- Home

- »

- Next Generation Technologies

- »

-

5G Services Market Size And Share, Industry Report, 2030GVR Report cover

![5G Services Market Size, Share & Trends Report]()

5G Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Communication Type (Fixed Wireless Access, eMBB, uRLLC, mMTC), By Vertical (Consumer, Enterprises), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-435-2

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Services Market Summary

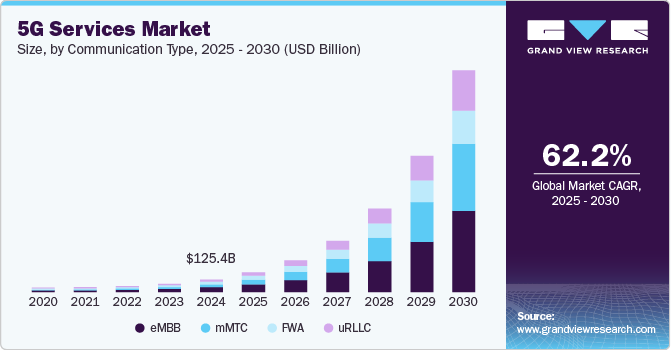

The global 5G services market size was estimated at USD 125.36 billion in 2024 and is projected to reach USD 2,208.25 billion by 2030, growing at a CAGR of 62.2% from 2025 to 2030. The increasing demand for faster download and upload speeds and consistent internet connectivity is the major driving factor behind the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the 5G services market with the largest revenue share of 41.3% in 2024.

- The 5G services market in the U.S. held a dominant position in 2024.

- Based on communication type, the enhanced mobile broadband (eMBB) segment led the market with the largest revenue share of 39.41% in 2024.

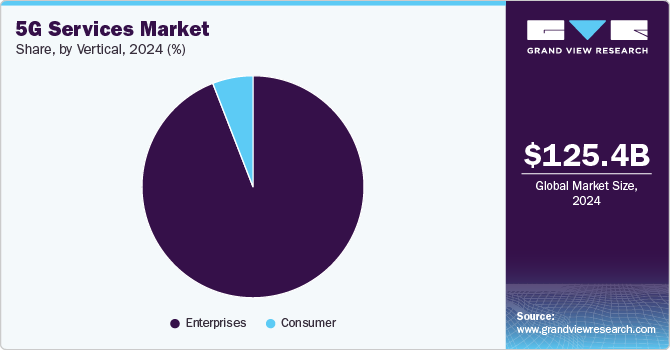

- Based on vertical, the enterprise segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 125.36 Billion

- 2030 Projected Market Size: USD 2,208.25 Billion

- CAGR (2025-2030): 62.2%

- Asia Pacific: Largest market in 2024

In addition, the rising demand for improved bandwidth connectivity with low latency for several mission-critical applications such as medical diagnostics and surgery, precision manufacturing, drone connectivity, vehicle-to-everything, and many other applications is also expected to contribute to the growth of the market. Furthermore, rising investments in 5G infrastructure worldwide by telecom operators, as well as various governments, are also boosting the market growth.

5G services provide enhanced user experience, including seamless video calling, Ultra-High Definition (UHD) video, as well as Augmented Reality (AR) and Virtual Reality (VR) for gaming. In addition, 5G networks offer significant improvements in speed, latency, and reliability compared to earlier generations of cellular wireless connectivity options, particularly for IoT infrastructures. The growing demand for IoT devices necessitates a fast and uninterrupted data connection, driving the need for 5G services. With its high-speed capabilities, scalability, and network-slicing features, 5G supports the massive connectivity requirements of IoT networks and enables efficient management of IoT devices.

Various governments across the globe are actively promoting the development and adoption of 5G services. For instance, in February 2023, the Minister of Finance of India announced plans to establish 100 labs in engineering institutions to develop applications that utilize 5G services. This initiative is expected to present numerous new opportunities for both businesses and employees. Such initiatives by governments across the globe are expected to drive the demand for 5G services from 2024 to 2030.

The increasing introduction of 5G FWA networks by several telecommunication companies and internet service providers to provide broadband services to a wider customer base across the world is further boosting the market’s growth. For instance, in August 2023, AT&T Inc. launched AT&T Internet Air, a fixed wireless home internet service over the reliable AT&T 5G wireless network. The AT&T Internet Air service has no price increase at 12 months, no overage fees, no annual contract, and no equipment fees. Such initiatives are expected to bode well for the growth of the 5G services industry.

Factors such as operational complexities, higher costs, and privacy & security concerns could hamper the growth of the 5G services industry. The growing demand for 5G services poses significant challenges to network infrastructure and capacity. As more devices connect through 5G IoT, the current infrastructure may become insufficient to handle the increased data traffic. In addition, the rising demand for cloud computing is expected to strain 5G networks further, potentially creating issues with spectrum allocation in the future. Moreover, the growing reliance on 5G networks poses significant cybersecurity challenges. The software-defined nature of 5G infrastructure makes it more vulnerable to hacking attempts, as software-based network functions can be more easily exploited compared to traditional hardware-based networks.

