- Home

- »

- Electronic & Electrical

- »

-

Greeting Cards Market Size, Share, Industry Report, 2033GVR Report cover

![Greeting Cards Market Size, Share & Trends Report]()

Greeting Cards Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (E-Card, Traditional Card), By Distribution Channel (Online, Offline), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-046-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Greeting Cards Market Summary

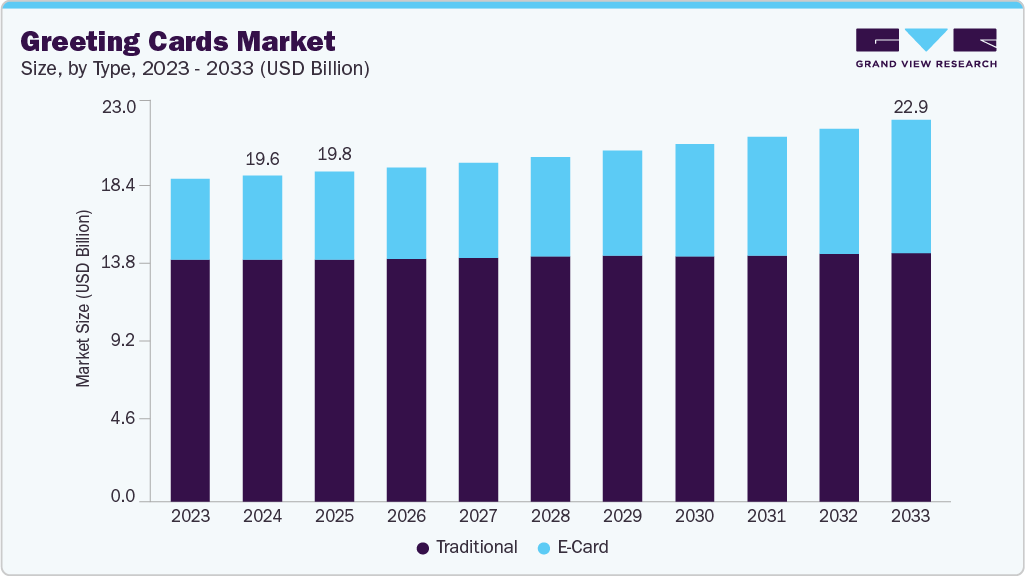

The global greeting cards market size was estimated at USD 19.61 billion in 2024 and is projected to reach USD 22.96 billion by 2033, growing at a CAGR of 1.8% from 2025 to 2033. The industry is experiencing renewed momentum, largely due to the rising cultural emphasis on celebrating milestones and special occasions.

