- Home

- »

- Water & Sludge Treatment

- »

-

India Membrane Bioreactor Market Report, 2021-2028GVR Report cover

![India Membrane Bioreactor Market Size, Share & Trends Report]()

India Membrane Bioreactor Market Size, Share & Trends Analysis Report By Product (Hollow Fiber, Flat Sheet), By Configuration (Submerged, Side Stream), By Application (Municipal, Industrial), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-3-68038-796-4

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Bulk Chemicals

Report Overview

The India membrane bioreactor market size was estimated at USD 135.6 million in 2020 and is anticipated to grow at a compound annual growth rate (CAGR) of 12.7% from 2021 to 2028. Growing wastewater production in industries, offices, and households is expected to drive the demand for wastewater management, thereby complementing market growth over the forecast period. During the COVID-19 pandemic, most of the cities in India were under strict lockdown, which increased the municipal waste, thereby boosting the demand for wastewater management services. Furthermore, as the country has started returning to normalcy due to vaccine rollouts and infusion of economic stimulus packages, the demand for membrane bioreactor (MBRs) is expected to witness growth with the industrial sector emitting industrial effluents.

The pandemic has led MBR manufacturers to develop new technologies at affordable rates to ensure competitive advantage. The Central Pollution Control Board has directed the sewage treatment plants to follow COVID-19 protocols to ensure that the virus does not enter water sources. This is expected to improve the market growth in the country over the coming years.

Rising public awareness about the importance of basic sanitation is expected to spur the development of municipal water treatment facilities in India. As India’s population grows, so will the demand for clean water, which will push the adoption of MBRs. However, hefty capital and operational costs are expected to hamper growth over the forecast period. Furthermore, rising fouling issues in the MBR are projected to limit the market growth.

Rapid urbanization and industrial development have necessitated the use of wastewater treatment technologies to treat waste before it enters natural sources. The wastewater sector is expected to witness growth in light of increasing government support from The Ministry of Water Resources (MOWR) and participation of private organizations.

Increased use of environmentally friendly water & wastewater management technologies in the industrial and sewage sectors is expected to drive market growth over the forecast period. Furthermore, increased awareness about the quality of drinking water, water scarcity, and demand for water from India’s fast-growing chemical, pharmaceutical, power plant, food, and textile industries are projected to drive the market.

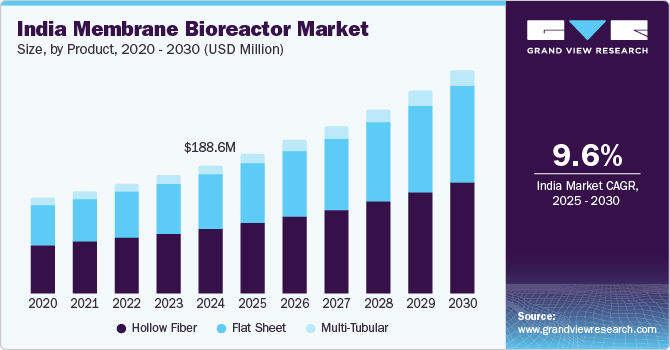

Product Insights

The hollow fiber product segment led the market and accounted for over 67% of the overall revenue share in 2020 due to the high demand as they have lower operational & maintenance expenses than multi-tubular and flat sheet MBRs. The hollow fiber MBR is made up of thousands of long, porous filaments that are enclosed in a PVC shell. The increased usage of hollow fiber membranes in municipal and industrial applications due to their high productivity per volume unit and high packaging density is predicted to enhance the segment growth. Furthermore, construction activities under programs such as Housing for All and the Smart Cities Mission have augmented the demand for wastewater management, boosting MBR market growth. The flat sheet segment is estimated to witness the second-fastest CAGR of 12.5% over the forecast period.

This is due to the rising usage of medium-scale industrial wastewater treatment systems. Flat sheet membranes are widely utilized in a variety of process industries, including dairy, food & beverage, pharmaceutical, and biotech, for all cross-flow filtration technologies, such as reverse osmosis, ultrafiltration, nanofiltration, and microfiltration. Flat sheet membranes are flat and primarily rectangular. They are intended to be immersed in the membrane tank and scoured with air to keep the sludge flowing through the membrane channels. These membranes are almost solely utilized for submerged MBRs in both industrial and municipal applications, where they are occasionally preferred for smaller installations because of their ease of operation.

Configuration Insights

The submerged MBRs segment led the market and accounted for more than 75% of the overall revenue share in 2020 owing to its lower energy usage, higher biodegradation efficiency, and lower fouling rate as compared to a side stream MBR. Submerged MBRs are becoming more popular in the industrial sector due to their high effluent quality, reduced sludge production, and have a significantly lower footprint. In the submerged MBR, hollow fiber or flat sheets are commonly utilized. High capital and maintenance costs may hamper the segment growth to some extent.

The side stream segment is likely to grow at a steady CAGR over the forecast period owing to its superior physical strength and more adaptable hydraulic loading and cross-flow velocity control. They are mostly used in wastewater treatment in industrial plants where influent flow rate and composition vary greatly and operational conditions are challenging. Side stream membranes are fitted on the reactor’s exterior, wherein the sludge is pumped straight through a succession of membrane modules before being returned to the reactor. These are mostly utilized in municipal and industrial water and wastewater treatment. The MBR combines biological treatment with micro, ultra, or nanofiltration.

