- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Digestive Health Supplements Market Size Report, 2030GVR Report cover

![Digestive Health Supplements Market Size, Share & Trends Report]()

Digestive Health Supplements Market Size, Share & Trends Analysis Report By Product (Prebiotics, Probiotics, Enzymes, Fulvic Acid, Others), By Form, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-998-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Digestive Health Supplements Market Trends

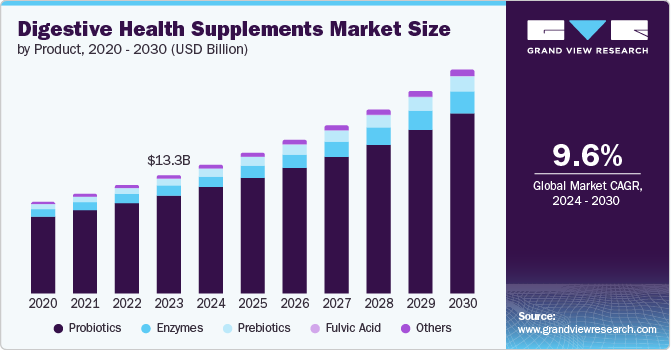

The global digestive health supplements market size was valued at USD 13.30 billion in 2023 and is projected to grow at a CAGR of 9.6% from 2024 to 2030. Digestive enzymes such as amylase, lipase, and protease are naturally produced in the body for better digestion of food. However, a substantial number of people face issues in naturally producing these enzymes, which requires them to consume enzyme supplements to fulfill the body's requirements. They generally take over-the-counter supplements for digestion-related problems such as acid reflux, gut irritation, bloating, heartburn, and diarrhea. A rising prevalence of digestive diseases in large populations and the increasing number of weight management programs globally are expected to propel market growth in the coming years.

An increasing proportion of the global population suffers from various digestive enzyme insufficiencies due to the body’s inability to produce these proteins, such as exocrine pancreatic insufficiency, congenital sucrase-isomaltase deficiency, and lactose intolerance. This insufficiency leads to irritation and various gut-related problems. External consumption of enzymes helps them to prevent further irritation. For instance, fulvic acid consumption helps alleviate inflammation in the digestive system. The increasing global prevalence of digestive disorders such as Irritable Bowel Syndrome (IBS) and Gastroesophageal Reflux Disease (GERD) is creating an expansive market for targeted digestive health supplements that cater to specific needs.

Prebiotics are compounds that enable the growth of good bacteria in the gastrointestinal tract. They are found in whole grains, chicory roots, onions, bananas, and soybeans. Consumption of prebiotics helps in better bowel movement. Additionally, there is a growing shift towards preventive healthcare globally, with governments and healthcare institutions increasingly recommending dietary supplements to manage health proactively. This trend is expected to impact the digestive health supplement market positively.

Product Insights

The probiotics segment dominated the global market with a revenue share of 82.9% in 2023. Probiotics contain good bacteria, which help relieve diarrhea, constipation, and other digestive ailments. Public awareness regarding the benefits of probiotics has significantly increased in recent years. Consumers are actively seeking out probiotic-rich foods and supplements, driving segment growth. Additionally, they are considered safe for consumption for most individuals by healthcare professionals. Probiotics offer a well-tolerated approach to digestive health. This positive safety profile makes them a particularly attractive option for consumers seeking natural and non-invasive solutions.

The fulvic acid segment is expected to grow at the fastest CAGR during the forecast period. This sizeable growth is owing to the emerging widespread applications of fulvic acid in allergic symptoms such as eczema and inflammation and in reducing swelling. Fulvic acid is naturally found in radish, beetroots, and carrots. Research has shown the potential benefits of fulvic acid in replenishing the body with naturally occurring soil-based organisms, boosting the immune system, and boosting brain health. These factors are anticipated to drive the demand for fulvic acid during the forecast period.

Distribution Channel Insights

Over-the-counter (OTC) distribution channel accounted for the largest revenue share in the global market in 2023. This is owing to the extensive availability of these supplements across several food retail chains, supermarkets, and convenience stores. Unlike prescription medicines, which the FDA regulates, these supplements are often taken without consulting the doctor. Additionally, they are available in various flavors, forms, and sizes, addressing the needs of most consumers. Increased marketing efforts by manufacturers increase their awareness among people, which in turn drives them to buy these products. Furthermore, the online sub-segment is expected to witness the highest growth rate, owing to the increasing popularity of e-commerce platforms globally.

