- Home

- »

- Electronic & Electrical

- »

-

Dishwasher Market Size, Share And Growth Report, 2030GVR Report cover

![Dishwasher Market Size, Share & Trends Report]()

Dishwasher Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Freestanding, Built-in), By Application (Residential/Household, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-337-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dishwasher Market Summary

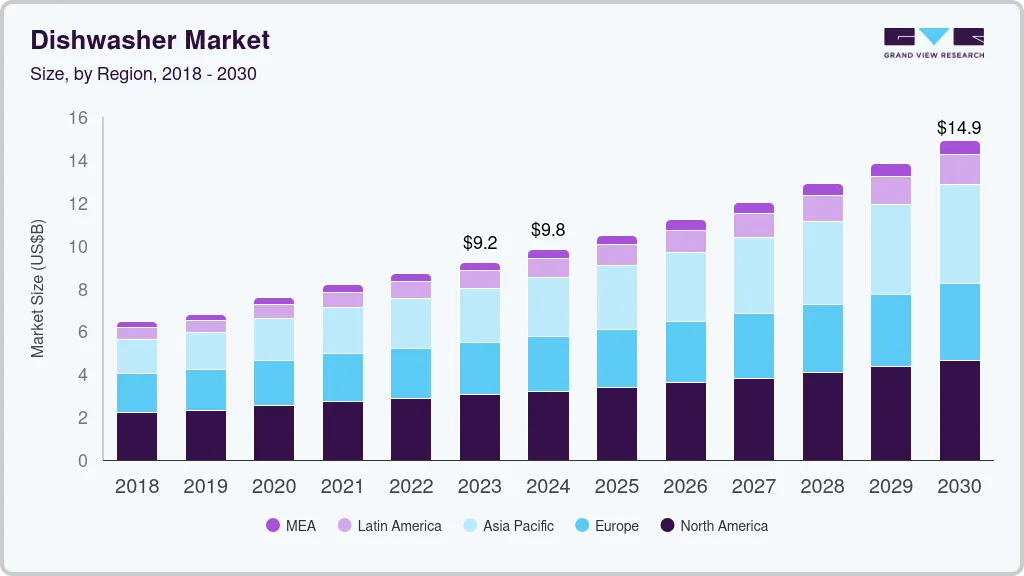

The global dishwasher market size was estimated at USD 9,234.7 million in 2023 and is projected to reach USD 14,907.3 million by 2030, growing at a CAGR of 7.2% from 2024 to 2030. The increasing adoption of automated appliances in households worldwide drives dishwasher demand.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, freestanding accounted for a revenue of USD 9,234.7 million in 2023.

- Freestanding is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 9,234.7 Million

- 2030 Projected Market Size: USD 14,907.3 Million

- CAGR (2024-2030): 7.2%

- North America: Largest market in 2023

As urbanization continues and lifestyles become busier, there's a growing preference for time-saving solutions in daily chores like dishwashing. Dishwashers offer convenience by automating a tedious task, thereby freeing up time for other activities, which appeals particularly to dual-income families and urban dwellers with hectic schedules.

Moreover, there's a heightened awareness of water and energy conservation globally. Modern dishwashers are designed to be more efficient than traditional handwashing methods, utilizing less water and energy per load. This eco-friendly aspect resonates well with environmentally conscious consumers who seek appliances that reduce their ecological footprint. Technological advancements have also played a pivotal role in driving demand. Innovations like improved water filtration systems, energy-efficient heating elements, and smart connectivity features have enhanced dishwasher performance and user convenience. Smart dishwashers, for instance, can be controlled remotely via smartphone apps, offer customized wash cycles based on load contents, and even provide notifications when detergent levels are low or maintenance is required.

Furthermore, changing demographics and lifestyle preferences increase demand for dishwashers. With more people living independently or in smaller households, the need for efficient kitchen appliances that cater to smaller loads and varied schedules becomes more pronounced. Dishwashers fit into this trend by offering flexibility and convenience in managing kitchen hygiene without the space and time constraints of traditional washing methods.

Product Insights

The freestanding segment held the largest market revenue share of 56.3% in 2023. Freestanding dishwashers offer greater flexibility in installation, allowing consumers to place them anywhere in the kitchen without requiring built-in cabinetry. This flexibility benefits renters and homeowners alike, who may want to avoid committing to permanent fixtures. Advancements in design and technology have made freestanding dishwashers more energy-efficient and aesthetically pleasing, aligning with consumer preferences for stylish yet functional kitchen appliances. Additionally, the ease of installation and relocation of freestanding models contributes to their popularity in rental properties and smaller homes where space optimization is crucial.

