- Home

- »

- Homecare & Decor

- »

-

Europe MICE Market Size & Share, Industry Report, 2030GVR Report cover

![Europe MICE Market Size, Share & Trends Report]()

Europe MICE Market (2024 - 2030) Size, Share & Trends Analysis Report By Event Type (Meetings, Incentives, Conferences, Events), By Country (Germany, UK, France), And Segment Forecasts

- Report ID: GVR-4-68040-221-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe MICE Market Size & Trends

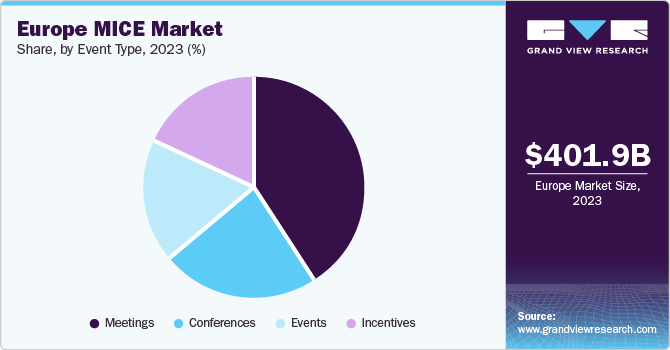

The Europe MICE market size was estimated at USD 401.95 billion in 2023 and is expected to grow at a CAGR of 9.4% from 2024 to 2030. Meetings, incentives, conferences, and exhibitions (MICE) are business-related travel destinations that fall under the umbrella of the travel and tourism industry. MICE aims to bring together elite professionals from various industries in a customized, improved hospitality environment.

The Europe MICE market held over 50% of the global MICE market revenue in 2023. The expansion of businesses, communities, and destinations is positively impacted by the size and growth of the European MICE sector. Resorts in the area are adjusting to specialist MICE hotel settings and services as MICE events become more common in Europe. A bigger benefit for MICE reservations is this diversification of hotel operations. For example, the Grand Luxor Hotel in Spain provides services for trade shows and exhibitions, corporate incentives, experiential events, team building, and more. High-tech audio-visual media and equipment service, simultaneous translation, branding, and high-speed internet access in the rooms (Wi-Fi) are additional amenities and services offered.

Because they yield the highest profits, conferences are the diamond in the MICE crown. Product expos and international organization conferences for cardiologists or architects are good examples. Thirty thousand people could attend these conferences. These are showing to be advantageous for a continent like Europe, which is already well-liked for leisure travel due to its favorable temperature.

In Europe, businesses are adapting to changing labor and economic conditions by reviewing their corporate travel policies and implementing new expense technology. For example, customized MICE tour bookings are available from Europe Incoming, a provider of hotels, European excursions, and ground services. It provides amenities like three- to five-star lodging, opulent transportation, entertainment, on-site project management, and more.

The term "business tourism" describes the services and amenities provided to travelers on business trips, such as lodging and travel assistance. Furthermore, the growing millennial workforce is fueling the bleisure demand, which is probably going to support the market's expansion. For example, about 90% of millennials travel for leisure, according to a June 2022 State of Business Travel Survey. Furthermore, nearly 49% of millennials have scheduled a vacation around business travel or have converted business travel into a vacation in order to save money on vacation expenses.

The MICE sector is also being driven by an increase in business travelers for corporate events and exhibitions, as well as by elements like employee engagement. Employee engagement is a crucial component that all organizations take into account since it helps them to inspire and develop their workforce. The rise of flexible work conditions has led to a rise in the demand for leisure travel, which in turn fuels the MICE market's expansion.

Market Concentration & Characteristics

The presence of numerous businesses with a global presence, strong brand awareness, and extensive distribution networks makes the MICE industry extremely competitive. It is anticipated that the market would continue to prioritize innovation while increasing investment in R&D. Over the course of the forecast period, mergers and acquisitions are anticipated to rise as businesses seek to broaden their geographic reach.

Players operating in this market have been focusing on the concept of service differentiation owing to the varying needs of their clients. The increasing preference for bleisure trips and incentive travel is expected to be one of the key factors attracting new players over the forecast period.

Companies can also focus on sponsorships and partnerships as this significantly helps target the right audience. Companies can position themselves as organizers of meetings, conferences, and exhibitions by marketing relevant images through social media, customer referrals, and participating in trade shows. This will help them achieve interactions with the right consumer base.

The increasing demand for sustainable events is another trend companies can focus on to enter the MICE market. Also, growing trend of customization and on-demand decoration and setting as per theme of the events as is acting as a strong business segment for new entrants in the market.

