- Home

- »

- Medical Devices

- »

-

Fetal And Neonatal Care Equipment Market Size Report, 2030GVR Report cover

![Fetal And Neonatal Care Equipment Market Size, Share & Trends Report]()

Fetal And Neonatal Care Equipment Market Size, Share & Trends Analysis Report By Product (Fetal Care Equipment, Neonatal Care Equipment), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-414-7

- Number of Report Pages: 83

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global fetal and neonatal care equipment market size was valued at USD 8.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.47% from 2023 to 2030. The growth of this market is attributed to factors such as high birth rates in developing countries, the prevalence of premature births, and government efforts to increase survival rates in such cases. In addition, factors such as the increasing prevalence of nosocomial infections in newborns and growing awareness regarding newborn care equipment are expected to contribute to the growth.

The increasing prevalence of hospital-acquired infections among neonates and rising awareness regarding neonatal devices are expected to contribute to market growth. According to the UN Foundation, maternal and infant health is a global priority as around 800 women die every day from preventable causes associated with pregnancy or childbirth. Pregnancy-related medical problems are leading to alarming rates of fetal mortality worldwide. According to the National Vital Statistics Reports, nearly 20,854 fetal fatalities were reported in the U.S. at 20 weeks of gestation or more in 2020. This emphasizes the pressing need for infant care devices.

The increasing prevalence of preterm hypothermia is a major public health concern and is a leading cause of infant mortality and morbidity. According to the journal “Anesthesia & Analgesia”, the global prevalence of hypothermia is up to 85% in hospitals and 92% in homes. Furthermore, a study published in Oxford Academic Journal found that from August 2018 to March 2019, approximately 74-77% of 1,120 enrolled infants suffered from hypothermia at birth.

Neonatal devices are witnessing an increasing demand in middle-income countries owing to high birth rates. Furthermore, the governments of these countries are increasingly focusing on maternal and child health. As a result, sales of these devices are expected to flourish at a rapid rate.

COVID-19 fetal and neonatal care equipment market impact: 0.8% decrease from 2020 to 2021

Pandemic Impact

Post COVID Outlook

A significant reduction in NICU admissions and neonatal resuscitation was observed during the COVID-19 pandemic. Premature births under 34 weeks of gestation decreased significantly, which had a negative impact on the sales of infant medical devices.

In 2020, 1 in 10 babies born in the U.S. were affected by premature birth. About 8% of U.K. births were premature. This equates to approximately 60,000 babies annually, which could increase the demand for neonatal care devices. As a result, the market is expected to expand significantly during the forecast period.

The manufacturers reported a sharp decline in their revenue. For instance, the neonatal segment of Utah Medical Products, Inc. reported a decline of 3.2% in 2020.

High preference for home healthcare is expected to continue post-pandemic, creating new opportunities in the coming years. The U.S. FDA has relaxed policies regarding noninvasive maternal and fetal monitoring devices to ensure product availability in the market. Products allowing remote health monitoring such as Avalon CL Fetal and Maternal Pod and Patch were launched, which enabled infant monitoring while reducing the risk of COVID-19 infection.

Public and private organizations are taking initiatives to increase the availability of NICUs in both rural and urban areas. For instance, in September 2017, BC Children's Hospital, Vancouver announced the launch of Teck Acute Care Centre and claimed to have North America’s first NICU to provide critical care to mothers and infants in the same room. Thus, an increasing number of NICU facilities and admissions are likely to bode well for the market.

Product Insights

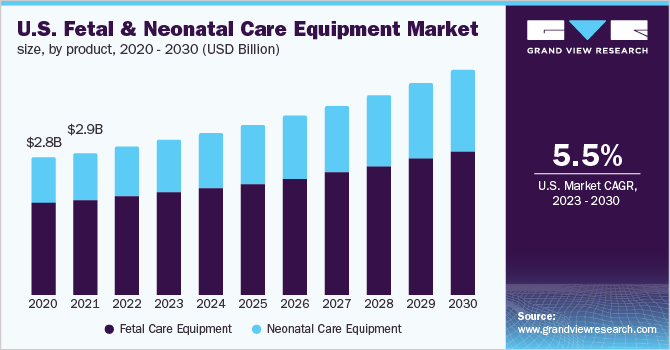

The fetal care equipment segment dominated the market in 2022 with a revenue share of over 67.0%. The segment is further bifurcated into ultrasound devices, MRI systems, monitors, and pulse oximeters. The ultrasound devices segment held the largest share in 2021 owing to the increasing application to view the fetus during pregnancy. Besides, rising awareness, technological advancements, and ease in utility have further triggered the usage of portable and do-it-yourself ultrasound devices for home use.