The built-in segment is expected to grow at the fastest CAGR of 7.6% during the forecast period. Built-in dishwashers are increasingly favored for their seamless integration into kitchen designs, offering a streamlined and modern aesthetic that appeals to homeowners and designers alike. This integration enhances kitchen functionality by maximizing space efficiency and providing a customized look that blends with cabinetry. Additionally, built-in dishwashers often come with advanced features such as quieter operation, energy efficiency, and superior cleaning performance, meeting the growing consumer demand for appliances that offer convenience without compromising sustainability.

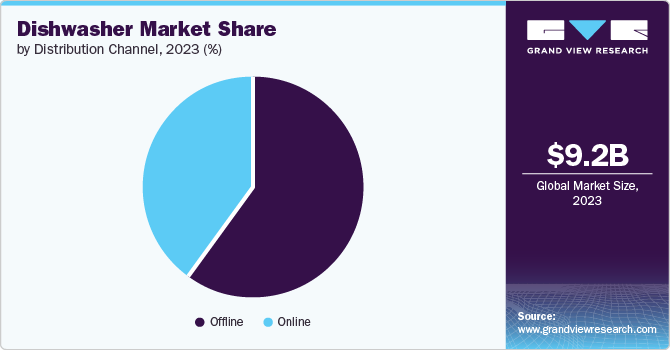

Distribution Channel Insights

Offline segment dominated the market in 2023. Offline channels such as brick-and-mortar stores allow consumers to physically examine and compare different dishwasher models, which builds trust and confidence in their purchase decisions. Unlike online purchases, where consumers rely solely on digital descriptions and images, offline channels provide a tactile experience that can influence buying choices, especially for appliances like dishwashers, which are considered significant investments for many households.

Online segment is projected to grow at the fastest CAGR over the forecast period. Online platforms offer consumers convenience and a wide range of choices, allowing them to compare features, prices, and brands easily from the comfort of their homes. This accessibility is essential for busy consumers who value time efficiency and the ability to research extensively before purchasing. The global pandemic accelerated the shift towards online shopping, which highlighted the convenience and safety of purchasing household appliances without visiting physical stores.

Application Insights

The commercial segment held the largest market revenue share in 2023. As the food service industry continues to expand globally, there is a growing need for efficient and high-capacity dishwashing solutions in restaurants, hotels, and catering services. Commercial dishwashers are designed to handle large volumes of dishes quickly, which helps businesses maintain smooth operations and meet stringent hygiene standards. Technological advancements have led to more energy-efficient and water-saving models for companies looking to reduce operating costs and environmental impact.

The residential/household segment is expected to grow at the fastest CAGR over the forecast period. The growing trend towards convenience and time-saving solutions in household chores drives the demand for dishwashers. This trend is bolstered by busier lifestyles and an increasing number of dual-income households, where consumers are willing to invest in appliances that streamline their daily routines. Furthermore, advancements in dishwasher technology have led to more energy-efficient and water-saving models, for environmentally conscious consumers looking to reduce their carbon footprint. Additionally, the affordability and availability of dishwashers have improved over the years, making them more accessible to a broader segment of the residential/household market.

Regional Insights

The North America dishwasher market held the largest market revenue share of 32.9% in 2023. Urbanization trends have led to smaller living spaces where efficient use of kitchen areas is crucial, prompting consumers to opt for compact, space-saving appliances like dishwashers. Environmental concerns drive the adoption of energy-efficient models that reduce water consumption and utilize eco-friendly detergents, aligning with consumer preferences for sustainable living. Moreover, the growing preference for convenience among North American households, coupled with busier lifestyles, has boosted the appeal of dishwashers as time-saving appliances that streamline daily chores. Additionally, advancements in dishwasher technology, such as improved cleaning capabilities and quieter operation, have further contributed to their popularity in the region.

U.S. Dishwasher Market Trends

The U.S. dishwasher market held the largest market revenue share regionally in 2023. The rise in dual-income households has led to greater time constraints, making dishwashers essential for saving time and effort in daily chores. Technological advancements have made dishwashers more energy-efficient and water-efficient for environmentally conscious consumers. Additionally, with more Americans opting for modern kitchen renovations, dishwashers are increasingly seen as a standard appliance rather than a luxury. Moreover, the dishwasher's convenience aligns with changing consumer lifestyles, where convenience and efficiency are prioritized.

Europe Dishwasher Market Trends

Europe dishwasher market was identified as a lucrative region in 2023 European households have a growing preference for convenience and time-saving appliances, driven by changing lifestyles and an increasing number of dual-income families. Rising environmental consciousness has led consumers to opt for energy-efficient and water-saving models, which are becoming more widely available. Additionally, integrating smart technologies in dishwashers has appealed to tech-savvy consumers, offering remote control and energy monitoring features. Moreover, urbanization trends in Europe have contributed to smaller living spaces, where compact and integrated dishwasher solutions are particularly favored.

