- Home

- »

- Consumer F&B

- »

-

Amla Extracts Market Size, Share & Trends Report, 2030GVR Report cover

![Amla Extracts Market Size, Share & Trends Report]()

Amla Extracts Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Powder, Pulp), By Application (Food & Beverages, Pharmaceuticals, Personal care & Cosmetics, Nutraceutical), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-638-7

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Amla Extracts Market Size & Trends

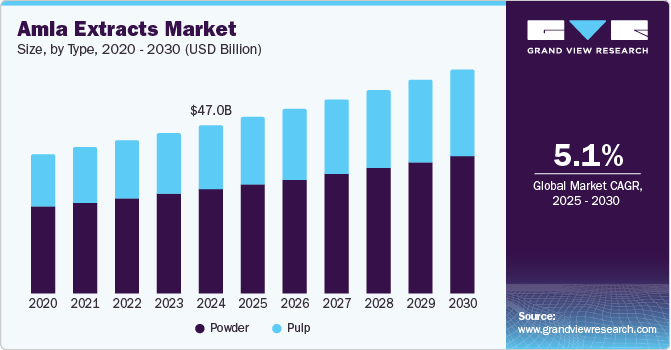

The global amla extracts market size was valued at USD 47.00 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2030. The market growth can be attributed to the increasing consumer awareness of the health benefits associated with amla extract. These extracts are often applied as a natural remedy for boosting immunity, improving digestion, and promoting heart health as they are rich in antioxidants, vitamin C, and other essential nutrients. Rising awareness regarding numerous benefits of amla extract to improve body composition, weight loss, metabolism, immune and digestive system, and liver and heart health is anticipated to drive the product demand. Consumers have increasingly recognized these benefits, incorporating amla extract into their daily diets and wellness routines, thereby driving the market demand.

Moreover, consumers have progressively become more conscious of the ingredients in their food and personal care products and have sought items that are free from synthetic additives and preservatives. Amla extract, being a natural and organic ingredient, fits perfectly into this trend. Its use in food and beverages, pharmaceuticals, personal care, and cosmetics has accelerated the market growth, as consumers prefer products that are both healthy and environmentally friendly.

In addition, the rapid expansion of the nutraceuticals and dietary supplements industry has considerably contributed to the market demand. Amla extracts are widely used in dietary supplements and functional foods due to their immune-boosting, anti-inflammatory, and antioxidant properties. The growing awareness of these benefits has fueled demand for amla in supplement form, particularly among the aging population and those seeking to enhance their health naturally.

Furthermore, amla extracts have been increasingly used in hair care, skin care, and cosmetic products for their rejuvenating, anti-aging, and nourishing properties. The growing demand for natural and organic beauty products, along with the rising awareness of amla’s effectiveness in promoting hair growth and skin health, has propelled its usage in the cosmetics sector.

Type Insights

Amla powder held a dominant market share in 2024 with the rising consumer preference for natural and organic products. The market witnessed considerable preference for this powder among health-conscious consumers seeking clean-label products free from synthetic additives and preservatives, as it is a natural ingredient rich in antioxidants and vitamin C. The powder significantly improves lipoprotein levels and helps reduce the risk of cardiovascular diseases and improves glucose metabolism in skeletal muscle. It is the purest form of vitamin C which helps strengthen the blood vessels and improve the immune system. In addition, amla powder with its health-promoting properties has been increasingly used in various food and beverage products, such as juices, smoothies, and dietary supplements. The growing interest in functional foods that offer additional health benefits beyond basic nutrition has driven the market growth for amla powder.

Amla pulp is expected to grow at a CAGR of 5.5% over the forecast period as it has been increasingly used in functional foods, beverages, and dietary supplements due to its high nutritional value. Consumers have sought products that offer added health benefits, leading to an increase in demand for amla-based drinks, jams, candies, and energy bars. Additionally, amla pulp is a plant-based ingredient, making it suitable for the growing number of consumers adopting vegan, vegetarian, and plant-based diets.

Application Insights

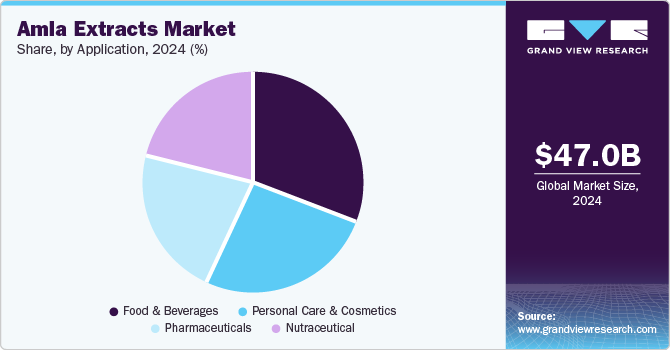

The food and beverages segment dominated the market with 34.3% share in 2024 owing to the rapid demand for functional foods. Amla extracts being rich in antioxidants, and other nutrients that support immune function, digestive health, and overall wellness, have been increasingly incorporated in smoothies, health drinks, and energy bars. Consumers have sought food products that offer added health benefits, making amla extracts a popular choice for inclusion in fortified foods, dietary supplements, and beverages aimed at improving digestion and immunity.