The fetal monitor segment emerged as the second-largest segment in 2021 owing to its utility in determining the baby's heart rate during pregnancy and labor. In June 2020, Koninklijke Philips N.V. announced the launch of Avalon CL Fetal and Maternal Pod and Patch, a remote monitoring device allowing continuous monitoring of maternal and fetal heart rate. This can be used in high-risk pregnancies by reducing physical interaction between patient and doctor, which was important during the pandemic.

The neonatal care equipment segment is projected to register highest CAGR of 7.50% during the forecast period. In neonatal care equipment, the neonatal monitoring devices segment is expected to witness significant growth during the forecast period due to factors such as constant technological advancements in neonatal monitors, including improvements in connectivity and ease of use in home settings. Respiratory devices are expected to advance owing to the increasing demand for respiratory care in neonates to reduce the length of hospital stay and risk of long-term disability. Nearly all newborns are prone to respiratory difficulties at birth, and neonate respiratory devices ease the process, ensuring better health for the baby.

End-use Insights

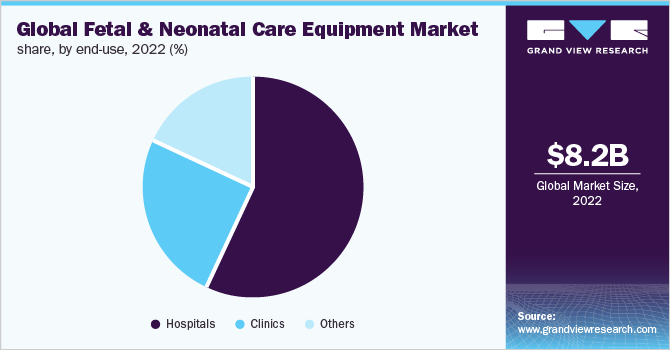

The hospitals segment accounted for the largest revenue share of over 57.7% in 2022 and is anticipated to register substantial growth with a CAGR of 6.94% during the forecast period. Factors contributing to this growth are the presence of the latest and technologically advanced equipment to improve patient care and the availability of specialists. Furthermore, the increasing number of NICUs in hospitals and high patient volume are propelling segment growth. Based on end-use, the market is bifurcated into hospitals, clinics, and others.

The clinics' segment is expected to grow at a significant rate during the forecast period. Clinics offer specialized services and are often preferred where large facilities are not available. In countries such as China, Nigeria, and India, the demand for clinics is growing due to the increasing need for specialized care and quick diagnosis and effective care offered by specialty clinics.

The others segment include home care, nursing homes, diagnostic centers, and others. The rising prevalence of genetic disorders in infants is driving the demand for nursing homes and diagnostic centers. In addition, increasing preference for wearable devices that can help in remote monitoring from home is anticipated to boost segment growth.

Regional Insights

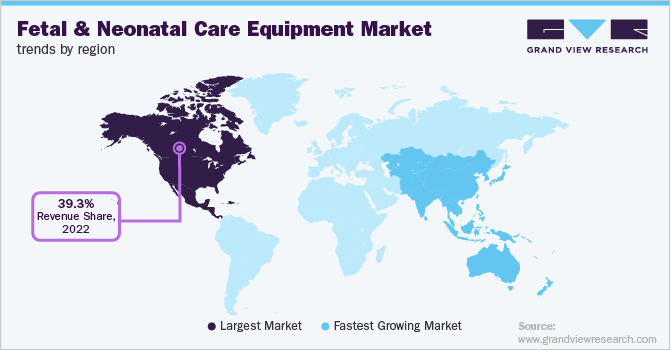

North America held the largest revenue share of over 39.3% in 2022 owing to a huge demand for technologically advanced products, ensuring better healthcare delivery. The value-based healthcare model has led to the development of well-equipped NICU centers along with an increasing number of approvals for these devices from the FDA. For instance, in June 2021, Nuvo Group received supplemental 510 (k) approval by the FDA to add a new module for the uterine activity to its INVU system, a wearable pregnancy monitoring device. Such initiatives are expected to boost market growth in the U.S.

The market in Europe is expected to grow due to the increasing frequency of acquired infections among newborn babies and a growing number of hospitals and NICUs. In addition, a sizeable patient population suffering from low birth weight and an increasing number of preterm births are poised to surge the market growth in Europe.

