- Home

- »

- Green Building Materials

- »

-

Ceramic Wall Tiles Market Size, Share & Growth Report 2030GVR Report cover

![Ceramic Wall Tiles Market Size, Share & Trends Report]()

Ceramic Wall Tiles Market (2023 - 2030) Size, Share & Trends Analysis Report By Dimensions (20 * 20, 30 * 30, 30 * 60), By Application (Residential, Commercial, HORECA, Office), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-953-1

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Wall Tiles Market Size & Trends

The global ceramic wall tiles market size was valued at USD 132.2 billion in 2022 and is anticipated to grow at a CAGR of 7.8% from 2023 to 2030.Rising construction activities due to the growing need for housing and commercial spaces are expected to augment the demand for ceramic wall tiles. The demand is also expected to benefit from growing renovation activities in commercial spaces, including offices, hospitals, and shopping malls. Ceramic wall tiles are rapidly replacing traditional wall covering materials, such as paint, wallpapers, and wooden panels, on account of their durability, stain & scratch resistance, and low maintenance properties. Furthermore, the growing adoption of ceramic wall tiles as a low-cost alternative to marble and other natural stone slabs is further expected to boost market growth over the forecast period.

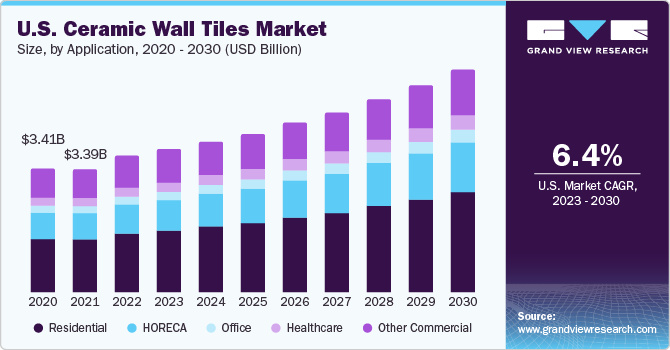

The U.S. is emerging as one of the leading markets, owing to the growing adoption of ceramic wall tiles in the residential housing segment. The substantial growth of single-family housing constructions in the country is expected to propel product demand over the projected period. Moreover, increasing demand from the commercial sector, such as corporate offices, hotels, and restaurants, is expected to fuel market growth for ceramic wall tiles in the coming years.

Decorative walls play a significant role in increasing the elegance and overall aesthetics of a building structure. A majority of consumers prefer innovative and decorative wall tiles to add an aesthetic appeal to residential as well as commercial buildings. As a result, the market for ceramic wall tiles is witnessing innovations and experiments by notable players in the given market space.

The emergence of digital inkjet printing technology has revolutionized the global ceramic tiles market. The process involves directly spraying the ink on the tile surface to imitate images and designs with photo-realistic resolutions. As a result, the adoption of digital inkjet printing technology has enabled manufacturers to replicate the design, color depth, and pattern of various natural products, including marble, wood, and metals.

Market players have introduced extra-large size products, especially for commercial spaces such as airports, offices, shopping malls, and retail stores. These products are witnessing a steady growth in demand, owing to their ability to offer a seamless and monolithic look. However, high installation costs and a lack of skilled labor are expected to restrain the demand for these tiles in the market over the coming years.

Application Insights

The residential segment accounted for the largest revenue share of 44.0% in 2022 in the ceramic wall tiles market and is expected to expand at the fastest CAGR of 8.4% during the forecast period. The growing demand for housing structures globally, coupled with the rapid pace of urbanization is expected to drive market growth for the residential application segment over the forecast period.

Ceramic wall tiles are used extensively in residential and commercial sectors on account of their ability to create several designs and styles. The rising preference for ceramic wall tiles by designers and architects is expected to boost product demand. Factors, such as the expansion of modern office spaces, along with a growing number of renovation activities in retail spaces and corporate offices, are expected to propel market growth.

