- Home

- »

- Next Generation Technologies

- »

-

Cellular IoT Market Size, Share And Growth Report, 2030GVR Report cover

![Cellular IoT Market Size, Share & Trends Report]()

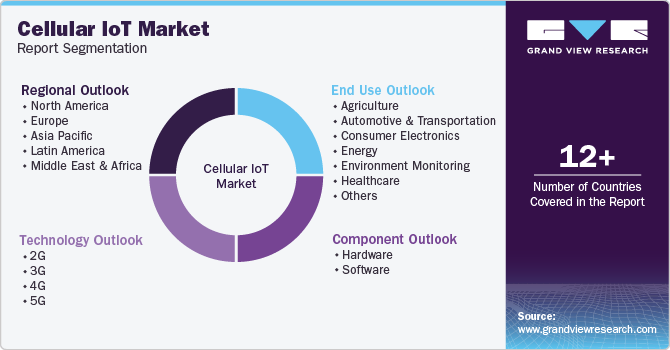

Cellular IoT Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (2G, 3G, 4G, 5G), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-578-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cellular IoT Market Summary

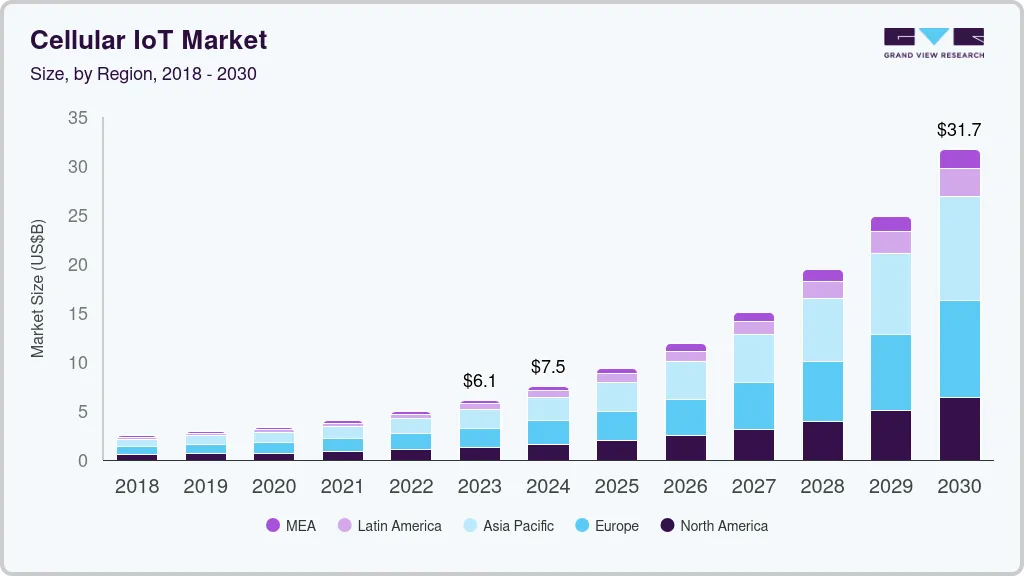

The global cellular iot market size was estimated at USD 6.11 billion in 2023 and is projected to reach USD 31.69 billion by 2030, growing at a CAGR of 27.1% from 2024 to 2030. The rising demand for Cellular IoT is attributed to the growing need for efficient and secure connectivity solutions across diverse sectors, including healthcare, agriculture, and utilities.

Key Market Trends & Insights

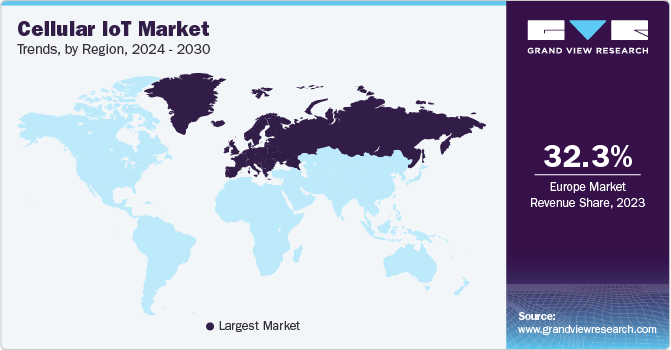

- The Europe dominated the market in 2023 and accounted for a market share of 32.3%.

