- Home

- »

- Automotive & Transportation

- »

-

Center Stack Display Market Size, Industry Report, 2030GVR Report cover

![Center Stack Display Market Size, Share & Trends Report]()

Center Stack Display Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (TFT LCD, OLED), By Display Size (Upto 7 Inch, More Than 7 Inch), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-4-68038-552-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Center Stack Display Market Size & Trends

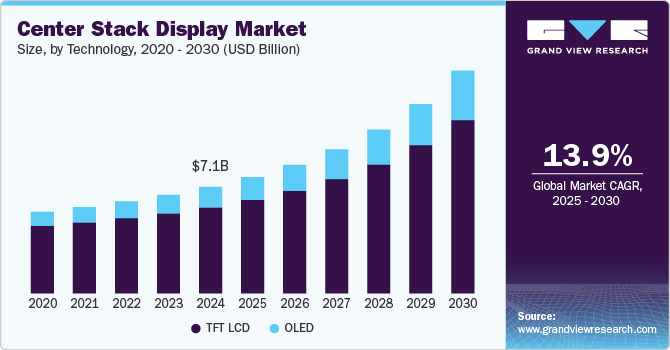

The global center stack display market size was estimated at USD 7,183.0 million in 2024 and is projected to grow at a CAGR of 13.9% from 2025 to 2030. The market is expected to grow significantly in the forthcoming years owing to increasing demand for gesture controls, advanced infotainment systems, and central controllers widely used in passenger vehicles for luxury, safety, comfort, and security benefits. The automobiles are outfitted with center stack systems on the vehicle's dashboard, consisting of the control systems, such as music and audio system and temperature display, and support reverse rearview camera system.

The rapid adoption of electric vehicles (EVs) and autonomous vehicles (AVs) is transforming the center stack display industry, driving demand for larger, smarter, and more interactive displays. Unlike traditional vehicles, EVs rely heavily on digital interfaces for battery management, energy efficiency monitoring, and infotainment controls, making the center stack display a crucial user interface. The transition to fully digital dashboards and touch-based controls is eliminating the need for physical buttons, and streamlining minimalistic and futuristic interior designs. In addition, autonomous driving technology is reshaping vehicle interiors, with center stack displays evolving into entertainment hubs, productivity screens, and personalized control panels.

Automakers are integrating multi-screen setups, curved OLED displays, and augmented reality (AR) overlays to enhance both functionality and aesthetics. As AVs progress toward higher levels of automation (SAE Level 3-5), center stack displays will play a pivotal role in offering video streaming, gaming, and real-time AI-driven assistance. Moreover, the push for sustainable and energy-efficient displays is leading to the adoption of low-power OLED and MicroLED technologies in EVs. With EV and AV adoption accelerating, the demand for advanced center stack displays will continue to rise, shaping the future of digital automotive interiors.

An increase in the sales of passenger vehicles pre-equipped with audio and visual entertainment in the form of infotainment units, coupled with features such as real-time traffic and navigation, is bolstering the market growth. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2023, the sales of passenger cars worldwide accounted for 65,272,367 units. In 2022, the sales of passenger vehicles accounted for 58,644,601 units. Thus, an increase in the sales of passenger vehicles is expected to drive the market growth over the forecast period

The integration of advanced display technologies, such as OLED, QLED, and touchscreen interfaces, significantly increases manufacturing costs in the center stack display industry. OLED displays, known for their superior contrast, flexibility, and energy efficiency, are more expensive than traditional LCDs due to complex production processes and material costs. In addition, the incorporation of haptic feedback, curved screens, and multi-touch functionality further escalates expenses. Automakers must also invest in durability testing, heat resistance, and anti-glare coatings to ensure longevity and usability. As vehicle interiors become more digitalized, scaling production while maintaining affordability remains a challenge, impacting pricing strategies and adoption rates, particularly in mid-range and economy vehicles.

