- Home

- »

- Petrochemicals

- »

-

Biolubricants Market Size, Share And Growth Report, 2030GVR Report cover

![Biolubricants Market Size, Share & Trends Report]()

Biolubricants Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (Vegetable Oil, Animal Oil), By Application (Transportation, Industrial), By End-use (Commercial Transportation, Consumer Automotive), By Region, And Segment Forecasts

- Report ID: 978-1-68038-013-2

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biolubricants Market Summary

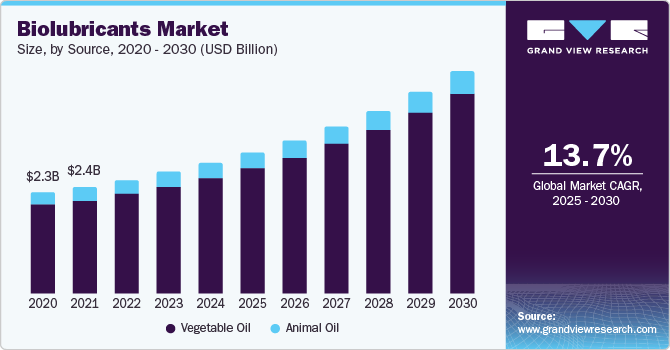

The global biolubricants market size was valued at USD 2.95 billion in 2024 and is projected to reach USD 5.04 billion by 2030, growing at a CAGR of 13.7% from 2025 to 2030. Due to the increasing applications in the transportation and manufacturing industries, there is a growing demand for lubricants with superior characteristics, such as high flash points, consistent viscosity, lower emissions, and biodegradability.

Key Market Trends & Insights

- North America dominated the biolubricants market with a share of 36.6% in 2024.

- U.S. held over 76.5% revenue share of the overall North America biolubricants market.

- Based on source, the vegetable oil segment accounted for the largest revenue market share, 89.6%, in 2024.

- Based application, the automotive segment dominated the market with a revenue share of over 62.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.95 Billion

- 2030 Projected Market Size: USD 5.04 Billion

- CAGR (2025-2030): 13.7%

- North America: Largest market in 2024

Stringent emission guidelines and regulatory frameworks drive this demand. Key industry participants are ramping up their research and development initiatives and technological innovations, which are expected to create new opportunities for lubricant applications. The market is supported by a rising supply of high-performance, cost-competitive green base oils, which align with government regulations encouraging such products. Major factors driving the demand for lubricants include heightened environmental concerns and strict government regulations regarding synthetic lubricants, particularly in Europe and North America.

The growth of the automotive sector, especially in emerging markets like India, China, South Africa, and Brazil, is anticipated to boost the demand for sustainable products that enhance fuel efficiency and reduce carbon emissions from vehicles. The production of biolubricants heavily relies on the availability of vegetable and animal oils, which are by-products of other industrial processes. The complex processing technologies can also increase initial production costs, potentially hindering growth over the forecast period.

Drivers, Opportunities & Restraints

Growing environmental awareness among consumers and industries has led to increased demand for sustainable products, including biolubricants derived from renewable resources. Stringent regulations aimed at reducing petroleum-based lubricants' environmental impact also encourage the adoption of biodegradable alternatives. Additionally, advancements in technology have improved the performance and cost-effectiveness of biolubricants, making them more attractive to manufacturers. Furthermore, the rising automotive and machinery sectors seek eco-friendly options to enhance their sustainability efforts, further propelling market growth.

The market faces several restraints that can hinder its growth. One significant challenge is the higher production costs associated with biolubricants compared to traditional petroleum-based alternatives, which can deter manufacturers from switching. Additionally, end-users need to be more aware of and understand biolubricants, which impact overall demand. The performance characteristics of some biolubricants may need to meet the rigorous requirements necessary in specific industrial applications, leading to hesitance in adoption. Lastly, fluctuations in the supply and pricing of raw materials, like vegetable oils, can affect the stability and scalability of biolubricant production.

The market presents significant opportunities driven by increasing environmental awareness and stringent regulations on petroleum-based products. As businesses seek sustainable alternatives to reduce their carbon footprint, the demand for biolubricants is expected to rise. Innovations in formulation and production technology can enhance the performance of biolubricants, making them more appealing for various industrial applications. Furthermore, the growing automotive and manufacturing sectors will likely adopt biolubricants as they strive for greener practices. With rising consumer preferences for eco-friendly products, the market is poised for substantial growth in the coming years.

Source Insights

“Vegetable Oil held the revenue share of over 89.6% in 2024.”

The vegetable oil segment accounted for the largest revenue market share, 89.6%, in 2024 and is expected to continue to dominate the industry over the forecast period. Biolubricants derived from animal fats and vegetable oils are becoming increasingly popular due to their eco-friendly characteristics and broad acceptance. These lubricants are recognized for their positive environmental impact, leading to their growing adoption across various industries. Vegetable oils exhibit exceptional lubricity, which surpasses that of mineral oils. Additionally, vegetable oils have a high viscosity index and flash point.