Communication Type Insights

Based on communication type, the enhanced mobile broadband (eMBB) segment led the market with the largest revenue share of 39.41% in 2024. The high share is attributed to the preliminary focus by 5G network operators on delivering enhanced broadband capabilities for applications, such as high-speed cloud-based gaming, AR/VR, UHD video, and uninterrupted video calls. The initial phase of the rollout is expected to focus on a 5G wireless non-standalone deployment model. eMBB provides extremely high data speeds for residential and commercial use. Thus, eMBB is expected to cater to several use cases, such as in-vehicle infotainment, 4K video access, and virtual meetings, thereby driving the segment's growth.

The massive machine-type communications (mMTC) segment is expected to witness at the fastest CAGR from 2025 to 2030. Massive machine-type communications are envisaged, catering to the growing need for a developed digital ecosystem. mMTC focuses on providing services for high connection density applications, such as smart buildings and smart cities. The growing need to ensure uninterrupted connectivity for all the IoT devices deployed in a network is anticipated to contribute to the growth of the mMTC segment from 2025 to 2030.

Vertical Insights

Based on vertical, the enterprise segment accounted for the largest revenue share in 2024. The growing need for ultra-fast connectivity and extremely low latency among enterprises drives the growth of the market. Compared to previous generations, 5G offers data speeds up to 100 times faster and latency as low as 1 millisecond. This performance is particularly beneficial for industries that rely on real-time data transmission, such as manufacturing, logistics, and financial services. For instance, real-time analytics, remote monitoring, and instant communication become more reliable, enhancing operational efficiency and responsiveness.

The consumer segment is expected to grow at the fastest CAGR from 2025 to 2030. This growth is attributed to the increasing commercialization of 5G services for consumer applications across various countries, including the U.S., China, Japan, Germany, and South Korea. The number of 5G subscribers is increasing at a faster rate since 5G provides lower latency, higher speed, and greater capacity as compared to 4G LTE networks.

Regional Insights

The 5G services market in North America held a significant share in 2024. Enterprises across North America are actively undergoing digital transformation, adopting advanced technologies such as IoT, AI, robotics, and cloud computing. These initiatives require high-performance connectivity that 4G networks often cannot support. 5G enables real-time data processing, automation, and remote operations, capabilities crucial for industries such as manufacturing, logistics, healthcare, and retail. As a result, enterprises are increasingly turning to 5G to support their evolving business models and maintain competitiveness.

U.S. 5G Services Market Trends

The 5G services market in the U.S. held a dominant position in 2024, due to the vast presence of 5G services providers such as AT&T, Inc., T-Mobile USA, Inc., and Verizon Communications, Inc., which is the major driving factor behind the market growth in the country.

Asia Pacific 5G Services Market Trends

Asia Pacific dominated the 5G services market with the largest revenue share of 41.3% in 2024. Key market companies in APAC, such as China Telecom Corporation Limited, China Mobile Limited, SK Telecom, and KT Corp., are investing aggressively in rolling out 5G network infrastructure in China, Japan, and South Korea. Most of these investments are for the deployment of next-generation infrastructure for media & entertainment, transportation & logistics, healthcare, and manufacturing industry verticals. These investments are expected to propel the growth of the Asia Pacific regional market from 2025 to 2030. Moreover, the high demand for smartphones supporting higher data speeds has resulted in robust production of 5G-enabled smartphones across the region.

The 5G services market in Japan is expected to grow at a rapid CAGR over the forecast period. In Japan, major telecom operators have launched 5G networks in major cities, offering high-speed connectivity and enhanced user experiences. There is a strong focus on leveraging 5G to drive industrial transformation across sectors such as manufacturing, transportation, and healthcare.

The China 5G services market held a substantial market share in 2024. The 5G services industry in China continues to mature, leading to both broader economic value and increased connections. Rapid 5G adoption in the country is propelled by the swift deployment of networks and the development of a mature device ecosystem.

Europe 5G Services Market Trends

The 5G services market in Europe was identified as a lucrative region in 2024. Telecom operators across Europe are actively rolling out 5G networks, aiming to provide seamless connectivity and enable transformative technologies. Telecom operators such as Vodafone Group Plc, Deutsche Telekom AG, and Telefónica, S.A. are some of the prominent companies in the 5G deployment across Europe. Thus, the increasing availability of 5G networks across the region is boosting the market’s growth.

The UK 5G services market is expected to grow at a rapid CAGR during the forecast period, due to the availability of 5G services as it is growing across the country. For instance, according to the Office of Communications (Ofcom) Connected Nations, UK Report 2023, as of September 2023, the number of 5G deployments in the UK had increased to over 18,500, up from about 12,000 reported in 2022. These deployments were spread across approximately 81,000 sites in the country.

