- Home

- »

- Homecare & Decor

- »

-

Golf Trolley Market Size And Share, Industry Report, 2030GVR Report cover

![Golf Trolley Market Size, Share & Trends Report]()

Golf Trolley Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Electric, Manual), By Application (Commercial, Non-commercial), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-359-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Golf Trolley Market Size & Trends

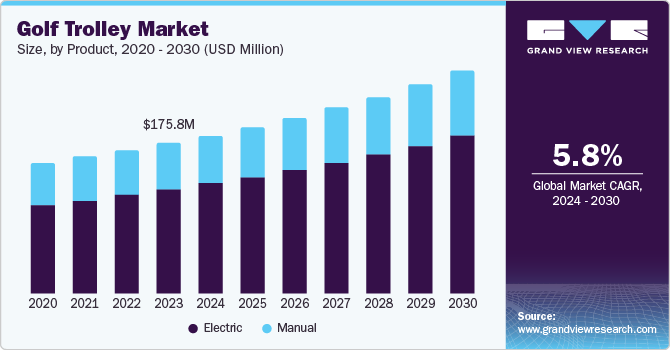

The global golf trolley market size was valued at USD 175.8 million in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. The market growth can be credited to the rising popularity of golf as a sport and a leisure activity. The increasing interest has been particularly notable among younger demographics and women, expanding the traditional golf audience and increasing the demand for golf-related equipment, including trolleys. The growing number of golf courses worldwide and favorable government initiatives promoting golf tourism have further bolstered market growth.

In addition, technological advancements such as electric and remote-controlled golf trolleys have revolutionized the golfing experience. Brands such as Stewart Golf, MGI, and Foresight Sports offer enhanced convenience and reduce physical strain on players. These advancements include the use of lightweight materials, including aluminum and carbon fiber, which make trolleys easier to maneuver, and the integration of features such as GPS, USB charging ports, and advanced braking systems.

The increasing disposable income and urbanization worldwide contributed to the market’s growth. As more individuals have the financial means to engage in leisure activities, the demand for high-quality, convenient golfing equipment has significantly risen. This trend is particularly evident in emerging markets in Asia Pacific, where the popularity of golf has grown rapidly. In addition, the aging population in many countries has led to a higher demand for golf trolleys as older golfers seek ways to continue enjoying the sport without the physical burden of carrying heavy golf bags.

Moreover, the market has benefited from continuous innovations in design and functionality. Manufacturers have increasingly focused on creating more ergonomic and user-friendly designs, with features such as adjustable handles, foldable frames, and enhanced storage options. For instance, E-Z-GO and Yamaha offer precision engineering and user-centric designs. Their golf carts feature ergonomic handles and foldable frames. Such improvements enhance the user experience and attract a broader range of golfers.

Product Insights

Electric products held the dominant market share of 69.4% in 2023. The market was majorly driven by technological innovations such as lightweight materials, advanced braking systems, and the integration of GPS and USB charging ports that have enhanced the functionality and convenience of electric golf trolleys. The development of efficient lithium-ion batteries has played a crucial role, offering longer battery life and faster charging times, which appeal to modern consumers seeking reliability and ease of use.

Manual products are expected to boost over the forecast period, primarily owing to economic considerations. Manual golf trolleys are generally more cost-effective than their electric counterparts, making them an attractive option for budget-conscious consumers. This affordability factor is particularly important in emerging markets with rising disposable incomes. However, consumers are still price-sensitive. Moreover, manual trolleys' simplicity and low maintenance requirements make them a practical choice for many golfers, reducing the need for frequent repairs or battery replacements.

Application Insights

The non-commercial segment held 64.6% of the share in 2023 owing to the increasing popularity of golf as a leisure activity. As more individuals take up golf for relaxation and social interaction, the demand for non-commercial golf trolleys has surged significantly. These trolleys are particularly appealing to amateur and casual golfers who play the sport for enjoyment. The affordability and simplicity of non-commercial trolleys make them an attractive option for golfers, who may not require the advanced features found in commercial models.

Commercial applications are expected to emerge as the fastest-growing segment over the forecast period attributed to the increasing promotion of golf tourism worldwide. Countries including the U.S., Spain, and South Africa have heavily invested in the construction of professional golf courses and hosting international tournaments to attract tourists. This has led to a higher demand for golf trolleys in commercial settings such as golf resorts, hotels, and amusement parks, where they are offered as part of the amenities. In addition, innovations such as electric and remote-controlled golf trolleys have enhanced the convenience and experience which makes them a favorable choice in commercial applications.

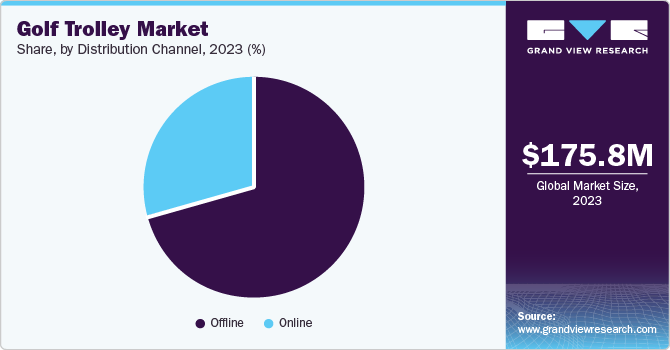

Distribution Channel Insights

The offline distribution channel accounted for the largest share in 2023 due to the increasing penetration of sports and specialty shops. These physical stores provide a tangible shopping experience that allows consumers to assess the products before making a purchase, which is particularly important for high-involvement products including golf trolleys. Moreover, skilled customer service personnel in these stores offer personalized advice and support, helping consumers make informed decisions and enhancing the overall shopping experience. In addition, offline retailers often host promotional events, demonstrations, and workshops that draw in customers and provide hands-on experiences with the latest golf trolley models.

