- Home

- »

- Animal Health

- »

-

Animal Genetics Market Size, Share, Industry Report, 2033GVR Report cover

![Animal Genetics Market Size, Share & Trends Report]()

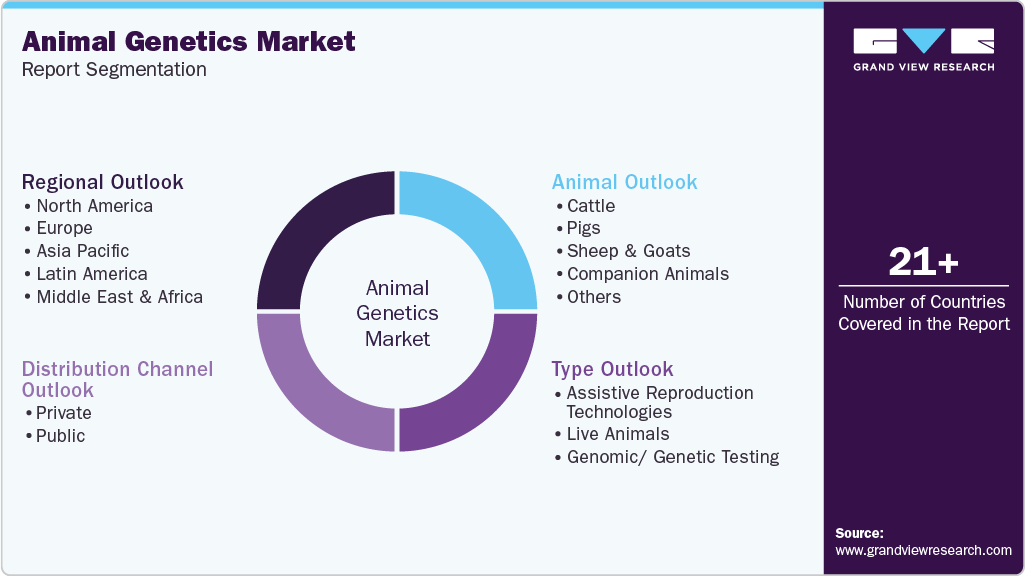

Animal Genetics Market (2026 - 2033) Size, Share & Trends Analysis Report By Animal, By Type (Assistive Reproduction Technologies, Live Animals, Genomic/ Genetic Testing), By Distribution Channel (Private, Public), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-740-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Animal Genetics Market Summary

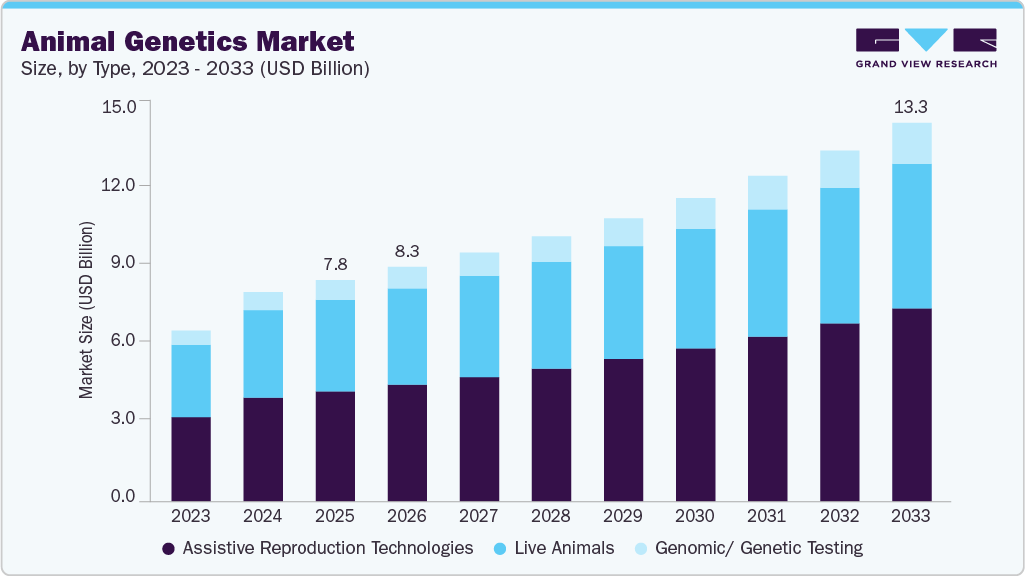

The global animal genetics market size was estimated at USD 7.80 billion in 2025 and is projected to reach USD 13.35 billion by 2033, growing at a CAGR of 7.09% from 2026 to 2033. The animal genetics market is advancing, driven by rising demand for animal protein, advancements in genetic technologies and growing focus on animal health & disease resistance.