The UK dishwasher market held a substantial market share in 2023. The shift towards more efficient and time-saving household appliances drives the country's market growth. This trend is particularly evident among urban households where time constraints and convenience are important. Environmental concerns play a crucial role as modern dishwashers are designed to be more energy and water-efficient, appealing to eco-conscious consumers seeking to reduce their carbon footprint. Technological advancements have led to quieter operations and enhanced cleaning capabilities, further driving adoption rates. Lastly, changing lifestyles, including smaller living spaces and busier schedules, have made dishwashers a practical investment, catering to the growing number of dual-income households and smaller families across the UK.

The dishwasher market in Germany held a substantial market share in 2023. Changing demographics, such as an aging population and more women entering the workforce, have heightened the demand for time-saving appliances like dishwashers. This demographic shift underscores a broader societal trend towards convenience and efficiency in household chores. Advancements in dishwasher technology have significantly improved their performance and energy efficiency. Moreover, the steady urbanization and smaller living spaces in cities such as Berlin and Munich have boosted the appeal of compact, space-saving appliances like dishwashers, considered essential in modern kitchen designs.

Asia Pacific Dishwasher Market Trends

Asia Pacific dishwasher market is anticipated to witness significant growth in the dishwasher market. Urbanization across countries such as China and India has led to busier lifestyles and smaller living spaces, increasing the demand for time-saving appliances such as dishwashers. The rising disposable incomes have made dishwashers more affordable and desirable, especially among middle-class families seeking convenience in household chores. Additionally, changing cultural attitudes towards kitchen hygiene and modern living standards are crucial in driving adoption.

China dishwasher market held a substantial market share in 2023. The increasing urbanization and modernization across China lead to busier lifestyles and higher disposable incomes among urban households, fueling the demand for dishwashers. As more Chinese consumers prioritize convenience and efficiency in household chores, dishwashers are perceived as time-saving appliances that offer greater hygiene and convenience than traditional hand-washing methods. Additionally, changes in consumer behavior, influenced by Western living standards and preferences, have also contributed to the growing acceptance and adoption of dishwashers in Chinese households.

The dishwasher market in India held a substantial market share in 2023. Dishwashers, traditionally seen as a luxury, are increasingly considered essential in urban homes where dual-income families seek efficiency in daily chores. Changing lifestyles and higher disposable incomes have shifted consumer preferences towards products that offer convenience and efficiency. Dishwashers fit into this trend by reducing manual effort and ensuring hygienic cleaning of utensils, which is particularly appealing in a country where cleanliness standards are crucial. Moreover, as awareness grows about water conservation and the environmental impact of traditional dishwashing methods, energy-efficient dishwashers are becoming more attractive options for environmentally conscious consumers.

Key Dishwasher Company Insights

Some of the key companies in the dishwasher market include Whirlpool Corporation., Robert Bosch GmbH, SAMSUNG, LG Electronics., Haier Group, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Whirlpool Corporation. Is a kitchen and laundry appliance company which owns various well-known brands. The company offers both standard and premium models of dishwashers with larger capacities and targeted cleaning.

-

Haier Group provides digital transformation solutions, focusing on innovations and new designs. It also focuses on R&D activities and technological advancement in its products.

Key Dishwasher Companies:

The following are the leading companies in the dishwasher market. These companies collectively hold the largest market share and dictate industry trends.

- Whirlpool Corporation.

- Robert Bosch GmbH

- The Miele Company

- Electrolux AB

- SAMSUNG

- LG Electronics.

- Haier Group

- The Middleby Corporation

- Amica Group

- Asko Appliances AB

Recent Developments

-

In November 2022, Whirlpool Corporation announced the acquisition of InSinkErator. The acquisition aims to expand Whirlpool's product offerings in the kitchen appliance sector, enhancing its portfolio of sustainable solutions for home kitchens.

-

In July 2022, Samsung announced the launch of a new line of dishwashers designed to provide a hygienic, convenient, and efficient cleaning experience. These dishwashers feature advanced technologies aimed at improving user convenience and enhancing cleaning performance.

Dishwasher Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.83 billion

Revenue forecast in 2030

USD 14.91 billion

Growth Rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Brazil, and South Africa

Key companies profiled

Whirlpool Corporation.; Robert Bosch GmbH; The Miele Company; Electrolux AB; SAMSUNG; LG Electronics.; Haier Group; The Middleby Corporation; Amica Group; Asko Appliances AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dishwasher Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dishwasher market report based on product, application, distribution channel and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Freestanding

-

Built-in

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential/Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.