Online distribution channels are anticipated to grow at a CAGR of 6.3% during the forecast period with the increasing popularity of e-commerce platforms. The convenience of online shopping, with features such as easy ordering, free returns, and home delivery, has significantly boosted the sales of golf trolleys through online channels. This trend is particularly strong among millennial consumers who prefer the ease and efficiency of digital shopping experiences. In addition, the use of Augmented Reality (AR) and Virtual Reality (VR) technologies allowed consumers to visualize products in a more interactive and immersive way, helping them make informed purchasing decisions.

Regional Insights

The North America golf trolley market held the dominant share of 53.5% in 2023 owing to the rising adoption of golf trolleys by the tourism and hospitality industries. Many hotels, resorts, and amusement parks now offer golf facilities as part of their amenities, driving the demand for golf trolleys. This trend is supported by the increasing number of golf tournaments and events, which attract both professional and amateur golfers, further stimulating market growth.

U.S. Golf Trolley Market Trends

The golf trolley market in the U.S. is expected to be propelled by the growing popularity of golf as a sport and a recreational activity over the forecast period. The increasing number of golf courses and clubs across the region has further bolstered market growth, providing more opportunities for enthusiasts to engage in the sport. The U.S. held the largest number of courses in the world. The U.S. alone has more than 15,000 golf facilities. Among them, over 75% are publicly owned clubs that serve the daily fee-paying players.

Europe Golf Trolley Market Trends

The Europe golf trolley market held a lucrative market share in 2023 owing to technological innovations such as electric and remote-controlled golf trolleys that offer enhanced convenience and reduce physical strain on players. For instance, Germany’s Ministry of Environment requires the use of renewable energy sources, including solar and wind power, for generating electricity to recharge plug-in vehicles. With the increasing adoption of renewable energy-powered golf trolleys, this regulation is expected to boost the sales of golf carts and other low-emission vehicles.

Asia Pacific Golf Trolley Market Trends

The golf trolley market in the Asia Pacific region is expected to witness a CAGR of 7.0% over the forecast period pertaining to the rising disposable incomes and urbanization in emerging countries including China, Japan, South Korea, and Australia. With individuals having the financial means to engage in leisure activities, the adoption of high-quality, convenient golfing equipment has significantly increased.

Key Golf Trolley Company Insights

Key manufacturers of this industry include BATCADDY, Motocaddy, Golf Tech Golfartikelvertriebs GmbH, and others. These producers have increasingly engaged in product innovations and have invested a significant amount in research and development to gain a competitive advantage.

-

Motocaddy offers models including the M-Series, which includes advanced features such as GPS, remote control, and compact folding designs.

-

Bat-Caddy offers a range of models, including the popular X-Series and the innovative EVO Series. These caddies are designed to enhance the golfing experience by reducing physical strain and providing greater mobility on the course.

Key Golf Trolley Companies:

The following are the leading companies in the golf trolley market. These companies collectively hold the largest market share and dictate industry trends.

- BATCADDY

- Motogolf

- Golf Tech Golfartikelvertriebs GmbH

- THE PROACTIVE SPORTS GROUP

- SunMountainSports

- Cart Tek

- Spitzer Industrial Products

- Axglo International Inc.

- Bag Boy Company

Recent Developments

-

In December 2023, GT Goldf Supplies acquired The ProActive Sports. The initiative was aimed at expanding the former company’s dominance as the biggest golf accessories distributor in the U.S.

-

In December 2022, Saera Electric Auto introduced an exclusive electric golf cart in India. This new golf cart features bucket seats and a monocoque frame for optimal comfort, with cabin lights and a zero-maintenance AC drive.

Golf Trolley Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 185.0 million

Revenue forecast in 2030

USD 259.0 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

BATCADDY; Motogolf; Golf Tech Golfartikelvertriebs GmbH; THE PROACTIVE SPORTS GROUP; SunMountainSports; Cart Tek; Spitzer Industrial Products; Axglo International Inc.; Bag Boy Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Golf Trolley Market Report Segmentation

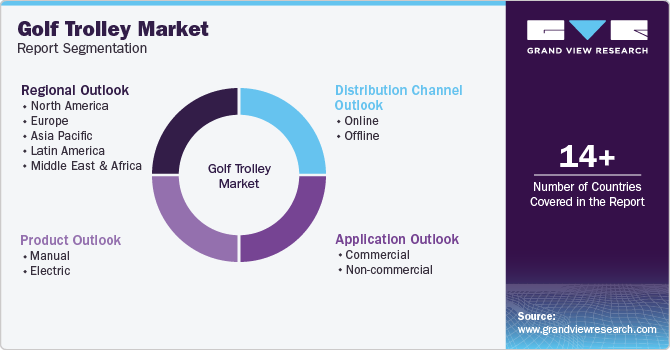

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global golf trolley market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Electric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Non-commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.