Key Market Trends & Insights

- North America animal genetics market held the largest share of 30.86% of the global market in 2025.

- By animal, cattle segment held the largest share of over 40.84% of the market in 2025.

- By type, assistive reproduction technologies segment held the largest market share in 2025.

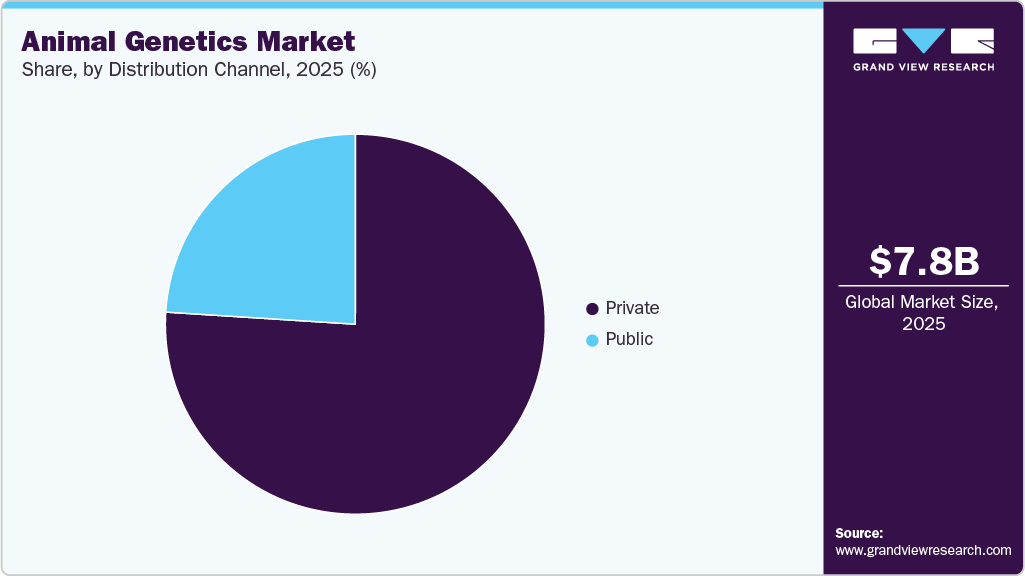

- Based on distribution channel, private segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7.80 Billion

- 2033 Projected Market Size: USD 13.35 Billion

- CAGR (2026-2033): 7.09%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The global demand for meat, milk and eggs continues to grow, fueled by population expansion, income growth, and changing dietary preferences.According to Food and Agriculture Organization of the United Nations report of 2025, global milk production has surged by over 77% in the past thirty years, rising from 524 million tonnes in 1992 to 930 million tonnes in 2022. India ranks leads as the top producer, contributing 22% of total output, followed by the U.S., Pakistan, China, and Brazil.

