- Home

- »

- Agrochemicals & Fertilizers

- »

-

Ammonia Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Ammonia Market Size, Share & Trends Report]()

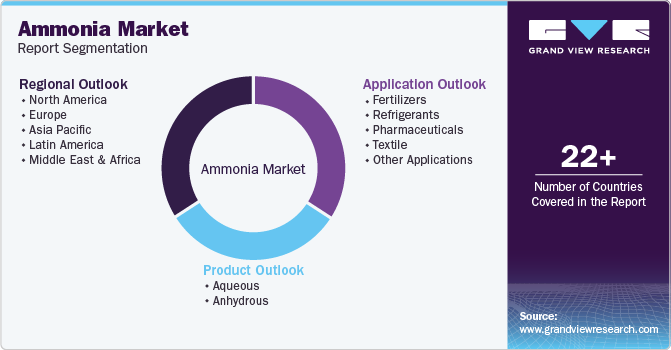

Ammonia Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Aqueous, Anhydrous), By Application (Fertilizers, Refrigerants, Pharmaceuticals, Textile), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-207-5

- Number of Report Pages: 82

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ammonia Market Summary

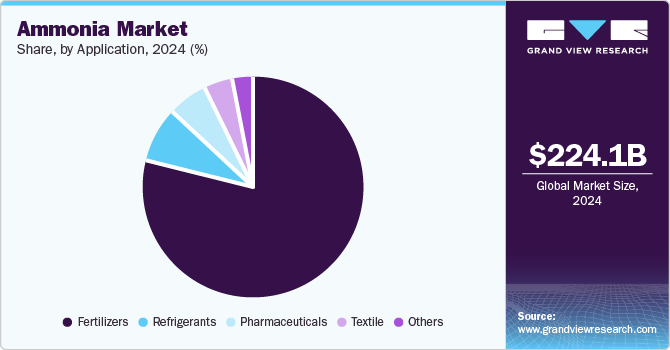

The global ammonia market size was valued at USD 224,101.6 million in 2024 and is projected to reach USD 313,212.1 million by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The rising demand for ammonia, especially in fertilizers and refrigerants, can be attributed to several interrelated factors. Key among these is the increase in global population, which has led to a growing demand for food.

Key Market Trends & Insights

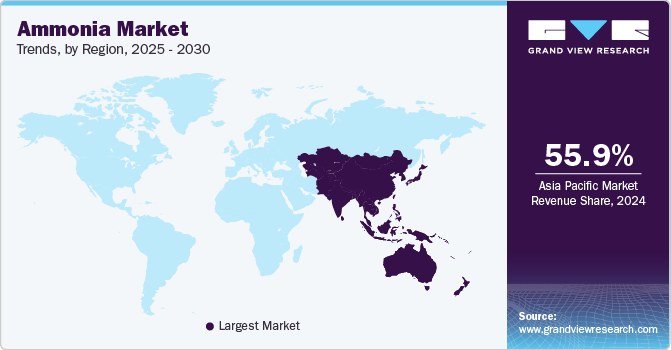

- Asia Pacific dominated the ammonia market with a share of 55.9% in 2024.

- Based on product, the anhydrous segment accounted for the largest revenue market share, 59.8%, in 2024.

- In terms of application, the herbicides segment dominated the market with a market share of 78.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 224,101.6 Million

- 2030 Projected Market Size: USD 313,212.1 Million

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest market in 2024

This, combined with the decline in available arable land, significantly drives the need for NH3 fertilizers. As a result, the market is experiencing notable growth. Ammonia is essential not only in agricultural applications but also in large-scale refrigeration plants. It is available in various forms, including liquid and gas, catering to multiple industrial needs.

Additionally, the demand for crop protection products in agriculture is increasing, further propelling market growth. Other important factors influencing the industry include the growing adoption of precision farming methods and the urgent need to address food scarcity due to the rising global population. Together, these elements comprehensively picture the factors driving the market growth.

Drivers, Opportunities & Restraints

Due to the growing population worldwide, there is a high demand for food crops. However, depleting arable land in mature economies is one of the biggest challenges faced by the global agricultural sectors. Ammonia-based fertilizers offer a partial solution to this problem as they increase agricultural yield and address major issues such as water conservation, soil pollution, and climatic change.