Animal oil, which includes rendered fats and oils from animal byproducts, comes from renewable sources, making it an environmentally sustainable choice for biolubricants. Using animal oil helps decrease our reliance on non-renewable resources. Biolubricants from animal oil offer excellent lubrication properties and are compatible with various applications and equipment. They provide effective lubrication, protection, and durability, supporting optimal performance while reducing maintenance needs.

Application Insights

“Automotive held the revenue share of over 62.4% in 2024.”

The automotive segment dominated the market with a revenue share of over 62.4% in 2024. Automotive engine oils lead the industry due to their superior performance compared to conventional engine oils. Additionally, bio-based engine oils offer a higher rate of biodegradation, lower toxicity to aquatic organisms, and minimal bioaccumulation, making them more appealing for use in this sector. Another critical application of biolubricants is in transmission fluids. These fluids improve the performance of valve operation, brake band friction, torque conversion, and gear lubrication. Transmission fluids are also used as hydraulic and lubricants in power steering systems and four-wheel-drive (4WD) transfer cases. As the use of transmission fluids in automotive manufacturing increases, it is expected to impact the market positively.

The industrial segment is expected to experience growth during the forecast period. Process oils hold a significant share in the industrial application segment, as they are widely used in technical and chemical industries to enhance production processes. The increasing demand for specialty chemicals in the emerging economies of the Asia-Pacific region is anticipated to drive the consumption of these oils.

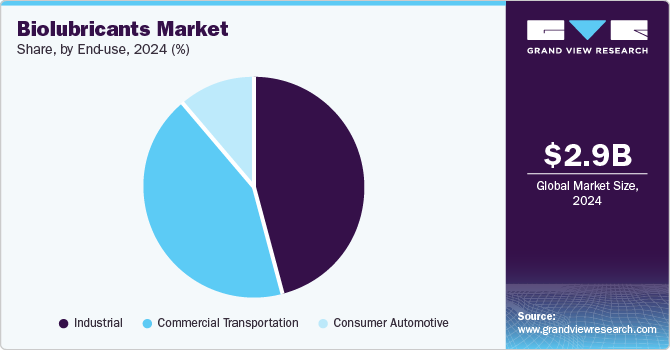

End-use Insights

“Industrial segment held the revenue share of over 46.1% in 2024.”

The industrial use of biolubricants is rising due to increasing awareness of environmental sustainability and health concerns related to traditional lubricants. Biolubricants, made from renewable resources, offer a biodegradable and non-toxic alternative that meets the performance demands of various industrial applications. Industries are adopting biolubricants to reduce their ecological footprint and comply with stringent environmental regulations. This shift not only enhances equipment efficiency but also improves workplace safety. As companies seek to implement greener practices, the demand for biolubricants in industrial settings is expected to grow.

The commercial transportation sector is anticipated to grow in the coming years, driven by a growing awareness of fuel efficiency and maintenance in heavy and light-duty trucks. Enhanced vehicle quality is directly linked to decreased environmental impact, leading to a significant rise in the popularity of these lubricants in the industry.

Regional Insights

“U.S. held over 76.5% revenue share of the overall North America Biolubricants market.”

North America biolubricants market is projected to grow during the forecast period. The resurgence of the automotive industry in the U.S. and Canada, combined with increasing regulatory measures from the U.S. government that mandate minimum renewable content in various products, is expected to boost the consumption of bio-based lubricants.

U.S. Biolubricants Market Trends

The biolubricants market in the U.S. is growing as the Air Force encourages the use of plant-based biodegradable products as a strategic approach to national security, which is a significant factor driving the market growth. Additionally, North America is well-positioned to benefit from its ample supply of soybean and rapeseed feedstock, largely due to the region's high levels of biodiesel production.

Asia Pacific Biolubricants Market Trends

The biolubricants market in Asia Pacific is expected to grow during the forecast period. The region hosts significant automobile manufacturing hubs. Countries like China, India, Indonesia, and other Southeast Asian nations are increasingly producing and exporting passenger cars and vehicles to developed regions. The relocation of production facilities to Asian countries due to favorable government regulations and lower labor costs is expected to further increase industrialization and automotive spending in the region. Additionally, the growing trend towards sustainable vehicles with improved efficiency will likely enhance both the production and demand for biolubricants.

Europe Biolubricants Market Trends

The biolubricants market in Europe is growing as the automotive industry in the European Union is one of the largest industries across the globe, forming a crucial part of its economy. According to the European Commission, this industry employs approximately 2.6 million people who are directly involved in the manufacturing of vehicles, thereby representing approximately 8.5% of the total manufacturing employment of the European Union. The region is also one of the leading producers of motor vehicles in the world, owing to increased support provided by governments of different countries of the region in the form of funds and technological harmonization for carrying out research and development activities in automation.

Latin America Biolubricants Market Trends

The biolubricants market in Latin America is growing as the region has formulated various policies to promote investment and partnerships with the private sector to address port and transportation infrastructure opportunities across the region. Brazil Terminal Portuario, one of the busiest container ports in Latin America, is also planning multiple terminal development projects in Moin, Costa Rica, Mexico, and Peru. This initiative is expected to boost the demand for biolubricants in the marine industry in the coming years.