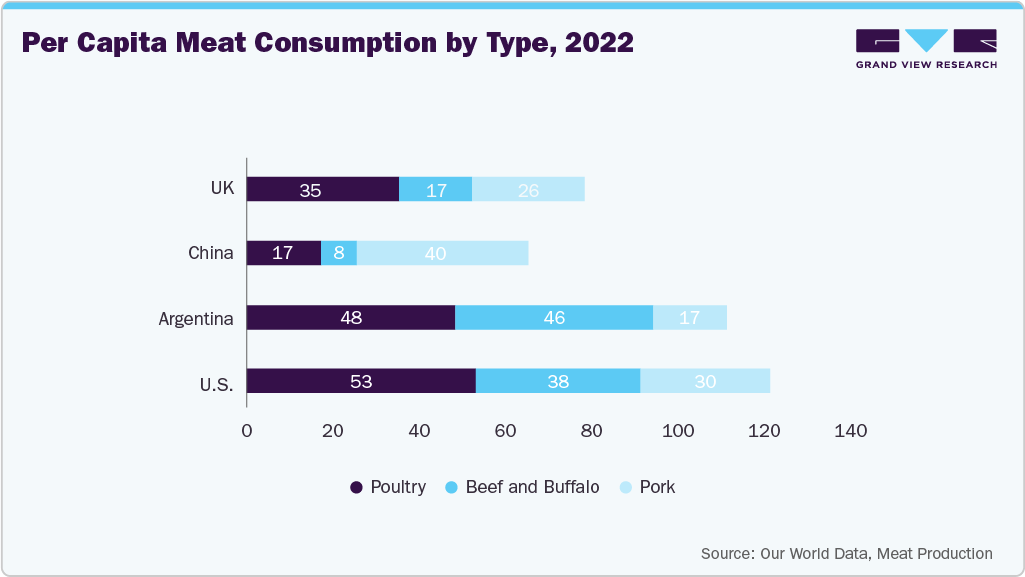

This surge places pressure on livestock producers to enhance efficiency and productivity. Animal genetics plays a key role by enabling selective breeding, improving reproductive efficiency, and producing superior breeds with higher yields. By enhancing disease resistance, growth rates, and product quality, genetic advancements help farmers meet increasing protein needs sustainably. The shift toward premium meat and dairy products also accelerates adoption of genetic solutions, driving significant growth in the animal genetics market worldwide. The graph below illustrates rising meat consumption of various types for the year 2022:

Continuous innovation in genomics, artificial insemination, gene editing, and marker-assisted selection has transformed animal breeding. Advanced technologies such as CRISPR and next-generation sequencing (NGS) allow precise genetic improvement, reducing disease risks while enhancing productivity and efficiency. Such breakthroughs are increasingly accessible to both large-scale commercial farms and smaller breeding programs, supporting widespread adoption. In addition, genomic selection accelerates breeding cycles and improves the predictability of offspring traits. These innovations reduce costs over time and improve return on investment for breeders, encouraging stronger industry participation. As technology integration increases, animal genetics becomes an indispensable tool for sustainable livestock production.

Disease outbreaks in livestock, such as avian influenza, African swine fever, and bovine respiratory disease, cause massive economic losses globally. This has heightened the focus on breeding animals with enhanced immunity and resilience. Genetic tools enable the identification and propagation of disease-resistant traits, lowering dependency on antibiotics and veterinary interventions. Breeding healthier animals not only reduces mortality rates but also improves welfare standards and overall productivity. As governments, farmers, and consumers demand safer, healthier animal products, genetic improvement is increasingly recognized as a cost-effective, long-term solution to strengthen biosecurity and ensure more resilient livestock populations.