Event Type Insights

The meetings event type segment dominated the industry in 2023 and accounted for the maximum share 40.8% of the overall revenue. The market's need for meetings is being driven by the increase in corporate events occurring worldwide. Shareholder meetings, management meetings, general meetings, etc. are a few of the forms. Additionally, the demand for meetings in these areas is being driven by the growing appeal of regional destinations in addition to tier cities with lower population densities. For example, a number of governments provide funds to promote business travel and events.

Over the course of the projection period, the incentives segment is expected to grow at the quickest rate. The incentive travel market is being driven by millennials' increasing desire for unusual travel experiences. Travel awards known as incentives are provided by companies to their partners, affiliates, teams, and employees as a way to encourage and support them and raise their spirits. Companies are under pressure to find accessible and fascinating travel destinations due to the growing demand for travel among millennials. Additionally, the expansion of leisure travel is being aided by the growing trend of firms offering custom packages.

Country Insights

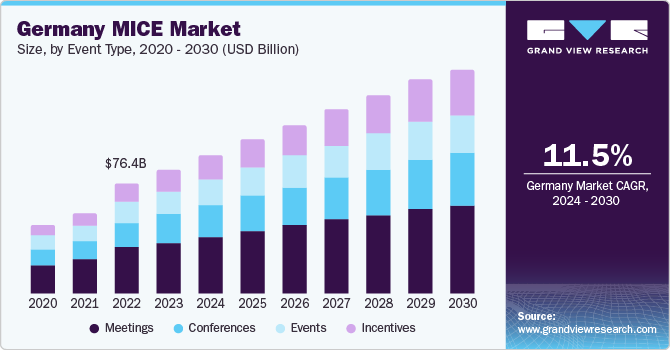

Germany MICE Market Trends

The MICE market in Germany accounted for 26.7% of the European market revenue in 2023. All the major travel markets are represented, including youth, adventure, business, and MICE travel, as well as newly developing markets like travel technology and the ground-breaking fields of CSR and responsible tourism. It is anticipated that these gatherings would increase business travel within the country. The largest travel exhibition in Germany, ITB Berlin, will take place from March 7-9, 2023, and will feature 10,000 exhibitors and over 110,000 people across 160,000 square meters. The market penetration of MICE has increased as more businesses choose to implement a mixed work culture.

UK MICE Market Trends

Trade shows that offer social value in the form of networking and branding draw attendees. Being the second most spoken business language in the world and home to the third-largest population in Europe, showing in the UK is becoming a more and more important part of the marketing mix. Top UK sites are attracting organizers with intriguing services and amenities in response to the growing trend of exhibitions.

Key Europe MICE Company Insights

There are a number of well-established and newly emerging players in the market. In order to compete with one another, several major players are putting more of an emphasis on mergers and acquisitions as well as expansion. For example:

- Its longstanding Italian partner, BCD Travel Ventura Spa, purchased the business travel, meetings, and events activities.

Key Europe MICE Companies:

- Global Air-American Express Travel Services (Global Business Travel Group, Inc.)

- CWT Meetings & Events

- BCD Meetings & Events

- Maritz

- Conference Care

- ATPI Ltd.

- FCM Meetings & Events

- Global Cynergies, LLC

- Capita plc

- AVIAREPS AG

Recent Developments

-

In November 2022, BCD Travel signed an agreement with Sabre to deepen its technology development collaboration and increase its booking volume through this expansion.

-

In November 2022, Air Serbia will benefit from AVIAREPS' extensive suite of sales, booking, and ticketing services as it expands into 16 new countries with its appointment of AVIAREPS as its general sales agent in pan-Europe

Europe MICE Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 437.37 billion

Revenue forecast in 2030

USD 751.50 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Event type, country

Regional scope

Europe

Country scope

UK; Germany; France, Italy, Spain

Key companies profiled

Global Air-American Express Travel Services (Global Business Travel Group, Inc.); CWT Meetings & Events; BCD Meetings & Events; Maritz; Conference Care; ATPI Ltd.; FCM Meetings & Events; Global Cynergies, LLC; Capita plc; AVIAREPS AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe MICE Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe MICE market report based on event type and country:

-

Event Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Meetings

-

Incentives

-

Conferences

-

Events

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. Germany dominated the Europe MICE market with a share of around 26.7% in 2023. It is anticipated that these gatherings would increase business travel within the country. The market penetration of MICE has increased as more businesses choose to implement a mixed work culture.

b. Some of the key players operating in the Europe MICE market include Global Air-American Express Travel Services (Global Business Travel Group, Inc.); CWT Meetings & Events; BCD Meetings & Events; Maritz; Conference Care; ATPI Ltd.; FCM Meetings & Events; Global Cynergies, LLC; Capita plc; AVIAREPS AG

b. The expansion of businesses, communities, and destinations is positively impacted by the size and growth of the European MICE sector.

b. The Europe MICE market was estimated at USD 401.95 billion in 2023 and is expected to reach USD 437.37 billion in 2024.

b. The Europe MICE market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 751.5 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.