- Home

- »

- Next Generation Technologies

- »

-

Food Robotics Market Size, Share And Growth Report, 2030GVR Report cover

![Food Robotics Market Size, Share & Trends Report]()

Food Robotics Market Size, Share & Trends Analysis Report By Robot (Articulated, Parallel, SCARA, Cylindrical, Other), By Payload (Low, Medium, Heavy), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-047-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Food Robotics Market Size & Trends

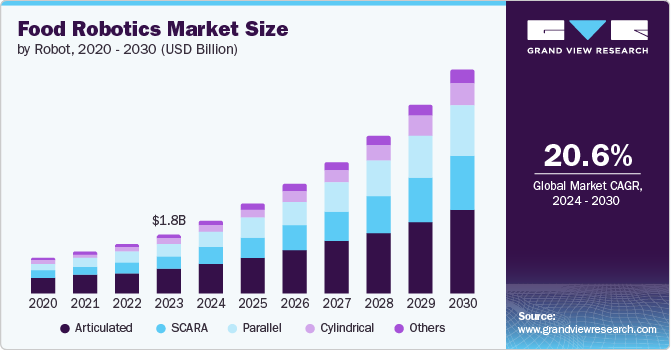

The global food robotics market size was valued at USD 1.81 billion in 2023 and is projected to grow at a CAGR of 20.6% from 2024 to 2030. The key factors contributing to the market growth are the increasing demand for food due to the rising population and the growing demand for advanced productivity in the food industry. Additionally, growing investments by major organizations in robotics in the food industry are driving market growth.

In recent years, the food industry has changed significantly due to the rising number of food tech startups utilizing robotics to revolutionize numerous aspects of the sector. These startups use recent artificial intelligence and robotics developments to enhance food safety, efficiency in manufacturing, and the overall customer experience by automating multiple processes such as harvesting, planting, cooking, and delivering food. Automation enables workers to shift their attention and time from tiring tasks to more crucial responsibilities.

Similarly, robots have gained significance in the food processing industry due to their excellent capacity and power to perform tasks with exceptional accuracy. Robots are developed with the capacity to operate in challenging conditions while handling heavy workloads. Additionally, the food service industry is experiencing a significant increase in the use of robots for various tasks, including cooking, delivery, and food preparation. Moreover, the rising demand for baked goods and packaged dairy products industries is driving the food robotics market due to the requirement for large-scale manufacturing of these products.

Robot Insights

Articulated robots dominated the market and accounted for a market revenue share of 41.9% in 2023. The growth is attributed to the articulated robot's structure and design, which mimics a human arm's movements. Articulated robots have revolutionized the food processing industry by streamlining production by performing tasks such as pick and place, palletizing, and bin-picking, with a minimum amount of error. Multiple prominent organizations in the food industry have started adopting these robots to ensure enhanced compliance with food safety regulations and maintain hygiene in the production area while attaining improved processes with minimal use of other resources such as labor and time.

Selective Compliance Assembly Robot Arm (SCARA) is expected to experience the fastest CAGR of 22.8% during the forecast period. SCARA robots are extensively used in high-speed automated processes, and their axis configuration provides a combination of rigidity and flexibility for assembly applications, which has great importance in the food and beverages industries. These robots can be easily relocated owing to their compact size and can be accommodated in confined workplaces without compromising ample floor space. The market is driven by their high precision and cost-effectiveness, which makes them ideal for use in cleanrooms and food plants.

Payload Insights

The medium payload segment accounted for the largest revenue share in 2023. Medium payload capability robots address applications such as selecting, repackaging, packing, and transferring. The adoption of these automated robots is anticipated to speed up the growth of the food robotics sector. They balance payload capacity and flexibility, making them highly versatile and suitable for a wide range of applications in the food industry. The robust design allows them to handle heavier loads with precision and stability, essential for maintaining product integrity and safety. Furthermore, medium payload robots have advanced control systems and sensors, enabling them to perform complex tasks accurately and consistently.

The heavy payload segment is expected to experience a noteworthy CAGR during 2024 to 2030. This segment is primarily driven by the rising adoption of heavy payload robotic systems by companies operating in the processed food industry. Two of the key applications of these systems include palletizing and depalletizing. Increasing demand for heavy payload robotics in companies for functions such as material handling, pick & place, machine loading and unloading, and packing & palletizing processes is driving the segment growth.

