- Home

- »

- Next Generation Technologies

- »

-

Asia Pacific Smart Retail Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Smart Retail Market Size, Share & Trends Report]()

Asia Pacific Smart Retail Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution, By Application (Visual Marketing, Smart Label, Smart Payment System Intelligent System), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-204-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Smart Retail Market Trends

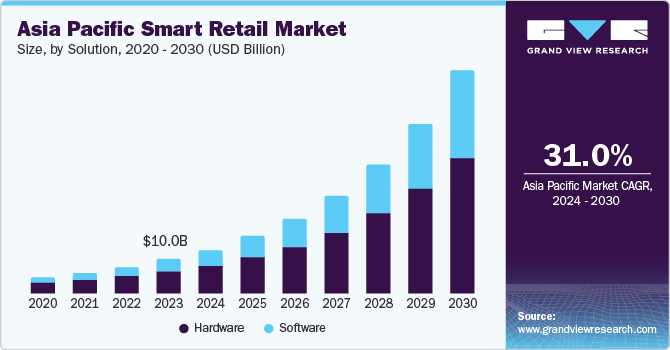

The Asia Pacific smart retail market size was valued at USD 10.04 billion in 2023 and is projected to grow at a CAGR of 31.0% from 2024 to 2030. Increasing inclusion of advanced technologies such as artificial intelligence or the Internet of Things (IoT) in retail operations such as logistics & supply, inventory management, back-office operations, marketing, and customer engagement is one of the key growth-driving factors for this market. As many businesses from multiple industries adopt a global operations approach and focus on online distribution, smart technologies in retail have become significant in recent years. To address the growing competition and changing customer preferences, businesses embrace advanced technology solutions to improve customer experience and enhance business operations simultaneously.

The growth in demand for online shopping experience in the retail industry has driven multiple changes in the operations and management of retail businesses in recent years. The emergence of technologies such as artificial intelligence (AI), virtual reality, Internet of Things (IoT), generative AI, in-store analytics, voice commerce, cashless transactions, and augmented reality have assisted the retail industry in numerous ways. Right from inventory management to labeling and shipping, multiple business functions in the retail sector are run with the help of these technologies.

As market competition increases rapidly and fragmentation grows, retailers have struggled in recent years. Increasing inclination towards online shopping and the focus of multiple companies to enhance customer experience has resulted in a rise in market competition. Retail businesses have been concentrating on embracing effective technology solutions to reduce operational costs and increase profit margins. For instance, multiple retailers use self-checkout technology assisted by AI, resulting in numerous benefits, such as reducing queue time. In addition, once every bought item is scanned through the self-checkout system, the display panel shows a list of discounted products for a particular day, which are placed right next to checkout points.

The emergence of augmented and virtual reality has also driven growth for the smart retail industry in recent years. Online retail platforms associated with sectors such as fashion, wearables, home décor & beauty have embraced these technologies to offer unparalleled shopping experiences. For example, IKEA's AR app allows customers to see how furniture would look in their home before purchasing. Lenskart, one of the key players in the region's eyewear industry, offers a 'Tryin3D' alternative to its buyers where individuals can see if a particular frame or sunglasses suit their facial profile.

The growing consumer preference for contactless shopping remains a key growth factor. Retailers across the region are investing heavily in adopting contactless payment systems, self-service kiosks, and digital queuing systems to enhance the in-store experience. For example, in July 2023, Japan's 7-Eleven collaborated with the Industrial Technology Research Institute (ITRI) to develop the flagship X-STORE 7 c-store. This new store is completely autonomous and unstaffed, utilizing ITRI's Grab & Go System Service, which combines intelligent shelves and AI sensors.