Middle East & Africa Biolubricants Market Trends

The biolubricants market in the Middle East & Africa is anticipated to witness a rapid growth rate over the forecast period owing to the rising demand for automobiles across the region. The commercial vehicle is expected to witness an upward trend in the coming years, which, in turn, is projected to create lucrative opportunities for high-performance biolubricants in automotive applications. These trends are further anticipated to boost the demand for automotive biolubricants in the coming years.

Key Biolubricants Company Insights

Some of the key players operating in the market include TotalEnergies, Shell plc, and PETRONAS Lubricants International

-

ExxonMobil Corp. is a global manufacturer and supplier of synthetic lubricants. The company mainly operates in three business segments: upstream (oil and gas, E&P, shipping, and wholesale operations), downstream (refining, marketing, and retail operations), and chemicals.

-

Fuchs, a German lubricants producer. The company produces lubricants for a variety of industries, including mining, energy, transportation, industrial manufacturing, construction, consumer goods, and agriculture. The product portfolio includes compressor oils, corrosion preventatives, engine oils, food grade, gear oils, glass lubricants, grease, hydraulic oils, metalworking & motorcycle. It has a total of 54 operating companies with 34 production plants across the globe.

Key Biolubricants Companies:

The following are the leading companies in the biolubricants market. These companies collectively hold the largest market share and dictate industry trends.

- TotalEnergies

- Exxon Mobil Corporation

- Shell plc

- CASTROL Limited

- PETRONAS Lubricants International

- Kluber Lubrication

- Emery Oleochemicals

- Albemarle Corporation

- Chevron Corporation

- FUCHS

Recent Developments

-

In February 2024, Kraton introduced a new product line, SylvaSolve, which consists of bio-based oils. This product line is designed for various industrial applications, including coatings, adhesives, and personal care products. SylvaSolve oils are derived from renewable sources and offer a more sustainable alternative to traditional petroleum-based products. The company aims to meet the growing demand for eco-friendly solutions while supporting customers' sustainability goals.

-

In April 2023, Exxon Mobil announced its plan to invest approximately USD 110 million in establishing a lubricants production facility in India. This proposed plant is expected to begin operations at the end of 2025, with a projected annual production capacity of up to 159 million liters of lubricants. The aim of this strategic investment is to meet the growing domestic demand from various sectors, including steel, manufacturing, mining, power, and construction, as well as the commercial and passenger vehicle industries.

Biolubricants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.19 billion

Revenue Forecast in 2030

USD 5.04 billion

Growth rate

CAGR of 13.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin Africa, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, Saudi Arabia, and South Africa.

Key companies profiled

TotalEnergies, Exxon Mobil Corporation, Shell plc, CASTROL Limited, PETRONAS Lubricants International, Kluber Lubrication, Emery Oleochemicals, Albemarle Corporation, Chevron Corporation, FUCHS, Labiofam SA, Sigma Agri-Science, LLC, Agrinos Inc., Fertilizers USA LLC, and Kiwa Bio-Tech Sources Group Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

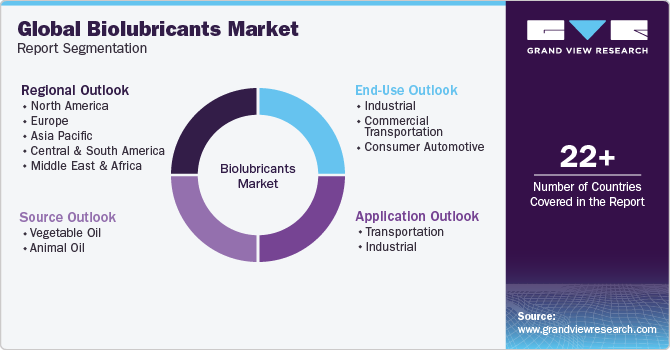

Global Biolubricants Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biolubricants market report based on source, application, end-use, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Vegetable Oil

-

Animal Oil

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Automotive Engine Oils

-

Gear Oils

-

Hydraulic Oil

-

Transmission Fluids

-

Greases

-

Chainsaw Oils

-

Other Transportations

-

-

Industrial

-

Process Oil

-

Demolding Oil

-

Industrial Gear Oil

-

Industrial Greases

-

Metal Working Fluid

-

Other Industrial

-

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial Transportation

-

Consumer Automotive

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biolubricants market size was estimated at USD 2.95 billion in 2024 and is expected to reach USD 3.19 billion in 2025.

b. The global biolubricants market is expected to grow at a compound annual growth rate of 13.7% from 2025 to 2030 to reach USD 5.04 billion by 2030.

b. North America dominated the biolubricants market with a share of 36.6% in 2024. This is attributable to increasing regulatory intervention from the U.S. government that has specified a minimum renewable content for various products.

b. Some key players operating in the biolubricants market include Total S.A., UBL, Shell, ExxonMobil, Chevron and British Petroleum.

b. Key factors that are driving the biolubricants market growth include superior characteristics of biolubricants such as constant viscosity, high flash points, biodegradability, and lower emission levels.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.