- Home

- »

- Consumer F&B

- »

-

Gluten-free Pizza Crust Market Size & Share Report, 2030GVR Report cover

![Gluten-free Pizza Crust Market Size, Share & Trends Report]()

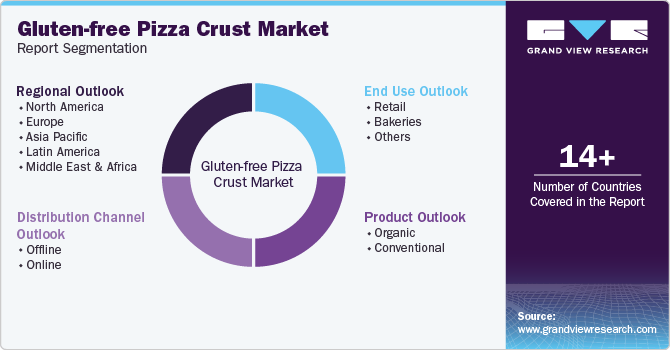

Gluten-free Pizza Crust Market Size, Share & Trends Analysis Report By Product (Organic, Conventional), By End Use (Retail, Bakeries), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-606-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Gluten-free Pizza Crust Market Size & Trends

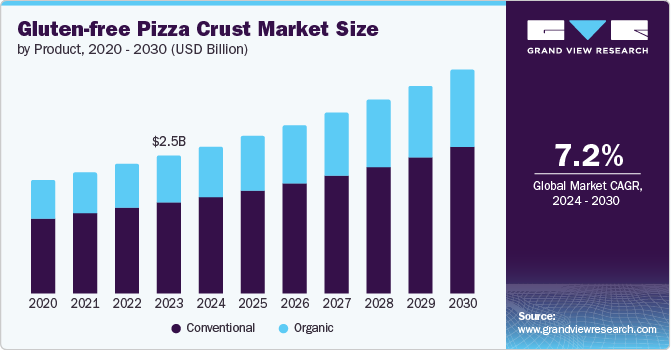

The global gluten-free pizza crust market size was valued at USD 2.46 billion in 2023 and is projected to grow at a CAGR of 7.24% from 2024 to 2030. The market growth can be attributed to the increased knowledge of health risks associated with gluten, the increase in the number of people related to gluten diseases, and the trend towards healthier alternatives. The makers also focus on creating the classic pizza experience while meeting the demand for gluten-free requirements.

Customers with gluten-related diseases such as celiac prefer gluten-free substitutes, and the penetration of pizza in developing countries such as India, Bangladesh, and Myanmar is also a reason for further expansion of the market. Innovations in developing the product using a wide range of ingredients have also been the reason for the growth of the gluten-free pizza crust market. The manufacturers are constantly experimenting with combinations of new items and ingredients to improve taste, maintain the pizza crust texture, and maintain the nutritional value of gluten-free products. According to an article published by Beyond Celiac, approximately 1 in 133 Americans had celiac disease, but recent studies suggest a higher prevalence. Mass screening in Italy found 1.6% of children with celiac disease, while Finland estimates 1.99% of the population had the condition.

The increasing presence of gluten-free pizza crusts because of the increase in several outlets, supermarkets, and retail stores has further propelled the market by making gluten-free pizza crusts more accessible to consumers worldwide. For instance, in January 2023, PILLSBURY launched a Gluten-Free Pizza Crust Thin and crispy Mix at Walmart stores and online. This product addresses the demand for gluten-free options, especially amid increasing home cooking due to inflation. This launch follows the success of Pillsbury's regular Pizza Crust Mix, which saw an 18% year-over-year growth.

Product Insights

The conventional market segment is the most dominant segment with a global market share of 66.7% in 2023. Manufacturers and vendors are attracting consumers by increasing the standards of their products and expanding their product portfolios. Health consciousness among consumers is the main reason for the segment's growth. In addition, retail chains such as Dominos, Pizza Hut, and Bob’s Red Mill Natural Foods. Offer various gluten-free pizzas, which are successfully attracting customers' interest. For instance, in May 2022, Schwan’s Consumer Brands, Inc. introduced gluten-free and thin-crust pizza flavors, including a gluten-free Margherita with roasted garlic and a Thin-Crust Margherita. The gluten-free option will be available at Publix and Kroger, while the thin-crust option will be at Food Lion and Harris Teeter. They also launched a direct-to-consumer delivery service for gluten-free pizzas in 15 Midwest states.

