- Home

- »

- Agrochemicals & Fertilizers

- »

-

Glyphosate Market Size And Share, Industry Report, 2030GVR Report cover

![Glyphosate Market Size, Share & Trends Report]()

Glyphosate Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Agricultural, Non-agricultural), By Crop (GM Crops, Conventional Crops), By Form (Solid, Liquid), By Region, And Segment Forecasts

- Report ID: 978-1-68038-264-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2020

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glyphosate Market Summary

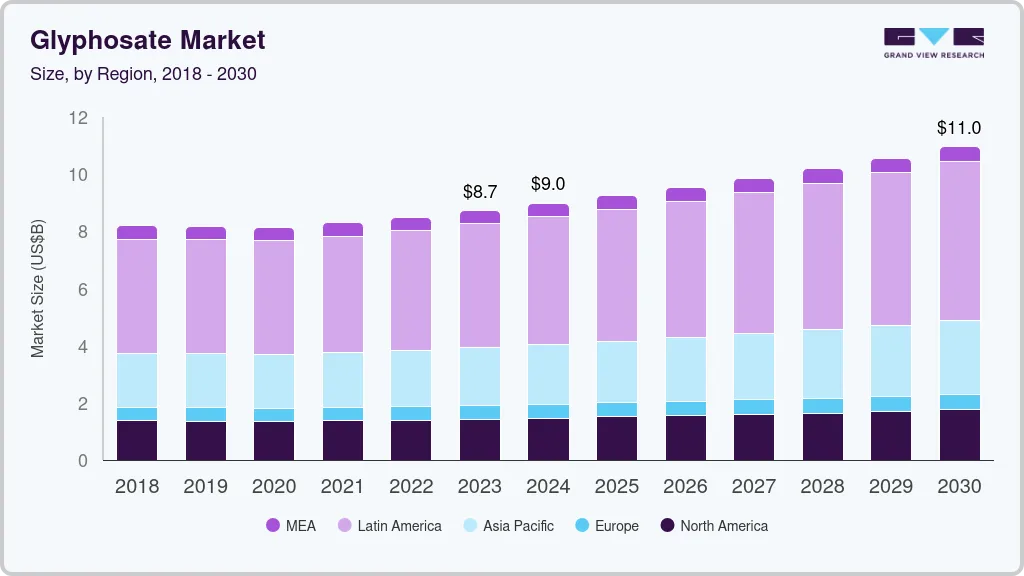

The global glyphosate market size was estimated at USD 8,727.7 million in 2023 and is projected to reach USD 10,951.1 million by 2030, growing at a CAGR of 3.4% from 2024 to 2030. The market growth is due to increasing agricultural activities, rising global population, and growing demand for food.

Key Market Trends & Insights

- In terms of region, Latin America was the largest revenue generating market in 2023.

- In terms of segment, agricultural accounted for a revenue of USD 8,727.7 million in 2023.

- Agricultural is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 8,727.7 Million

- 2030 Projected Market Size: USD 10,951.1 Million

- CAGR (2024-2030): 3.4%

- Latin America: Largest market in 2023

The rising cultivation activities of fruits and vegetables have significantly driven the glyphosate market worldwide, primarily due to heightened vulnerability to fungal diseases. Genetically Modified (GM) crops, such as soybeans, corn, and cotton, are engineered to withstand glyphosate application, allowing farmers to use the herbicide without damaging the crops. This compatibility reduces the need for mechanical weed control methods and supports large-scale, efficient farming operations. As more countries approve and cultivate GM crops, the demand for glyphosate is expected to grow further. For instance, in November 2023, the European Commission announced that it was approving glyphosate across the European Union for another decade.

Glyphosate offers a more economical solution for farmers, especially when managing extensive agricultural areas. Its systemic action ensures that it is absorbed by the plants and translocated to the roots, providing thorough weed eradication. This efficiency saves labor and time and reduces the overall cost of weed management, driving its popularity among farmers globally. Additionally, increased adoption of advanced agricultural practices, rising incidences of fungal crop infestations, and the cost-effectiveness of glyphosate compared to alternative fungicidal methods are all factors contributing to the increased demand for glyphosate.

