- Home

- »

- Consumer F&B

- »

-

Jellies & Gummies Market Size And Share Report, 2030GVR Report cover

![Jellies & Gummies Market Size, Share & Trends Report]()

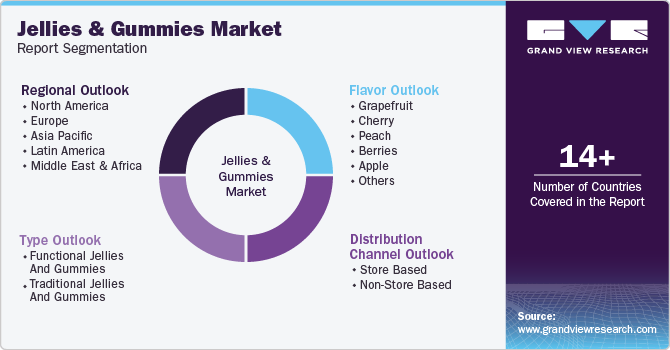

Jellies & Gummies Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Functional, Traditional), By Flavor (Grapefruit, Cherry, Peach, Berries, Apple), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-647-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Jellies & Gummies Market Summary

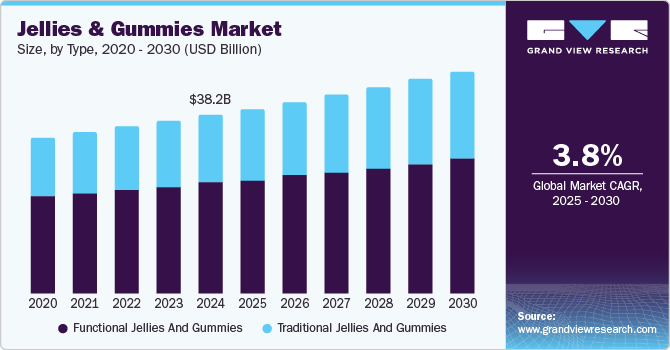

The global jellies & gummies market size was valued at USD 38.18 billion in 2024 and is projected to reach USD 47.65 billion by 2030, growing at a CAGR of 3.8% from 2025 to 2030. The market growth is attributable to the increasing consumer demand for convenience foods.

Key Market Trends & Insights

- The North America jellies & gummies secured the dominant market revenue share of 34.3% in 2024.

- The jellies & gummies market in the U.S. is expected to grow significantly from 2025 to 2030.

- Based on type, the functional jellies and gummies segment dominated the market with a 61.8% revenue share in 2024.

- Based on flavor, the berry flavor segment dominated the market in 2024.

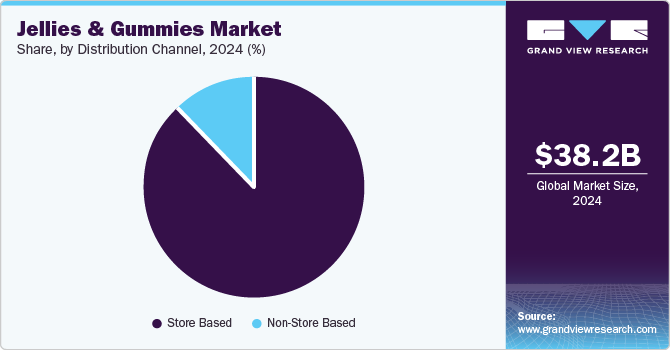

- Based on distribution channel, the store-based distribution channels segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.18 Billion

- 2030 Projected Market Size: USD 47.65 Billion

- CAGR (2025-2030): 3.8%

- North America: Largest market in 2024

With hectic schedules and busy lifestyles, consumers have increasingly sought quick and easy snack options, including jellies and gummies. These products are convenient and come in a wide range of flavors and forms that appeal to a broader range of consumers. Health consciousness among consumers is another major factor propelling the market. As consumers become more inclined towards healthier eating habits, manufacturers have responded by incorporating vitamins, minerals, and natural ingredients into their products. A McKinsey and Company report suggests that up to 40% of conscious consumers prefer eating fresh produce, while 33% prefer meals without artificial ingredients. This shift towards functional and fortified gummies has attracted health-conscious consumers. Additionally, the rising popularity of vegan and sugar-free options has contributed to market growth. Consumers have progressively continued to adopt vegan lifestyles and become aware of the negative impact of excessive sugar consumption, leading to the ongoing demand for vegan and sugar-free jellies and gummies.