Key Market Trends & Insights

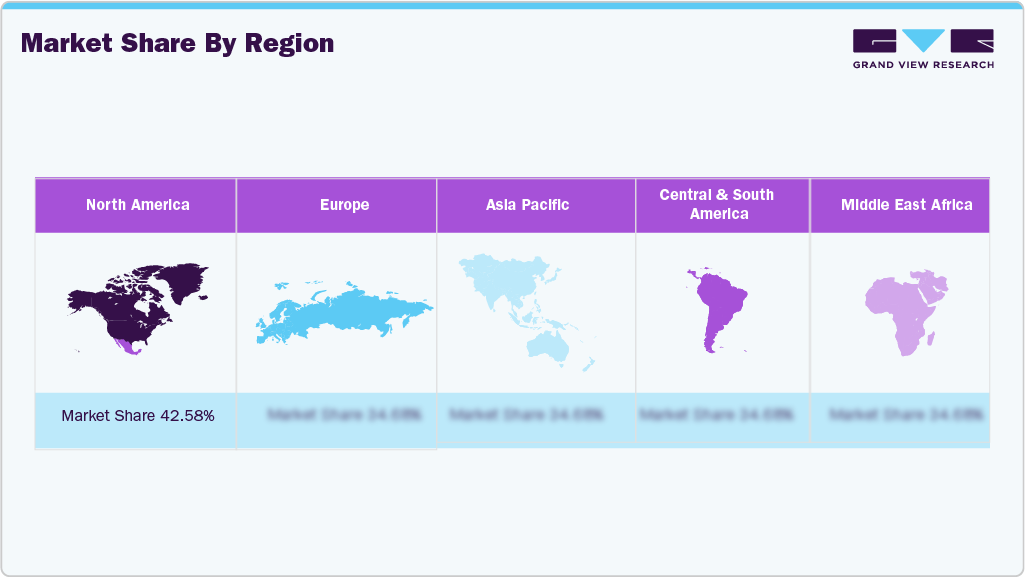

- North America greeting cards market held the largest share of 42.58% of the global market in 2024.

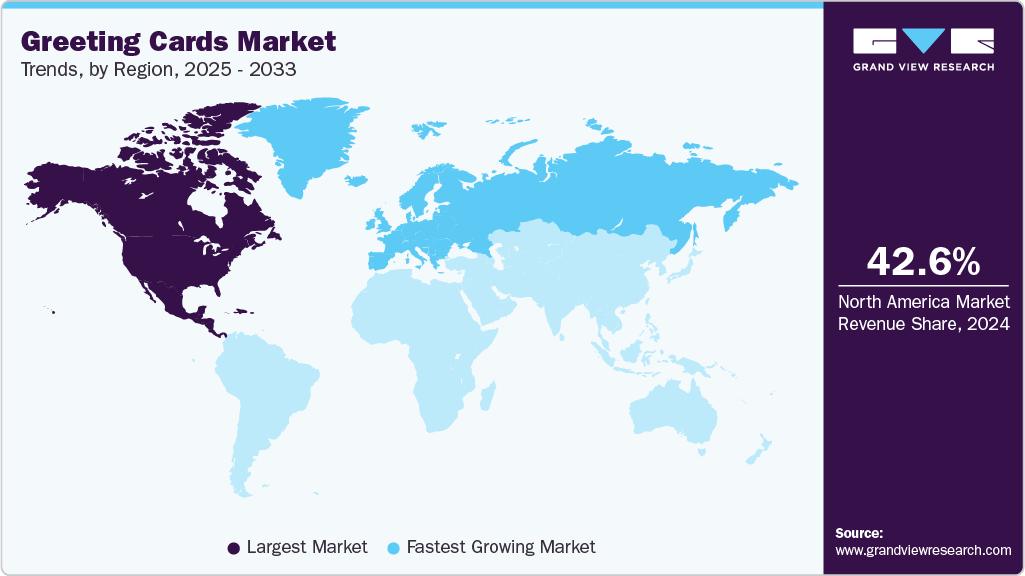

- The greeting cards industry in Europe is expected to grow steadily over the forecast period.

- By type segment, traditional cards held the highest market share of 74.26% in 2024.