The rapid growth of the tourism industry in the Asia Pacific region has resulted in the strong expansion of the HORECA segment. The increasing number of hotels and restaurants in Southeast Asian countries is expected to propel the demand for ceramic wall tiles over the projected period. Also, rising investments in the development and renovation of tourism infrastructure within Europe and the Americas are further expected to boost product demand.

The healthcare application segment is expected to expand at a CAGR of 7.6% over the projected period, in terms of revenue. The product is witnessing growing adoption in the healthcare sector, aided by the increasing investments in the development and upgrade of healthcare infrastructure across the globe. The product is preferred in this space owing to its beneficial properties, including superior microbe, fungus, and bacterial resistance, as well as ease of cleaning.

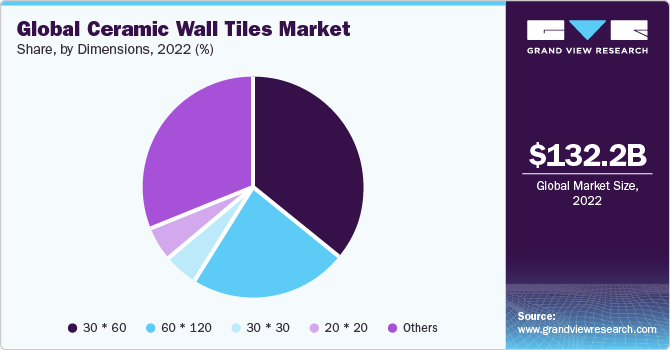

Dimensions Insights

The 30 * 60 dimension segment accounted for the largest revenue share of 36.4% in 2022. This size is widely preferred in the residential application space, on account of its versatility and ability to be installed in a variety of layouts such as lines, staggered, combined, or modular. However, products with larger dimensions are finding increasing acceptance among consumers, which is expected to hamper the demand for 30 * 60-sized products.

Improvements in production technology have made it possible to produce ceramic wall tiles of larger dimensions. Modern ceramic tiles are slimmer and lightweight as compared to their predecessors. However, the installation of these extra-large tiles on vertical walls is found to be challenging owing to their high weight, which makes the process cost-intensive, thereby affecting industry growth.

Ceramic wall tile sizes and shapes have steadily evolved over the years. Square-shaped products, including 15 * 15 and 20 * 20 were especially popular in the preceding decade; however, modern trends are favoring rectangle-shaped tiles owing to their ability to provide a cleaner and uniform look. In addition to size, shape, texture, and designs of tiles, the installation pattern has been also found to play an integral role in imparting the desired visual appeal to building interiors.

The 60 * 120 segment is expected to expand at the fastest CAGR of 8.6% during the forecast period, owing to factors such as consumer tastes for seamless and aesthetically pleasing designs, market trends favoring larger-sized tiles, innovations in technology that enhance both craftsmanship and aesthetic options, economic trends impacting building and remodeling activities, and environmental concerns encouraging sustainable choices.

Regional Insights

Asia Pacific ceramic tiles market dominated the market and accounted for the largest revenue share of 46.1% in 2022. The robust economic expansion is one of the major factors driving the regional ceramic wall tile market growth. Recent economic progress in nations such as India, China, Japan, and South Korea has resulted in rising disposable income and urbanization. The outcome has been an increase in residential and commercial construction activity, which has boosted the market for ceramic wall tiles.

The commercial construction industry in China is supported by the growing demand for commercial spaces such as hotels, offices, airports, and retail showrooms. A high population growth rate, coupled with rising multi-family constructions in the country, is likely to support market growth. In June 2023, a new Kajaria Galaxy showroom named New A Class Marbles & Tiles was inaugurated in Itahari, Nepal, by Kajaria Ceramics Limited.

Brazil emerged a significant consumer for ceramic wall tiles in Central & South America. Growing investments in the development of housing structures, along with rising demand for aesthetically appealing, durable, low maintenance, and cost-effective products, is projected to propel product demand in the country.

The Middle East & Africa region is expected to expand at the fastest CAGR of 9.5% during the forecast period. The high product demand in the region is primarily driven by the economies of Saudi Arabia, UAE, Egypt, and Iran. Constantly rising investments in developing commercial spaces, including airports and corporate offices, are projected to have a positive impact on regional market growth over the forecast period.

