- Home

- »

- Pharmaceuticals

- »

-

Geriatric Medicine Market Size, Share & Growth Report 2030GVR Report cover

![Geriatric Medicine Market Size, Share & Trends Report]()

Geriatric Medicine Market (2024 - 2030) Size, Share & Trends Analysis Report By Therapeutics (Analgesics, Antihypertensive, Statins, Proton Pump Inhibitors), By Condition, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-887-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2024

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geriatric Medicine Market Size & Trends

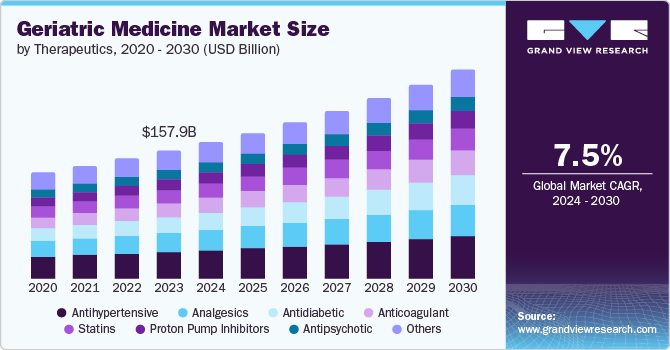

The global geriatric medicine market size was valued at USD 157.9 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030. Geriatric medicines are specifically aimed at offering care for the medical needs of the population. The fast-expanding medical infrastructure, increasing government support, and rising healthcare expenditures have boosted the geriatric medicine market. Several countries are formulating national programs for the elderly population and offer various policies such as ease of availability, affordability, good medicinal quality, and dedicated care services with major facilities.

A few other metrics such as the increasing prevalence of chronic disorders, i.e. cardiovascular disorder, rheumatoid arthritis, neurological disorders, and cancer have enabled new avenues for market growth. This population is more susceptible to high cholesterol levels, high blood sugar levels, and low immunity levels, which is increasing the prevalence of such diseases. Moreover, the geriatric population is relying on heavy medications, which can lead to negative side effects due to the interaction of diverse medicines. The augmented demand for geriatric care and developments boost the geriatric medicine market worldwide.

Furthermore, technological developments have significantly improved the quality of healthcare services that are available to the aging population. These advancements have made healthcare more reachable, efficient, and tailored. The technological integration with healthcare has upgraded the management of chronic conditions and also enabled early interference and preventive care.

Therapeutics Insights

In the therapeutic category, antihypertensive therapeutics accounted for a share of 20.2% in 2023. These are used for treating high and low blood pressure. There are a variety of antihypertensive drugs available in the market. Some antihypertensive medicines remove extra salt and fluids from the body while others help relax and widen blood vessels. The results vary and differ from one patient to another. Some may require more antihypertensive agents to lower blood pressure. At present, various medications are studied and experimented for developing drug efficacy. Moreover, a rise in diseases such as arthritis, diabetes, bone health, and cardiovascular, neurological, and metabolic disorders.

Antidiabetic therapeutics witnessed to grow at a CAGR of 9.4% in projected years. The rise in diabetes at an old age is driven by lifestyle-related risk factors i.e. smoking, less physical activity, alcohol consumption, high cholesterol levels, and obesity. With an increase in the prevalence of diabetes in the geriatric population, the market for antidiabetic drugs is projected to grow high in the forthcoming years.

Condition Insights

In the condition segment, cardiovascular diseases were leading and accounted for the largest market share of 32.6% in 2023. Cardiovascular diseases have become a common problem all over the world and geriatrics are prone to suffer from hypertension, diabetes, hypercholesterolemia, and other cardiovascular diseases. The growing population of older adults (age ≥65 years) is expected to lead to a higher prevalence of cardiovascular disease with parallel geriatric-specific conditions. The biology of aging is conducive to cardiovascular disease (CVD), such that the prevalence of coronary artery disease, heart failure, valvular heart disease, arrhythmia, and other illnesses is rising as more adults contribute to old age.

Diabetes and metabolic disorders experienced exponential growth in projected years with a CAGR of 9.8%. These disorders are chronic and quite progressive, and their prevalence rises with aging. Adults commonly suffer less or lower risk for physical or cognitive dysfunction, though some deal with critical clinical circumstances. However, their older counterparts mostly face more challenges beyond diabetes-related issues, due to the correspondence with the aging process and age-related or age-dependent disease factors. The overall cause for geriatric medicine market growth is led by enhancement in healthcare facilities and advanced healthcare infrastructure and equipment, reimbursement policy, and the rising number of old people suffering from several target diseases.