Unceasing growth in market penetration of multiple technologies and the growing use of smartphones and other devices have resulted in numerous changes in customer behavior. It has led to changing consumer expectations and preferences. Businesses have started investing in adopting advanced and innovative technologies to bridge the gap between existing operations and collective customer expectations. This has encouraged multiple technology industry participants to launch efficient and novel solutions for retail businesses. For instance, in February 2024, Huawei unveiled its Smart Retail Solution to enhance the operational efficiency of retail campuses, stores, and multi-branch networks. The smart retail solution comprises factors such as integrated cloud, network, and security features, Software-Defined Wide Area Network (SD-WAN), and Wi-Fi 6/7 technologies.

Solution Insights

The hardware segment dominated the regional industry and accounted for the revenue share of 64.3% in 2023. The growing adoption of technologies such as Augmented Reality (AR), Virtual Reality (VR), and artificial intelligence, increased use of point of sale (POS) systems, Radio-frequency identification (RFID) systems and Bluetooth beacons, to offer an immersive in-store shopping experience is expected to drive growth for this industry in approaching years. For instance, in October 2023, JTC Corporation introduced smart retail services in its industrial estates, featuring autonomous food delivery robot and facial recognition payment systems. Moreover, the rising demand for Internet of Things (IoT) devices, which enable real-time inventory tracking and smart payment solutions, has been driving growth for this segment. As e-commerce expands in countries such as India and China, robust hardware infrastructure to support these operations becomes even more crucial.

The software segment is anticipated to witness the fastest CAGR during the forecast period. Numerous companies and businesses have adopted multiple software technologies to collect data, manage inventories, identify and understand changes in customer preferences, and gain insights regarding consumer behavior patterns, driving the growth of this segment in recent years. The presence of various companies on online platforms and the increasing inclination among consumers towards the online shopping experience are expected to grow demand for this segment in the approaching years.

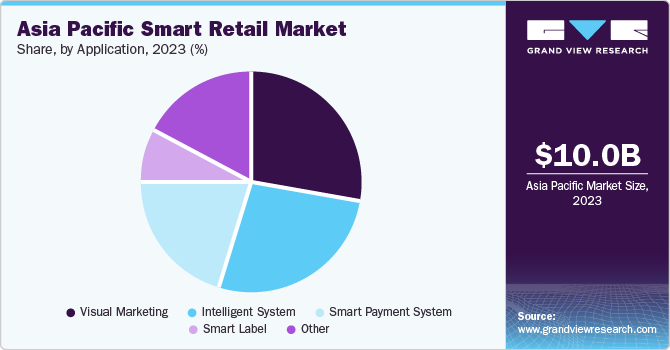

Application Insights

The visual marketing segment held the largest revenue share of the Asia Pacific industry in 2023. Increasing use of display screens, digital signage, audiovisual videos, infographic content, memes, and more to promote and market the products and services is expected to drive growth of this segment. Unceasing growth in internet use, increasing adoption of smartphones, growth in time spent on social media interactions, and rising inclination towards online shopping platforms have driven growth of this segment in recent years. The emergence of multiple content development platforms, content delivery applications, and increasing assistance provided by AI has resulted in the growing trend of visual marketing in the retail industry. This has helped companies to achieve enhanced brand visibility and improved market penetration through distribution of visual marketing campaigns.

The smart label segment is expected to experience a significant CAGR from 2024 to 2030. One of the primary factors driving the increasing adoption of IoT technology is smart labels to track inventory levels, monitor product freshness, and provide real-time product information. For example, in May 2024, Roambee Corporation, one of the prominent players in supply chain excellence technology and innovation, 'peel-and-ship' smart label technology that offers enhanced experience utilizing 5G, NIST calibrated sensors, and GPS. Regulations regarding clear labeling and unprecedented growth in demand for smart logistic solutions driven by the growing market penetration accomplished by the e-commerce industry is expected to generate greater demand for this segment during forecast period.

Asia Pacific Asia Pacific Smart Retail Market Trends

China dominated the regional market and accounted for a revenue share of 39.0% in 2023. The growth of this market is attributed to its robust technological infrastructure, vast consumer base, and rapid digital transformation of businesses operating in the retail industry. The region is home to prominent e-commerce industries and multiple manufacturers of numerous products in the retail sector. In addition, China's government policies, such as the "Digital China" and "Smart Retail" initiatives, support digital innovation and smart city developments, encouraging retailers to adopt smart technologies. Moreover, the tech-savvy population in the region with high penetration of digital platforms further drives demand for personalized and interactive retail experiences, accelerating the smart retail market.

