- Home

- »

- Beauty & Personal Care

- »

-

Dental Floss Market Size, Share And Trends Report, 2030GVR Report cover

![Dental Floss Market Size, Share & Trends Report]()

Dental Floss Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Waxed Floss, Unwaxed Floss, Dental Tape, And Others), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-355-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Floss Market Summary

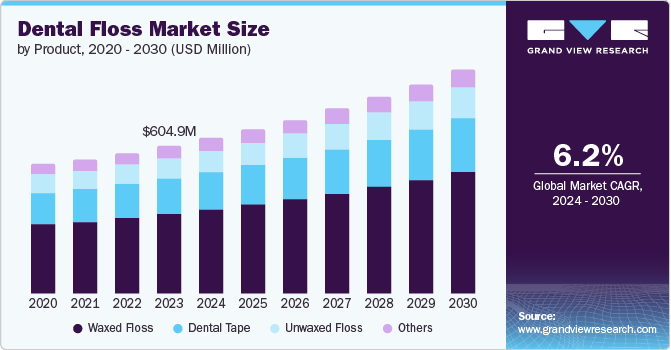

The global dental floss market size was estimated at USD 604.9 million in 2023 and is projected to reach USD 914.4 million by 2030, growing at a CAGR of 6.2% from 2024 to 2030. With a growing emphasis on preventive dental care, consumers increasingly recognize the importance of daily flossing to prevent gum disease, cavities, and bad breath.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, waxed floss accounted for a revenue of USD 604.9 million in 2023.

- Waxed Floss is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 604.9 Million

- 2030 Projected Market Size: USD 914.4 Million

- CAGR (2024-2030): 6.2%

- North America: Largest market in 2023

Educational campaigns by dental professionals, public health organizations, and media outlets have significantly elevated public knowledge about the benefits of flossing.

The growing prevalence of dental issues such as cavities, gum diseases, and bad breath propels the demand for dental floss. Consumers are becoming more proactive in addressing these oral health concerns, leading to a greater adoption of preventive dental care practices, including regular flossing. As a result, the dental floss market is witnessing a steady increase in demand from individuals looking to maintain good oral hygiene and prevent dental problems.

As the elderly population grows, there is a greater emphasis on oral health maintenance to prevent age-related dental issues. This demographic shift has led to an increased demand for specialized dental floss products designed for sensitive teeth and gums, bolstering the overall growth of the dental floss market.

Product Insights

Waxed floss dominated the market and accounted for a share of 53.8% in 2023. As consumers become more discerning about the quality of dental hygiene products, they are increasingly willing to invest in higher-end options that offer additional benefits. Waxed floss, often marketed as a premium product due to its enhanced features and effectiveness, fits well into this trend. Manufacturers have responded to this demand by developing high-quality waxed floss options with added features such as mint flavors, ergonomic packaging, and eco-friendly materials. For instance, in March 2023, Burst Oral Care launched the BURSTkids Flossables explicitly designed for children. The floss is coated with natural wax and free from harmful chemicals such as PFAS (per- and polyfluoroalkyl substances), BPA (bisphenol A), Teflon, artificial colors, and flavors.

The dental tape segment is anticipated to grow significantly over the forecast period. This increased width enables dental tape to effectively remove plaque and food particles from the surfaces of teeth, particularly in areas where traditional floss may struggle. The flat design also allows for better adaptation to the contours of the teeth and gums, making it easier to clean around wider gaps or spaces between teeth. As a result, users may experience improved oral hygiene and reduced risk of cavities and gum disease when incorporating dental tape into their daily routine.

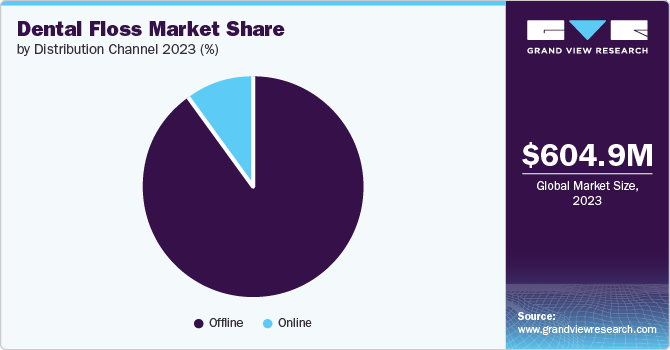

Distribution Channel Insights

The offline segment accounted for the largest market revenue share in 2023. Supermarkets, pharmacies, and convenience stores are omnipresent, allowing consumers to purchase dental floss conveniently during their regular shopping trips. This ease of access supports the offline distribution channel, as consumers can quickly pick up dental floss without ordering online and waiting for delivery.