- Based on component, the hardware segment held the largest market revenue of 58.8% in 2023.

- Based on end use, the energy industry accounted for a significant market share in 2023.

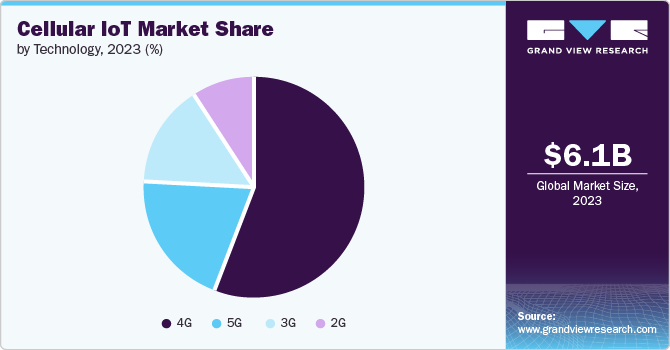

- Based on technology, the 4G segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.11 Billion

- 2030 Projected Market USD 31.69 Billion

- CAGR (2024-2030): 27.1%

- Europe: Largest market in 2023

These industries leverage IoT to optimize operations, enhance productivity, and reduce costs through the remote monitoring, predictive maintenance, and asset tracking capabilities enabled by Cellular IoT networks.

The 5G network technology advancement also drives the growth of the cellular IoT market. As the 5G network provides high-speed data, low latency, and greater device connectivity, it offers new potential for innovative IoT applications, driving rapid expansion in this sector. IoT devices are integrated with manufacturing processes to create smart factories where equipment and systems are interconnected and operate autonomously. IoT devices also help monitor energy use in industrial plants to identify improvement and cost-saving areas.

The increasing need for comprehensive security measures, including secure access at the device level and encrypted data transmission, is driving the expansion of the worldwide cellular IoT market. Cellular IoT solutions offer a reliable framework that enables businesses to reduce risks and enhance operational efficiency. Moreover, the rising demand for broader network coverage, increased inclination towards expanding business operations beyond traditional mobile broadband, and the necessity to support a large volume of connected devices across global enterprises are key drivers expected to boost the cellular IoT market's growth.

Component Insights

The hardware segment held the largest market revenue of 58.8% in 2023. As IoT applications expand across healthcare, manufacturing, and agriculture industries, there is a rising need for reliable and robust hardware to support these connected devices. Hardware components like sensors, modules, and gateways form the foundational infrastructure enabling devices to communicate securely and efficiently over cellular networks. Moreover, technological advancements have led to the development of more cost-effective and energy-efficient hardware solutions, making IoT deployment more feasible for businesses of all sizes. Additionally, the proliferation of 5G networks is further driving demand, as it promises faster speeds, lower latency, and more excellent connectivity, enhancing the performance and scalability of IoT applications.

Software component is expected to grow at the fastest CAGR of 29.2% over the forecast period. The increasing demand for connected devices, including wearables, smart home appliances, and industrial sensors, drives the market for cellular IoT solutions. Advancements in 5G technology enable faster data transmission and lower latency, making real-time communication feasible. In addition, smart city initiatives rely on IoT technologies, boosting the deployment of cellular IoT. Industries embrace IoT for automation, predictive maintenance, and supply chain optimization. Cellular IoT provides reliable connectivity for industrial applications.

End Use Insights

The energy industry accounted for a significant market share in 2023. As IoT devices proliferate across various industries, such as smart homes, industrial automation, and smart cities, there is an increasing need for a reliable and continuous power supply to support these devices. IoT applications like smart meters, environmental sensors, and remote monitoring systems require uninterrupted energy to function optimally and provide real-time data. Advancements in battery technology and energy harvesting techniques are making it more feasible to deploy IoT devices in remote or challenging environments where access to traditional power sources may be limited. This has expanded the scope of IoT deployments, further driving up the demand for energy solutions tailored to these devices.