Asia Pacific is expected to witness remarkable growth of 7.93% during the forecast period owing to the increasing initiatives by private and government agencies, rising awareness programs for newborn care, and increasing birth rates. For instance, according to the World Health Organization, over 60% of premature births occur in South Asia and Africa. The premature birth rate in low-income countries is about 12%, and in high-income countries, it is 9%. India reported around 3,519,100 premature births in 2018.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of various players. Key manufacturers are working with leading networks of childcare providers to increase awareness and drive product sales. Several companies are involved in approvals and product launches. For instance, in August 2020, Pulsenmore Ltd., an Israeli company involved in the manufacturing and marketing of ultrasound devices, launched a remote handheld ultrasound device. This first-ever self-administered ultrasound machine allows pregnant women to perform ultrasound scans at home. Some prominent players in the global fetal and neonatal care equipment market include:

-

Cardinal Health

-

Drägerwerk AG & Co. KGaA

-

Koninklijke Philips N.V.

-

GE Healthcare

-

Medtronic

-

Vyaire

-

BD

-

Utah Medical Products, Inc.

-

Natus Medical Incorporated

-

Ambu A/S

-

Inspiration Healthcare Group plc

-

Atom Medical Corp.

-

Fisher & Paykel Healthcare Limited

-

Masimo

-

Phoenix Medical Systems (P) Ltd.

Fetal And Neonatal Care Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.6 billion

Revenue forecast in 2030

USD 13.4 billion

Growth rate

CAGR of 6.47% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Cardinal Health; Drägerwerk AG & Co. KGaA; GE Healthcare; Koninklijke Philips N.V.; Medtronic; BD; Vyaire; Utah Medical Products, Inc.; Ambu A/S; Natus Medical Incorporated; Inspiration Healthcare Group plc.; Atom Medical Corp; Fisher & Paykel Healthcare Limited; Masimo; Phoenix Medical Systems (P) Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fetal And Neonatal Care Equipment Market Segmentation

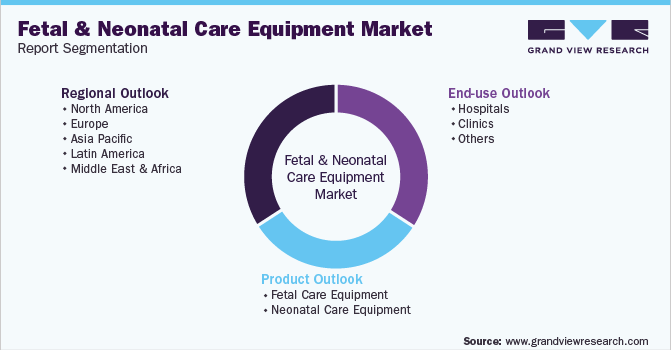

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the global fetal and neonatal care equipment market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2030)

-

Fetal Care Equipment

-

Ultrasound Devices

-

Fetal MRI Systems

-

Fetal Monitors

-

Fetal Pulse Oximeters

-

-

Neonatal Care Equipment

-

Infant Warmers

-

Incubators

-

Convertible Warmers & Incubators

-

Phototherapy Equipment

-

Respiratory Devices

-

Neonatal Ventilators

-

Continuous Positive Airway Pressure (CPAP) devices

-

Oxygen Analyzers and Monitors

-

Resuscitators

-

Others

-

-

Neonatal Monitoring Devices

-

Blood Pressure Monitors

-

Cardiac Monitors

-

Pulse Oximeters

-

Capnographs

-

Integrated Monitoring Devices

-

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global fetal and neonatal care equipment market size was estimated at USD 8.2 billion in 2022 and is expected to reach USD 8.6 billion in 2023.

b. The global fetal and neonatal care equipment market is expected to grow at a compound annual growth rate of 6.47% from 2023 to 2030 to reach USD 13.4 billion by 2030.

b. North America dominated the fetal and neonatal care equipment market with a share of 39.3% in 2022. This is attributable to a huge demand for technologically advanced products ensuring better healthcare delivery.

b. Some key players operating in the fetal and neonatal care equipment market are Cardinal Health; Drägerwerk AG & Co. KGaA; GE Healthcare; Koninklijke Philips N.V.; Medtronic; BD; Vyaire; Utah Medical Products, Inc.; Ambu A/S; Natus Medical Incorporated; Inspiration Healthcare Group plc.; Atom Medical Corp; Fisher & Paykel Healthcare Limited; Masimo; Phoenix Medical Systems (P) Ltd.

b. Key factors that are driving the fetal and neonatal care equipment market growth include the increasing prevalence of neonatal hospital-acquired infections and rising awareness about neonatal health & care, the high birth rate in developing countries, rising prevalence of preterm births, and efforts by the government to increase survival rates in such cases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."