The organic segment is expected to grow at the fastest CAGR of 7.6% over the forecast period. The major factors contributing to the segment's growth are the increase in the usage of environmentally sustainable ingredients in gluten-free pizza crusts and growing awareness about the effects of the ingredients on the human body. In addition, the increase in visibility of gluten-free crust pizzas can enhance the chances for further market growth.

End-Use Insights

Retail dominated the market and accounted for a share of 38.6% in 2023. The significant factors contributing to the market's dominance are the increase in retail outlets, increased awareness about the benefits of gluten-free pizzas compared to traditional ones, the presence of players such as Domino's and Pizza Hut outlets, which have a large share of gluten-free pizzas and changing trends towards a healthy lifestyle. For instance, in March 2024, Slice House, a fast-casual pizza chain, announced an expansion to Tennessee. They signed a franchise agreement to open 11 new locations in the state starting in 2025. This marks Slice House's initial entry into the southern market, with the new restaurants primarily located in major Tennessee trade areas.

The bakeries segment is expected to grow at the fastest CAGR of 7.8% over the forecast period. The presence of gluten-free pizzas in bakeries has sparked the interest of consumers seeking healthy products and options. As the penetration of gluten-free pizza has increased, the demand has increased, and many bakeries are trying to capture the market by making their own gluten-free pizzas.

Distribution Channel Insights

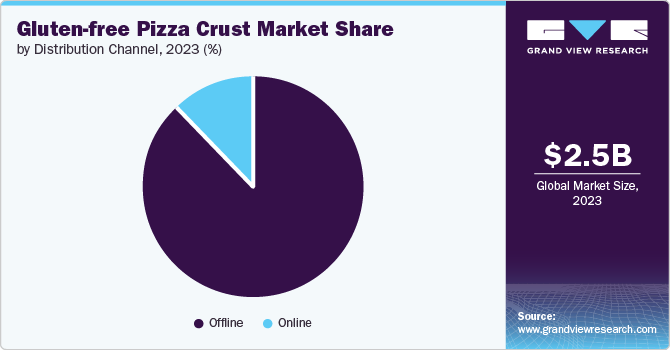

The offline segment was the most dominant segment with a global market share of 87.8% in 2023. The offline segment includes the pizza outlets, retail shops, supermarkets, restaurants, and cafes. Due to these outlets' large presence, gluten-free pizza availability has increased, which has fueled the market's growth. Major players such as Domino’s and Pizza Hut have made various types of gluten-free pizzas that taste better and are also healthy, which is the main reason for the growth and dominance of the segment.

The online segment is expected to grow at the fastest CAGR of 8.8% over the forecast period. The presence of online websites of retail pizza giants such as Domino's, Pizza Hut, and various other retail chains has been the main reason for the market's growth. In addition, the increase in digitization and the internet will further propel the market's growth. For instance, in 2021, Domino's had 91.2% of sales online and 42% through its mobile app. Deliveries average 25 minutes, and collections are recovering post-pandemic, aiming to double the UK market share. The company grew by 5.5%, opened 31 shops in 2021, and targeted 45 in 2022, reaching 1,227 shops.

Regional Insights

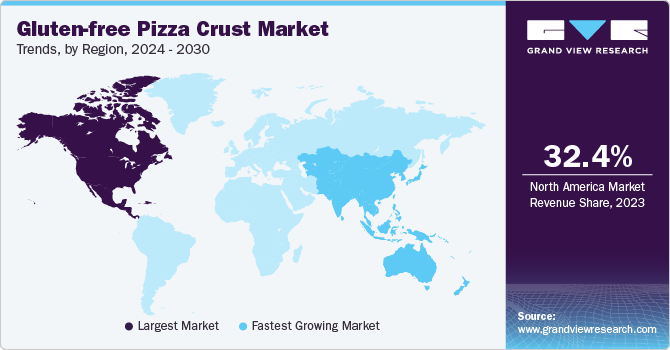

North America gluten-free pizza crust market accounted for the largest revenue share of 32.4% in 2023. Factors such as awareness about the health benefits of gluten-free products and the presence of major retail chains such as Domino's and Pizza Hut, which make large expenditures on experimenting with the ingredients to make healthy and taste-viable products, have played a major role in positively impacting the market growth. For instance, in February 2024, Grupo Bimbo acquired Amaritta Food SL to enhance its expertise in gluten-free bread. The acquisition aims to leverage Amaritta's technology to expand its presence in the high-growth gluten-free market.