The automotive & transportation segment is expected to grow at the fastest CAGR over the forecast period. The rising necessity for seamless connectivity in vehicles and transportation infrastructure is propelling the adoption of cellular IoT. Fleet management, real-time monitoring, and predictive maintenance are among the applications that heavily rely on reliable connectivity. Regulations about safety, emissions, and data collection are driving the integration of IoT technologies. Cellular IoT aids in compliance by facilitating data-driven insights and reporting. New applications such as autonomous vehicles, smart parking, and environmental monitoring also depend on cellular IoT. These different use cases are fostering innovation and attracting investments in the automotive and transportation sectors.

Technology Insights

The 4G technology segment dominated the market in 2023. The demand for the 4G technology in the cellular IoT market is increasing primarily due to its capability to provide robust connectivity, higher data speeds, and lower latency compared to older technologies like 2G and 3G. This is crucial for IoT applications that require real-time data transmission and reliable connectivity, such as industrial IoT (IIoT) deployments, smart city infrastructure, and connected vehicles. 4G LTE offers broader coverage and more stable connections, making it suitable for IoT devices deployed in remote or challenging environments where consistent communication is essential. Additionally, the maturity and widespread adoption of 4G networks by telecom operators globally make it a practical choice for scaling IoT deployments without the need for significant infrastructure upgrades.

5G segment is projected to witness the fastest CAGR over the forecast period. 5G networks offer significantly higher data transfer speeds and lower latency than previous generations like 4G LTE. This enhanced performance is crucial for IoT applications requiring real-time data processing, such as industrial automation, autonomous vehicles, and remote healthcare monitoring. 5G networks support many connected devices per unit area, enabling IoT deployments at scale without compromising network performance. This scalability is essential as industries increasingly adopt IoT solutions to improve operational efficiency and enable new services.

Regional Insights

The North American market is expected to grow at a significant CAGR over the projected period. This is due to the rise in the adoption of smart devices and the increase in spending on cellular IoT technologies by end users. In addition, the surge in the adoption of 5G technologies, particularly in developed nations, has driven the North American cellular IoT market growth. Furthermore, the availability of advanced telecom infrastructure is projected to drive the North American cellular IoT market growth during the forecast period.

U.S. Cellular IoT Market Insights

The U.S. dominated the regional market in 2023. The growing demand for secure and reliable connectivity as organizations increasingly rely on IoT applications drives market growth. Technological advancements in cellular networks, including LTE, 5G, and NB-IoT, have positioned the U.S. at the forefront of IoT deployment. The adoption of low-power wide-area networks (LPWAN) further supports IoT scalability. In addition, connected health wearables and the need for timely data insights contribute to the U.S.'s leadership in this market.

Europe Cellular IoT Market Insights

Europe dominated the market in 2023 and accounted for a market share of 32.3%. The expanding adoption of smart city initiatives across major European urban centers fuels the market demand. These initiatives leverage Cellular IoT technologies to enhance urban management systems, including smart lighting, waste management, and traffic control, improving efficiency and sustainability. Additionally, industries such as automotive and transportation are increasingly integrating Cellular IoT for fleet management, vehicle tracking, and remote diagnostics, which optimize operations and reduce costs.

UK market is projected to witness a prominent growth in the projected years. The UK's push towards digital transformation across various sectors, such as manufacturing, healthcare, and transportation, has spurred the adoption of IoT solutions. These solutions leverage cellular networks to enable real-time data collection and analysis, enhancing operational efficiency and enabling predictive maintenance. Secondly, regulatory initiatives promoting smart city development and environmental sustainability have accelerated IoT deployment. Moreover, the expansion of 5G networks promises higher bandwidth and lower latency, further fueling the growth of cellular IoT applications in the UK.

The Cellular IoT market in Germany is anticipated to be lucrative in this industry. One significant driver is the country's robust industrial sector, particularly in the manufacturing and automotive industries, where IoT technologies enhance operational efficiency through real-time monitoring of equipment and processes. IoT enables predictive maintenance in manufacturing, reducing downtime and optimizing production schedules. Moreover, Germany's strong focus on environmental sustainability drives IoT adoption in smart energy management systems, facilitating efficient use of resources like electricity and water. Another critical application lies in healthcare, where IoT devices enable remote patient monitoring and data-driven healthcare solutions, supporting aging populations and improving overall patient care quality.