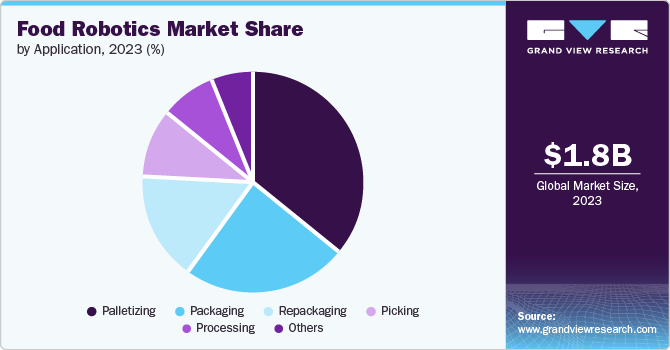

Application Insights

The palletizing segment dominated the global industry in 2023. Robots are commonly used for packaging or stacking the food onto pallets for warehousing or transportation. In addition, robots for palletizing are designed to manage heavy items and high quantities, ensuring accurate and effective stacking of products. Furthermore, these robots can function at high speeds, boost productivity, and minimize physical strain on the labor force, ultimately enhancing workplace safety. Ease of availability, global expansions by multiple manufacturing organizations, post-sale service provisions by major players, and a growing inclination towards automation are expected to generate greater growth for this segment in approaching years.

The picking segment is anticipated to experience the fastest CAGR over the forecast period. Robots are commonly used in picking tasks to select and manage individual items, typically in anticipation of packaging or additional processing. They are integrated with advanced vision systems and gripping technologies that enable them to recognize and manipulate various types of food products accurately. The adaptability and accuracy of picking robots make them useful for critically handling delicate products, such as fruit and pastries.

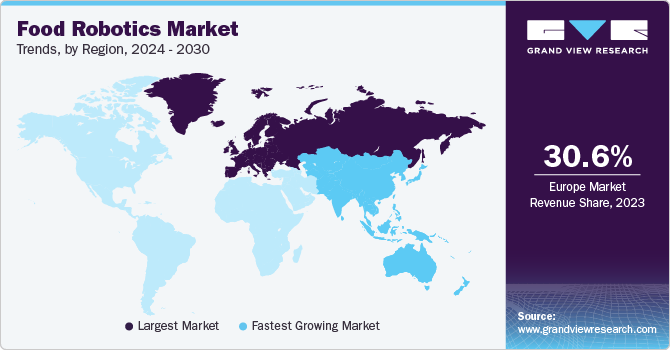

Regional Insights

North America food robotics market was identified as a lucrative region in 2023. Due to the presence of regulatory authorities in the region, such as the Food and Drug Administration, strict regulations to produce quality products influence the installation of robotics to minimize errors and improve quality and productivity. Moreover, rising technological advancements, growing demand for processed and packaged food products in the region, availability of advanced robotics solutions, and ease of accessibility are expected to generate greater growth for this market.

U.S. Food Robotics Market

The U.S. food robotics market dominated the North America industry and accounted for revenue share of 81.8 % in 2023. This market is mainly influenced by the country's unceasing demand for packaged food, leading to enhanced manufacturing, operational, and delivery processes. An increasing number of food delivery businesses, the rising inclusion of food products by online retail platforms in the product catalogs, growing innovation backed by research & development activities, and an increasing number of companies shifting focus to cost reductions are expected to fuel the growth of this industry.

Europe Food Robotics Market

Europe's food robotics market dominated the global industry and accounted for a revenue share of 30.6% in 2023. It is attributed to the regulations concerning food safety, the rising labor costs in the region, and the growing inclination towards the automation of multiple processes in the food industry. Key companies operating in the processed food industry have increasingly adopted robotics to reduce manufacturing and operational costs while catering to unceasing demand within time constraints. In addition, several factors are anticipated to drive regional growth, including the increasing popularity of culinary tourism, the rise of automated processes like food delivery, and a shortage of skilled personnel.

Germany food robotics market is projected to experience noteworthy growth in upcoming years. This market is primarily driven by the aspects such as presence of multiple large enterprises operating in the food industry, early adoption of technology trends in the manufacturing sector, existence of prominent robotics companies such as autonox Robotics GmbH and KUKA AG, and growth in culinary tourism.

