- Home

- »

- Next Generation Technologies

- »

-

Biometric Technology Market Size & Share Report, 2030GVR Report cover

![Biometric Technology Market Size, Share & Trends Report]()

Biometric Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Offering, By Authentication Type, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-299-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biometric Technology Market Summary

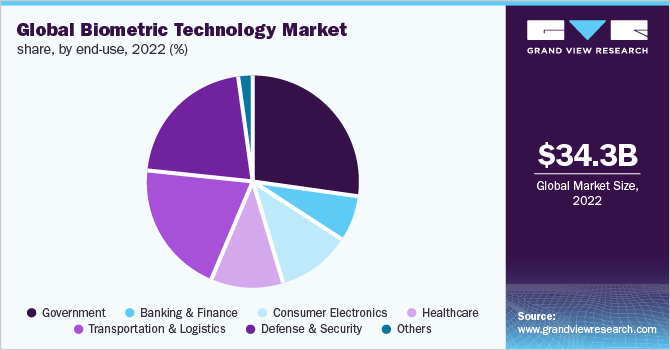

The global biometric technology market size was valued at USD 34.27 billion in 2022 and is projected to reach USD 150.58 billion by 2030, growing at a compound annual growth rate (CAGR) of 20.4% from 2023 to 2030. The demand for biometric technology is being driven by growing adoption of biometric systems in consumer electronics and automotive. Major factors influencing market growth are expanding applications of biometric technology in various industries and rising demand for authentication, identification, and security and surveillance solutions in a variety of application areas.

Key Market Trends & Insights

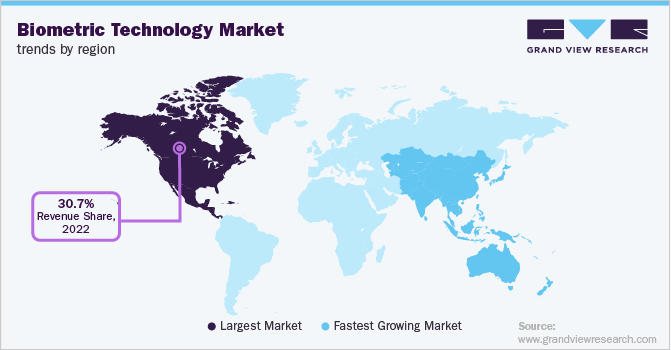

- North America accounts for the largest revenue share of 30.7% in 2022.

- Asia Pacific is projected to grow at highest CAGR of 22.4% during the forecast period.

- In terms of component, hardware segment dominates the biometric technology market is anticipated to hold 42.5% in 2022.

- Based on offering, contact segment is accounted to hold highest share of 37% in 2022.

- Based on authentication type, single factor authentication segment accounted for highest revenue share of 57.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 34.27 billion

- 2030 Projected Market Size: USD 150.58 billion

- CAGR (2023-2030): 20.4%

- North America: Largest market in 2022

However, significant barriers for market expansion include high prices required for biometric systems, as well as misunderstandings and ignorance about them. Comparing biometric technology to more conventional approaches like using tokens and passwords, fraud and security breaches are decreased. A biometric system offers high security and accuracy by using a reader, associated software, and a database to compare. Additionally, biometric technology is anticipated to expand during forecast period owing to the e-commerce sector's increased adoption of technology for safe payments. Moreover, growing usage of technology in both public and commercial sectors, for employee identification and attendance, is also projected to foster overall market demand.

Major Key players are entering into partnerships to expand their operations across the globe. For instance, Recently, Microsoft evaluated and certified three new small USB fingerprint reader accessories from BIO-Key, the, SideTouch, SideSwipe and EcoID, to support Windows 10's newest biometric authentication sign-in feature. In addition, multimodal biometric, which combine many behavioral or physiological traits for authentication, are anticipated to enhance security and recognition capabilities. A trend toward contactless biometric systems that evaluate face, posture, and voice recognition for identity authentication has also been brought about by coronavirus disease outbreak.

Businesses all across the world have been severely affected by the global COVID-19 outbreak. After the pandemic, biometric technologies proved to be quite helpful. During the pandemic, people started using masks, making it difficult for biometric technology equipment to identify the wearer. This resulted in development of, noncontact technologies like face and iris recognition to new levels in order to increase government screening, surveillance, and protection. In terms of sales and distribution capabilities of their product offering, the pandemic has helped businesses mobilize swiftly and make both short-term and long-term adaptations to their business models. As the epidemic spread across the world, global supply networks were disrupted and uncertainty regarding duration of the quarantine had an impact on sales. Additionally, the epidemic hastened adoption of digital services in all sectors of the economy. However, the biometric technology market is anticipated to rebound over course of the forecast period, owing to the precautionary investments in contactless biometric technology systems in developed and developing countries across the globe.