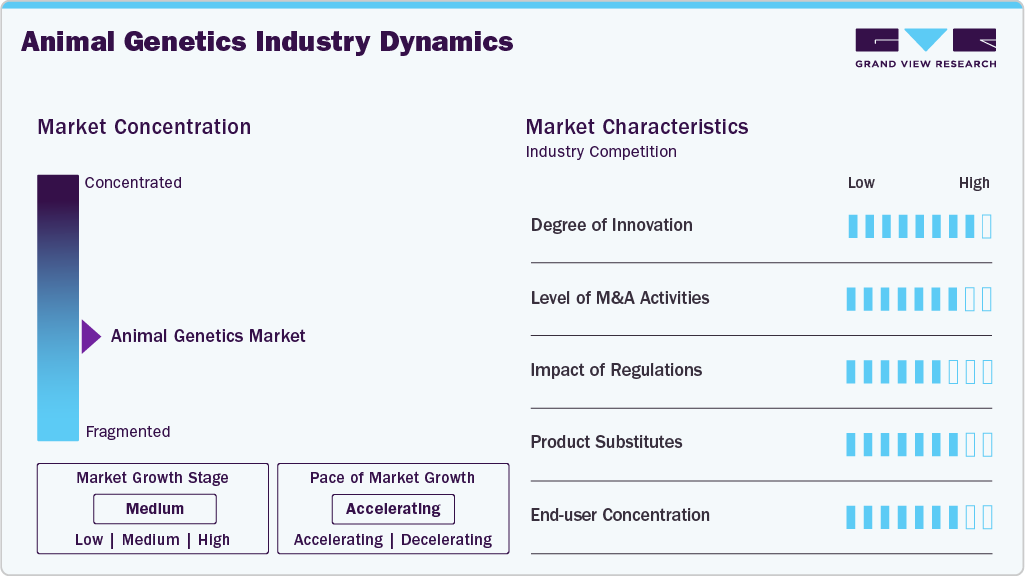

Market Concentration & Characteristics

The animal genetics market is moderately concentrated, with a few multinational corporations such as Genus plc, Zoetis, Neogen, STgenetics, Semex, URUS, CRV, and Hendrix Genetics dominating global market share. These leaders leverage advanced technologies such as genomics, AI, and sexed semen to strengthen their positions. Meanwhile, emerging players such as Swine Genetics International, Animal Genetics Inc., Generatio GmbH, and Genetics Australia occupy niche segments, offering specialized solutions in swine, equine, or regional markets. Consolidation through mergers, acquisitions, and strategic alliances further intensifies industry concentration.

Animal Genetics Market Industry Characteristics

-

The animal genetics market shows a high degree of innovation, driven by breakthroughs in genomics, CRISPR-based gene editing, and next-generation sequencing. Technologies such as marker-assisted selection and artificial insemination enable precise breeding for productivity, disease resistance, and sustainability. For instance, in December 2024, IPB University researchers applied IVF and ART to conserve endangered animals such as the Sumatran rhino. Using ovum pick-up, ICSI, and BioBanking, they produce, preserve, and transfer embryos to support wildlife conservation. Continuous R&D investment by global player’s fosters advanced genetic solutions, transforming livestock production efficiency and product quality worldwide.

-

Mergers and acquisitions remain a key growth strategy, with leading players consolidating to expand portfolios, strengthen regional footprints, and gain access to advanced genetic technologies. Companies such as Genus, Zoetis, and URUS actively pursue acquisitions and partnerships to diversify across cattle, swine, and poultry. For example, in September 2024, Zoetis and Danone partnered to integrate genetics and sustainability in dairy farming, aiming to enhance cow health, reduce environmental impact, and strengthen long-term resilience through advanced genomic testing solutions.

-

Regulations significantly influence the animal genetics market, balancing innovation with ethical, safety, and environmental concerns. Stringent guidelines govern gene editing, crossbreeding, and international trade of genetic material. In November 2024, USFDA, in partnership with USDA, updated guidance on intentional genomic alterations in animals, enhancing regulatory clarity, flexibility, and efficiency to support biotechnology innovations that improve animal health, sustainability, and food production. Supportive policies promoting biosecurity, animal welfare, and sustainable farming encourage adoption of genetic solutions.

-

The threat of substitutes in animal genetics is relatively low but exists in the form of conventional breeding and biotechnologies such as vaccines or feed additives that improve productivity and disease resistance. However, these alternatives often lack the precision, long-term efficiency, and sustainability benefits provided by advanced genetic tools, making genetics the preferred long-term solution.

-

End user concentration is moderate, with demand distributed across commercial livestock farms, breeding organizations, research institutes, and smallholder farmers. Large-scale dairy, poultry, and swine producers dominate adoption due to capacity for investment in advanced genetics. However, growing accessibility of genomic tools is expanding uptake among smaller farmers, supporting wider market penetration and balanced end-user distribution.

