- Home

- »

- Plastics, Polymers & Resins

- »

-

Bags And Containers Market Size, Industry Report, 2030GVR Report cover

![Bags And Containers Market Size, Share & Trends Report]()

Bags And Containers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Backpacks, Travel Bags, Sports Bags & Tote Bags), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-942-3

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bags And Containers Market Summary

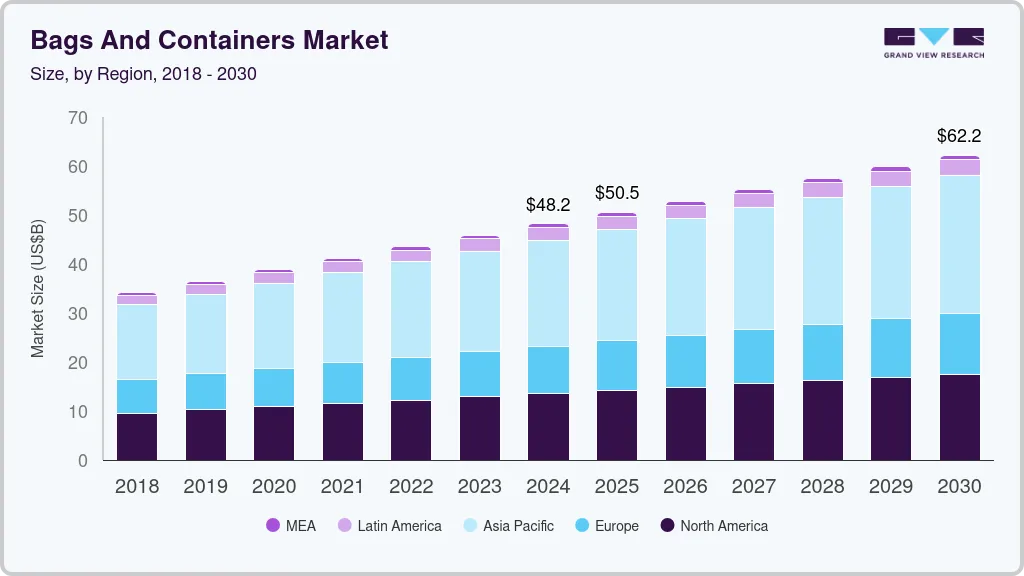

The global bags and containers market size was estimated at USD 48,188.6 million in 2024 and is projected to reach USD 62,184.6 million by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The growth of the global bags & containers industry is primarily driven by the increasing global travel and tourism sector and customer preference for high-end baggage.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, UK is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, backpacks accounted for a revenue of USD 20,430.5 million in 2024.

- Travel Bags is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 48,188.6 Million

- 2030 Projected Market Size: USD 62,184.6 Million

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2023

Furthermore, growing requirements for backpacks from the business and educational sectors are fueling the growth of the bags market. Rapidly changing lifestyles, urbanization, and increasing purchasing power of the middle class, particularly in developing nations, are the factors expected to drive demand for luxury and trendy bags. Increased domestic tourism, business trips, and growing demand for weekend family visits, all contribute to increased bags & containers sales.

The increase in demand for bags & containers is directly proportional to the growth of the travel and tourism industry. The worldwide travel and tourism business has seen substantial expansion in recent years. The tourism business is currently one of the world's fastest growing and most diverse sectors. Countries such as China, the U.S., Spain, and Germany among others have high outbound tourism. Furthermore, women's spending on luxury travel has increased dramatically in recent years, thereby supporting the market growth.

Drivers, Opportunities & Restraints

The rapid growth of e-commerce is a significant driver for the bags and containers market. Online retail platforms demand secure, lightweight, and versatile packaging solutions to ensure product safety during transit. Bags and containers made from advanced materials are being designed to meet these needs, offering tamper-proof and moisture-resistant options. Additionally, the convenience offered by resealable and customizable designs is enhancing their appeal, fueling increased adoption across various industries, including retail, food, and pharmaceuticals.

The rise of circular economy practices presents a substantial opportunity for the bags and containers market. Businesses are increasingly investing in closed-loop systems, where used packaging is collected, recycled, and reintroduced into production. This approach not only reduces waste but also aligns with the sustainability goals of major corporations. Companies that can establish efficient recycling and upcycling programs stand to gain a competitive edge, particularly as consumer and regulatory pressures for environmental accountability continue to rise.

