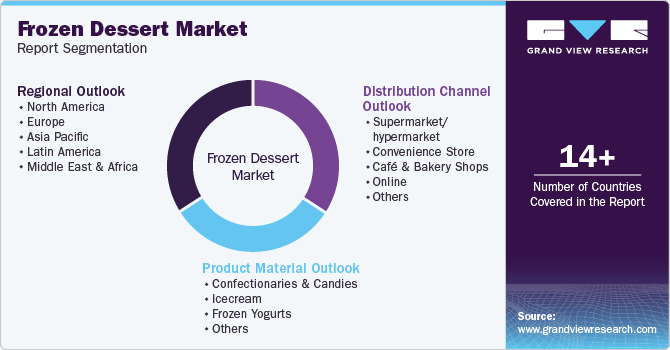

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global frozen dessert market report based on product, distribution channel, and region.

-

Product Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Confectionaries & Candies

-

Icecream

-

Frozen Yogurts

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/hypermarket

-

Convenience Store

-

Café & Bakery Shops

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

Italy

-

-

Asia Pacific

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.