Furthermore, the growing awareness of the drawbacks of consuming traditional chocolates and candies has stimulated market growth. As consumers become more health conscious, they have shifted towards alternatives, including jellies and gummies that are perceived to be healthier. The increasing availability of transparent-label products with recognizable ingredients further supports this shift.

In addition, the market has benefitted from the versatility of jellies and gummies. These products can be consumed as standalone snacks and used to top cakes, desserts and mocktails, and cocktails. Such a versatile profile makes them popular among consumers looking for multi-functional food items.

Type Insights

The functional jellies and gummies segment dominated the market with a 61.8% revenue share in 2024 owing to the increasing consumer demand for health and wellness products. Functional jellies and gummies, fortified with vitamins & minerals, probiotics, and other beneficial ingredients, offer an appealing solution to consumers who seek convenient and enjoyable ways to incorporate essential nutrients into their diets. For instance, a recent report indicates that 73% of Indian consumers read about nutritional values before purchasing snacks. Moreover, the ongoing innovation in flavors and formulations has kept up the market momentum. Manufacturers such as Mars Wringley and Prinova have continuously experimented with new flavors, textures, and functional ingredients to cater to diverse consumer preferences.

Traditional jellies and gummies are expected to grow at the fastest CAGR during the forecast period owing to the continuous innovation in product offerings. Manufacturers have introduced new and exotic flavors with unique shapes and textures to keep consumers engaged. This constant innovation helps maintain consumer interest and drives repeat purchases. Additionally, the market has benefited from the increasing demand for convenience foods. Jellies and gummies are easy to carry and consume, which makes them a perfect on-the-go snack.

Flavor Insights

The berry flavor segment secured the dominant market revenue share in 2024 due to consumers' growing health consciousness. Berries have been widely recognized for their health benefits, including high antioxidant levels, fiber content, and anti-inflammatory properties. These attributes make berry-flavored jellies and gummies particularly appealing to health-conscious consumers who have looked for tasty yet nutritious snack options. Another important factor is the diverse and appealing flavor profile of berries. Flavors such as strawberry, blueberry, raspberry, and blackberry cater to a wide range of taste preferences. This variety allows manufacturers to innovate and introduce new products that keep consumers engaged. The natural sweetness and vibrant colors of berries enhance the sensory and visual appeal of jellies and gummies.

The cherries flavor segment is anticipated to grow at the fastest CAGR during the forecast period due to their intense and appealing flavor profile. Cherry-flavored jellies and gummies offer a unique combination of sweetness and tartness that appeals to a wide range of consumers. This distinctive taste makes cherry a popular choice among both children and adults, contributing to its strong market presence.

Distribution Channel Insights

Store-based distribution channels registered the highest market revenue share in 2024. The largest consumers of jellies and gummies belong to the age group <17 as access to the local stores is more feasible for them over online purchases. The convenience of immediate purchase and consumption, which is a significant advantage over online shopping has boosted the market growth. Moreover, developed countries have a high density of grocery stores, where the products are easily available as a part of the marketing strategy. Additionally, the presence of jellies and gummies in high-traffic areas of stores, such as checkout counters, encourages impulse buying, further boosting sales.

The non-store based segment is expected to grow at the fastest CAGR during the forecast period. Work-life dynamics, increasing congestion, a growing need for convenience, and increasing demand for regional candies have majorly driven the segment. Global players including Nexira and Ferrara have increasingly offered a wide range of jellies and gummies in their portfolio, including shapes such as fruits, living creatures, wheels, and bottles. These products are offered in both sugar and sugar-free versions to fulfill growing consumer demand from all age groups. Additionally, faster and more reliable delivery options have made it easier for consumers to receive their orders promptly, enhancing the overall shopping experience.

Regional Insights

The North America jellies & gummies secured the dominant market revenue share of 34.3% in 2024. The growth can be credited to the growing demand for jellies and gummies and increasing shelf space in stores as compared to other confectioneries. The growing inclination of the millennials towards these products has considerably driven the market.

U.S. Jellies & Gummies Market Trends

The jellies & gummies market in the U.S. is expected to be driven by the increasing vegan population and high consumer spending on confectionery items including candies and jellies over the forecast period. Additionally, the market value is being boosted by consumers’ growing awareness of the drawbacks of chocolate consumption, along with the appeal of novel tastes, textures, designs, shapes, packaging, and sugar content in sweets.

