- Home

- »

- Clothing, Footwear & Accessories

- »

-

Hydration Belt Market Size, Share And Growth Report, 2030GVR Report cover

![Hydration Belt Market Size, Share & Trends Report]()

Hydration Belt Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (With Bottle, Without Bottle), By Form, By Protective Medium, By Capacity, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-446-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydration Belt Market Size & Trends

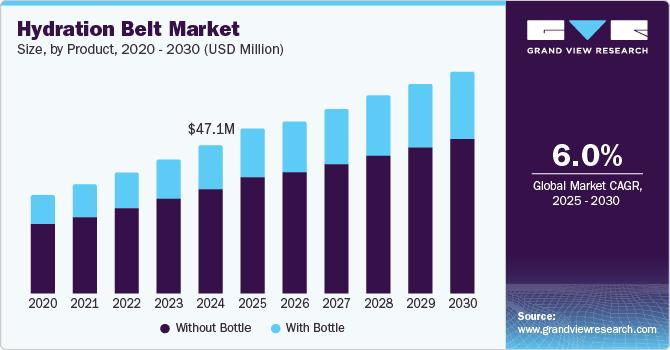

The global hydration belt market size was valued at USD 47.1 million in 2024 and is expected to grow at a CAGR of 6.0% from 2025 to 2030. The increasing awareness of the importance of staying hydrated during physical activities, such as running and cycling. Hydration belts offer a convenient way for athletes to carry water and other fluids without interrupting their performance. The rising popularity of outdoor sports and fitness activities, along with the growing health and wellness trend, further supports the market's expansion.

The increasing fitness consciousness among consumers and the growing participation in outdoor activities such as running, cycling, and hiking drive the demand for convenient hydration solutions. The heightened awareness of health and wellness and the trend of staying hydrated to prevent dehydration-related issues like headaches and muscle cramps further support market growth. Technological innovations and product enhancements, such as improved designs and materials, attract a diverse consumer base.

Product Insights

The without bottle segment dominated the market with the largest revenue share of 70.5% in 2024. This segment's growth is attributed to the convenience and flexibility it offers users. Without bottle hydration belts typically feature integrated water reservoirs or pouches that can be easily refilled, allowing users to carry more water without the bulk of traditional bottles. This design is particularly favored by runners and cyclists who prefer a streamlined and unobtrusive solution for staying hydrated during their activities. The segment's dominance underscores the market's shift towards more efficient and user-friendly hydration solutions.

The with bottle segment is expected to grow at the fastest CAGR of 5.9% over the forecast period. These hydration belts offer users the convenience of carrying pre-filled bottles, easily accessible during activities like running, hiking, and cycling. The growing trend of fitness and outdoor activities fuels the demand for practical and efficient hydration solutions. Additionally, the increasing availability of ergonomically designed hydration belts with bottle holders that ensure comfort and stability during exercise is attracting more consumers.

Form Insights

The hard bottle belt segment dominated the market with the largest revenue share in 2024. This dominance is driven by the practical and user-friendly design of hard bottle belts, which ensure durability and easy access to hydration during physical activities. The ability to securely hold bottles in place, preventing spills and making it convenient for users to stay hydrated, appeals to a wide range of consumers, especially runners and hikers. Additionally, the growing popularity of outdoor sports and fitness activities has increased the demand for reliable and efficient hydration solutions, further bolstering the market position of hard bottle belts.

The soft flask belt segment is expected to grow at the fastest CAGR over the forecast period. Soft flask belts offer flexibility and comfort, appealing to athletes and fitness enthusiasts seeking lightweight and compact hydration solutions. The soft flasks are designed to collapse as empty, minimizing sloshing and reducing bulk, which enhances the overall user experience. The growing popularity of trail running, marathons, and other endurance sports also drives demand for practical and efficient hydration options.

Protective Medium Insights

The non-insulating segment dominated the market with the largest revenue share in 2024. Non-insulating hydration belts are typically lighter and more flexible, making them ideal for athletes and fitness enthusiasts who prioritize comfort and convenience during their activities. Their affordability also makes them accessible to a wider range of consumers. Additionally, the rising popularity of outdoor sports and endurance events, where quick and easy access to hydration is crucial, further boosts the demand for these products.

The insulating segment is expected to grow at the fastest CAGR over the forecast period. Insulating hydration belts are designed to keep beverages at a desired temperature for extended periods, making them ideal for long-duration outdoor activities and extreme weather conditions. The rising participation in endurance sports, marathons, and outdoor adventures fuels demand for these products. Additionally, the focus on innovative materials and designs that enhance insulation efficiency is attracting more consumers. The increased awareness of the benefits of staying hydrated with temperature-controlled fluids further supports the growth of the insulating segment.

Capacity Insights

The single bottle segment dominated the market with the largest revenue share in 2024. Single bottle hydration belts are highly convenient and easy to use, making them a popular choice among runners and cyclists who need quick access to hydration. The simplicity and compact design of these belts allow for comfortable wear without compromising performance. Additionally, the growing trend of outdoor fitness activities and the increasing number of marathons and endurance events have further boosted the demand for single bottle hydration belts.