The prescription segment is anticipated to advance at a substantial growth rate during the forecast period. Increased awareness regarding the potential side effects of OTC supplements has paved the way for people to visit professionals to seek advice regarding the consumption of these supplements. The wrong dosage of enzymes is associated with severe reactions in the body. With stricter government regulations on the OTC segment, the growth prospects for prescription supplements are expected to remain promising in the upcoming years.

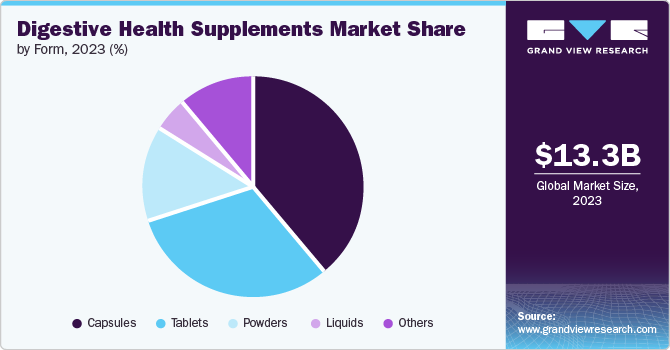

Form Insights

In terms of supplement form, capsules accounted for the highest revenue share in 2023. This is owing to the advantageous property of capsules of allowing for precise dosing of active ingredients, thus ensuring consistent and controlled delivery throughout the digestive system. This is crucial for maintaining the supplement’s efficacy and maximizing its benefits. Moreover, capsules offer a convenient and easy way to consume supplements. They have an odorless and tasteless gelatin enteric coating, making them suitable for individuals who dislike the taste or texture of powders and liquids. Additionally, cost-effectiveness of capsules over other options makes them a popular choice among consumers.

Tablets segment is expected account for a significant revenue share in 2023. Tablets are known for superior stability over alternative formats such as capsules or powders. This results in a longer shelf life, reducing waste and ensuring product efficacy throughout the lifespan of the supplement. Additionally, tablets are the most familiar format for consuming medications and supplements. This high level of familiarity with tablets plays a vital role in influencing consumer preference and purchasing decisions, propelling segment expansion.

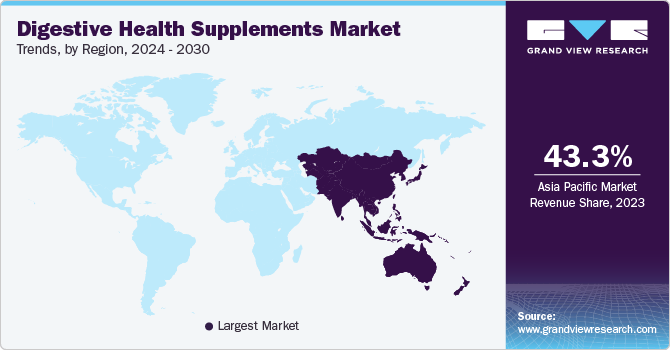

Regional Insights

North America held a substantial market share in 2023. Consumers in North America are increasingly becoming proactive about their health. A major proportion of the population is focusing on physical fitness and bodily well-being. This awareness fosters a focus on preventative measures, including the use of digestive health supplements to address digestive tract issues. Additionally, easy availability of these supplements in supermarkets, pharmacies, and e-commerce platforms propels market growth.

U.S. Digestive Health Supplements Market Trends

The U.S. is known for its fast food culture. A large population prefers consumption of ultra-processed food and sugar-rich beverages. This has resulted in two-third of Americans experiencing gut related issues, as per a study by MDVIP and Ipsos conducted in March 2023. A predominance of obesity, digestive system disorders, and lifestyle-related diseases on account of poor eating habits may further lead to serious issues such as diabetes and heart diseases. High consumption of over-processed, high-sodium content, and junk foods has led to over half of the American population consuming OTC digestive products to address associated disorders, leading to increased demand.

Asia Pacific Digestive Health Supplements Market Trends

The Asia Pacific region accounted for the highest revenue share of 43.3% in 2023. People in the region are experiencing a rise in digestive health problems such as bloating, constipation, irritable bowel syndrome, and cholecystitis. This is partly due to a shift towards a Western diet that is high in processed foods, saturated fats, bread, and sodium in salty snacks. Urbanization and changing lifestyles in these countries are major contributing factors to market growth. Rising disposable income allows consumers to invest in preventive healthcare and prioritize digestive well-being, which leads to a strong demand for digestive health supplements.

India has witnessed an accelerated adoption of the western culture in recent years. This is primarily reflected in food habits. Global restaurant chains are spreading their base in major Indian cities. With significant disposable income, people are buying ultra-processed food items that are packed with preservatives. An increasingly sedentary lifestyle further fuels the issue of gut health, leading to a steady rise in the number of patients having digestive problems. These factors combine to fuel the demand for digestive supplements and propel market growth in India.