Technology Insights

Based on technology, the TFT LCD segment led the market with the largest revenue share of 80.76% in 2024.TFT LCDs are the preferred choice for mid-range and economy vehicles due to their cost-effectiveness and large-scale production capabilities. Compared to OLEDs, TFT LCDs are more affordable, making them accessible to a broader range of automakers. Their well-established manufacturing ecosystem ensures high production efficiency and lower costs, enabling widespread adoption. Unlike OLEDs, which are mostly found in luxury vehicles, TFT LCDs are widely used in entry-level, mid-range, and commercial vehicles, giving them a larger market share. Their durability, reliability, and continuous advancements in brightness and touch capabilities further contribute to their increasing use in modern digital cockpits and infotainment systems.

The OLED segment is anticipated to grow at a significant CAGR of 16.6% during the forecast period. OLED displays are gaining traction in the center stack display industry due to their superior visual performance. They offer higher contrast ratios, deeper blacks, and vibrant colors compared to traditional LCDs, enhancing daytime and nighttime visibility while improving vehicle aesthetics. This premium display quality is particularly attractive to luxury and electric vehicle (EV) manufacturers, who prioritize sleek, high-tech interiors. OLEDs are also thinner, lighter, and more energy-efficient, making them ideal for EVs that require optimized power consumption. As demand for minimalistic, futuristic dashboards grows, automakers are increasingly integrating curved, flexible, and touch-enabled OLED screens, further driving adoption in premium and high-end vehicles.

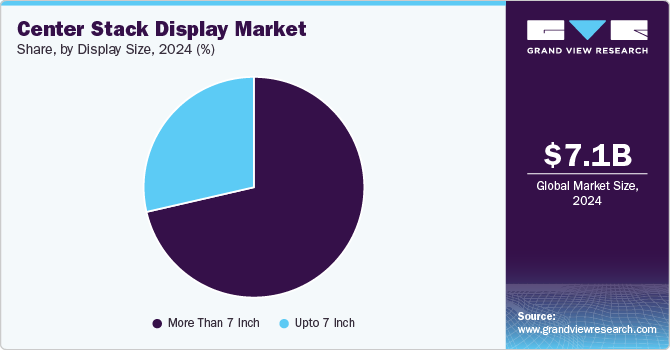

Display Size Insights

Based on display size, more than 7 inch segment led the market with the largest market share of 71.41% in 2024. Consumers increasingly prefer larger, high-resolution screens for navigation, multimedia, and vehicle controls, driving demand for 7-inch+ center stack displays. Bigger screens enhance visibility, usability, and overall driving experience, making them a key feature in modern vehicles. Automakers are integrating advanced infotainment systems with split-screen capabilities, AI-driven assistants, and wireless connectivity, requiring larger-screen real estate for seamless functionality. Features like real-time navigation, voice control, and smartphone mirroring perform better on bigger, high-definition displays, improving user convenience. As automotive interiors evolve into digital cockpits, larger displays are becoming a standard feature, especially in premium, electric, and connected vehicles.

The up-to-7-inch segment is expected to grow at a significant CAGR during the forecast period. The up to 7-inch display segment offers cost efficiency, making it ideal for economy and mid-range vehicles, where advanced features need to be incorporated without raising vehicle prices. Smaller displays are also widely adopted in entry-level cars, commercial vehicles, and fleet management systems, where the focus is on functionality over screen size. These displays enable basic infotainment and navigation systems while keeping the overall vehicle cost competitive, and appealing to cost-conscious consumers and commercial fleet operators.