The smart retail market in India is expected to witness the fastest CAGR from 2024 - 2030. The continuous increase mainly influences the growth of this market in demand experienced by online retail, the entry of multiple businesses in the country through online shopping platforms, and the growing number of smartphone users in the country. In addition, government policies such as Digital India, resulting in extraordinary growth in digital payments and the ever-increasing need for technology-driven solutions related to logistics, supply chain management, customer experience, customer assistance, shipping, and delivery, are expected to fuel growth for this market during the forecast period.

Key Asia Pacific Smart Retail Company Insights

Some of the key companies involved in the Asia Pacific smart retail market include Cisco Systems, Inc., Amazon, Bosch Global Software Technologies Private Limited, Probiz Technologies and others. To address the growing completion in the industry, companies have adopted strategies such as increased focus on research and development, innovation based new product launches, portfolio enhancement and collaborations with other organizations.

-

Probiz Technologies, one of the emerging organizations in the system integration and maintenance industry, offer multiple services and solutions such as design engineering, risk assessments, building management systems, security solutions, doortech engineering and others. The retail automation solutions provided by the company include retail automation, retail software, POS solutions, bar-code solutions, and more.

-

Cisco Systems Inc., a major market participant in technology and innovation industry, offers multiple retail solution such as mobile engagement, digital merchandising, intelligent contact center, drive-thru optimization, associate mobility, associate engagement, flexible fulfillment, safety and surveillance, loss & fraud detection, secure connectivity and optimization, intelligent operations, distribution and fulfillment, distribution automation and others.

Key Asia Pacific Smart Retail Companies:

The following are the leading companies in the Asia Pacific smart retail market. These companies collectively hold the largest market share and dictate industry trends.

- IntelliVision

- Probiz Technologies

- InvenSense (TDK Corporation)

- Cisco Systems, Inc.

- Honeywell International Inc.

- Amazon.com, Inc. (Amazon)

- Bosch Global Software Technologies Private Limited

- IBM

- Cognizant

- Ingenico

Recent Developments

-

In February 2024, Huawei Technologies Co., Ltd., a key industry participant in the innovation and technology market, introduced a Smart Retail Solution developed for retail industry settings, multi-branch interconnections, and retail stores. The newly launched solution series includes offerings related to energy efficiency, intelligence warehousing, digital marketing, and smart store networks. This entails advanced technologies intended to assist businesses in reducing costs, enhancing efficiency, improving customer experience, and achieving operational excellence.

-

In June 2024, Honeywell International Inc., a prominent organization in the automation and technology industry, announced the integration of artificial intelligence (AI) and machine learning technologies with its Guided Work Solutions. The step aims to deliver advanced AI solutions to retail businesses seeking sophisticated systems and solutions to keep up with trends such as online shopping, inclination towards highly personalized experiences, and pick-up in stores. With the newly updated integration of AI technology and Guided Work Solutions, the speech technology solution is empowered to understand employees' speech in 48 languages.

Asia Pacific Smart Retail Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.90 billion

Revenue Forecast in 2030

USD 65.32 billion

Growth rate

CAGR of 31.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Solution, application, region

Regional scope

Asia Pacific

Country scope

Japan, China, India, Australia, South Korea,

Key companies profiled

IntelliVision; Probiz Technologies; InvenSense (TDK Corporation); Cisco Systems, Inc.; Honeywell International Inc.; Amazon.com, Inc. (Amazon); Bosch Global Software Technologies Private Limited; IBM; Cognizant; Ingenico

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Smart Retail Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific smart retail market report based on solution, application, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Visual Marketing

-

Smart Label

-

Smart Payment System

-

Intelligent System

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.