Fluctuating raw material prices pose a significant restraint in the bags and containers market. Materials like plastic, aluminum, and specialty paper are subject to price volatility due to geopolitical tensions, supply chain disruptions, and changes in energy costs. Such unpredictability impacts profit margins and operational planning for manufacturers. Smaller players, in particular, face challenges in absorbing these costs, often leading to reduced competitiveness or delays in product innovation.

Type Insights

Backpacks dominated the bags & containers market across the product segmentation in terms of revenue, accounting for an industry share of 40.52% in 2024. Rising demand for the backpacks, for their multipurpose use by the working population to carry laptops and important accessories coupled with the demand from the educational sector, travelers, and trekkers; is likely to propel the backpacks market growth.

Growing demand for premium and customized bags from individuals will drive the backpack's future market growth. Additionally, the rising demand for fancy and trendy backpacks is expected to create numerous business opportunities for the market players, to expand their product portfolio and open new revenue streams.

The sports bags and tote bags sector is expanding at the fastest growth rate of 4.13% CAGR from 2025 to 2030. Growing sports activities and health-conscious individuals have led to rising demand for sports bags in the international market. Consumer spending on sporting items, particularly sports baggage, is expected to arouse interest and participation in various sports. This factor is predicted to contribute to market expansion.

In the next few years, rising involvement in professional sports is predicted to boost the product demand in this market. Furthermore, tote bags are getting popular to carry multiple belongings, as they are flexible and capable of accommodating multiple things. Premium and branded tote bags demand will drive the segment growth.

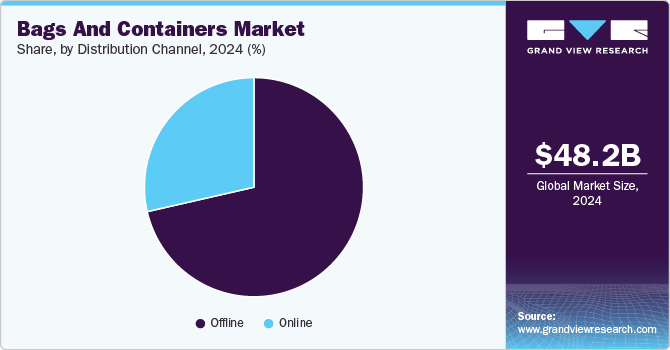

Distribution Channel Insights

Offline dominated the bags & containers industry across the distribution channel segmentation in terms of revenue, accounting to a market share of 71.42% in 2024. The growing chain of supermarkets and hypermarkets, the establishment of dedicated retail stores from top brands, and rapid urbanization are the factors that propel the offline channels' market growth.

A large portion of the population still prefers to buy products in the traditional way, which leads to the growing market for bags & containers at offline stores. As a part of their market growth strategy, bags and luggage manufacturing companies are extending the number of retail shops. Consumers' purchasing decisions are influenced even more when retailers provide goods discounts in exchange for club memberships.

The online segment is estimated to be the fastest-growing distribution channel over the forecast period. Rising demand for premium products through the e-commerce domain, availability of the products in a variety of price ranges, colors, design patterns, and materials appeals to the rising consumer base.

Consumers changed buying behavior during the pandemic positively benefited the market growth. Consumers now have access to a wide selection of product options because of the growth of e-commerce platforms and a preference for online purchasing. Many manufacturers are putting more emphasis on e-commerce, in order to gain momentum by using the direct-to-consumer model.

Regional Insights

Asia Pacific dominated the global bags & containers industry and accounted for largest revenue share of 44.81% in 2024, which is attributable to an increase in travel and tourist activities as well as the growth in the number of business travelers, the market is predicted to develop, resulting in an increase in sales of travel and business bags in Asia Pacific.

North America Bags And Containers Market Trends

In North America, the increasing preference for convenience-oriented packaging is a primary driver. Consumers are opting for resealable, lightweight, and easy-to-carry bags and containers for both on-the-go lifestyles and home storage needs. Furthermore, the region’s strong focus on sustainability and stringent regulations on single-use plastics are pushing manufacturers to innovate with recyclable and compostable materials. The rising popularity of meal kits and frozen foods further bolsters demand for specialized containers in this region.

U.S. Bags And Containers Market Trends

The U.S. bags & containers industry’s growth is primarily driven by the rapid expansion of e-commerce and home delivery services. Companies are focusing on protective, tamper-proof, and customizable packaging to meet consumer expectations and enhance brand identity. The robust food and beverage sector in the U.S., with a growing preference for packaged organic and fresh produce, is also driving the demand for high-quality bags and containers.