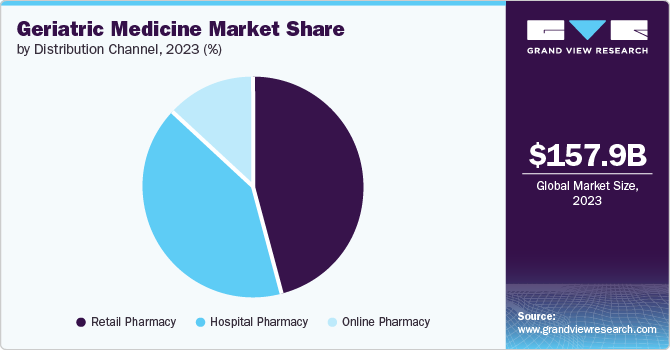

Distribution Channel Insights

In distribution channel segments, retail pharmacies dominated the market with 45.9% market share in 2023. In this segment, retail pharmacy exhibits various dominating factors led by the growing elderly population and the increasing prevalence of age-related health conditions. Another key factor is that prescription medications are aligned to manage chronic disease risks, i.e. hypertension, diabetes, cardiovascular disorders, and arthritis. The retail sector in pharmaceutical distribution and the geriatric medicine market plays a vital role in availing such medications, displaying them as an important place for older patients to seek healthcare.

However, online pharmacies are experiencing significant growth in the distribution of geriatric medicine, with a projected CAGR of 10.7% over the forecast period. One of the main factors for the market growth is the easy accessibility and convenience & availability of geriatric medicines, which are inaccessible in retail pharmacy stores. The online platform offers several services, including discounts and free home delivery. In addition, the strong influence of social media and promotional advertisement also impacts segmental growth.

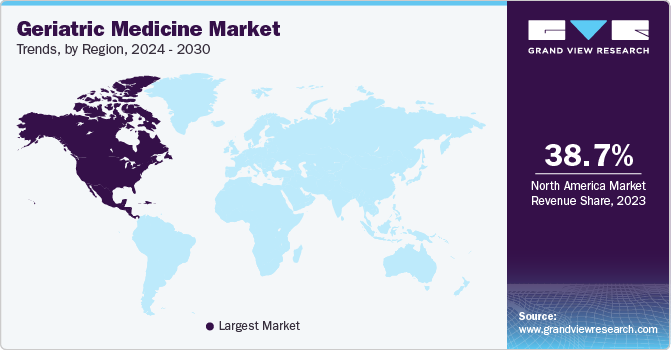

Regional Insights

The North America geriatric medicine market registered 38.7% of the market share. This is mainly due to the rising geriatric population, the presence of leading players, strong healthcare infrastructure, and an increasing awareness. In addition, thorough research activities conducted in the region expedite the development of novel therapies, and further boosts the market growth.

U.S Geriatric Medicine Market Trends

The geriatric medicine market in the U.S. dominated the market with a share of 89.3% in 2023. The primary drivers for the U.S. market include the higher prevalence and increasing awareness about the elderly population related to diabetes, cardiovascular disorders, and other risks. The U.S. is experiencing a significant growth in the elderly population is an important aspect. The prevalence of chronic conditions such as diabetes, arthritis, and cardiac diseases is more common in elderly groups. Moreover, advancements in medical technology, including telemedicine, healthcare systems, remote monitoring devices, and highly equipped medical diagnostics are increasing the quality of geriatric care. These factors account for the rise in the geriatric medicine market in projected years.

Europe Geriatric Medicine Market Trends

Europe geriatric medicine market is a significant market for geriatric medicine & ranked second position in 2023, with substantial variations across countries, high awareness of geriatric medications, and implementation of robot-assisted surgical processes. Another major reason is that elderly people (≥65 years) comprise a substantial and increasing proportion of the European population and it is expected that they will make up 30% by 2050. Due to the increased illness of multiple chronic and acute diseases, older people are the main users of healthcare resources, and it has been estimated that over 10% of the older population receives 10 or more related medicines. In addition, the support of government initiatives also boosts the growth of the geriatric medicines market. Moreover, government agencies and public companies are investing in and providing insurance policies to the people.

In the UK geriatric medicine market, the rising prevalence of cardiovascular diseases and diabetes in the geriatric, uplift in government funding, rising healthcare infrastructure developments, and the rising count of specialty clinics are driving the market growth. Some factors that may lead to the growth include growth in disposable income, the launch of many generic and patented drugs, and the growth of private and public healthcare expenses. Most geriatricians work as part of a multidisciplinary team in an acute hospital. Geriatric is in turn typically placed within a medical division beside specialties such as diabetes and respiratory medicine. Geriatricians work in smaller groups of hospitals as community geriatricians. The rising incidence of medication-related issues among older adults and the urgent requirement for palliative care are the determining factors fueling the regional market growth.