The global population has been rapidly rising, and this trend is expected to continue over the forecast period. Major countries across the globe have seen a tremendous increase in population. This situation has been straining primary resources, particularly food. Additionally, due to population growth, food consumption per person has increased.

The market in the North American region has witnessed a depletion due to the shift in manufacturing to the regions of Asia Pacific, Central, and South America, owing to the availability of cheap labor and low-cost raw materials. The product innovation strategies of the companies in the European region have enabled them to gain a larger market and thus provide high-quality ammonia products. Traditional manufacturers are facing stiff competition owing to their higher fixed costs and lack of product differentiation.

The presence of ammonia in fertilizers increases agricultural productivity and improves soil fertility, which in turn results in an increase in crop production. In addition, they are also used to imply nutrients to the soil, as chemical elements such as ammonia are necessary for plant growth. Therefore, increasing growth of the fertilizers industry will benefit the market growth over the forecast period. Ammonia is considered a natural refrigerant as it has no direct greenhouse effect and has no potential for ozone depletion. In addition, ammonia poses thermodynamic properties, which enable it to require low energy input to create refrigerating capacity. Moreover, besides ecological advantages, ammonia is also sustainable from an economic point of view as it is an inexpensive feedstock compared with synthetic refrigerants. Such trends are expected to fuel the market growth over the forecast period.

Product Insights

The anhydrous segment accounted for the largest revenue market share, 59.8%, in 2024 and is expected to continue to dominate the industry over the forecast period. NH3-based nitrogenous fertilizers provide increased yield, adequate crop protection, and enhanced production cycles. The anhydrous form of this fertilizer is widely used in agriculture due to its high nitrogen content of 82 percent. However, it is more effective in warmer climates than in cooler temperatures. Anhydrous ammonia has a strong odor and requires a high amount of energy to vaporize, making it useful as a refrigerant and a solvent. Liquefied NH3 is utilized in various industrial applications, including the production of synthetic fibers, the manufacture of pharmaceuticals, and the extraction of metals from ores. Its ability to dissolve a wide range of polymers makes the liquefied or anhydrous form an ideal solvent in the spinning process for synthetic fibers, such as nylon and rayon.

Aqueous ammonia, or ammonia water, is a solution of ammonia gas dissolved in water. This solution is typically clear and colorless, although it may have a faint yellow tint due to impurities. Aqueous ammonia is widely used as a cleaning agent for various surfaces and materials because it effectively dissolves and removes oils, grease, and dirt.

Application Insights

The herbicides segment dominated the market with a market share of 78.8% in 2024, during the forecast period. This growth is due to farmers' increasing use of nitrogenous fertilizers. These fertilizers are highly soluble, allowing them to be absorbed by plants quickly and efficiently. As a result, they provide the necessary nitrogen for plant growth more rapidly than organic fertilizers, which take time to decompose and release nutrients.

Ammonia (NH3) is frequently used as a refrigerant because of its outstanding thermodynamic properties. Unlike CFCs and HFCs, it is nonflammable and has zero ozone depletion and zero global warming potential. Additionally, it is relatively inexpensive and widely available. Ammonia is typically employed in smaller refrigeration applications, such as cold storage facilities, ice rinks, and food processing plants. It is also utilized in large-scale industrial refrigeration systems in the petroleum and gas processing sectors and in chemical production.

Regional Insights

The Asia Pacific ammonia market is expected to grow the fastest growth during the forecast period. The Asia-Pacific region is home to many agricultural countries, including Japan, Thailand, Indonesia, India, and the Philippines. This region accounts for approximately 60% of the world’s consumption of nitrogenous fertilizers. According to the International Energy Agency, China is the largest ammonia producer globally, responsible for around 30% of total production. Additionally, China is the largest consumer of nitrogenous fertilizers, making up one-third of global consumption.

North America Ammonia Market Trends

North America produces various crops, including specialty crops, vegetables, fruits, oilseeds, and cereals. Agribusinesses and farmers in the region are at the forefront of effective chemical application and employ advanced agricultural techniques.

The U.S. is a major ammonia producer, ranking third globally, and it is also a significant importer, primarily partnering with Trinidad and Tobago and Canada for trade. Approximately 92% of ammonia production in the U.S. is based on natural gas, with about 60% of the production capacity in Louisiana, Oklahoma, and Texas due to their large natural gas reserves. This dependence on natural gas positions the U.S. as highly competitive in the market, fostering increased domestic consumption and exports.