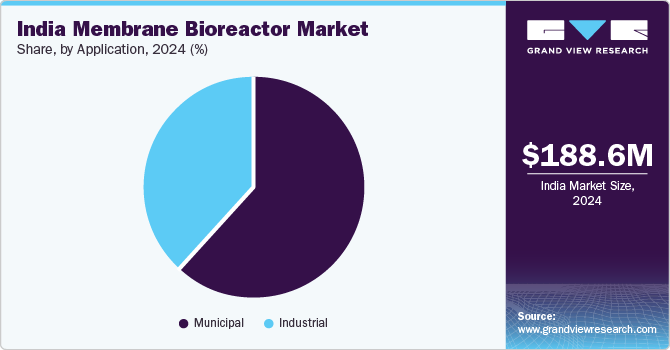

Application Insights

The municipal end-use segment led the market and accounted for the largest revenue share of over 80% in 2020. The water & wastewater treatment equipment market is projected to witness significant growth in municipal sectors in India on account of the stringent policies for wastewater treatment that aim at preventing water pollution. The market is expected to witness growth in the municipal sector owing to increasing environmental laws, along with reduced capital for MBR installation and operating costs, mainly energy consumption. Central funding schemes of the National River Action Plan, such as the Ganga Action Plan and Yamuna Action Plan, are anticipated to augment market growth.

The industrial segment is likely to grow at the fastest CAGR over the forecast period. Factors, such as increasing industrialization as well as population and rapid economic growth, are expected to boost the demand for more dependable municipal and industrial water supplies. Government efforts, such as Make in India, are expected to enhance the industrial growth, in turn, the generation of industrial waste and waste treatment technologies, such as MBR, over the forecast period. Membrane bioreactors are used in various industries, such as food & beverages, paper and pulp, chemicals, mining, and refineries. Rapid urbanization, technological advancement, and an increase in production units have resulted in high demand for fresh and processed water, thereby augmenting the market growth.

Key Companies & Market Share Insights

The market is highly competitive owing to the presence of both multinational and local manufacturers. Manufacturers adopt several strategies including acquisition, collaboration, new product development, and geographical expansion to enhance their market penetration and meet the changing technological demand from various applications industries, such as municipal and industrial.

For instance, In October 2020, Thermax Ltd. launched a sewage recycling system called ‘atom’ that is based on MBR technology. It is an ultra-compact system that is used to treat wastewater efficiently in confined spaces in residential and commercial sectors. Some prominent players in the India membrane bioreactors market include:

-

General Electric Energy LLC

-

Kemira

-

Aquatech International Corp.

-

Mitsubishi Chemical Corp.

-

Danaher Corporation

-

Veolia Environment S.A.

-

Toray Industries

-

UEM India Pvt. Ltd.

-

Ion Exchange India Ltd.

-

VA Tech Wabag Ltd

-

Suez Environment S.A.

-

Thermax India Ltd.

-

Aquatech Systems Asia Pvt. Ltd.

-

Kubota Corp.

India Membrane Bioreactor Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 142.4 million

Revenue forecast in 2028

USD 329.4 million

Growth rate

CAGR of 12.7% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, configuration, application

Country scope

India

Key companies profiled

General Electric Energy LLC; Kemira; Suez Environment S.A.; Buckman Laboratories; Aquatech International Corp.; Mitsubishi Chemical Corp.; UEM India Pvt. Ltd.; Ion Exchange India Ltd.; VA Tech Wabag Ltd.; Thermax India Ltd.; Aquatech Systems Asia Pvt. Ltd.; Kubota Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the India membrane bioreactor market report on the basis of product, configuration, and application:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Hollow Fiber

-

Flat Sheet

-

Multi-Tubular

-

-

Configuration Outlook (Revenue, USD Million, 2017 - 2028)

-

Submerged

-

Side Stream

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Municipal

-

Industrial

-

Frequently Asked Questions About This Report

b. The India membrane bioreactor market size was estimated at USD 135.6 million in 2020 and is expected to reach USD 142.4 million in 2021.

b. The India membrane bioreactor market, in terms of revenue, is expected to grow at a compound annual growth rate of 12.7% from 2021 to 2028 to reach USD 329.4 million by 2028.

b. The municipal segment accounted for 80.8% of the total revenue share in 2020, attributed to the reduced capital for membrane bioreactor installation and operating costs mainly energy consumption.

b. Some of the key players operating in the India Membrane Bioreactor market include General Electric Energy LLC, Kemira, Suez Environnement S.A., Buckman Laboratories, Aquatech International Corporation, Mitsubishi Chemical Corporation, UEM India Pvt. Ltd. Ion Exchange India Ltd., VA Tech Wabag Ltd, Thermax India Ltd., Aquatech Systems Asia Pvt. Ltd,, Kubota Corporation., among others

b. The key factors that are driving the India membrane bioreactor market include growing wastewater production in industries, offices, and homes and stringent regulations by the government related to wastewater emission.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."