- Home

- »

- Medical Devices

- »

-

Corporate Wellness Market Size & Share Report, 2023-2030GVR Report cover

![Corporate Wellness Market Size, Share & Trends Report]()

Corporate Wellness Market Size, Share & Trends Analysis Report By Service (Health Risk Assessment, Fitness), By End Use, By Category, By Delivery Model (Onsite, Offsite), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-395-9

- Number of Report Pages: 113

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2028

- Industry: Healthcare

Report Overview

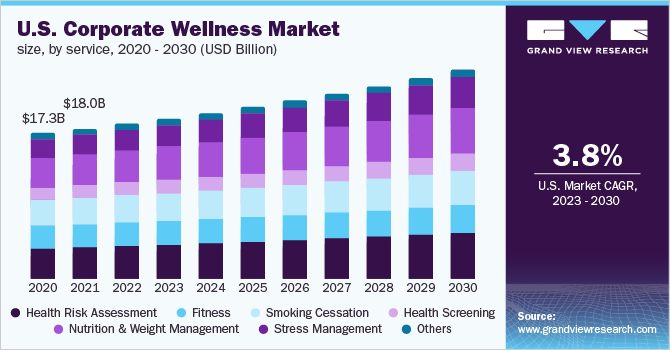

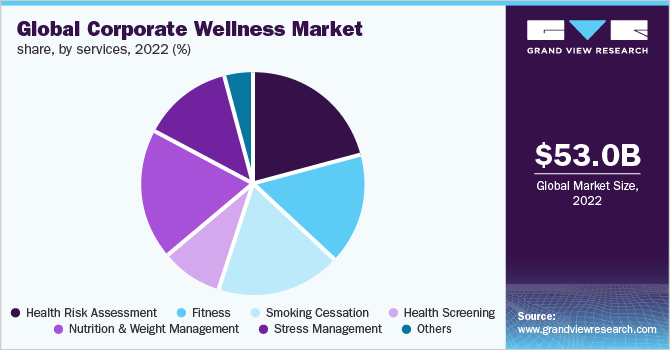

The global corporate wellness market size was valued at USD 53.0 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.47% from 2023 to 2030. Many businesses and enterprises in various industry verticals have started implementing health programs for their employees, which will boost the market demand. Health programs at the workplace help companies in augmenting productivity while reducing overall operational costs. Rising awareness regarding employee health and well-being is expected to drive the market for corporate wellness.

Corporate wellness programs include a set of policies, programs, and benefits addressing multiple risk factors and conditions and influencing both employees and the overall organization. According to the National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP), in the U.S., corporate programs promoting well-being and health, and providing disease prevention plans can potentially influence more than 150 million employees reducing the cost of healthcare significantly.

Employees are encouraged to adopt a healthier lifestyle and help companies to enhance productivity and reduce costs, by ultimately improving employee well-being. The total costs related to lost productivity due to absenteeism related to illnesses are expected to cross USD 150 billion in the coming years. The increase in the overweight and obese population results in increased insurance costs, which places a financial strain on companies.

Additionally, market growth is being driven by an increase in the prevalence and early onset of chronic diseases, as well as a decrease in employee healthcare costs. Today's work culture means that the majority of individuals do not have enough time to engage in mental and physical activities after work or during their free time, resulting in health problems. Globally, chronic diseases are a significant threat, since the prevalence of many of these disorders continues to rise. For example, the World Health Organization (WHO) estimates that cancer will claim around 10 million lives by 2020.

Furthermore, according to the American Cancer Society's 2021 statistics, the global burden of cancer is anticipated to rise to 16.3 million cancer deaths and 27.5 million new cases by 2040. Similarly, heart diseases, obesity and diabetes are some of the chronic diseases that have afflicted many countries around the world as a result of an unhealthy and sedentary lifestyle, including many industrialized nations. As a result, the prevalence of numerous chronic diseases is increasing. These diseases, however, are avoidable. As a result, holistic approaches to workplace wellness programmes are in high demand to educate employees about the importance of building healthy habits and the advantages of sticking to fitness goals.