U.S Gluten-free Pizza Crust Market Trends

The U.S. gluten-free pizza crust market was identified as a lucrative country in 2023. Owing to the large population and awareness about the health benefits of gluten-free products, the market seems to be positively impacted by it. The population has been largely influenced by healthy lifestyles and fitness, and gluten-free pizza meets their demand, satisfies their hunger, and also satisfies their taste and thirst.

Europe Gluten-free Pizza Crust Market Trends

The Europe gluten-free pizza crust market had a significant market share in 2023. The increasing trend of healthy lifestyles and changes in preference by the current young populations, young generation, and millennials largely influence the European market. The increase in demand for healthy alternatives to regular pizzas has also been the major factor propelling the market.

Italy gluten-free pizza crust market is expected to grow significantly over the forecast period. Italy was the most dominant market as the consumption of pizzas is more than in any European country, and the healthy alternative to regular pizzas has sparked the market's growth. For instance, in July 2022, Morato Group acquired Nt Food to expand its gluten-free product line. NtFood operates three gluten-free production plants spanning 7,000 square meters in Lucca, Italy, producing a wide range of gluten-free products, including bread, rusks, flour mixes, and pastries.

Asia Pacific Gluten-free Pizza Crust Market Trends

The Asia Pacific market is expected to grow at the fastest CAGR of 7.9% over the forecast period. Regions such as China, India, and Bangladesh have significantly contributed to the market's growth. The reason for the market's growth is mainly the changing trends toward healthy food products and knowledge about gluten-free pizza.

The India gluten-free pizza crust market is expected to grow rapidly in the coming years. The main reason for the market's growth is the large population of adults and teenagers aware of the benefits of gluten-free products. According to the United Nations Population Fund (UNFPA), India holds the world's largest adolescent and youth population. This demographic window of opportunity, leading to a "youth bulge," is projected to last until 2025, with India maintaining one of the youngest populations globally until 2030.

Key Gluten-free Pizza Crust Company Insights

Some of the key companies in the global gluten-free pizza crust market Udi's Gluten Free (Conagra, Inc.), Conagra Brands, Inc., RICH PRODUCTS CORPORATION, Gillian’s Foods, Kinnikinnick Foods & Kinnikinnick Fresh Bakery, Rizzuto Foods (RICH PRODUCTS CORPORATION), Vicolo Wholesale, and Mama Jim’s Pizza, Inc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Gluten-free Pizza Crust Companies:

The following are the leading companies in the gluten-free pizza crusts market. These companies collectively hold the largest market share and dictate industry trends.

- Udi's Gluten Free (Conagra, Inc.)

- Conagra Brands, Inc.

- RICH PRODUCTS CORPORATION

- Gillian’s Foods

- Kinnikinnick Foods & Kinnikinnick Fresh Bakery

- Rizzuto Foods (RICH PRODUCTS CORPORATION)

- Vicolo Wholesale

- Mama Jim’s Pizza, Inc.

Recent Developments

-

In October 2023, CAULIPOWER launched seven new products for National Pizza Month, including the first "fluffy, hand-stretched" cauliflower crust, three premium-topped cauliflower crust pizzas, and the first baked cauliflower crust Pizza Bites.

-

In March 2023, RICH PRODUCTS CORPORATION launched a gluten-free Detroit-style pizza crust for people who wanted the crispy texture and feel of regular pizza with health benefits.

Gluten-free Pizza Crust Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.63 billion

Revenue forecast in 2030

USD 4.00 billion

Growth Rate

CAGR of 7.24% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Udi's Gluten Free (Conagra, Inc.); Conagra Brands, Inc.; RICH PRODUCTS CORPORATION; Gillian’s Foods; Kinnikinnick Foods & Kinnikinnick Fresh Bakery; Rizzuto Foods (RICH PRODUCTS CORPORATION); Vicolo Wholesale; Mama Jim’s Pizza, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gluten-free Pizza Crust Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gluten-free pizza crust market report based on product, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Bakeries

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."