Nutraceuticals are expected to emerge as the fastest-growing segment over the forecast period as consumers significantly prioritize preventive healthcare. Amla extracts are rich in vitamin C, antioxidants, and other bioactive compounds. They have been valued for their immune-boosting, anti-inflammatory, and antioxidant properties which drove their use in nutraceuticals. Additionally, the heightened awareness of immune system health, particularly in the post-pandemic period, has stimulated the demand for nutraceuticals containing amla extracts. Amla’s high vitamin C content and ability to support immune function and oxidative stress make it a popular ingredient in immune-boosting nutraceuticals and a balanced health regimen. Various manufacturers have launched amla extract dietary supplements in the form of tablets, capsules, and powders to cater to the rising demand.

Regional Insights

The amla extracts market in North America secured 24.6% share in 2024 owing to the increasing health consciousness among consumers that drove demand for natural, nutrient-rich ingredients including amla. Furthermore, the rapid expansion of the nutraceutical sector accelerated by the growing interest in preventive healthcare and functional supplements. Amla extracts, known for their ability to support immunity, digestive health, and cardiovascular function, have become popular ingredients in dietary supplements, immune boosters, and functional foods.

U.S. Amla Extracts Market Trends

The U.S. amla extracts market in 2024 held considerable share owing to health-conscious consumers and increasingly prioritizing natural solutions for overall well-being. Amla extracts with their vitamin C content, antioxidants, and immune-boosting properties, have gained traction as people seek out natural ways to support their health, particularly in immune supplements and digestive products. Additionally, the market experienced a growing interest in holistic health practices and traditional medicine including Ayurveda, which features amla as a key ingredient. U.S. consumers have been increasingly inclined to herbal remedies for natural, time-tested health benefits, driving the amla extracts market.

Asia Pacific Amla Extracts Market Trends

The Asia Pacific amla extracts market accounted for the dominant market share of 29.3% in 2024. Amla has a deep-rooted presence in traditional medicine, particularly in Ayurveda, which is widely practiced in India and other parts of Asia. The long-standing use of amla for health benefits, such as boosting immunity, promoting digestion, and improving hair and skin health, has supported its continued demand across the region.

Europe Amla Extracts Market Trends

The amla extracts market in Europe held 21.3% of the market share in 2024. The market was propelled by a strong shift in the region towards natural, organic, and plant-based products across multiple industries, including food, beverages, cosmetics, and supplements. As amla is a natural fruit extract, it aligns with the growing preference for clean-label and sustainable products, boosting its demand in the region.

Key Amla Extracts Company Insights

The global amla extracts market is moderately concentrated with key players such as Biomax Life Sciences Limited, Taiyo International, Arjuna Natural, and others. The market can be characterized by strategic initiatives such as product launches, acquisitions, and mergers.

-

Taiyo International is a pioneer in the research and manufacture of functional ingredients for the food, beverage, and pharmaceutical industries. The company is renowned for its innovative ingredients derived from natural sources such as Sunfiber, Suntheanine, and SunActive.

-

Arjuna Natural is a leading manufacturer and exporter of standardized botanical extracts. The company has been at the forefront of botanical engineering, producing high-quality extracts for the nutraceutical, pharmaceutical, and food industries.

Key Amla Extracts Companies:

The following are the leading companies in the amla extracts market. These companies collectively hold the largest market share and dictate industry trends.

- Biomax Life Sciences Limited

- Taiyo International

- Arjuna Natural

- Patanjali Ayurveda Limited

- Archerchem

- SYDLER

- RiSun Bio-Tech Inc

- Ambe Phytoextracts Pvt. Ltd.

- Herbeno Herbals

- Bhumi Amla

Recent Developments

-

In February 2023, RANAVAT launched the Regenerative Veda Bond Complex Shampoo and Conditioner. This two-step hair treatment effectively eliminates scalp congestion and delivers scalp moisturization. It proactively strengthens and protects the hair follicle from stressors to help stimulate shiny and healthy hair regrowth.

Amla Extracts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 49.34 billion

Revenue forecast in 2030

USD 63.27 billion

Growth Rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Biomax Life Sciences Limited; Taiyo International; Arjuna Natural; Patanjali Ayurveda Limited; Archerchem; SYDLER; RiSun Bio-Tech Inc; Ambe Phytoextracts Pvt. Ltd.; Herbeno Herbals; Bhumi Amla

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Amla Extracts Market Report Segmentation

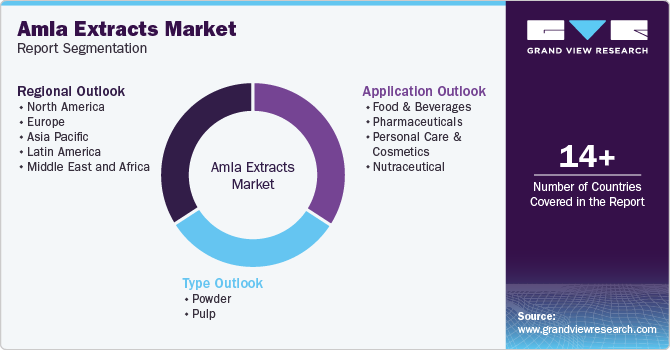

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global amla extracts market report based on product, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Powder

-

Pulp

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Personal care & Cosmetics

-

Nutraceutical

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.