COVID-19 Corporate Wellness Market Impact:- 3.7% decrease from 2019 to 2021

Pandemic Impact

Post COVID Outlook

In-person attendance is a large part of the traditional workplace wellness-related expenditures, and many of these activities were canceled or shifted to lower-cost online platforms during the pandemic due to office closures or cost-cutting measures.

The pandemic has heightened interest in establishing stress-relieving environments that promote mental well-being and workplace effectiveness. As a result, the market is expected to grow at a lucrative rate throughout the forecast period.

The COVID-19 pandemic impacted negatively on the economy, causing financial hardship for many individuals, which had a negative effect on their mental health. To address the issue, employee health service providers are utilizing virtual techniques to deliver services such as counseling sessions with health coaches and psychologists.

Worry, stress, and despair have risen as a result of the pandemic. Employers will need to spend resources in the future to develop wellness-supportive environments - both physical and mental - in all of their workspaces and locations.

The COVID-19 pandemic has had a significant influence on employees' mental health. Following its inception, it resulted in the work-from-home transition, which caused significant stress among employees due to a sense of isolation. Due to the COVID-19 epidemic, businesses have discovered ways to physically protect and prioritize their employees by giving technical support to aid in the adoption of new leave policies. Employers' priorities have switched to preventive and constructive management, which includes assisting employees in adapting to new requirements.

Service Insights

Based on service, the market is segmented into health risk assessment, fitness, smoking cessation, health screening, nutrition & weight management, stress management, and others. The health risk assessment segment dominated the market in 2022 with a revenue share of 21.0%. Corporate employee health programs mainly include screening activities to identify health risks and implement appropriate interventional strategies to promote a healthy lifestyle among employees. Around 80% of the employers offering employee well-being services, opt for health risk assessment of their employees. In June 2016, Wellness Corporate Solutions launched the WCS Analytics+ platform, which consists of an interactive data dashboard that enables clients to plan and implement healthy activities leading to productive workplaces.

Fitness programs are a pivotal part of any workplace health program. Many companies provided their employees with health wristbands, such as Fitbit, in the past to monitor their daily physical activity. Employers encourage their employees to be more active and special recognition is given to those who can reach their targets daily. Increasing adoption of remote patient monitoring devices is expected to drive the growth of the fitness segment.

Increasing smoking population and rising awareness about side effects are major factors driving the growth of the smoking cessation segment. Health screening involves checking vital body stats like blood sugar levels, cholesterol, and urine among others to ensure normal body functioning. It has been found that many diseases are preventable if detected at the right time. Hence, if organizations make investments in health screenings, diseases will be detected earlier and can be prevented. Thus, investing in health screening can help save on employee health care plans.

End-Use Insights

The large-scale organizations with a share of 53.1% dominated the market in 2022. Well-documented studies indicate that correctly implemented programs can yield a return on investments of around 3:1. Larger organizations can incorporate programs and services into their company’s infrastructure. Small-scaled organizations can benefit from corporate memberships and outsourcing the services.

The implementation of corporate wellness programs helps in tracking various diseases. Health screening programs are conducted at regular intervals to keep a check on health, promote preventive care, and reduce treatment costs. The focus on such conditions can reduce the disease burden and the overall cost of healthcare premiums paid by the employer to any insurance provider. Although lockdown and closure of offices have resulted in a large group of employees switching to work-from-home models, it still remains vital to ensure that employees are able to access and continue to use health services at the workplace.

Rising awareness about employee health programs and increased absenteeism and attrition are anticipated to boost the growth of small and medium-scale organizations. These organizations can provide their employees with on-site services, such as yoga and meditation classes. This can be done bi-monthly or once a month.

Category Insights

In terms of category, the market is bifurcated into fitness & nutrition consultants, psychological therapists, and organizations/ employers. The organizations/ employers segment with 50.0% in 2022 accounted for the maximum portion of the market. The service providers offer in-house as well as outsourced health management services for large as well as small-scale corporations.