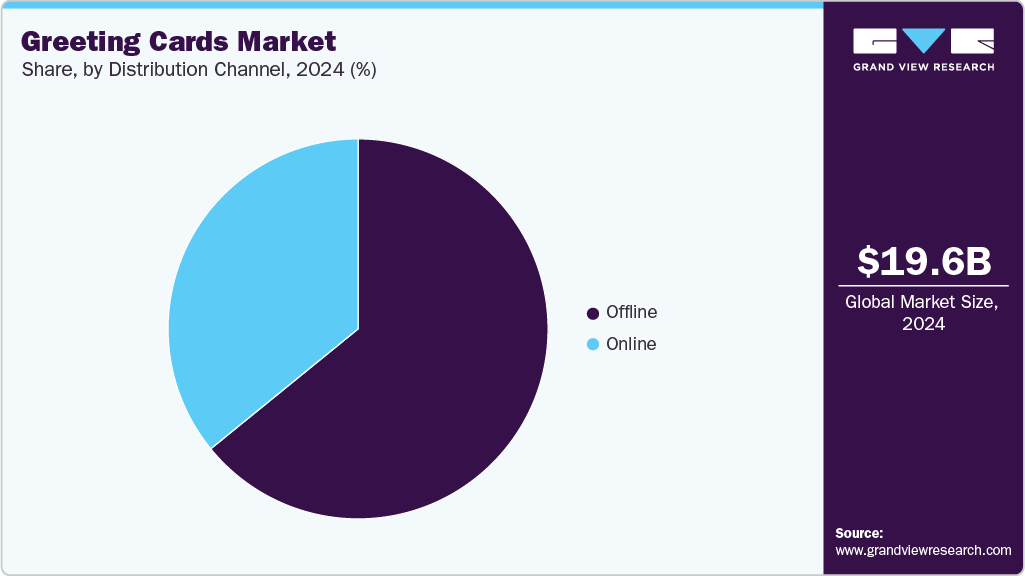

- By distribution channel, offline sales held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.61 Billion

- 2033 Projected Market Size: USD 22.96 Billion

- CAGR (2025-2033): 1.8%

- North America: Largest market in 2024

- Europe: Fastest growing market

As people continue to seek meaningful ways to share affection, the ritual of exchanging cards remains deeply relevant. Notably, there has been growing interest in handmade cards, which are valued for their personal and thoughtful appeal. Industry figures from the UK indicate that sales of individual greeting cards reached approximately USD 1.7 billion in 2024, underscoring their continued relevance for events ranging from birthdays to festive holidays. In the United States, early 2025 insights reinforce the same behavior, as billions of cards are still exchanged every year, particularly birthday cards, which consistently lead sales worldwide. This continued preference for physical cards, despite the availability of digital alternatives, highlights their enduring emotional and keepsake value. At the same time, the emergence of interactive cards and e-card innovations is expanding the category by offering new avenues for personalized messaging and expression.

The growing relevance of greeting cards is also mirrored in specific seasonal occasions. For example, nearly 40% of Mother’s Day shoppers in 2024 included a greeting card in their gift-buying, with a surge of purchases occurring in the week leading up to the holiday. This uptick reflects broader trends among younger consumers, particularly Gen Z, who are increasingly participating in seasonal holidays and often prefer gestures that feel genuine and heartfelt. As gifting trends evolve, greeting cards are proving especially resilient by offering an accessible and meaningful way to personalize celebrations, bridging the gap between quick convenience and emotional sincerity.

The COVID-19 pandemic caused widespread disruption across the greeting card industry, primarily due to the temporary closure of non-essential retail outlets and interruptions in global supply chains. These constraints not only limited the production and distribution of physical cards but also altered consumer behavior. With fewer opportunities to shop in-store, many customers shifted to digital greetings or online card platforms, marking a temporary but notable change in how expressions of care and celebration were shared. Through strategies such as relocating cards to prominent locations outside the usual seasonal aisles and positioning them near gifting and high-traffic areas, brands have successfully reintroduced the category to everyday visibility. These efforts, combined with the expansion of personalization options through online platforms, have helped maintain relevance in a hybrid retail environment where both digital convenience and physical keepsakes coexist.

Consumer Insights

In France, the demand for greeting cards was most prominent among individuals in the 41 to 60 age group, which accounted for approximately 44.5% of all purchases in 2023, as per the GVR analysis. The population in this age group, often at the peak of their careers and family life, primarily prefers purchasing traditional greeting cards. They buy cards for various occasions, such as birthdays, anniversaries, holidays, and life milestones. Moreover, they like high-quality, meaningful cards that reflect the significance of these events, contributing to the higher share of market demand in this age range.

