- Home

- »

- Pharmaceuticals

- »

-

Kidney Cancer Drugs Market Size, Industry Report, 2030GVR Report cover

![Kidney Cancer Drugs Market Size, Share & Trends Report]()

Kidney Cancer Drugs Market Size, Share & Trends Analysis Report By Type (Renal Cell Carcinoma (RCC), Transitional Cell Cancer, Wilms Tumor, Renal Sarcoma), By Therapy, By Drug Class, By Route of Administration, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-514-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Kidney Cancer Drugs Market Size & Trends

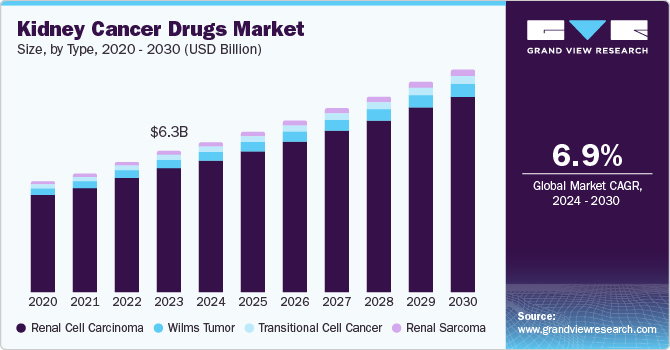

The global kidney cancer drugs market size was valued at USD 6.25 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. This growth is attributed to the advancements in treatment options, rising healthcare expenditure, and increasing research and development efforts. According to American Cancer Society, about 81,800 cases were diagnosed of malignant tumors of the kidney and renal pelvis, with 13,780 deaths in both males and females in 2023. The aging population, lifestyle factors, and improved access to healthcare are contributing to the higher incidence rate of kidney cancer. Immunotherapy, targeted therapies, and combination therapies are improving treatment outcomes.

Cancer is the second largest cause of death globally, after cardiovascular diseases. External factors such as changing food patterns, smoking, urbanization, and prolonged post-reproductive life contribute to cancer. The growth in the aging population and the increasing frequency of kidney cancer patients are the factors driving market expansion. Although there are several therapeutic options available, researchers have shifted their focus to medicines and immunotherapies. Therefore, the market is expected to increase further through robust pipeline and developing treatments in the coming years.

The lack of suitable regulatory requirements for medication prescriptions and preference for cost-effective generic renal cancer treatments is likely to obstruct the global market for drugs. Furthermore, the drugs destroying the cancer cells proves harmful for healthy cells in the body. This causes several side effects in patients, the most prevalent of which are gastrointestinal issues, hair loss, exhaustion, and skin diseases. As a result, the market's expansion is being hampered by the disadvantages associated with kidney cancer medications.

Immunotherapies pose a lucrative avenue for kidney cancer treatment. Moreover, in future, the developing regions with a large undiagnosed patient population are expected to attract market opportunities for manufacturers.

Type Insights

Renal cell carcinoma (RCC) accounted for the largest market revenue share of 85.8% in 2023. This is attributable to the aging population, as the risk of RCC increases with age. In addition, lifestyle factors such as smoking, obesity, and exposure to certain chemicals have been linked to increased risk. Moreover, advancements in diagnostic techniques have led to earlier detection of RCC, contributing to the observed increase in incidence. According to European Association of Urology, RCC is the most common solid lesion within the kidney and accounts for approximately 90% of all kidney malignancies .

Renal sarcoma is expected to register a CAGR of 6.8% during the forecast period. This growth is attributed to the increasing use of imaging techniques that can detect smaller tumors, as well as the growing awareness of the disease among healthcare providers. Moreover, advancements in personalized medicine are paving the way for targeted therapies that can address specific genetic mutations associated with renal sarcomas, thus enhancing treatment outcomes and driving market growth.

Therapy Insights

Targeted therapy dominated the market and accounted for a share of 57.1% in 2023. This high percentage can be attributed to their unique molecular characteristics, minimizing damage to healthy tissues. The increasing prevalence of kidney cancer, coupled with the development of more effective targeted therapies, has driven a surge in their use. In addition, the success of targeted therapies in improving patient outcomes and reducing side effects has contributed to their growing popularity within the kidney cancer treatment landscape.