The online segment is expected to register the fastest CAGR during the forecast period. E-commerce platforms offer a wide range of dental floss products, including various brands, types (waxed, unwaxed, tape, etc.), flavors, and sizes, far beyond what most physical stores can accommodate. Consumers can easily compare prices, read product reviews, and access detailed product descriptions to make informed purchasing decisions. This extensive selection and the ability to compare options empower consumers to choose the best dental floss products for their needs, contributing to the market's growth.

Regional Insights

North America dental floss market accounted for the largest market revenue share of 35.3% in 2023. The Centers for Disease Control and Prevention (CDC) reports that approximately 42% of adults aged 30 years and older show signs of gum disease, underscoring the need for effective preventive measures like flossing. As more individuals seek solutions to combat these issues, the region's demand for dental floss continues to rise.

U.S. Dental Floss Market Trends

The U.S. dental floss market is anticipated to grow significantly over the forecast period. As the U.S. healthcare system increasingly emphasizes preventing health issues rather than merely treating conditions after they arise, there has been a growing focus on self-care practices. Dental floss is a simple yet effective preventive measure for maintaining oral health, aligning with the overall preventive healthcare trend.

Europe Dental Floss Market Trends

Europe dental floss market was identified as a lucrative region in 2023. The rising incidence of dental conditions such as gum disease, cavities, and tooth decay fuel the demand for the market in Europe. As dental problems become more prevalent, consumers and dental professionals are emphasizing preventive care more. Dental floss is increasingly recommended as a vital component of oral hygiene routines to prevent gingivitis and periodontitis.

The UK dental floss market is expected to grow rapidly in the coming years. Public health campaigns and educational initiatives led by organizations such as the British Dental Association (BDA) have increased awareness of oral hygiene. These campaigns emphasize the importance of daily flossing as a preventive measure against dental diseases, including gum disease and cavities.

Asia Pacific Dental Floss Market Trends

Asia Pacific dental floss market is anticipated to register the fastest CAGR over the forecast period. The increasing availability of dental floss through modern retail channels fuels the market in the Asia-Pacific region. The expansion of modern retail formats, including supermarkets, hypermarkets, and convenience stores, has made dental floss more accessible to a broader audience. Furthermore, the growth of e-commerce platforms in the region has provided consumers convenient access to a wide range of dental floss products.

China dental floss market is expected to grow rapidly in the coming years. As the population ages, the demand for dental floss products increases. Older adults are more likely to require enhanced oral care to prevent dental and gum diseases. According to the United Nations, China’s population aged 65 and above is expected to reach 14% of the total population by 2030. This demographic shift will increase demand for dental floss products, driving market growth.

Key Dental Floss Company Insights

Some of the key companies in the dental floss market include Procter & Gamble, Colgate-Palmolive Company, Prestige Consumer Healthcare, Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Procter & Gamble offers several dental floss products under its brand, Oral-B. The company’s dental floss line includes various types designed to cater to different consumer needs, such as waxed and unwaxed options, flavored and unflavored varieties, and specialized floss for sensitive gums or tight spaces between teeth.

-

Colgate-Palmolive Company offerings include traditional waxed and unwaxed dental floss and specialized options such as flavored floss and those designed for sensitive gums. The brand emphasizes the importance of daily flossing as part of a comprehensive oral care routine, aiming to help consumers maintain healthy teeth and gums while preventing cavities and gum disease.

Key Dental Floss Companies:

The following are the leading companies in the dental floss market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble

- Colgate-Palmolive Company

- Prestige Consumer Healthcare, Inc.

- Johnson & Johnson Services, Inc

- HRB Brand, LLC

- 3M

- Lion Corporation

- Dr Wild & Co. AG

- Sunstar Suisse SA

- The Humble Co.

Recent Developments

-

In November 2022, Slate Dental launched the Slate Electric Flosser, which utilizes advanced technology to provide an effective cleaning experience that can cater to various dental needs. This ensures that users can maintain optimal oral health with ease. The launch of this product aligns with growing consumer demand for user-friendly dental care solutions that fit seamlessly into busy lifestyles.

Dental Floss Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 637.4 million

Revenue forecast in 2030

USD 914.4 million

Growth Rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., UK, Germany, China, Japan, India, Brazil, South Arabia, South Africa, and UAE

Key companies profiled

Procter & Gamble; Colgate-Palmolive Company; Prestige Consumer Healthcare, Inc.; Johnson & Johnson Services, Inc; HRB Brand (Dr. Fresh LLC); 3M; Lion Corporation; Dr Wild & Co. AG; Sunstar Suisse SA; The Humble Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Floss Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental floss market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Waxed Floss

-

Unwaxed Floss

-

Dental Tape

-

Others

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.