The 5G services market in Germany held a substantial market share in 2024, owing to factors such as growing digitalization across various industries, the presence of major 5G services providers, and the adoption of 5G technologies in sectors such as manufacturing and IT, and telecom are driving the market growth.

Key 5G Services Company Insights

Some of the key companies in the 5G services industry include AT&T, Inc., China Mobile Limited, Verizon Communications Inc., Deutsche Telekom AG, Vodafone Group Plc, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Deutsche Telekom AG is a telecommunications service provider in Germany. The company offers fixed-network/broadband, internet, mobile, and internet-based TV services and products for consumers and information and communication technology solutions for corporate and business customers.

-

British Telecommunications plc is a connectivity service provider. It provides global businesses with connectivity, networking, and security solutions. The company’s customers span a wide range of customer segments, such as consumer customers, business customers, and communication providers.

Key 5G Services Companies:

The following are the leading companies in the 5G services market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T, Inc.

- British Telecommunications plc

- China Mobile Ltd.

- China Telecom Corporation Ltd.

- Bharti Airtel Limited

- KT Corp.

- Saudi Telecom Company

- Vodafone Group Plc

- Deutsche Telekom AG

- SK Telecom Co., Ltd.

- Verizon Communications, Inc.

- NTT DOCOMO

- T-Mobile USA, Inc.

- Rakuten Mobile Inc.

Recent Developments

-

In February 2025, Bharti Airtel partnered with Ericsson to deploy advanced 5G Core technology, marking a significant step in its transition to a full-scale 5G Standalone (SA) network in India. This collaboration builds on their 25-year relationship and aims to enhance Airtel's network capacity, enabling the delivery of innovative and differentiated services for millions of customers and enterprises. Ericsson's dual-mode 5G Core solutions will support Airtel in monetizing its network through features such as network slicing and API exposure, unlocking new use cases for consumers and businesses.

-

In June 2023, AT&T, Inc. and Cisco Systems, Inc. entered into a strategic collaboration aimed at assisting businesses in enhancing connectivity to meet the growing needs of a workforce that relies heavily on mobile devices. Together, these companies are looking forward to providing SD-WAN connectivity along with additional services, such as 5G and broadband, ensuring that businesses of all scales can experience an optimized and seamless experience.

5G Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 196.42 billion

Revenue forecast in 2030

USD 2,208.25 billion

Growth rate

CAGR of 62.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2020 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Communication type, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Italy; Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

AT&T, Inc.; British Telecommunications plc; China Mobile Ltd.; China Telecom Corporation Ltd.; Bharti Airtel Limited; KT Corp.; Saudi Telecom Company; Vodafone Group Plc; Deutsche Telekom AG; SK Telecom Co., Ltd.; Verizon Communications, Inc.; NTT DOCOMO; T-Mobile USA, Inc.; Rakuten Mobile Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2030. For this study, Grand View Research has segmented the global 5G services market report based on communication type, vertical, and region.

-

Communication Type Outlook (Revenue, USD Million, 2020 - 2030)

-

Fixed Wireless Access (FWA)

-

Enhanced Mobile Broadband (eMBB)

-

Ultra-Reliable and Low-Latency Communications(uRLLC)

-

Massive Machine-Type Communications(mMTC)

-

-

Vertical Outlook (Revenue, USD Million, 2020 - 2030)

-

Consumer

-

Enterprises

-

Manufacturing

-

Public Safety

-

Healthcare & Social Work

-

Media & Entertainment

-

Energy & Utility

-

IT & Telecom

-

Transportation & Logistics

-

Aerospace & Defense

-

BFSI

-

Government

-

Retail

-

Mining

-

Oil & Gas

-

Agriculture

-

Construction

-

Real Estate

-

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G services market size is expected to reach USD 125.36 billion in 2024 and USD 196.42 billion in 2025.

b. The global 5G services market is expected to grow at a compound annual growth rate of 62.2% from 2025 to 2030 to reach USD 2,208.25 billion by 2030.

b. Asia Pacific is estimated to dominate the 5G services market with a share of 41.3% in 2024. This is attributable to huge investments made by key service providers such as China Telecom, China Mobile, SK Telecom, and KT Corporation, in rolling out the 5G network infrastructure in China, Japan, and South Korea.

b. Some key players operating in the 5G services market include AT&T, Inc., British Telecommunications plc, China Mobile Ltd., China Telecom Corporation Ltd., Bharti Airtel Ltd., NTT Docomo, KT Corp., Saudi Telecom Company, Vodafone Group, Deutsche Telekom AG, SK Telecom Co., Ltd., Verizon Communications, Inc., T-Mobile USA Inc, Rakuten Mobile Inc.

b. Key factors that are driving the 5G services market growth include growing demand for high-speed connectivity with low latency and rising adoption of IoT devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.