Europe Digestive Health Supplements Market Trends

A busy lifestyle in Europe has led to the rapid emergence of several fast food chains. Increased consumption of junk food from these outlets leads to digestive tract issues. According to a report from United European Gastroenterology (UEG), over 330 million people in Europe are living with gut-related disorders. With an aging population, this number is expected to increase steadily. Unattended ailments may lead to more serious health issues such as cancer, which drives the demand for preventive medication such as digestive supplements.

The UK was identified as a lucrative region for the digestive supplements market. A large population in the UK is experiencing digestive problems such as coeliac disease, irritable bowel syndrome (IBS), and acid reflux. This creates a strong demand for external enzymes that can alleviate symptoms and improve digestive functioning. Digestive health supplements cater to this need, offering targeted solutions for various gut-related concerns. Additionally, a robust distribution network of supermarkets and advertising efforts by manufacturers help maintain a steady demand for these products.

Key Digestive Health Supplements Company Insights

Some key companies involved in the global digestive health supplements market include Abbott; Glanbia plc; and Amway Corporation.

-

Abbott is an American multinational healthcare and medical devices company. The company offers a range of digestive medications under the name Pankreoflat digestive enzyme liquid, tablets, creon tablets, cremaffin liquid, glucerna, combinorm, and digene to address various digestion and pancreatic enzyme-related disorders.

-

Amway offers products in the areas of personal care, beauty, nutrition, and homecare. The company markets its digestive enzymes under the brand Nutrilite. It is available in capsule form and supports the body’s normal digestion of carbohydrates, protein, and dairy. Amway offers products made from natural ingredients to address liver-related issues under the same brand.

Key Digestive Health Supplements Companies:

The following are the leading companies in the digestive health supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Abbott

- Glanbia plc

- Herbalife Nutrition Ltd.

- Nature’s Bounty

- Amway Corporation

- Garden of Life

- NU SKIN

- Lonza Group Ltd.

- NOW Foods

Recent Developments

-

In April 2024, Bayer Consumer Health announced the launch of the plant-based digestive health product Iberogast in the United States. The product consists of a proprietary six-herb blend. It leverages natural powers to offer dual-action relief for people experiencing occasional digestive symptoms by relieving stomach upsets and restoring their digestive functioning.

-

In August 2023, Herbalife announced the launch of the Herbalife V plant-based supplement line. These products have been verified non-GMO, certified USDA Organic, certified kosher, and certified vegan and plant-based by FoodChain ID. The line consists of plant-based protein shakes with 20 grams of protein; a greens booster prepared using organic fruits and vegetables, green tea, and superfood powders; a formula for supporting immune health containing vitamins C & D and zinc; and a digestive health formula incorporating guar fiber and oat.

Digestive Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.50 billion

Revenue Forecast in 2030

USD 25.17 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, form, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Sweden, Netherlands, Spain, Denmark, China, Japan, Australia & New Zealand, Hong Kong, Singapore, India, Brazil, South Africa, UAE

Key companies profiled

Abbott; Glanbia plc; Amway Corp.; Bayer AG; Herbalife Nutrition Ltd.; Nature’s Bounty; Garden of Life; NU SKIN; Lonza Group Ltd.; NOW Foods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

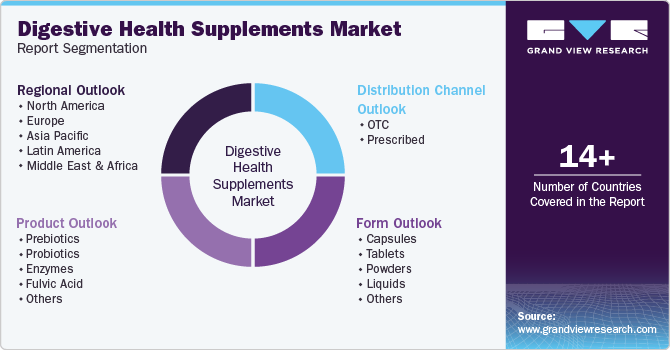

Global Digestive Health Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digestive health supplements market report based on product, form, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prebiotics

-

Probiotics

-

Enzymes

-

Fulvic Acid

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Tablets

-

Powders

-

Liquids

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Supermarkets/ Hypermarkets/Food Stores

-

Drug Stores & Pharmacies

-

Convenience Stores

-

Online

-

Others

-

-

Prescribed

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Netherlands

-

Denmark

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia & New Zealand

-

Hong Kong

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."