Market Dynamics

Use of biometric technology in consumer electronics has seen significant growth in recent years. It measures and analyzes unique physical or behavioral characteristics, such as fingerprints, facial features, iris patterns, voiceprints, and even heartbeats, for authentication and identification purposes. This technology has become increasingly prevalent in consumer electronics for several reasons, and its widespread adoption has become a driver for the biometric technology market. Firstly, biometric technology offers higher security than traditional authentication methods like passwords or personal identification numbers (PINs). Biometric features are unique to individuals, making it difficult for unauthorized users to access devices or data. As consumers become more aware of the vulnerabilities of traditional authentication methods and increasingly demand more secure alternatives, the adoption of biometric technology is growing. Biometric authentication methods are generally more convenient and user-friendly. Users can scan their fingerprints, faces, or irises to unlock devices, make payments, or access various applications. It eliminates the need to remember complex passwords or carry physical tokens like keys or access cards. The seamless and intuitive user experience biometric technology offers have fueled its popularity among consumers. Additionally, the COVID-19 pandemic has led to a significant increase in demand for contactless solutions across various industries. Biometric technology provides a touchless and hygienic authentication method, reducing the risk of germ transmission. Consumers increasingly prefer contactless interactions, such as contactless payments, access control, or attendance tracking, which has further driven demand for biometric technology in consumer electronics.

Component Insights

In terms of component, hardware segment dominates the biometric technology market is anticipated to hold 42.5% in 2022. Significant emergence of mobile biometric devices, increased focus on hardware-based security capabilities, and expanding usage of biometric technology in consumer electronics for authentication and identification applications are key factors driving expansion of biometric technology. Advantages of biometric hardware, including precise identification accountability, high performance, reliability, and high security & assurance, all contribute to the growth of this segment. To enhance hardware capabilities and lower cost for small and medium-sized businesses, many suppliers are investing in R&D for innovative technologies.

For ensuring compatibility and interoperability of biometric devices, software segments are crucial. The demand for associated software is anticipated to magnify as cloud-based services and AI are being used in biometric devices, ensuring device and operating system compatibility for a variety of applications. By storing and memorizing geographic data and enabling real-time data streaming, biometric systems use software to augment hardware. For instance, to increase its commercial reach in Middle East and Africa (ME&A), MasterCard collaborated with Thales to introduce a biometric payment card for Jordan Kuwait Bank.

Offering Insights

Based on offering, contact segment is accounted to hold highest share of 37% in 2022. Systems that recognize fingerprints, palm prints, and signatures are contact-based biometric systems. It is anticipated that growing use of fingerprint recognition systems in consumer electronics will propel contact segment's growth. Additionally, it is anticipated that growing use of contact-based biometric systems in athletic clubs, such as wellness gyms, fitness centers, and sports institutions, would support segment's expansion. The systems help clubs manage their memberships and keep track of training sessions.

Due to customers' growing security and hygiene concerns related to touch-based technologies, contactless industry is growing rapidly. This industry is expected to rise as a result of a number of factors, including strong government initiatives, growing use of contactless biometric in context of the pandemic, and expanding usage of face recognition in both public and private sectors. The need for contactless biometric systems has increased as a result of pressing need to reduce spread of COVID-19 as it can be conveyed by touching objects. The developing market for contactless systems and demand for biometric systems with improved features drive manufacturers of biometric systems to consistently engage in R&D activities.

Authentication Type Insights

Based on authentication type, single factor authentication segment accounted for highest revenue share of 57.3% in 2022 and is anticipated to hold leading share throughout the forecast period. This is attributable to high prominence of single-factor authentication since it is more practical, quick to respond, and economical. Most common single factor technologies are face and fingerprint recognition, particularly in applications related to government, banking, and travel and immigration. The desire for single factor systems has been further fueled by quick uptake of these technologies in consumer electronic gadgets.

High security is provided by two-factor authentication while maintaining a quick and simple user interface for increased user acceptance and adoption. A two-factor biometric solution like ID offers ability to require step-up security based on flexibility, risk and unmatched security. For instance One-time passwords (OTPs) delivered by SMS are commonly used as a second authentication factor, frequently used in conjunction with a traditional username/password login. The user's cellphone number will receive a code using this method.

Application Insight

Based on application, the Non-AFIS segment is accounted to have highest revenue share of 36.1% in 2022. Owing to increased use in common applications and implementation of regulations, Non-AFIS has most noticeable application. Non-AFIS are widely used in cell phones and PCs because they are simple to use and more conservative than automated fingerprint identification system (AFIS). AFIS is also projected to hold prominent share throughout the forecast period, attributing to its escalating usage in law enforcements and civil applications. Whereas AFIS are used in taxpayer-funded projects, ATM locations, exchange security, financial institutions, and military intelligence. Comfort and wellbeing are two key benefits of Iris technology; using it doesn't require user to be in a reading-related frame of mind.

