- Home

- »

- Advanced Interior Materials

- »

-

Heating Radiator Market Size & Share Report, 2022-2030GVR Report cover

![Heating Radiator Market Size, Share & Trends Report]()

Heating Radiator Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Hydronic, Electric), By Application (Residential, Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-523-6

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global heating radiator market size was estimated at USD 4.46 billion in 2021 and is anticipated to witness a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030. The market growth is expected to be driven by the increased demand for energy-efficient heating solutions in the residential sector on account of the increase in population. To curb the spread of the COVID-19 virus, the government implemented stringent lockdown measures across the world that made it difficult to obtain the raw materials required for the manufacture of radiators. Furthermore, the pandemic has adversely affected the industry due to a halt in the construction of residential and commercial facilities. This impacted the production of this product.

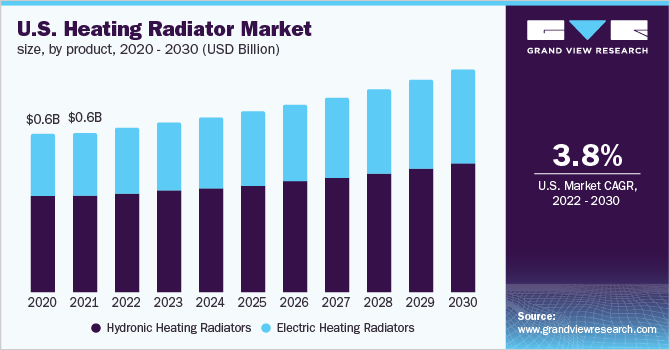

The electric segment is expected to dominate the industry in the U.S. during the forecast period due to its better performance and low maintenance. Furthermore, the growing population, coupled with the rising need for efficient heating solutions in the housing sector, is expected to drive the electric heating radiator market in the U.S. Manufacturers are prioritizing continuing research and technological innovations to meet the needs of their customers. In addition, a huge number of domestic players pose a serious challenge to foreign players. Furthermore, the businesses face challenges as a result of increased demand for skilled labor and fluctuating raw material prices.

The radiator industry is expected to grow in response to an increase in demand for energy-efficient space heating equipment during the forecast period. In addition, growing consumer awareness regarding energy savings in the industrial and residential sectors is predicted to boost the industry for heating radiators in the coming years. The increasing construction activities across residential units in North America, coupled with an increased investment toward industrial infrastructure development, are expected to drive the industry during the forecast period. The rising demand for efficient heating solutions will augment the heating radiator demands in the residential and commercial sectors.

Product Insights

The hydronic segment dominated the market and accounted for a revenue share of over 61.5% in 2021. These radiators work by pumping hot water into the in-floor tubing, which is then directed into the heat exchanger to extract heat from the water and use it for space heating through convection. Hot water and steam are the most common radiator media used. Hydronic radiators are considered safe to be used by customers with allergies or respiratory issues, as these radiators do not blow air when compared to forced-air heating systems. Furthermore, hydronic radiators are economical compared to electric ones, but the operating costs for these radiators are higher comparatively.

The electric segment is expected to witness a CAGR of 5.3% during the forecast period. These products are experiencing increased demand due to their low operating costs, ease of maintenance, and efficiency in maintaining precise temperature coupled with a wide range of applicability. Rapid industrialization, the introduction of energy efficiency mandates, and rising demand for electricity consumption are set to positively impact the electric radiators market size. Electric radiators are one of the eco-friendly forms of space heaters as they provide efficient heating by using electricity. These products offer high efficiency over the conventional radiators which use various fuels as their source of energy and also offer low maintenance compared to other radiators. These properties are expected to boost the product demand in the coming years.

Application Insights

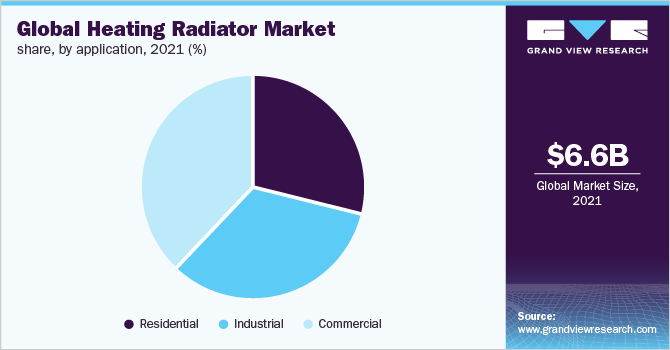

The industrial application segment dominated the market and accounted for a revenue share of 33.0% in 2021. These products are employed in manufacturing, smelting, and other processes in industries along with their use in space heating. They are widely used in aviation, food and beverage, and mining industries. Heating radiators are used in commercial facilities like hotels, office buildings, houses of worship, schools, and historic buildings since their forced airflow systems allow them to provide efficient solutions for these buildings. These products can also help achieve energy savings and close temperature ranges when opted for the right product.