The 30 to 40 years age group, including individuals highly engaged in family and social life, accounted for the second-largest demand share of 26.9% in 2023. Meanwhile, the under-30 years group held 15.6% of the greeting card market, often purchasing cards for more casual or social occasions, with a growing interest in digital or personalized cards. The above-60-year-old group represented 13.1% of the overall market demand in 2023. This age group typically purchases greeting cards for significant family milestones, holidays, and special occasions, often favoring traditional paper cards that align with their long-standing gift-giving practices.

According to the GVR Analysis, the demand for greeting cards is significantly higher among women, who accounted for approximately 72% of all greeting card purchases in 2023. This can be attributed to the cultural role often played by women in social and familial events, where they are seen as the primary drivers of gift-giving and emotional expression. Women are more likely to purchase cards for various occasions, such as birthdays, anniversaries, holidays such as Christmas and New Year, and special milestones like weddings and births. Their preference for personalized and unique designs further influences the market, with most of them often choosing boutique or customizable greeting cards to convey thoughtful and meaningful messages.

In the same year, men accounted for 28% of the greeting cards market, in terms of demand, in France. While this share is smaller, men still contribute significantly to the market, particularly during key occasions like Valentine’s Day, Father’s Day, and Christmas. They prefer convenience, often purchasing ready-made cards with pre-written messages for specific events. However, there is also a growing trend among men toward personalized or humorous cards, reflecting a shift in consumer behavior where they are becoming more engaged in the tradition of sending cards to express emotions.

Seasonality Trends

The industry continues to be strongly shaped by seasonal peaks tied to major occasions, such as Christmas/New Year, Valentine’s Day, Mother’s Day, and birthdays. For instance, data show that Christmas remains the highest-volume occasion: globally, about 1.3 billion Christmas cards are exchanged annually. Valentine’s Day and Mother’s Day follow as the next most-active occasions, with approximately 145 million Valentine’s cards and 113 million Mother’s Day cards in the U.S. alone in recent years. Consequently, industry players time product launches, marketing campaigns, and logistics around these periods to capture surge demand.

As these peak periods approach, certain consumer and channel behaviours become apparent. For instance, the spring period is seeing an increase in personalization, eco-friendly materials, and niche design styles in greeting cards. During the major holiday season, the physical card tradition remains strong in many markets, although rising postage costs and competition from e-cards pose a challenge. According to an article by The Guardian, there are declines in boxed Christmas card sales, while younger consumers still indicate a willingness to send more cards, resisting purely digital alternatives. From a channel perspective, online and direct-to-consumer e-card and personalization platforms are gaining traction, complementing traditional retail channels.

Greeting-card businesses have responded to seasonal rhythms by forging partnerships and innovating formats to meet consumer expectations of speed, convenience, and novelty. Some brands have introduced hybrid products that combine the tactile allure of a physical card with digital elements such as QR codes and interactive features timed for seasonal gifting windows. For instance, in October 2024, Hallmark introduced a new greeting-card line called Gift Card Greetings, which embeds a QR code within a physical card that links to a digital gift card. The card’s interior features a peel-away sticker that reveals the QR code, accompanied by a scratch-off code underneath for the recipient to redeem via their smartphone. The digital gift card, powered by The Gift Card Shop, enables the recipient to choose from over 100 retailers. This format seeks to merge the tactile appeal of a traditional greeting card with the convenience and flexibility of digital gifting. Marketing initiatives are organised around the lead-up to major gift-giving occasions, emphasising limited-edition designs, sustainability credentials, or personalization to stand out in a crowded seasonal window. These collaborations and innovations support brands in capturing upticks in consumer demand when the calendar aligns.

Type Insights

Traditional greeting cards accounted for a revenue share of 74.26% in the year 2024. These cards remain the preferred format for a wide range of occasions, whether birthdays, anniversaries, religious festivals, or social events, particularly in regions where the cultural significance of handwritten or printed messages is deeply rooted. Their straightforward design, low unit cost, and universal availability make traditional cards a practical and sentimental choice for consumers of all ages. Moreover, growing interest in expressive, tactile forms of communication and the continued association of cards with thoughtful gifting have helped sustain demand, even as digital alternatives expand.