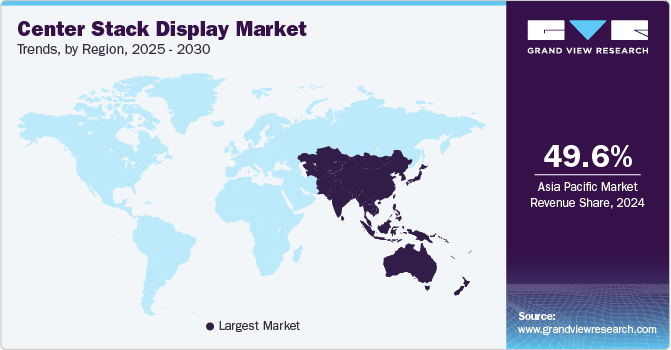

Regional Insights

The center stack display market in North America accounted for the largest market share of 14.0% in 2024. In North America, there is a growing demand for premium vehicles and electric vehicles (EVs). These vehicles often feature large, high-resolution center stack displays to enhance infotainment, navigation, and vehicle controls. The integration of advanced touchscreen interfaces and digital cockpits not only improves the user experience but also aligns with the increasing consumer desire for high-tech, intuitive features in modern automobiles.

U.S. Center Stack Display Market Trends

The center stack display market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. Major players like Tesla, General Motors, and Ford are at the forefront of integrating advanced center stack displays into their EVs and luxury vehicles, promoting innovation in vehicle interiors and attracting tech-savvy consumers. Similarly, the U.S. automotive industry is increasingly focusing on digital cockpits that combine instrument clusters and center stack displays into unified interfaces, improving the driving experience and functionality.

Asia Pacific Center Stack Display Market Trends

Asia Pacific dominated the center stack display market with the largest revenue share of 49.59% in 2024. The Asia Pacific region has a rapidly expanding middle-class consumer base, especially in countries like China, India, and Southeast Asia, where there is a growing demand for affordable vehicles with advanced infotainment features. This drives the need for affordable yet high-quality center stack displays in entry-level and mid-range vehicles.

The center stack display market in China held a substantial market share in 2024. Chinese automakers like BYD, Geely, and NIO are incorporating cutting-edge technologies such as AI-driven infotainment systems, touchscreens, and voice assistants in their vehicles. These innovations demand sophisticated and high-quality center stack displays to enhance user experience.

The Japan center stack display market accounted for a substantial market share in 2024. Japan is home to key display manufacturers such as Sony and Sharp, which are at the forefront of OLED and LCD technologies. The availability of high-quality display solutions made locally further fuels the demand for advanced center stack displays in Japanese vehicles.

The center stack display market in India is growing rapidly, as India has a price-sensitive automotive market, with a significant share of mid-range and entry-level vehicles. As manufacturers introduce affordable digital infotainment systems, the demand for cost-effective center stack displays is increasing, particularly TFT-LCD screens.

Europe Center Stack Display Market Trends

The center stack display market in Europe is anticipated to grow at a significant CAGR of 13.6% from 2025 to 2030, due to the presence of large technology companies and significant investments made in the R&D of center stack displays are the major factors fueling the market growth. Moreover, some players operating in the region are Continental AG, Robert Bosch GmbH, Preh GmbH, and MTA S.p.A. In addition, major vehicle OEMs in the region are anticipated to boost regional market growth.

The UK center stack display market is expected to grow at a rapid CAGR during the forecast period. The UK government is investing in autonomous vehicle technologies, and driver assistance systems are becoming standard features in new models. As these systems often require digital interfaces and center stack displays for ease of operation, this drives the adoption of advanced display solutions.

The center stack display market in Germany held a substantial market share in 2024. Germany is known for its luxury vehicle segment, with brands like Audi, Porsche, and BMW integrating state-of-the-art digital cockpits and high-quality displays into their vehicles. As consumers increasingly demand high-tech interiors, the market for center stack displays in premium vehicles is expanding.

Key Center Stack Display Company Insights

The key market players in the global center stack display industry include Continental AG, Alpine Electronics, Inc., Panasonic Holdings Corporation, HARMAN International, MOBIS INDIA LIMITED, Robert Bosch Manufacturing Solutions GmbH, Texas Instruments Incorporated, MTA S.p.A, PREH GMBH, and Visteon Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Center Stack Display Companies:

The following are the leading companies in the center stack display market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- Alpine Electronics, Inc.

