- Home

- »

- Medical Devices

- »

-

Europe Home Care Market Size, Industry Report, 2020-2027GVR Report cover

![Europe Home Care Market Size, Share & Trends Report]()

Europe Home Care Market Size, Share & Trends Analysis Report By Component [Equipment (Therapeutics, Diagnostic, Mobility Assist), Services (Skilled Nursing Services, Unskilled Nursing Services)], By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-113-5

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

Report Overview

The Europe home care market size was valued at USD 84.2 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2020 to 2027. The growing geriatric population in the region coupled with the rising incidence of chronic diseases is the key factor driving the market for home care in the region. According to European Commission 2018 Ageing Report, public spending (on healthcare, long-term care, pension, etc.) is expected to increase by 1.7% to 26.7% of GDP from 2016 to 2070 due to the increasing aging population. In addition, advancements in medical devices, pharmaceuticals, and services and innovations in technology have also made home care solutions affordable for people that are homebound and prefer medical care in the comfort of their homes.

Furthermore, increasing awareness about home care services and the launch of new devices for treating various conditions at home is another major factor propelling the market growth. The availability of portable devices such as heart rate monitors, respiratory aids, and blood glucose monitors has improved the efficiency and effectiveness of home care for lifestyle diseases.

The reimbursement provided by the government is also driving the market for home care in Europe with the transition from inpatient to outpatient care. More than three-quarters of outpatient care spending in the EU is borne by compulsory financing schemes and the government. In the majority of EU countries, the outpatient specialist and primary care are generally free at the point of use.

The care homes have been affected largely due to the COVID-19 pandemic and almost one-third of the deaths in France are related to COVID in care homes. The death toll in care homes rose to 9,471 by the first week of May. However, the home care workers are allowed to work, provided they wear face masks while at work.

In the event of the COVID-19 pandemic, the Department of Health and Social Care has released guidelines on the provision of healthcare. It has suggested the home care provider work with health agencies in order to provide a multi-agency plan to reduce the number of people coming in contact with the individual opting for home care. COVID-19 tests are made accessible to individuals providing care in the home care sector by an adult social care action plan of the government.

Component Insights

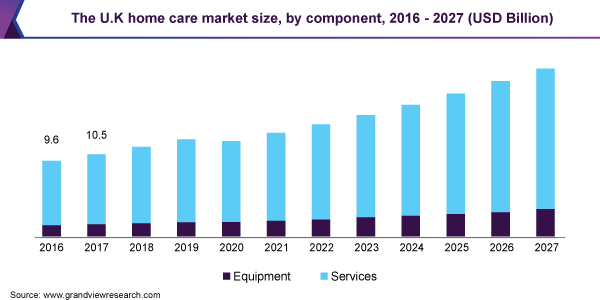

The services segment dominated the market for home care in Europe and accounted for a revenue share of 84.3% in 2019. This is attributed to a rise in the aging population in the region and the growing demand for home-based care. The equipment segment is further segmented into therapeutic, diagnostic, and mobility assistance equipment. Therapeutic equipment dominated the market for home care in Europe in 2019. However, the diagnostic equipment segment is anticipated to witness significant growth over the forecast period. Technologically advanced products that enable accurate and timely diagnoses such as strapless heart rate monitors, iPhone heart-rate monitors, and TQR heart rate watches are likely to propel segment growth.

The market by services is segmented into skilled home care and unskilled home care. Skilled home care services are provided by healthcare professionals. The aging population suffering from diseases, such as diabetes or cardiovascular disorders seeking medical assistance is driving the market. Furthermore, the increasing prevalence of lifestyle diseases has increased the need for continuous and coordinated care services for home-bound patients recovering from acute injury or illness. Moreover, skilled nursing services avoid unnecessary hospital stays for patients and family caregivers and reduce significant medical expenditure by providing the same quality of care at a reduced cost.