E-cards are projected to grow at a CAGR of 4.7% over the forecast period of 2025-2033. As digital communication becomes increasingly embedded in daily life, e-cards offer a convenient, cost-effective, and instant alternative to physical greeting cards. Their appeal is further heightened by personalization features, multimedia integration, and the ability to schedule or automate deliveries, making them suitable for last-minute or long-distance sharing. The growing emphasis on eco-friendly practices, especially among younger demographics, also supports the shift toward paperless greetings. Moreover, the rise of mobile-friendly platforms, social media sharing options, and AI-powered design tools has expanded the creative possibilities within e-cards. Together, these factors position e-cards as a modern, sustainable, and scalable format for emotional connection and gift-giving in the digital age.

Distribution Channel Insights

Offline sales of greeting cards accounted for a revenue share of 64.13% in the year 2024. Brick-and-mortar stores, including supermarkets, convenience chains, bookstores, and specialist card shops, offer consumers the tactile experience of selecting a card, often tied to impulse buying and last-minute gifting. The offline segment caters to a wide spectrum of price points: budget-friendly mass-market cards are typically available for under USD 2, while mid-range cards from brands like Papyrus or Hallmark Signature range between USD 4 and USD 8, and premium handcrafted or artist-designed cards can exceed USD 10 per piece. This broad pricing range enables offline retailers to serve a diverse range of consumer segments, from everyday purchasers seeking affordable options to those looking for high-end, keepsake-quality cards.

Online sales of greeting cards are projected to grow at a CAGR of 2.1% over the forecast period of 2025-2033, supported by the continued expansion of e-commerce and the rising demand for convenient, on-demand gifting solutions. Digital platforms such as Moonpig, Paperless Post, Etsy, and Amazon offer access to a vast array of designs across various styles, formats, and occasions, while also allowing users to personalize cards with names, messages, images, or multimedia elements. Many platforms further enhance accessibility by offering options for instant digital delivery or print-and-ship services, removing geographic barriers and catering to last-minute needs. Driven by increasing digital adoption, sustainability concerns, and consumer openness to hybrid gifting formats, online channels are steadily capturing a larger share of the greeting card market, particularly among tech-savvy and younger demographics.

Regional Insights

North America greeting cards industry held 42.58% of the global revenue in 2024, supported by deeply ingrained card-giving traditions and an extensive retail framework that spans supermarkets, pharmacies, bookstores, and specialty gift outlets. Iconic players such as Hallmark and American Greetings continue to shape the industry landscape through their broad distribution networks and evolving product portfolios, while the region's consumers consistently purchase cards for a wide variety of occasions, including birthdays, holidays, graduations, and personal milestones. Alongside strong offline availability, North America has also witnessed growth in digital and hybrid card formats, as more consumers embrace personalized, print-on-demand designs or multimedia-enabled e-cards.

U.S. Greeting Cards Market Trends

The greeting cards industry in the U.S. accounted for a regional revenue share of 91.38% in the year 2024. Greeting cards play a central role in American gift-giving behavior, with strong retail presence across mass merchandisers, pharmacies, specialty card shops, and lifestyle retailers. Market leaders such as Hallmark and American Greetings have further strengthened their dominance through extensive product diversification, including hand-finished cards, collectible designs, and licensed collaborations tailored to specific demographics. Additionally, new formats such as personalized, print-on-demand cards and interactive e-cards have expanded category appeal among younger consumers while maintaining the emotional value associated with physical cards.

Europe Greeting Cards Market Trends

The greeting cards industry in Europe accounted for a revenue share of around 31.28% in the year 2024, supported by a deeply rooted card-giving tradition and strong cultural emphasis on seasonal and sentiment-based expressions. Many European countries maintain a robust greeting card culture, particularly for holidays such as Christmas, Mother’s Day, and Easter, as well as personal occasions like birthdays and anniversaries. The region benefits from well-established retail networks, including specialist card shops, bookstores, gift boutiques, and major supermarket chains, which ensure a wide range of product availability. Additionally, several European markets have seen a rise in demand for premium, artisanal, and eco-friendly cards, reflecting growing consumer preference for sustainably produced paper goods and handcrafted designs.