The double bottle segment is expected to grow at the fastest CAGR over the forecast period. Double bottle hydration belts offer the convenience of carrying more water, making them ideal for long-distance runners, hikers, and cyclists. This increased capacity is particularly appealing for endurance athletes who require more hydration during extended activities. The growing trend of outdoor fitness and the rise in participation in marathons and other endurance events are also fueling the demand for double bottle hydration belts. Additionally, advancements in ergonomic design and materials are making these belts more comfortable and user-friendly, further boosting their popularity.

Distribution Channel Insights

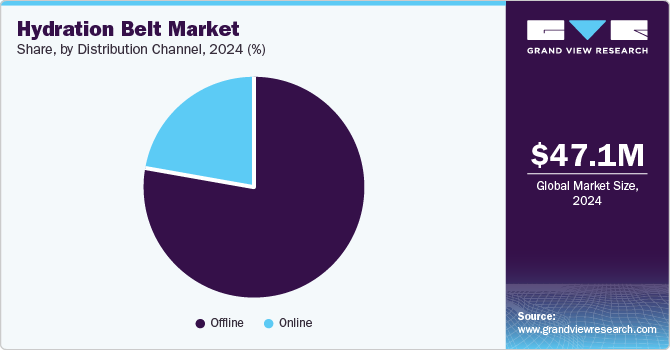

The offline channel segment dominated the market with the largest revenue share in 2024. This dominance is largely attributed to consumers' preference for physically inspecting and purchasing hydration belts from brick-and-mortar stores like sports equipment shops, outdoor gear retailers, and department stores. These physical stores provide customers with the opportunity to evaluate product quality, fit, and functionality firsthand, ensuring they make informed purchasing decisions. Additionally, the availability of in-store promotions, personalized customer service, and the ability to try on different models contribute to the segment's strong market presence.

The online channel segment is expected to grow at the fastest CAGR over the forecast period owing to the convenience and accessibility of online shopping, allowing consumers to browse and purchase hydration belts from the comfort of their homes. The increasing use of smartphones and the expansion of internet access are further fueling this trend. Online platforms offer a wide range of products, detailed descriptions, customer reviews, and competitive pricing, making it easier for consumers to make informed decisions. The ability to compare different brands and models quickly also enhances the shopping experience.

Regional Insights

North America hydration belt market dominated the global market with the largest revenue share of 37.3% in 2024. The region's high participation rates in outdoor sports and fitness activities. The increasing awareness of the importance of staying hydrated during physical activities is also a significant driver. Moreover, the presence of major market players and the availability of a wide range of innovative products cater to the diverse needs of consumers.

U.S. Hydration Belt Market Trends

The U.S. hydration belt market is expected to grow significantly over the forecast period owing to the increasing participation in outdoor sports and fitness activities. Furthermore, the rising awareness of the importance of staying hydrated and the growing trend of health and wellness is expected to drive market growth. Additionally, the availability of advanced and innovative hydration belt products, along with the presence of key market players, further supports the market's expansion.

Europe Hydration Belt Market Trends

Europe hydration belt market was identified as a lucrative region in 2024. The increasing popularity of outdoor sports and fitness activities, which drive the demand for convenient hydration solutions. The rising health and wellness trend among consumers, along with the availability of advanced and innovative hydration belt products, further supports this market's expansion. Additionally, the presence of key market players and the growing emphasis on staying hydrated during physical activities contribute to the strong performance of the Europe hydration belt market.

Asia Pacific Hydration Belt Market Trends

Asia Pacific hydration belt market is expected to grow at the fastest CAGR of 7.1% over the forecast period. The increasing participation in outdoor sports and fitness activities, rising health and wellness awareness, and the growing middle-class population with higher disposable incomes. Additionally, the region's focus on technological advancements and the availability of innovative hydration belt products further support this market's expansion.

Key Hydration Belt Company Insights

Some key companies in the hydration belt market include Nathan, Fitletic, URPOWER, Adalid Gear, and others. Companies are introducing innovative belts to remain competitive. Moreover, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Nathan offers a variety of hydration belts and accessories, including TrailMix Plus Hydration Belt, Swift Plus Hydration Belt 10oz, and Hydration Vests and Packs. Nathan also provides hydration vests and packs designed for seamless integration and reliable performance during adventures.

-

Fitletic offers a range of hydration belts and accessories, including Hydra 16 Hydration Belt, Ultimate I Running Belt, and Mini Sport Bel. The company is dedicated to delivering high-quality hydration solutions that cater to the diverse needs of athletes and fitness enthusiasts, ensuring they stay hydrated and comfortable during their activities.

Key Hydration Belt Companies:

The following are the leading companies in the hydration belt market. These companies collectively hold the largest market share and dictate industry trends.

- Nathan

- Fitletic

- URPOWER

- Adalid Gear

- Salomon S.A.S.

- CamelBak

- Ultimate Direction

- FFITTECH

- Osprey

- Implus

Hydration Belt Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 52.3 million

Revenue forecast in 2030

USD 70.03 million

Growth Rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, protective medium, capacity, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Nathan; Fitletic; URPOWER; Adalid Gear; Salomon S.A.S.; CamelBak; Ultimate Direction; FFITTECH; Osprey; Implus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydration Belt Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydration belt market report based on, product, form, protective medium, capacity, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

With Bottle

-

Without Bottle

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Hard Bottle Hydration Belt

-

Soft Flask Hydration Belt

-

-

Protective Medium Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulating

-

Non-insulating

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Bottle

-

Double Bottle

-

Multiple Bottle

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.