- Panasonic Holdings Corporation

- HARMAN International

- MOBIS INDIA LIMITED

- Robert Bosch Manufacturing Solutions GmbH

- Texas Instruments Incorporated

- MTA S.p.A

- PREH GMBH

- Visteon Corporation.

Recent Developments

-

In January 2024, Continental AG introduced the 10-inch Crystal Center Display, a transparent, high-resolution display designed to seamlessly blend into a vehicle’s interior. It features high contrast, low reflection, and energy-efficient technology, enhancing both aesthetics and functionality. Recognized as a CES 2024 Innovation Award Honoree, the display offers a sleek, modern interface for infotainment and controls, catering to the growing demand for premium in-car digital experiences

-

In April 2023, HannStar, a company specializing in display technologies, recently developed a TFT LCD-based Paper Display as a competitor to E Ink's EPD (electronic paper display). The Paper Display utilizes thin-film transistor liquid crystal display (TFT LCD) technology, offering an alternative solution to E Ink's popular EPD technology. The TFT LCD-based Paper Display aims to provide similar benefits to EPD, such as low power consumption and a paper-like reading experience. It utilizes a thin and lightweight design, making it suitable for display sizes such as e-readers, electronic shelf labels, and other devices requiring low-power, reflective displays.

-

In January 2023, HARMAN, a subsidiary of Samsung Electronics Co., Ltd. and an automotive technology company specializing in designing automotive-grade consumer experiences, has recently introduced HARMAN Ready Vision. This innovative offering comprises hardware and software products for Augmented Reality (AR) head-up displays (HUDs) to improve driver awareness and safety. Ready Vision's AR software seamlessly incorporates with vehicle sensors, providing drivers with visual alerts and immersive audio. These alerts deliver crucial information and knowledge in accurate, timely, and non-intrusive manner, empowering drivers with enhanced situational awareness.

Center Stack Display Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 7,843.9 million

Market size forecast in 2030

USD 15,017.8 million

Growth rate

CAGR of 13.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Market size in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Technology, display size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Continental AG; Alpine Electronics, Inc.; Panasonic Holdings Corporation; HARMAN International; MOBIS INDIA LIMITED; Robert Bosch Manufacturing Solutions GmbH; Texas Instruments Incorporated; MTA S.p.A; PREH GMBH; Visteon Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Center Stack Display Market Report Segmentation

This report forecasts market size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global center stack display market report based on technology, display size, and region.

-

Technology Outlook (Market Size, USD Million, 2018 - 2030)

-

TFT LCD

-

OLED

-

-

Display size Outlook (Market Size, USD Million, 2018 - 2030)

-

Upto 7 inch

-

More than 7 inch

-

-

Regional Outlook (Market Size, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global center stack display market size was estimated at USD 7,183.0 million in 2024 and is expected to reach USD 7,843.9 million in 2025.

b. The global center stack display market is expected to grow at a compound annual growth rate of 13.9% from 2025 to 2030 to reach USD 15,017.8 million by 2030.

b. The TFT LCD segment accounted for a market share of over 80.0% in 2024. TFT LCDs are the preferred choice for mid-range and economy vehicles due to their cost-effectiveness and large-scale production capabilities. Compared to OLEDs, TFT LCDs are more affordable, making them accessible for a broader range of automakers. Their well-established manufacturing ecosystem ensures high production efficiency and lower costs, enabling widespread adoption.

b. The key market players in the global center stack display market include Continental AG, Alpine Electronics, Inc., Panasonic Holdings Corporation, HARMAN International, MOBIS INDIA LIMITED, Robert Bosch Manufacturing Solutions GmbH, Texas Instruments Incorporated, MTA S.p.A, PREH GMBH, and Visteon Corporation.

b. The market for center stack displays is expected to grow significantly in the forthcoming years owing to increasing demand for gesture controls, advanced infotainment systems, and central controllers widely used in passenger vehicles for luxury, safety, comfort, and security benefits. The automobiles are outfitted with center stack systems on the vehicle's dashboard, consisting of the control systems, such as music and audio system and temperature display, and support reverse rearview camera system.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.