Immunotherapy is projected to grow at CAGR of 7.4% over the forecast period. The increasing understanding of the immune system's role in cancer and the development of innovative immunotherapy drugs have led to a significant increase in their use. By stimulating the immune system to recognize and attack tumor cells, immunotherapy offers a promising approach for patients with advanced-stage disease. Moreover, the strong clinical results obtained through immunotherapy have solidified its role as a fundamental aspect of treating kidney cancer.

Drug Class Insights

Angiogenesis inhibitors accounted for the largest market revenue share of 42.1% in 2023. Angiogenesis inhibitors are a class of drugs that target the process of blood vessel formation, which is essential for tumor growth. By inhibiting angiogenesis, these drugs can starve tumors of oxygen and nutrients, leading to their shrinkage or destruction. The increasing understanding of the role of angiogenesis in tumor growth and the development of more potent angiogenesis inhibitors have contributed to their rising popularity in the treatment of kidney cancer. Moreover, the favorable safety profiles and efficiency of many angiogenesis inhibitors have made them attractive options for patients.

Cytokine immunotherapy (IL-2) is expected to register the fastest CAGR of 8.4% during the forecast period. IL-2 (interleukin-2) is a immunostimulatory agent that promotes T-cell proliferation and enhances the immune response against tumors. According to National Library of Medicines, the high-dose IL-2 can lead to durable responses in a subset of patients with metastatic RCC, making it a valuable option. As researchers continue to refine IL-2 treatment, it may play a more prominent role in the future management of kidney cancer.

Route of Administration Insights

The oral segment accounted for the largest market revenue share of 61.0% in 2023. This is attributable to its convenience and patient preference. Patients often prefer oral medications as they can be self-administered at home, avoiding the need for frequent visits to healthcare facilities. Additionally, oral medications can improve patient compliance and quality of life. Advancements in drug formulation and delivery systems have enabled the development of oral medications with improved bioavailability and reduced side effects, further driving their adoption in the kidney cancer treatment landscape.

The subcutaneous segment is expected to register the CAGR of 6.8% during the forecast period. Subcutaneous administration involves injecting drugs under the skin and has become a viable option for certain kidney cancer medications. This route of administration offers several advantages, including sustained drug release, reduced systemic side effects, and improved patient convenience. Subcutaneous injections can be performed at home with minimal training, allowing for greater flexibility in treatment schedules. Moreover, advancements in drug delivery devices have made subcutaneous administration more accessible and user-friendly, contributing to its increasing popularity in the kidney cancer treatment market.

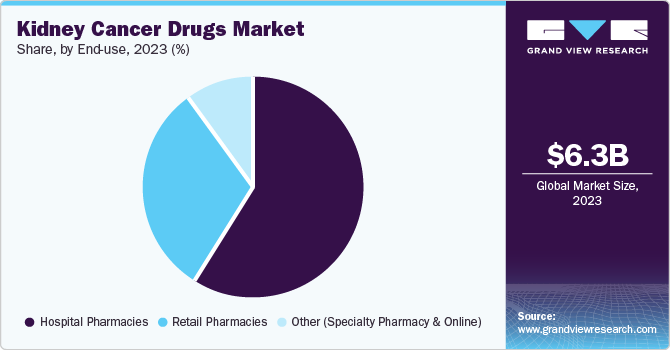

End Use Insights

The hospital pharmacies segment dominated the market and accounted for share of 56.0% in 2023. This is attributable to their role in providing specialized treatments and managing complex patient cases. Hospitals have on-site pharmacies that can ensure timely access to medications, particularly for patients undergoing intensive care or complex treatment regimens. In addition, hospital pharmacists play a vital role in monitoring drug interactions, managing side effects, and providing patient education, contributing to optimal treatment outcomes.

The retail pharmacies segment is projected to grow at the fastest CAGR of 7.4% over the forecast period. Retail pharmacies offer convenience and accessibility for patients, allowing them to obtain medications without the need for frequent hospital visits. Moreover, retail pharmacies can provide patient counseling and support, helping to ensure proper medication usage and adherence. As the number of patients with kidney cancer increases, retail pharmacies are well-positioned to play a more significant role in the delivery of these medications.