Key Companies & Market Share Insights

The market is characterized by the presence of both small-scale and large-scale players, resulting in an intense level of competition. China, India, Spain, Italy, and Brazil have emerged as global manufacturing hubs for ceramic tiles. On the other hand, developed countries, such as the U.S., the U.K., and Germany, are largely dependent on imports to address product demand.

Market players are undertaking several innovative initiatives and awareness campaigns to educate consumers regarding the advantages of ceramic wall tiles over traditional materials such as paints and wallpapers. For instance, the Tile Council of North America coordinated the Why Tile campaign launched in April 2017, with the primary aim of educating consumers about the benefits and positive aspects of ceramic tiles.

Industry players are developing lightweight products in large sizes and with smaller thickness. They are also investing in training programs for contractors for installing extra-large tiles. Furthermore, market players showcase their product portfolios through various exhibitions, such as Coverings, Cersaie, and CeramBath, to increase product adoption in end-use applications.

Key Ceramic Wall Tiles Companies:

- Porcelanosa Grupo A.I.E.

- Panariagroup Industrie Ceramiche S.p.A.

- Mohawk Industries, Inc.

- Kajaria Ceramics Limited

- China Ceramics Co., Ltd.

Recent Developments

-

In June 2022, Mohawk Industries, Inc. announced an agreement to buy Grupo Industrial Saltillo's Vitromex ceramic tiles business for around USD 293 million. Vitromex's expanded footprint, when combined with Mohawk's existing operations, has helped enhance the company's customer base, manufacturing effectiveness, and logistical capabilities

-

In August 2021, Grupo Lamosa announced the acquisition of the ceramic tile division of Roca Sanitario. This acquisition was a crucial step in terms of the company's growth and diversification plans. It allows the company to tap into the Brazilian market and enhance its position. The company's footprint in America will also be boosted

-

In January 2021, RAK Ceramics unveiled its first-ever flagship showroom in Jeddah, making it the company’s third one in Saudi Arabia. The new showrooms intend to satisfy the region's growing product demand and will establish the brand as a source of lifestyle solutions in Saudi Arabia

-

In June 2020, RAK Ceramics, one of the leading premium ceramic brands globally, announced its collaboration with Azizi Developments, a private developer in the UAE. As per the agreement, RAK Ceramics would supply kitchen and bathroom fittings, as well as floor & wall tiles to the famous Riviera in the MBR City waterfront project in Dubai

Ceramic Wall Tiles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 140.8 billion

Revenue forecast in 2030

USD 240.9 billion

Growth rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in million square meters, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Dimensions, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Turkey; Russia; Spain; China; Japan; India; South Korea; Argentina; Brazil; Saudi Arabia

Key companies profiled

Porcelanosa Grupo A.I.E.; Panariagroup Industrie Ceramiche S.p.A.; Mohawk Industries, Inc.; Kajaria Ceramics Limited; China Ceramics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ceramic Wall Tiles Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ceramic wall tiles market report based on dimensions, application, and region:

-

Dimensions Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

20 * 20

-

30 * 30

-

30 * 60

-

60 * 120

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

HORECA

-

Office

-

Healthcare

-

Other commercial

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Turkey

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global ceramic wall tiles market size was estimated at USD 132.22 billion in 2022 and is expected to reach USD 140.8 billion in 2023.

b. The global ceramic wall tiles market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 240.9 billion by 2030.

b. Residential application accounted for the largest revenue share 44.0% in 2022 of ceramic wall tiles market on account of rising adoption of the product by architects and designers owing to its ability to offer several styles and designs.

b. Some of the key players operating in the ceramic wall tiles market include Crossville Inc., Mohawk Industries, RAK Ceramics, Johnson Tiles, and Porcelanosa Grupo A.I.E.

b. The key factors that are driving the ceramic wall tiles market include the growth of construction sector coupled with rising refurbishment activities across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.