Europe Ammonia Market Trends

The growing agricultural industry, advancement in farming practices, and increased awareness of healthy eating are some of the major factors driving the demand for ammonia market in Europe. The growing need to improve crop yield and production efficiency drives the market due to the increasing population and diminishing farmlands. This has led to an increase in demand for product markets in the region.

Latin America Ammonia Market Trends

The significant growth of the agriculture sector, mainly in Brazil, due to the increasing demand for agrochemicals in Brazil to enhance the production of Brazilian soybean, is the key driving factor for the growth of the agricultural adjuvants market in Latin America.

Middle East & Africa Ammonia Market Trends

The Middle East and Africa ammonia market are expected to grow significantly over the forecast period. Pesticide consumption is increasing in Saudi Arabia and Oman, and the trend is steady for South Africa, Kuwait, and Qatar. In addition, there is tremendous growth in the consumption of pesticides in Ghana.

Key Ammonia Company Insights

Some of the key players operating in the market include Clariant, Dow, and Solvay

-

Yara, was founded as Norsk Hydro and was demerged as Yara International ASA in 2004. The company provides fertilizers, nutrition programs and technologies to improve the overall yield quality and to reduce the environmental impact. The company is listed on the Oslo Stock Exchange. The company has production facilities in 16 countries across the globe. The products and services of the company include fertilizers, analytical services, animal nutrition, exhaust gas treatment, hydrogen sulphide control, industry chemicals, mining applications, nitrogen chemicals, carbon dioxide, and setting accelerators. The company operates its sales offices in more than 60 countries and its products are marketed and sold in more than 160 countries across the globe

-

Qatar Fertilizer Company manufactures urea and ammonia. It is a joint venture of the Qatari government and foreign shareholders and operates as a subsidiary of Industries Qatar Q.S.C. The products manufactured by the company include ammonia, melamine, aqueous ammonia, urea- formaldehyde condensate, and urea. The company is actively investing in R&D activities to come up with innovative and effective ammonia products.

Key Ammonia Companies:

The following are the leading companies in the ammonia market. These companies collectively hold the largest market share and dictate industry trends.

- Acron

- Koch Fertilizers, LLC

- Yara International

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- Qatar Fertiliser Company

- Togliattiazot

- SABIC

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- BASF SE

- Asahi Kasei Corp

Recent Developments

-

In April 2024, JERA and CF Industries are evaluating a joint venture agreement to construct a low-carbon ammonia plant with an estimated 1.4 million metric tons capacity. JERA is considering acquiring 48% ownership of the project and has plans to procure over 500,000 metric tons of low-carbon ammonia annually to meet Japan's demand for low-carbon fuels.

-

In March 2024, Yara partnered with GHC SAOC, a subsidiary of Acme Cleantech. Acme will supply Yara with ammonia produced with reduced CO2 emissions through this partnership. The agreement covers the delivery of 100,000 tons of renewable ammonia per year.

Ammonia Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 235,144.8 million

Revenue forecast in 2030

USD 313,212.1 million

Growth Rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Acron; Koch Fertilizers, LLC; Yara International; CF Industries Holdings, Inc.; Nutrien Ltd.; Qatar; Fertiliser Company; Togliattiazot; SABIC; Sumitomo Chemical Co., Ltd.; Mitsui Chemicals, Inc.; BASF SE; Asahi Kasei Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ammonia Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Ammonia market report on the basis of product, application and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 -2030)

-

Aqueous

-

Anhydrous

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fertilizers

-

Refrigerants

-

Pharmaceuticals

-

Textile

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ammonia market size was estimated at USD 224.10 billion in 2024 and is expected to reach USD 235,144.8 billion in 2023.

b. The global ammonia market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 313,212.1 million by 2030.

b. Asia Pacific dominated the ammonia market with a share of 55.9% in 2024. This is attributable to large number of agrarian countries, including Thailand, Japan, India, Indonesia, and the Philippines in the APAC region.

b. Some key players operating in the ammonia market include Acron, Koch Fertilizer, LLC, Yara, CF Industries Holdings, Inc., Nutrien Ltd, QATAR FERTILISER COMPANY, Togliattiazot, SABIC & Sumitomo Chemical Co., Ltd.

b. Key factors that are driving the ammonia market growth include rising demand for ammonia majorly in the fertilizers and refrigerants industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.