Asia Pacific Greeting Cards Market Trends

The greeting cards industry in Asia Pacific is projected to grow at a CAGR of 1.2% from 2025 to 2033. Countries such as India, China, Japan, and Australia are experiencing a surge in demand for greeting cards, particularly for birthdays, weddings, religious festivals, and Western celebrations like Christmas and Valentine’s Day. The expansion of organized retail, including supermarkets, stationery chains, and lifestyle stores, has improved access to greeting cards across urban and semi-urban markets. At the same time, online platforms and mobile-based greeting apps are gaining popularity, especially among younger, tech-savvy consumers who value convenience and personalization.

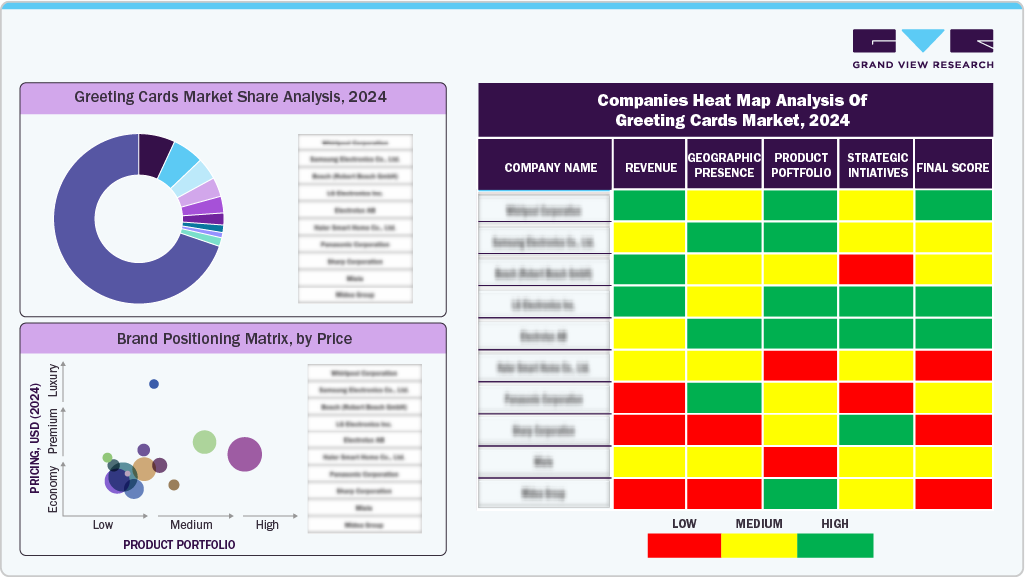

Key Greeting Cards Companies Insights

Key players operating in the greeting cards market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Greeting Cards Companies:

The following are the leading companies in the greeting cards market. These companies collectively hold the largest market share and dictate industry trends.

- American Greeting Corporation

- Archies Limited

- Avanti Press Inc.

- Budget Greeting Cards Ltd.

- Card Factory plc

- Carlton Cards Ltd.

- Crane & Co.

- Galison Publishing LLC

- Hallmark Cards, Inc.

- IG Design Group Plc

- John Sands (Australia) Ltd.

Recent Developments

-

In January 2025, Hallmark expanded its greeting card offerings with a new concept called Gift Card Greetings, which combines the charm of a traditional card with the convenience of a digital gift card. Shoppers can pick a physical card for various occasions and use a QR code inside to choose from more than 100 digital gift card options through The Gift Card Shop, powered by InComm Payments. Recipients can easily redeem their selected gift card by scanning the same code and entering a PIN. This strategy aims to deliver a personalized, hybrid gifting experience that suits both sentimental and convenience-driven consumers.