Asia Pacific Food Robotics Market Trends

The Asia Pacific food robotics market is anticipated to witness the fastest growth during the forecast period. The rising disposable income of customers in emerging economies is driving the demand for packaged and processed food, which in turn is fueling the need for automation technologies to improve food production capacities. Factors such as changing lifestyles, rising population and the unceasing demand for ready-to-eat food products contribute to the growing installations of robotic systems in food processing plants in China, Japan, South Korea, India, and Australia.

The China food robotics market held a substantial market share of the regional industry in 2023. The presence of multiple large enterprises operating in the packaged food industry, numerous players focusing on cost reductions, and a rise in the availability of customized robotics solutions are expected to develop growth for this market during the forecast period.

Key Food Robotics Company Insights

Some of the key companies in the food robotics market include ABB, KUKA AG, Kawasaki Heavy Industries, Ltd., FANUC CORPORATION, Rockwell Automation, YASKAWA ELECTRIC CORPORATION, and others. As demand for robotics solutions is growing at rapid pace, key companies in the market are adopting strategies such as innovation, collaborations, research & development, service differentiations and enhanced post-sale services to develop competitive advantage over others.

-

FANUC America Corporation, a prominent company operating in automation technology, operates in multiple regions including Asia Pacific, Americas, and Europe. The company offers a wide range of products related to food robotic including robots for food processing & handling, food grade robot DR-3iB/6 STAINLESS, Food & Beverage Robots such as SR-12iA SCARA Robot, FANUC M-2iA Series for picking & assembly, LR Mate 200iD/4SC Clean Room Robot and others.

-

Universal Robots A/S, an innovative robotics company, offers Collaborative Robots (Cobots), commonly employed in the food and beverage sector for tasks such as packaging and machine tending. Products provided by company include robots for higher speed & heavy payloads, robots for smaller work setting, and robots for larger work pieces and objects.

Key Food Robotics Companies:

The following are the leading companies in the food robotics market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- KUKA AG

- Kawasaki Heavy Industries, Ltd.

- FANUC CORPORATION

- Rockwell Automation

- YASKAWA ELECTRIC CORPORATION

- DENSO CORPORATION

- Mitsubishi Electric Corporation

- Universal Robots A/S

- JR Automation (Hitachi, Ltd.)

Recent Developments

-

In May 2024, ABB Robotics signed a collaboration agreement with Pulmuone Co Ltd, a food processing company in Seoul, for exploration of creating automation solutions equipped with Artificial intelligence. The collaborated effort is aimed at developing a new variety of laboratory-grown foods while automating numerous elements related to cell culture handling and testing.

-

In May 2024, Rockwell Automation, a prominent organization in robotics industry, joined forces with Azzurro, a subsidiary of Illukkumbura Industrial Automation (Pvt) Ltd, to expand its presence in Sri Lanka.

Food Robotics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.21 billion

Revenue forecast in 2030

USD 6.81 billion

Growth rate

CAGR of 20.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Robot, payload, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, South Arabia, UAE, and South Africa

Key companies profiled

ABB; KUKA AG; Kawasaki Heavy Industries, Ltd.; FANUC CORPORATION; Rockwell Automation; YASKAWA ELECTRIC CORPORATION.; DENSO CORPORATION.; Mitsubishi Electric Corporation; Universal Robots A/S; JR Automation (Hitachi, Ltd.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Robotics Market Report Segmentation

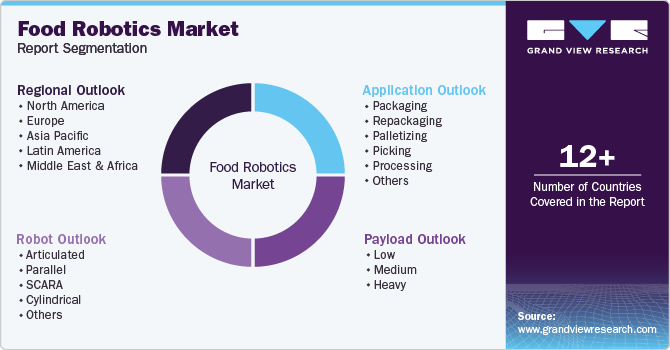

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the food robotics market report based on robot, payload, application, and region:

-

Robot Outlook (Revenue, USD Billion, 2018 - 2030)

-

Articulated

-

Parallel

-

SCARA

-

Cylindrical

-

Others

-

-

Payload Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low

-

Medium

-

Heavy

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Packaging

-

Repackaging

-

Palletizing

-

Picking

-

Processing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."