Europe Jellies & Gummies Market Trends

The Europe jellies & gummies market is projected to grow at the fastest CAGR during the forecast period owing to the increasing consumer consumption of these food ingredients and the launch of innovative products such as sugar-free jellies, gummies, and pick-and-mix candies by companies including Haribo, Mars, and Cloetta. The recent trend of pick-and-mix sweets has contributed to the industry’s expansion. It has gained popularity in the Nordic countries, whereas packaged candy held a stronger position in Central European countries.

Germany dominated the regional market in 2024 owing to the increasing demand for convenience foods plays a significant role. Consumers with busy lifestyles have increasingly preferred ready-to-eat snacks including jellies and gummies. Additionally, collaborations between brands and influencers have enhanced product visibility and appeal, particularly among younger demographics the rising health consciousness among consumers has boosted the demand for healthier options, such as vegan and sugar-free jellies and gummies.

Asia Pacific Jellies & Gummies Market Trends

The Asia Pacific (APAC) region held a significant revenue share 2024. The region boasts a robust snacking culture, as consumers frequently enjoy snacks in between meals. Jellies and gummies align with this habit. With the rising disposable incomes and urbanized lifestyles, the market experienced a growing demand for convenient and indulgent snack options including jellies and gummies.

Key Jellies & Gummies Company Insights

The global jellies & gummies market is intensely competitive, featuring key players such as Cloetta AB, Mars, Incorporated, THE HERSHEY COMPANY, and others. The market players have increasingly offered bite-size pieces of low-fat candies to improve sales among health-conscious consumers. Increasing focus on health among consumers fostered a paradigm shift in the ingredients and the packaging size. These players have adopted appealing packaging strategies.

-

Cloetta AB is a leading confectionery company that is renowned for its wide range of products, including chocolates, candies, nuts, pastilles, chewing gum, and pick & mix concepts. Chloetta operates in more than 50 markets worldwide, with a strong presence in the Nordic region and the Netherlands.

-

Mars Incorporated is a global food giant, that operates across four business segments including Petcare, Food, Mars Wrigley, and Mars Edge. The company is known for its iconic brands such as M&M’s, Snickers, Skittles, Pedigree, and Whiskas.

Key Jellies & Gummies Companies:

The following are the leading companies in the jellies & gummies market. These companies collectively hold the largest market share and dictate industry trends.

- HARIBO GmbH & Co. KG

- THE HERSHEY COMPANY

- Mondelez International

- Nestlé S.A.

- Ferrara Candy Company

- Mars, Incorporated

- Jelly Belly Candy Company

- Perfetti Van Melle

- Meiji Holdings Co., Ltd.

- Cloetta AB

Recent Developments

-

In September 2024, THE HERSHEY COMPANY launched its latest oversized gummy edition named Shaq-A-Licious XL Gummies. This product line includes Shaq-A-Licious Original and Shaq-A-Licious Sour that are available in three fun flavors and shapes.

-

In August 2024, HARIBO introduced the HARIBO Football Mix, the company’s debut football-themed treat. It features six new gummi shapes and fruity flavors, including strawberry, raspberry, pineapple, lemon, apple, and orange. This limited-edition gummy mix boasts a fluffy dual-layered texture.

-

In October 2023, Ferrara agreed to acquire Jelly Belly. This acquisition is initiated to merge Jelly Belly’s extensive range of Jelly Belly gourmet specialty confections with Ferrara’s diverse sugar candies.

Jellies & Gummies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.55 billion

Revenue forecast in 2030

USD 47.65 billion

Growth Rate

CAGR of 3.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, flavor, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, Australia, South Korea, Brazil, Saudi Arabia

Key companies profiled

HARIBO GmbH & Co. KG; THE HERSHEY COMPANY; Mondelez International; Nestlé S.A.; Ferrara Candy Company; Mars, Incorporated; Jelly Belly Candy Company; Perfetti Van Melle; Meiji Holdings Co., Ltd.; Cloetta AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Jellies & Gummies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the jellies & gummies market report based on type, flavor, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Functional Jellies and Gummies

-

Traditional Jellies and Gummies

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Grapefruit

-

Cherry

-

Peach

-

Berries

-

Apple

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Store Based

-

Non-Store Based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.