Animal Insights

Cattle represented the largest segment with a revenue share of 40.84% in 2025, driven by rising global demand for beef and dairy products. The increasing pressure to enhance productivity, efficiency, and disease resistance, cattle breeding programs are adopting advanced genetic technologies such as artificial insemination, genomic selection, and embryo transfer. For instance, in February 2025, Neogen Corporation launched Igenity BCHF, the first genomic test to assess cattle’s genetic risk for bovine congestive heart failure, aiming to improve herd health and address this growing industry concern. These innovations enable the production of high-yielding, healthier herds while reducing costs and improving sustainability. The expansion of premium dairy and meat consumption, coupled with growing investments in genetic improvement, continues to solidify cattle as the dominant segment in the animal genetics market.

The companion animals segment is projected to be the fastest growing in the animal genetics market, driven by rising pet ownership, increased spending on pet healthcare, and growing demand for genetic testing to improve breeding quality and disease resistance. Pet owners are increasingly prioritizing preventive healthcare and personalized solutions, boosting adoption of genetic tools such as DNA testing for inherited disorders, breed identification, and wellness traits. Advancements in veterinary diagnostics, coupled with the expanding trend of humanization of pets, are further accelerating growth in this segment worldwide.

Type Insights

Assistive Reproduction Technologies (ART) dominated the market with the largest revenue share in 2025, supported by widespread adoption of artificial insemination, embryo transfer, and in vitro fertilization to enhance breeding efficiency. In May 2025, PIC gained FDA approval for its gene-editing technology to breed PRRS-resistant pigs, marking a milestone in livestock innovation by improving animal welfare, reducing antibiotic reliance. These technologies enable producers to improve genetic traits, increase fertility rates, and ensure healthier, more productive livestock. The growing demand for sustainable food production, coupled with advancements in reproductive biotechnology, has further strengthened ART’s dominance. With livestock producers increasingly focused on disease resistance, productivity, and genetic diversity, ART continues to play a pivotal role in shaping the global animal genetics market.

Genomic and genetic testing is the fastest growing segment in the animal genetics market, driven by rising demand for precision breeding and improved herd management. These technologies allow farmers and breeders to identify desirable traits, detect genetic diseases, and predict productivity, fertility, and health outcomes with greater accuracy. Growing adoption in both livestock and companion animals reflects the increasing focus on sustainability, disease resistance, and cost efficiency. In addition, advancements in next-generation sequencing and affordable testing kits are accelerating accessibility, fuelling rapid market expansion and transforming modern animal breeding practices globally.

Distribution Channel Insights

The private segment represents both the largest and fastest-growing share of the animal genetics market, driven by rising demand for advanced breeding services, genomic testing, and assisted reproductive technologies. Private companies play a central role in developing innovative genetic solutions that enhance animal productivity, health, and profitability. Their agility in adopting cutting-edge tools, such as CRISPR-based gene editing and advanced genomic selection, has made them key contributors to market expansion. Mergers and acquisitions in the private segment of the animal genetics market are accelerating, enabling companies to consolidate expertise, expand genetic portfolios, and strengthen global distribution networks. In October 2024, Hendrix Genetics Hypor division and Danish Genetics have merged, forming a strategic alliance to expand global swine genetics, enhance portfolios, leverage advanced technologies, and drive innovation, sustainability, and value for pig producers worldwide.

Moreover, private players increasingly collaborate with livestock producers, companion animal breeders, and research institutes to accelerate genetic improvements tailored to market needs. The expansion of commercial breeding programs, growing investments in R&D, and the integration of sustainability goals such as disease resistance and reduced environmental impact further strengthen the private segment’s dominance. With strong global presence, rapid adoption of emerging technologies, and focus on commercial scalability, the private sector is set to maintain leadership in shaping the future of animal genetics.

Regional Insights

North America Animal Genetics Market Trends

The North America animal genetics market held the largest revenue share of 30.86% in 2025, driven by rising demand for high-quality livestock, advanced genomic testing, and growing adoption of assisted reproductive technologies. Some of the players such as Zoetis, Genus plc, and Neogen Corporation dominate the landscape, leveraging innovation, strategic partnerships, and R&D investments to strengthen genetic improvement programs, enhance productivity, and support sustainable livestock production across the region.