No-till farming involves minimal soil disturbance and aids in preserving soil structure, reducing erosion, and improving water retention. Glyphosate is essential in no-till systems as it controls weeds without the need for plowing. By facilitating weed management in no-till farming, glyphosate supports sustainable agricultural practices and boosts demand.

Application Insights

The agricultural segment dominated the market and accounted for 83.4% in 2023. As the world population grows, there is a corresponding need to boost agricultural productivity to ensure food security. Glyphosate aids farmers to manage weeds effectively, leading to higher crop yields. Its ability to control a wide range of weed species with a single application makes it an essential tool in large-scale farming operations, thereby driving its demand in agricultural applications.

The non-agricultural segment is anticipated to witness the fastest CAGR during the forecast period. Golf courses, sports fields, and recreational parks require regular weed control to ensure a safe and pleasant environment for users. Glyphosate is used to manage weeds in these areas due to its effectiveness and ease of application. Additionally, utilities and infrastructure providers, such as power companies, railroads, and highway authorities, use glyphosate to manage vegetation around power lines, railway tracks, and roadsides. Keeping these areas clear of weeds is crucial for safety and operational efficiency. Glyphosate's effectiveness in controlling dense and difficult-to-reach vegetation makes it an essential tool for these industries, supporting its market growth in non-agricultural applications.

Crop Insights

GM crops accounted for the largest market revenue share in 2023. GM crops allow farmers to apply the herbicide without damaging the crops. This compatibility simplifies weed management and reduces the need for multiple herbicides, making farming operations more efficient. Its extensive use eliminates the need for various products, reducing overall costs. As the cultivation of GM crops continues to expand globally, the demand for glyphosate in managing these crops increases, driving market growth.

The conventional crops segment is expected to witness significant growth over the forecast period. Glyphosate's flexibility and versatility make it a valuable tool for conventional crop farming. It is used in various stages of crop production, from pre-planting to pre-harvest, providing farmers with multiple options for weed control. Its effectiveness against annual and perennial weeds further enhances its utility across different crop types and growing conditions.

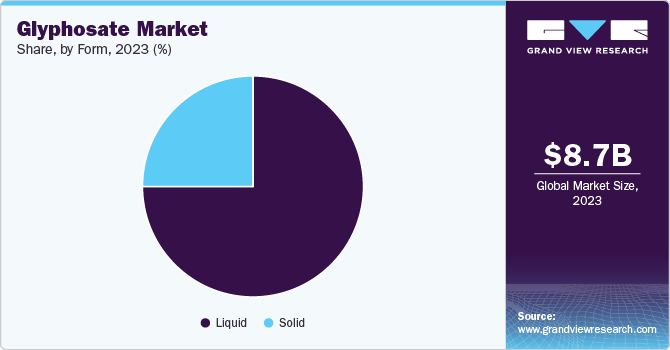

Form Insights

The liquid segment dominated the market in 2023. The ease with which liquid glyphosate is sprayed over large areas using standard agricultural equipment such as backpacks and handheld sprayers is expected to propel the segment’s growth in the coming years. Additionally, the liquid formulation is rapidly absorbed by plants and translocated to the roots, ensuring comprehensive weed control. This fast action is particularly advantageous in managing tough and persistent weeds, as it quickly disrupts their growth processes.

The solid segment is projected to witness significant growth during the forecast period. Solid formulations, such as granules and powders, are more stable and less lead to spillage. This stability simplifies transportation and storage, particularly in bulk quantities. Additionally, granular or powdered forms are applied directly to specific areas, reducing the risk of overspray and minimizing contact with non-target plants. This precision is essential in environments such as nurseries, ornamental gardens, and other environments where selective weed control is required.

Regional Insights

The North America glyphosate market is expected to witness significant growth over the forecast period. GM crops such as glyphosate-resistant soybeans, corn, and others allow farmers to use glyphosate for weed control without harming the crops. The widespread cultivation of GM crops drives the demand for glyphosate, as it is integral to the farming practices in this region. The efficiency and effectiveness of glyphosate in managing weeds in GM crops contribute significantly to its market growth in North America.