Employers are making significant investments to maintain healthy diets for their employees by offering healthy catering options on campus. Unhealthy employees increase the disease burden, which will lead to loss in productivity and absenteeism. In addition, employers have to pay an extra health insurance premium for such employees. In other words, employers try to reduce the financial burden caused by the health issues of their unwell employees. The fitness & nutrition consultants segment is expected to exhibit fastest growth of 4.38% during the forecast period.

Employers often provide their employees with meditation and yoga sessions for stress release. Stressed employees tend to get angry frequently, which negatively impacts an organization. Thus, organizations provide art therapy, which is a unique technique of releasing stress. It is considered as a form of expressive psychotherapy that uses art to improve a person’s emotional, physical, and mental well-being. Professionals also use this therapy on people suffering from emotional and mental disorders. Increasing demand for such therapy is propelling the growth of the psychological therapist segment.

Delivery Model Insights

On the basis of the delivery model, The onsite segment held the maximum market share of 56.4% in 2022. The segment is anticipated to witness a high growth rate over the forecast period. Onsite wellness initiatives provide a personal touch to employee well-being, along with the facilities to exercise under the guidance of fitness consultants and coaches to meet their personal health needs.

Many organizations have restructured or added benefits and insurance plans to meet employees' and their families health needs. Service providers are creating awareness among employees regarding unhealthy aspects related to work-from-home due to COVID-19. For instance, the pandemic has resulted in a shift from in-person meetings to virtual meetings. However, associated challenges such as the need to focus harder to process non-verbal cues such as body language and facial expressions, poor internet connections leading to disconnection from the meeting, and multitasking during meetings are causing more stress and exhaustion as compared to in-person meetings.

The offsite segment is projected to witness lucrative growth of 5.06% during the forecast period. Offsite programs include one-to-one interaction to improve employee health at different locations. Health services are constantly upgraded by the adoption of advanced technology. For instance, in January 2020, Virgin Pulse via the acquisition of a digital therapeutics provider Blue Mesa Health, Inc. is planning to leverage on its Diabetes Prevention Program to promote diabetes prevention. This is driving the growth of the offsite segment.

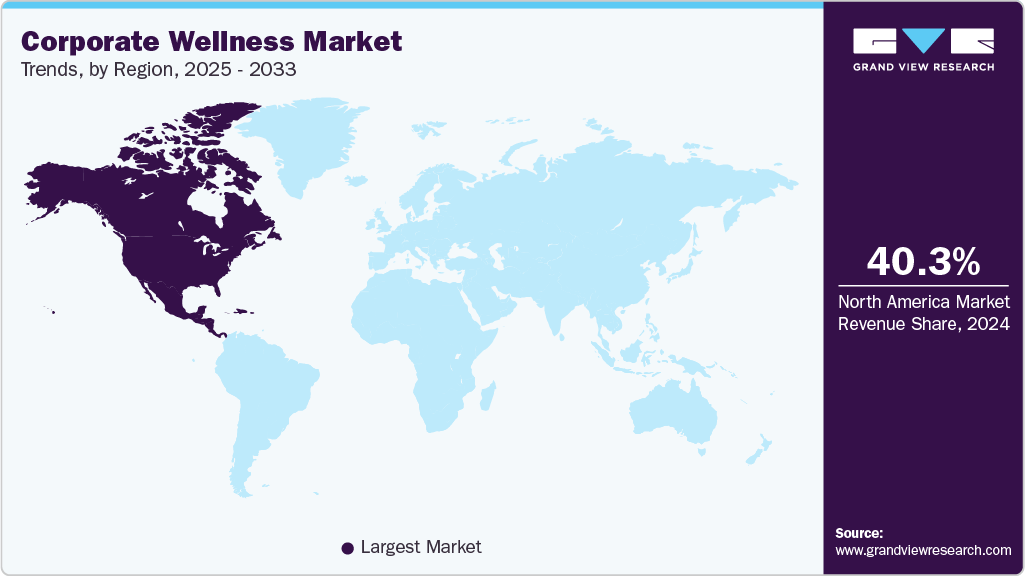

Regional Insights

North America dominated the corporate wellness market and accounted for the largest revenue share of 39.4% in 2022. Employers in the United States offer wellness programmes to their employees in around 50% of cases, as per the RAND employer survey. Employers with a larger workforce offer more intricate wellness programmes. Additionally, the region's business owners are influenced by the substantial domination of the office culture to incorporate such services to help their employee’s health.