U.S. Animal Genetics Market Trends

U.S. animal genetics market is witnessing significant growth, driven by rising demand for improved livestock quality, disease-resistant breeds, and advanced reproductive technologies. Innovations in genomic selection, CRISPR gene editing, and artificial insemination are transforming breeding practices. In January 2025, Ceva Animal Health partnered with Touchlight to leverage dbDNA technology for developing innovative DNA vaccines in animal health, combining Ceva’s commercialization strength with Touchlight’s rapid, antibiotic-free enzymatic DNA production expertise.

Europe Animal Genetics Market Trends

Europe's animal genetics market is advancing due to robust government support, cutting-edge research, and a growing demand for sustainable livestock practices. Technologies such as genomic selection and artificial insemination are enhancing breeding efficiency. In December 2024, Hendrix Genetics partnered with LABOGENA DNA, leveraging its multi-species SNP chip and high-throughput genotyping to enhance efficiency and drive improved genetic gain across its global breeding programs.

The UK animal genetics market is advancing through genomic technologies and data-driven breeding strategies, enhancing traits like growth rate, fertility, disease resistance, and product quality across species such as poultry, swine, and aquaculture. The drivers include government investment in research and development, fostering collaborations between public and private sectors to accelerate advancements in the field. In February 2024, Weatherbys Scientific and the UK Kennel Club launched a DNA testing service for 80 breeds, assessing inherited disorders to guide responsible breeding, improve dog health, and provide accessible results to breeders and buyers.

Asia Pacific Animal Genetics Market Trends

Asia Pacific market is fastest growing region over the forecast period, driven by increasing demand for high-quality animal products and the need to enhance livestock productivity. Governments in countries such as China and India are investing heavily in genetic research and breeding programs to improve livestock performance. Some of the companies such as Genus Plc, Hendrix Genetics, Zoetis, and Neogen Corporation are leading advancements in genomic selection, gene editing, and reproductive technologies. These innovations are revolutionizing breeding programs, enabling more precise genetic improvements and contributing to sustainable livestock production across the region.

The Indian animal genetics market is expanding due to rising demand for high-yield livestock, government-supported breeding programs, and advances in genomic selection and artificial insemination. According to the report of August 2025, the Livestock Health and Disease Control Programme (LHDCP) supported vaccination, disease surveillance, veterinary infrastructure, and training, strengthening livestock health, improving crossbred cattle genetics, and enabling rapid response to disease outbreaks. Key players are driving innovation, while initiatives such as crossbred cattle improvement and CRISPR-based research enhance genetic quality, productivity, and disease resistance across livestock sectors.

Latin America Animal Genetics Market Trends

Latin America market is growing, fueled by increasing demand for high-quality livestock, sustainable farming practices, and advancements in genomic selection and reproductive technologies. Some of the players such as Genus Plc, Hendrix Genetics, and Zoetis are leading innovations in disease-resistant breeds, precision breeding, and crossbreeding programs, driving productivity, profitability, and genetic improvement across cattle, poultry, and aquaculture sectors.

Brazil animal genetics market is expanding rapidly, driven by the country’s strong livestock industry, demand for high-yield and disease-resistant breeds, and adoption of advanced reproductive technologies. Some of the players such as Genus Plc, Neogen Corporation, and Hendrix Genetics are driving innovations in genomic selection, artificial insemination, and crossbreeding programs, enhancing productivity, genetic improvement, and sustainable livestock management nationwide.

Middle East & Africa Animal Genetics Market Trends

Middle East animal genetics market is evolving, driven by rising demand for food security, improved livestock productivity, and adoption of modern breeding technologies. Governments are investing in genomic research and sustainable agriculture. Key players such as Zoetis, Neogen Corporation, and Hendrix Genetics are advancing artificial insemination, genomic selection, and disease-resistant breeds, supporting regional self-sufficiency and genetic improvement.

In South Africa, animal genetics is fast emerging, driven by growing pet ownership and demand for advanced orthopedic care. Stem cell therapies represent the largest segment, while other products are the fastest growing. In March 2023, South Africa’s new Biodiversity Biobanks South Africa (BBSA) united 22 biobanks into a central repository, conserving over a million biodiversity samples to support genetic resources, research, biotechnology, and livestock improvement. Key providers such as Valley Farm Animal Hospital (in partnership with VetRenew) and Blue Hills Veterinary Hospital are advancing accessibility, signaling a strengthening and innovation-driven regional market.