Regional Insights

North America kidney cancer drugs market dominated the market in 2023. It is attributable to region’s strong healthcare infrastructure, with advanced medical facilities and access to cutting-edge treatments. Moreover, the presence of leading pharmaceutical companies and research institutions has fostered a culture of innovation and development in the field of kidney cancer therapy.

U.S. Kidney Cancer Drugs Market Trends

The U.S. kidney cancer drugs market dominated the North America market with a share of 89.3% in 2023. Increased adoption of therapeutics, established healthcare infrastructure, and the presence of key manufacturers in the country are major factors responsible for its large share. Japan is expected to experience a high growth rate owing to various factors such as multiple product launches in the region during the forecast period and the existence of a large geriatric population base susceptible to kidney cancer.

Europe Kidney Cancer Drugs Market Trends

The Europe kidney cancer drugs market was identified as a lucrative region in 2023. The region's strong healthcare infrastructure, coupled with a focus on research and development, has fostered a favorable environment for the development and adoption of innovative treatments. Moreover, the increasing prevalence of kidney cancer, particularly in older populations, has led to a growing demand for effective therapies. The UK kidney cancer drugs market is expected to grow rapidly in the coming years due to well-established healthcare system, coupled with its strong research capabilities.

Asia Pacific Kidney Cancer Drugs Market Trends

Asia Pacific kidney cancer drugs market is anticipated to witness fastest growth in the kidney cancer drugs market. The region's large population and increasing life expectancy have led to a rise in the incidence of kidney cancer. Moreover, the growing awareness of the disease and improved access to healthcare have contributed to increased demand for effective treatments.

Key Kidney Cancer Drugs Company Insights

Some of the key companies in the kidney cancer drugs market include Astellas Pharma Inc.; AstraZeneca PLC; Bayer AG; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd. and Novartis AG. Biosimilar development is gaining traction as a promising market opportunity in kidney cancer therapeutics. Several biotech companies have already launched their Avastin biosimilars across several cancer indications in emerging markets such as India, Russia, and Argentina.

- F. Hoffmann-La Roche Ltd specializes in developing drugs for the treatment of cancer, central nervous system disorders, autoimmune diseases, ophthalmological disorders, respiratory diseases, and infectious diseases.

Key Kidney Cancer Drugs Companies:

The following are the leading companies in the kidney cancer drugs market. These companies collectively hold the largest market share and dictate industry trends:

- Astellas Pharma Inc.

- AstraZeneca PLC

- Bayer AG

- Bristol-Myers Squibb Company

- Eisai Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- GSK plc

- Helsinn Healthcare SA

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novartis AG

Recent Developments

-

In December 2023, Merck announced the U.S. FDA approval of WELIREG. It has been approved for patients suffering with advanced renal cell carcinoma following programmed death-ligand 1 (PD-L1) inhibitor or programmed death receptor-1 (PD-1) and a vascular endothelial growth factor tyrosine kinase inhibitor (VEGF-TKI)

-

In February 2021, Glenmark Pharmaceuticals announced the launch of SUTIB. It is a generic version of Sunitinib oral capsules for treating kidney cancer in India.

Kidney Cancer Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.65 billion

Revenue forecast in 2030

USD 9.90 billion

Growth Rate

CAGR of 6.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, therapy, drug class, route of administration, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait.

Key companies profiled

Astellas Pharma Inc.; AstraZeneca PLC; Bayer AG; Bristol-Myers Squibb Company; Eisai Co., Ltd.; F. Hoffmann-La Roche Ltd.; GSK plc; Helsinn Healthcare SA; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Novartis AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kidney Cancer Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kidney cancer drugs market report based on type, therapy, drug class, route of administration, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Renal cell carcinoma (RCC)

-

Transitional cell cancer

-

Wilms tumor

-

Renal sarcoma

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Targeted therapy

-

Immunotherapy

-

Chemotherapy

-

Other therapies

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Angiogenesis inhibitors

-

Monoclonal antibodies

-

mTOR inhibitors

-

Cytokine immunotherapy (IL-2)

-

Other drug classes

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Intravenous

-

Subcutaneous

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other (Specialty pharmacy and online)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."