-

In February 2024, Minted entered a partnership with DoorDash to make greeting cards available for fast, on-demand delivery, catering especially to Millennial and Gen Z shoppers who prioritize both convenience and thoughtful gifting. The collaboration kicks off with a range of artist-designed Valentine’s Day cards offered through DashMart and The Flower & Gift Boutique on the DoorDash platform, with plans to introduce cards for more everyday occasions. This initiative reflects growing demand among younger consumers for quick-access, high-quality, and creatively designed products.

Greeting Cards Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.84 billion

Revenue forecast in 2033

USD 22.96 billion

Growth rate

CAGR of 1.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

American Greeting Corporation; Archies Limited; Avanti Press Inc.; Budget Greeting Cards Ltd.; Card Factory plc; Carlton Cards Ltd.;Crane & Co.; Galison Publishing LLC; Hallmark Cards, Inc.; IG Design Group Plc; John Sands (Australia) Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Greeting Cards Market Report Segmentation

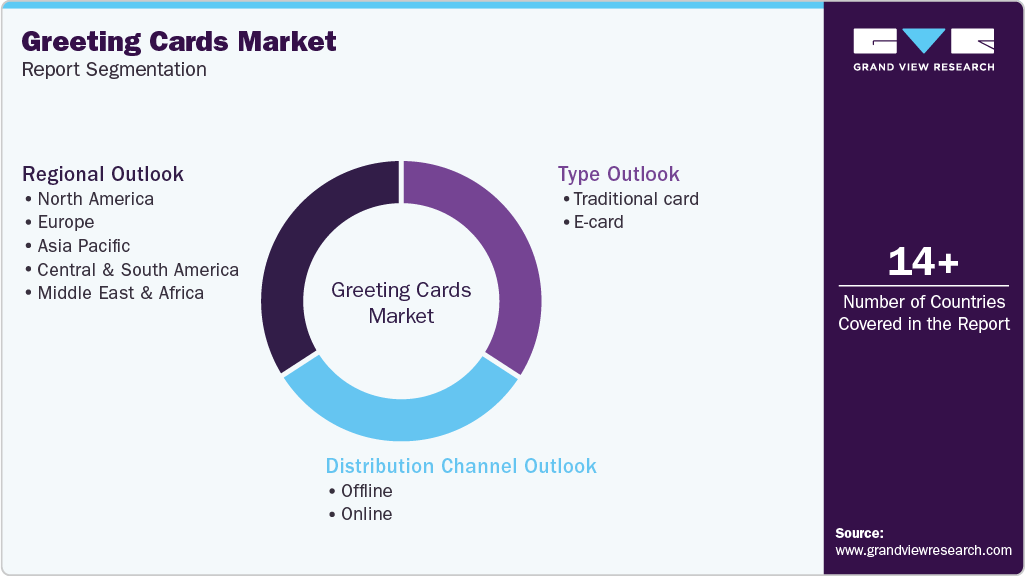

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global greeting cards market report on the basis of type, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Traditional card

-

E-card

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global greeting cards market size was estimated at USD 19.61 billion in 2024 and is expected to reach USD 19.84 billion in 2025.

b. The global greeting cards market is expected to grow at a compound annual growth rate of 1.8% from 2025 to 2033 to reach USD 22.96 billion by 2033.

b. North America dominated the greeting cards market with a share of 42.58% in 2024. The growth of this region is attributable to the high disposable income, the increase in the popularity of e-cards, and the rising demand for cards for non-traditional occasions.

b. Some key players operating in the greeting cards market include American Greetings Corporation, Hallmark Cards, Inc., Card Factory plc, John Sands (Australia) Ltd., and IG Design Group Plc

b. Key factors that are driving the greeting cards market growth include changing consumer preferences towards personalized and unique cards, increasing demand for cards for non-traditional occasions, and the rise in popularity of e-cards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.