Iris-based access controls, identity recognition, and surveillance are anticipated to grow into integral sections of the industry. They have applications in ATM facilities, financial institutions, transaction securities, military intelligence, and government programs. Primary advantage of Iris technology is safety and convenience; user does not need to have physical contact with the reader for using this technology. Face scanning is also one of most widely used biometric authentication technique. Contactless biometric techniques, such as hand geometry recognition, are projected to witness substantial growth over the forecast period.

End-use Insights

Based on end-use, government segment is estimated to hold leading revenue share and account for 27.2% in 2022. Biometric support justification of debasement through a variety of government-sponsored programmers for universal identifiable proof, such as biometric common IDs. With biometric distinguishing proof, qualified citizens can get government benefits, reimbursements, and incentives effectively while avoiding any potential framework constraints. Biometric technologies are frequently used by government organizations to confirm differences across international borders.

Defense & Security segment is also expected to account for prominent share during the forecast period. The biometric technology has wide applications to counter concerns including illegal migration and identity theft. Subsequently, the defense & security segment is anticipated to register robust demand throughout the forecast period. In order to stop criminals from entering their borders, some nations require visa applicants to undergo biometric tests that are scanned into databases of criminal histories and travel patterns.

Regional Insights

In terms of region, North America accounts for the largest revenue share of 30.7% in 2022. In the U.S., biometric techniques have wide applications in numerous departments including defense, homeland security, commerce, justice, and state. Biometric technology is being increasingly used to cater to safety and security needs, owing to increasing terrorist threats worldwide. Asia Pacific is projected to grow at highest CAGR of 22.4% during the forecast period. Initiatives, such as e-KTP electronic ID initiative in Indonesia and the UIDAI project in India, using face, fingerprints, and eye biometric, are also expected to provide new opportunities to the market.

Many financial institutions have adopted or are currently using biometric identification technology, and the banking industry has proceeded to replace conventional systems with biometric systems. The banking sector is rapidly digitizing, and stricter employee and customer identification protocols are still required in order to prevent fraud and identity theft. These factors have created the ideal conditions for biometric identification to become a strategic, integral component of banking security platforms around the world. The use of biometric in banking provides a reliable authentication technique that secures ATM, in-person, and online transactions while enhancing consumer trust and brand reputation. Banks have already started implementing biometric data-based technology to increase transaction security and improve customer experience.

Key Companies & Market Share Insights

To have a competitive edge, market vendors concentrate on growing their clientele. As a result, leading businesses undertake a range of strategic activities, such as joint ventures, mergers and acquisitions, collaborations, and the creation of new products and technologies. A competitive environment based on a thorough analysis of the major strategic moves made by the top market players in the biometric systems sector over the recent years. In order to maintain competitiveness in the market, participants are engaging in collaborations, mergers and acquisitions. For instance, In January 2022, IDEMIA announced a partnership with Microsoft for offering next-generation connectivity solutions and eSIM for consumer and IoT devices. Some prominent players in the global biometric technology market include:

-

Accu-Time Systems, Inc.

-

AFIX Technologies

-

BIO-key International, Inc.

-

DERMALOG Identification Systems GmbH

-

East Shore Technologies, Inc.

-

EyeVerify, Inc.

-

Fujitsu Limited

-

Gemalto NV

-

HID Global Corporation

-

IDEMIA

-

Iris ID, Inc.

-

NEC Corporation

Biometric Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 41.08 billion

Revenue forecast in 2030

USD 150.58 billion

Growth rate

CAGR of 20.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

component, offering, authentication type, application, end-use, region

Region scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Brazil

Key companies profiled

Accu-Time Systems, Inc.; AFIX Technologies; BIO-key International Inc.; DERMALOG Identification Systems GmbH; East Shore Technologies, Inc.; EyeVerify, Inc.; Fujitsu Limited; Gemalto NV; HID Global Corporation; IDEMIA; Iris ID, Inc.; NEC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biometric Technology Market Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Biometric Technology market report based on component, Offering, Authentication Type, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Contact

-

Contactless

-

Hybrid

-

-

Authentication Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Factor

-

Two Factor

-

Three Factor

-

Four Factor

-

Five Factor

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Face

-

Hand geometry

-

Voice

-

Signature

-

Iris

-

AFIS

-

Non-AFIS

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Government

-

Banking and Finance

-

Consumer Electronics

-

Healthcare

-

Transportation & Logistics

-

Defense & Security

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.