The residential application segment is expected to witness a CAGR of 5.1% during the forecast period. Investments in the housing sector are on a rise in recent years to facilitate the growing population, which thereby is creating a demand for energy and cost-efficient heating solution systems in residential buildings. The growing emphasis on the infrastructural repairs, renovation, and restoration of old buildings in the construction sector is expected to create an increased demand for these products during the projection period. Furthermore, the market is to be driven by the product's energy-saving and low-maintenance features, as well as its affordability, in the future years.

Regional Insights

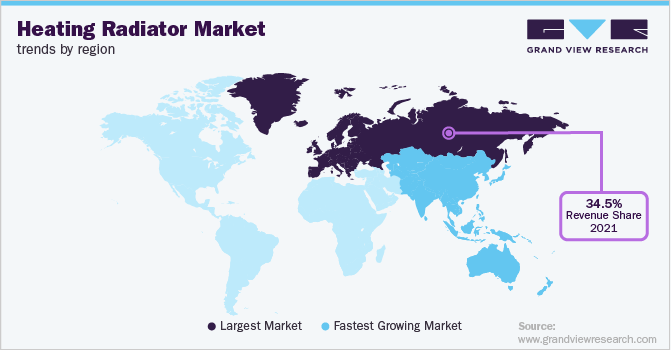

Europe dominated the market and accounted for the largest revenue share of 34.5% in 2021, due to several factors, including government initiatives, such as the energy efficiency mandate by the European Commission. The industry is expected to be boosted by governments' strict rules that adhere to environmental stability, as well as the establishment of building energy codes. Rising demand for energy-efficient and cost-effective heating solutions on account of the colder climate in the North American region is expected to drive the market during the forecast period. Furthermore, increased investments in the housing sector and industrial development in the region are expected to drive industry growth during the assessment years.

In Asia Pacific, the market is expected to witness a CAGR of 5.4% from 2022 to 2030. An increase in commercial and residential construction activities on account of the increasing population is expected to drive the market. In addition, regional markets such as China and India are emerging as major manufacturing hubs on account of their lower production cost offerings on account of low labor costs in the countries. The CSA region is expected to experience an increased demand for heating radiators over the coming years. The increased demand for energy-efficient heating solutions in the residential and commercial sectors, as well as increased awareness about climate change and the necessity of heating systems in residential structures, is expected to drive the industry growth.

Key Companies & Market Share Insights

The market is made up of both international and local producers due to the ongoing growth in demand for air heating in the coming years, making it one of the more competitive markets in the world. Companies advertise their products through a variety of channels, such as e-commerce websites, distributors, merchants, and end-users. Product costs, performance, make, technology, reputation, and availability are among the aspects that product makers compete on. New product launches, distribution network growth, R&D spending, and mergers and acquisitions are just a few of the primary techniques used by firms to expand their market reach and share. Some of the prominent players in the global heating radiator market include:

-

Runtal North America, Inc.

-

KORADO, a.s.

-

Vasco Group

-

U.S. Boiler Company, Inc.

-

Stelrad Limited

-

PURMO

-

H2O Heating Pty Ltd.

-

Nuociss

-

IRSAP

-

Hunt Heating

Heating Radiator Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 4.6 billion

Revenue forecast in 2030

USD 6.6 billion

Growth Rate

CAGR of 4.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; France; Russia; U.K.; China; Japan; Australia; India; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Runtal North America, Inc.; KORADO, a.s.; Vasco Group; U.S. Boiler Company, Inc.; Stelrad Limited; PURMO; H2O Heating Pty Ltd.; Nuociss; IRSAP; Hunt Heating

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heating Radiator Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global heating radiator market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Hydronic Heating Radiators

-

Electric Heating Radiators

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

Russia

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global heating radiator market size was estimated at USD 4.46 billion in 2021 and is expected to reach USD 4.62 billion in 2022

b. The heating radiator market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.5 % from 2022 to 2030 to reach USD 6.60 billion by 2030

b. Europe dominated the heating radiator market with a revenue share of 34.47% in 2021, on account of several factors including rising population levels leading to increase in demand for energy efficient heating solutions is expected to drive the market growth over the forecast period.

b. Some of the key players operating in the heating radiator market include: Runtal North America, Inc., KORADO, a.s., Vasco Group, U.S. Boiler Company, Inc, Stelrad Limited, PURMO, H2O Heating Pty Ltd., Nuociss, IRSAP, Hunt Heating

b. The key factors that are driving the heating radiator market include growing demand for cost-effective and sustainable heating systems, increasing population leading to the growing demand for air heating in residential and commercial facilities coupled with governments initiatives to promote energy-efficient heating systems to adhere to environmental stability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.