Regional Insights

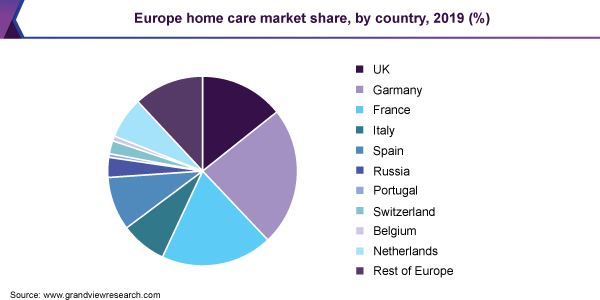

Among the European countries, Germany held the largest market share of 24.3% in 2019 attributed to the fastest growth rate of the aging population and favorable universal healthcare coverage system. The growing geriatric population in developed economies such as Germany, the U.K., France, and Italy coupled with the presence of high untapped opportunities in Eastern Europe are some factors expected to drive the market during the forecast period. Moreover, changes in the social and demographic structure in Europe are also likely to spur the demand for medical assistance at home.

Several European countries have universal long-term care coverage. In addition, the tax-based system in England is also focusing on the provision of rehabilitation and reablement services to patients. These factors are expected to result in lucrative growth of the market in Europe over the forecast period.

New regulations for medical devices were issued by the European parliament in 2017. The medical device regulation was effective from 2020 and in vitro diagnostic regulations will be effective from 2022.

Key Companies & Market Share Insights

The European home care market is highly fragmented owing to the presence of several international and regional players. Moreover, the consolidation activities undertaken by multinational companies are estimated to increase competition among new and local market players. The market is divided among the supplier/manufacturer and service providers. Collaboration between healthcare providers and MedTech companies offers a great opportunity and effective deployment of healthcare services at home.

For instance, Medtronic’s Integrated Health Solutions (IHS) has 170 ongoing long-term partnerships in 24 countries across Europe (such as the U.K., Italy, and the Netherlands) and the Middle East, delivering value to health care organizations and supporting the delivery of high-quality service at home more cost-effectively. In addition, voice technology is being adopted faster than any previous technology such as chatbots or doctor visits at home. Facility expansion through mergers and acquisitions is another key strategy followed by the major players in the region. For instance, In February 2019, Air Liquide acquired two home healthcare providers based in Switzerland named Megamed AG and Sleep and Health SA, to strengthen its home healthcare activity in Europe. Some of the prominent players in the Europe home care market include:

-

Healthcare at Home Ltd

-

Bayada Home Health Care

-

Ashfield Healthcare

-

Accredo Health Group, Inc.

-

Heritage Independent Living Ltd.

-

Mears Group PLC

Europe Home Care Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 82.3 billion

Revenue forecast in 2027

USD 137.5 billion

Growth Rate

CAGR of 7.6% from 2020 to 2027

Base year for estimation

2019

Historical period

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2016 to 2027

Report coverage

Revenue forecast, company position, competitive landscape, growth factors, and trends

Segments covered

Component, region

Regional scope

Europe

Country scope

The U.K.; Germany; France; Italy; Spain; Russia; Portugal; Switzerland; Belgium; Netherlands; Rest of Europe

Key Companies Profiled

Healthcare at Home Ltd.; Bayada Home Health Care; Ashfield Healthcare; Accredo Health Group, Inc.; Heritage Independent Living Ltd.; Mears Group PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the Europe home care market report based on component and region:

-

Component Outlook (Revenue, USD Million, 2016 - 2027)

-

Equipment

-

Therapeutic

-

Diagnostic

-

Mobility Assist

-

-

Services

-

Skilled Nursing Services

-

Unskilled Nursing Services

-

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Portugal

-

Switzerland

-

Belgium

-

Netherlands

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe home care market size was estimated at USD 84.2 billion in 2019 and is expected to reach USD 82.3 billion in 2020.

b. The Europe home care market is expected to grow at a compound annual growth rate of 7.61% from 2020 to 2027 to reach USD 137.5 billion by 2027.

b. The services segment dominated the Europe home care market with a share of 84.3% in 2019. This is attributable to growing awareness and increasing demand for home-based care.

b. The key service providers in Europe home care market are Healthcare at Home, Bayada Home Health Care, Ashfield Healthcare, Accredo Health Group, Inc., Heritage Independent Living Ltd, Mears Group PLC.

b. Growing healthcare expenditure, availability of cost-effective alternatives enabled with technological advancements, rising geriatric population, and shifting trend from communicable to lifestyle diseases are the factors driving the Europe home care market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."