Asia Pacific is likely to witness an impressive growth rate of 5.36% during the forecast period. Corporate employee health initiatives are necessary in the Asia Pacific due to the rising working population and increased awareness of employee health management. Additionally, the aging working-class population will benefit the market, as corporates are investing heavily in healthcare infrastructure, providing a significant opportunity to address untapped demands in the region.

Key Companies & Market Share Insights

The market is characterized by the increasing focus of companies on expansion to include in-house corporate wellness services. In the U.S., there are more than 550 organizations offering employee health programs. Market players are focusing on expanding their market presence through investment activities, mergers, and acquisitions, in order to accommodate and cater to larger groups of employees. For instance, in January 2022, Headspace Inc. announced Sayana, an AI-powered mental health company. Some of the prominent players in the corporate wellness market include:

-

ComPsych

-

Wellness Corporate Solutions

-

Virgin Pulse

-

EXOS

-

Marino Wellness

-

Privia Health

-

Vitality

-

Wellsource, Inc.

-

Central Corporate Wellness

-

Truworth Wellness

-

SOL Wellness

Corporate Wellness Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 55.1 billion

Revenue forecast in 2030

USD 74.9 billion

Growth Rate

CAGR of 4.47% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, category, delivery model, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Netherlands; Switzerland; Japan; China; India; Australia; New Zealand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

ComPsych; Wellness Corporate Solutions; Virgin Pulse; EXOS; Marino Wellness; Privia Health; Vitality; Wellsource, Inc.; Central Corporate Wellness; Truworth Wellness; SOL Wellness

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corporate Wellness Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For the purpose of this study, Grand View Research has segmented the global corporate wellness market report based on service, end-use, category, delivery model, and region:

-

Service Outlook (Revenue, USD Million, 2016 - 2030)

-

Health Risk Assessment

-

Fitness

-

Smoking Cessation

-

Health Screening

-

Nutrition & Weight Management

-

Stress Management

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2016 - 2030)

-

Small Scale Organizations

-

Medium Scale Organizations

-

Large Scale Organizations

-

-

Category Outlook (Revenue, USD Million, 2016 - 2030)

-

Fitness & Nutrition Consultants

-

Psychological Therapists

-

Organizations/Employers

-

-

Delivery Model Outlook (Revenue, USD Million, 2016 - 2030)

-

Onsite

-

Offsite

-

-

Corporate Wellness Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the corporate wellness market are ComPsych; Wellness Corporate Solutions; Virgin Pulse; EXOS; Marino Wellness, Privia Health; Vitality Group; Wellsource, Inc.; Central Corporate Wellness; Truworth Wellness; and SOL Wellness, Well Nation, ADURO, INC., Beacon Health Options, and Fitbit, Inc.

b. Key factors that are driving the corporate wellness market growth include growing preference for employee wellness, availability of wellness providers, and rising investments by employers.

b. The global corporate wellness market size was estimated at USD 53.0 billion in 2022 and is expected to reach USD 55.1 billion in 2023.

b. The global corporate wellness market is expected to grow at a compound annual growth rate of 4.47% from 2023 to 2030 to reach USD 74.9 billion by 2030.

b. North America dominated the corporate wellness market with a share of 39.4% in 2022. Approximately 50% of the employers in the U.S. offer wellness programs to their employees and larger organizations offer more advanced wellness initiatives.

b. The health risk assessment segment accounted for the largest revenue share in the corporate wellness market in 2021.

b. In terms of delivery model, onsite wellness programs accounted for a dominant market share in 2021 and are also expected to show the fastest growth through 2030.

b. As per a recent RAND employer survey, around 50% of employers in the United States provide wellness programs to their employees.

b. The large-scale organizations accounted for the largest share in the end-use segment of the corporate wellness market in 2021, followed by medium-scale organizations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."