Saudi Arabia’s animal genetics market is advancing through strong government support for food security, rising demand for premium livestock, and adoption of artificial insemination, genomic testing, and precision breeding tools. Companies such as Neogen, Genus Plc, Zoetis, and Hendrix Genetics lead innovations in disease-resistant and climate-adapted breeds. Capacity-building programs in genomic selection are boosting genetic improvement across the sector.

Key Animal Genetics Company Insights

Major players such as Zoetis, Hendrix Genetics BV, Genus plc, and URUS Group LP dominate the market with extensive product portfolios, global reach, and strong regulatory adherence. Growth is fueled by innovations in recombinant and vector-based vaccines, expansion into emerging regions, and strategic acquisitions. However, competition is shaped by regulatory complexities, high R&D costs, and tighter antibiotic controls, while emerging regional firms gain traction with affordable, targeted solutions addressing local disease challenges.

Key Animal Genetics Companies:

The following are the leading companies in the animal genetics market. These companies collectively hold the largest market share and dictate industry trends.

- Neogen Corporation

- Genetics Australia

- Hendrix Genetics BV

- URUS Group LP

- CRV

- Semex

- Swine Genetics International

- STgenetics

- Animal Genetics Inc.

- Generatio GmbH

- Zoetis Services LLC

- Genus plc

Recent Developments

-

In February 2025, Neogen Corporation launched Igenity BCHF, the first genomic test assessing cattle’s risk for bovine congestive heart failure, helping producers identify genetic predisposition, improve herd health, and address this fatal, rising condition.

-

In January 2025, Ceva Animal Health secured exclusive rights to Touchlight’s dbDNA technology, aiming to develop innovative DNA vaccines. The partnership combined Touchlight’s synthetic DNA expertise with Ceva’s vaccine leadership to accelerate novel animal health solutions.

-

In December 2024, Hendrix Genetics partnered with LABOGENA DNA as its exclusive genotyping provider. Together, they developed a multi-species SNP chip, enabling faster genetic gains and greater efficiency across poultry, swine, aquaculture, and shrimp breeding programs.

-

In September 2024, Zoetis partnered with Danone to advance sustainable dairy farming, combining genetics expertise with environmental stewardship. The collaboration integrated genomic testing to improve cattle health, reduce environmental impact, and promote long-term industry resilience.

Animal Genetics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.26 billion

Revenue forecast in 2033

USD 13.35 billion

Growth rate

CAGR of 7.09% from 2026 to 2033

Actual period

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Neogen Corporation; Genetics Australia; Hendrix Genetics BV; URUS Group LP; CRV; Semex; Swine Genetics International; STgenetics; Animal Genetics Inc.; Generatio GmbH; Zoetis Services LLC; Genus plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Animal Genetics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the animal genetics market report based on animal, type, distribution channel and region:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Cattle

-

Pigs

-

Sheep & Goats

-

Companion Animals

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Assistive Reproduction Technologies

-

Live Animals

-

Genomic/ Genetic Testing

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Private

-

Public

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global animal genetics market size was estimated at USD 7.80 billion in 2025 and is expected to reach USD 8.26 billion in 2026.

b. The global animal genetics market is expected to grow at a compound annual growth rate of 7.09% from 2026 to 2033 to reach USD 13.35 billion by 2033.

b. North America dominated the animal genetics market with a share of 30.86% in 2025. This is attributable to high research on animal genetics and adoption of strategic activities by industry players.

b. Some key players operating in the animal genetics market include Neogen Corporation, Genetics Australia, Hendrix Genetics BV, URUS Group LP, CRV, Semex, Swine Genetics International, STgenetics, Animal Genetics Inc., Generatio GmbH, Zoetis, Genus plc

b. Key factors that are driving the animal genetics market growth include increasing population & rapid global urbanization and growing preference for animal protein & adoption of various genetic services, rising adoption of progressive genetic practices, including Artificial Insemination (AI) and embryo transfer, for large-scale production of modified breeds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.