U.S. Glyphosate Market Trends

The U.S. glyphosate market accounted for the largest revenue share in 2023. Extension services, industry organizations, and educational institutions provide extensive resources and training on the use of glyphosate. Farmers are informed about glyphosate's benefits and proper application methods, leading to its widespread acceptance and use. The emphasis on education and awareness in the U.S. agricultural community drives the demand for glyphosate, contributing to its market growth.

Asia Pacific Glyphosate Market Trends

The Asia Pacific glyphosate market is expected to witness significant growth over the forecast period. The Asia Pacific region has a diverse agricultural output, including, rice, wheat, maize, soybeans, and cotton crops. Different crops face distinct weed challenges, and glyphosates make it a versatile solution for managing weeds across multiple crop types. The ability to use glyphosate in various cropping systems enhances its demand, supporting the growth of the glyphosate market in the Asia Pacific region.

Latin America Glyphosate Market Trends

Latin America glyphosate market accounted for the largest revenue share of 49.5% in 2023. The region’s agricultural exports necessitate efficient and cost-effective weed management solutions such as glyphosate. Effective weed control ensures higher crop yields and quality, which is crucial for maintaining competitiveness in international markets.

The Argentina glyphosate market is expected to witness significant growth over the forecast period. Extensive large-scale farming operations in Argentina necessitate efficient and scalable weed management solutions. Glyphosate's ability to control many weed species across vast agricultural areas with minimal application effort. Large-scale farmers rely on glyphosate to maintain productivity and reduce labor costs associated with weed control. The prevalence of these large-scale operations in Argentina drives substantial demand for glyphosate, supporting its market expansion.

Key Glyphosate Company Insights

Some of the key companies in the glyphosate market include Syngenta, Bayer AG, UPL Limited, Nufarm and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Key players are taking several strategic initiatives, such as mergers, acquisitions, and partnerships with other major companies.

-

Syngenta specializes in agricultural science and technology. The company produces agrochemicals and seeds, enhancing crop productivity and sustainability. Its product offerings include various herbicides, fungicides, insecticides, and seed treatments developed to protect crops from pests, diseases, and weeds.

-

Bayer AG is a global life sciences company with core competencies in healthcare and agriculture. The company operates through three main divisions such as pharmaceuticals, consumer health, and crop science. In the agricultural sector, Bayer offers a comprehensive range of products, including herbicides, fungicides, insecticides, and others, designed to protect crops and enhance productivity.

Key Glyphosate Companies:

The following are the leading companies in the glyphosate market. These companies collectively hold the largest market share and dictate industry trends.

- Syngenta

- Bayer AG

- Nufarm

- UPL

- ADAMA

- BASF SE

- GREENWELL BIOTECH

- HINDUSTAN BIO-TECH

- FMC Corporation (Cheminova India Ltd.)

- SinoHarvest

Recent Developments

-

In March 2023, Albaugh, LLC acquired Corteva Agriscience's glyphosate business. This acquisition includes intangible assets such as formulations, trade names, regulatory data, registrations, patents, and know-how used worldwide in Corteva's straight-goods glyphosate business, except in Argentina.

-

In August 2022, Bayer launched a glyphosate herbicide, Roundup Top, in Argentina. It is specifically for the pre-emergent and post-emergent control of annual and perennial weeds on grasses and broadleaf.

Glyphosate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.98 billion

Revenue forecast in 2030

USD 10.95 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, crop, form, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia.

Key companies profiled

Syngenta; Bayer AG; Nufarm; UPL; ADAMA; BASF SE; GREENWELL BIOTECH; HINDUSTAN BIO-TECH; FMC Corporation (Cheminova India Ltd.); SinoHarvest;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glyphosate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glyphosate market report based on application, crop, form, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Volume Kilotons)

-

Agricultural

-

Grains & Cereals

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Non-agricultural

-

-

Crop Outlook (Revenue, USD Million, 2018 - 2030) (Volume Kilotons)

-

GM Crops

-

Conventional Crops

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030) (Volume Kilotons)

-

Solid

-

Liquid

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Volume Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.