Asia Pacific Cellular IoT Market Insights

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. The rapid urbanization and industrialization across countries such as China and India have fueled the need for more efficient and connected infrastructure. This includes smart city projects, industrial automation, and agricultural advancements that rely on IoT solutions for real-time data monitoring and management. The increasing adoption of 5G technology in the region has enhanced the capability and reliability of cellular networks, making them more suitable for IoT applications that require high-speed connectivity and low latency.

China market is projected to grow significantly. The rapid expansion of smart cities initiatives across China has driven the need for robust and interconnected IoT networks. China's strong manufacturing base and focus on industrial IoT applications have propelled the adoption of Cellular IoT technologies in manufacturing, logistics, and agriculture sectors. Favorable government policies and investments in 5G infrastructure have accelerated the deployment of Cellular IoT solutions, fostering a conducive environment for innovation and market expansion.

The Cellular IoT market in India is projected to be lucrative in this industry. as Indian automotive manufacturers embrace digital transformation, there's a growing emphasis on integrating IoT technology to enhance vehicle performance, efficiency, and safety. IoT enables real-time monitoring of vehicle health, predictive maintenance, and fleet management, which are crucial for optimizing operations and reducing downtime. For instance, In November 2023, Cavli Wireless, an Indian tech company, announced the launch of a new Android smart module designed and manufactured entirely in India. This module aims to support various IoT applications globally, offering features like 4G LTE connectivity and support for AI and machine learning capabilities.

Key Cellular IoT Company Insights

Some of the key companies include Cisco; Tata Communications; Semtech; Verizon Communications Inc.; Microsoft Corporation; Huawei Technologies Co. Ltd.

-

Cisco offers an IoT Control Center, a complete solution enabling businesses to effectively manage and profit from their IoT devices. It enables rapid and precise connection, provisioning, and deployment of devices on a large scale. By integrating numerous automation rules, businesses can tailor the IoT Control Center to suit any IoT application and business scenario, facilitating rapid growth and innovation.

-

Tata Communications with its LoRaWAN network provides IoT solutions for enterprises in an industry-wide, business-ready solutions spanning across monitoring, metering and tracking use cases.

Key Cellular IoT Companies:

The following are the leading companies in the cellular IoT market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Semtech

- Verizon Communications Inc.

- Microsoft Corporation

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- AT&T Inc.

- Tata Communications.

- Fibocom Wireless Inc.

- Quectel Wireless Solutions Co., Ltd

Recent Developements

-

In April 2024, in partnership with XL Axiata, Cisco announced the launch of an IoT connectivity product aimed at advancing IoT services in Indonesia. This collaboration aims to drive digital transformation and operational efficiency across various sectors in the country, leveraging Cisco's technology expertise.

-

In February 2024, Fibocom, in partnership with STMicroelectronics, announced the launch of a smart home solution. This joint effort aims to showcase innovative capabilities in smart home technology, integrating Fibocom's expertise in IoT connectivity with STMicroelectronics' advanced semiconductor solutions.

Cellular IoT Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.53 billion

Revenue forecast in 2030

USD 31.69 billion

Growth Rate

CAGR of 27.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Saudi Arabia, and South Africa

Key companies profiled

Cisco Systems, Inc.; Semtech; Verizon Communications Inc.; Microsoft Corporation; Telefonaktiebolaget LM Ericsson; Huawei Technologies Co. Ltd.; Huawei Technologies Co. Ltd.; AT&T Inc.; Tata Communications.; Fibocom Wireless Inc.; Quectel Wireless Solutions Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cellular IoT Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cellular IoT market report based on component, technology, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

2G

-

3G

-

4G

-

5G

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Automotive & Transportation

-

Consumer Electronics

-

Energy

-

Environment Monitoring

-

Healthcare

-

Retail

-

Smart Cities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africaa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.