Europe Bags And Containers Market Trends

The Europe bags and containers industry is driven by the region’s strong environmental policies and consumer awareness regarding sustainability. The EU’s directives on reducing plastic waste and promoting circular economy practices have significantly influenced packaging trends. This has led to high demand for paper-based and reusable containers across industries, particularly in retail and food services. Additionally, Europe’s advanced recycling infrastructure and government support for eco-friendly packaging innovation are driving market growth.

China’s bags and containers market growth is driven by its position as a global manufacturing powerhouse and the world’s largest e-commerce market. The surge in online retail, fueled by platforms like Alibaba and JD.com, has increased the need for durable and versatile packaging materials. Moreover, China’s ban on non-degradable plastic bags in major cities has prompted manufacturers to develop sustainable and cost-effective alternatives. The country’s focus on reducing packaging waste as part of its environmental goals further supports the market’s expansion.

Key Companies & Market Share Insights

The bags & containers industry is highly competitive, with several key players dominating the landscape. Major companies include Ace Co. Ltd., Antler Ltd., Bric’s Industria Valigeria Fine SPA, Delsey S.A, Luggage America Inc., LVMH Moët Hennessy Louis Vuitton, Nike, Inc., Samsonite International S.A., V.F. Corporation, Valigeria Roncato, and VIP Industries Ltd. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Bags And Containers Companies:

The following are the leading companies in the bags and containers market. These companies collectively hold the largest market share and dictate industry trends.

- Ace Co. Ltd.

- Antler Ltd.

- Bric’s Industria Valigeria Fine SPA

- Delsey S.A

- Luggage America Inc.

- LVMH Moët Hennessy Louis Vuitton

- Nike, Inc.

- Samsonite International S.A.

- V.F. Corporation

- Valigeria Roncato

- VIP Industries Ltd.

- Briggs & Riley Travel ware

- Ralph Lauren Corp.

- Tommy Hilfiger

Recent Developments

-

In December 2024, Targus launched a new Made-in-India 15.6” Element Backpack (model TSB300AP), aimed at modern professionals in India. This backpack is designed to be both stylish and functional, offering ample storage and compartments for organization, making it suitable for both work and leisure activities. It features durable, water-resistant materials to protect devices and includes a trolley belt for easy transport in urban settings, as well as a hidden security compartment for valuables.

-

In October 2024, MUJI launched a new series of collapsible bags as part of its MUJI to GO collection. This range includes four types of bags: a backpack, a shoulder bag, and two Boston-style bags, all designed for travelers. Each bag features a water-repellent finish and can be easily collapsed into a compact storage bag for convenient transport. The new bags are now available in-store at the MUJI to GO section.

Bags And Containers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 50.52 billion

Revenue forecast in 2030

USD 62.18 billion

Growth rate

CAGR of 4.24% from 2025 to 2030

Historical data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Germany; UK; France; Russia; Italy; China; Japan; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Ace Co. Ltd.; Antler Ltd.; Bric’s Industria Valigeria Fine SPA; Delsey S.A.; Luggage America Inc.; LVMH Moët Hennessy Louis Vuitton; Nike, Inc.; Samsonite International S.A.; V.F. Corporation; Valigeria Roncato; VIP Industries Ltd.; Briggs &Riley Travelware; Ralph Lauren Corp.; Tommy Hilfiger

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bags And Containers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented bags and containers market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Backpacks

-

Travel Bags

-

Sports Bags and Tote Bags

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bags and containers market size was estimated at USD 48.18 billion in 2024 and is expected to reach USD 50.52 billion in 2025.

b. The global bags and containers market is expected to grow at a compound annual growth rate of 4.24% from 2025 to 2030 to reach USD 62.18 billion by 2030.

b. Asia Pacific dominated the bags and containers market with a share of 44.81% in 2024. This is attributable increase in travel and tourist activities as well as an increase in the number of business travelers.

b. Some key players operating in the bags and containers market include Ace Co. Ltd., Antler Ltd., Bric’s Industria Valigeria Fine SPA, Delsey S.A, Luggage America Inc., LVMH Moët Hennessy Louis Vuitton, Nike, Inc., Samsonite International S.A., V.F. Corporation, Valigeria Roncato, VIP Industries Ltd., Briggs & Riley Travelware, Ralph Lauren Corp., and Tommy Hilfiger.

b. Key factors that are driving the bags and containers market growth include increasing travel and tourism sector, customer preference for high-end baggage globally, and growing requirements for backpacks from the business and educational sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.