The geriatric medicine market in Germany is witnessing a rise, driven by an increasing old-age population and a high demand for specialized clinical services. Also, the growth is boosted by various factors, such as advancements in therapeutics, the assistance of governments and NGOs for elderly groups, and increasing emphasis on personalized medicine. Furthermore, rapid enhancements and improvements in healthcare infrastructure and investments support market growth.

Asia Pacific Geriatric Medicine Market Trends

Asia Pacific geriatric medicine market is anticipated to witness significant growth with a 9.1% CAGR in the forecast period. The rapidly growing older population in countries such as China, Japan, and India propel the demand for geriatric drugs and enhanced healthcare services and medications. This can be attributed to the developing healthcare infrastructure and facilities, government assistance, rising geriatric population, and increasing awareness about healthy lifestyles.

China geriatric medicine market is dominant because of a mix of factors that fuel the demand here. A major driver of the geriatric medicine market is the increasing aging population as China accounts for a significant share of the elderly population. The government has also been implementing reforms in healthcare to improve healthcare services for the elderly, with insurance coverage and investments in elder care.

India is also a significant market for geriatric medicines, factors that propel are- urbanization, insurance penetration, healthcare investments in the country made by governments, policy assistance, pharmaceutical demands aiming at the treatment of chronic diseases, and other age-related issues.

Key Geriatric Medicine Company Insights

Some key companies in the geriatric medicine market include AbbiVie Inc. Sanofi; and Pfizer. Inc.; Novartis AG; GSK plc; Takeda Pvt. Ltd.; in the market is focusing on the development of treatments for ankylosing spondylitis to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

AbbVie Inc (AbbVie) is a specialty biopharmaceutical company which discovers, develops, manufactures, and commercializes drugs for the treatment of chronic and complex diseases.

-

Takeda Pvt. Ltd. is a value-based, patient-focused, R&D-driven global biopharmaceutical player, focused on oncology, rare diseases, neuroscience, gastroenterology, plasma-derived therapies, and vaccines.

Key Geriatric Medicine Companies:

The following are the leading companies in the geriatric medicine market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd.

- Novartis AG

- AbbVie Inc.

- Johnson & Johnson, Inc.

- Merck & Co., Inc.

- Pfizer, Inc.

- Bristol-Myers Squibb Company

- Sanofi

- GSK Plc.

- Takeda Pharmaceuticals Company Ltd.

Recent Developments

-

In June 2024, Sun Pharmaceutical Industries inked a licensing pact with Takeda Pharmaceutical Company to commercialize a novel gastrointestinal drug in India. The company has entered into a non-exclusive patent licensing agreement with Takeda Pvt. Ltd to commercialize Vonoprazan tablets in volumes of 10 and 20 mg in India.

-

In May 2023, Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) has approved ABRYSVO (Respiratory Syncytial Virus Vaccine), the company’s bivalent RSV prefusion F (RSVpreF) vaccine, for the prevention of lower respiratory tract disease caused by RSV in individuals 60 years and older.

Geriatric Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 168.7 billion

Revenue forecast in 2030

USD 260.0 billion

Growth Rate

CAGR of 7.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapeutics, condition, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, UAE, South Africa, Saudi Arabia, Kuwait.

Key companies profiled

F. Hoffmann-La Roche Ltd.; AbbiVie, Inc; Amgen, Inc; Pfizer, Inc; UCB, Inc.; Novartis AG; Bristol-Myers Squibb Company; Johnson and Johnson Services, Inc; Merck and Co., Inc; Sanofi; GSK plc; Takeda Pharmaceutical Company Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geriatric Medicine Market Segmentation

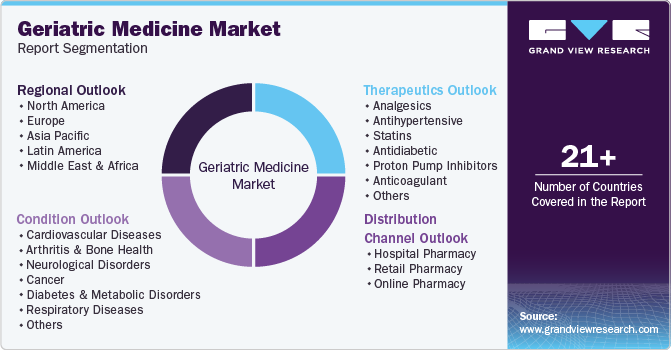

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global geriatric medicine market report based on therapeutics, condition, distribution channel, and region.

-

Therapeutics Outlook (Revenue, USD Million, 2018 - 2030)

-

Analgesics

-

Antihypertensive

-

Statins

-

Antidiabetic

-

Proton Pump Inhibitors

-

Anticoagulant

-

Antipsychotic

-

Others

-

-

Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Diseases

-

Arthritis & Bone Health

-

Neurological Disorders

-

Cancer

-

Diabetes and Metabolic Disorders

-

Respiratory Diseases

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.