- Home

- »

- Homecare & Decor

- »

-

Kitchen Knives Market Size, Share & Growth Report, 2030GVR Report cover

![Kitchen Knives Market Size, Share & Trends Report]()

Kitchen Knives Market Size, Share & Trends Analysis Report By Manufacturing Process, By Cutting Edge (Plain, Serrated), By Price (Low, High), By Application, By Distribution Channel, By Size, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-453-6

- Number of Report Pages: 84

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global kitchen knives market size was valued at USD 1.76 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.2% from 2023 to 2030. The market is anticipated to be driven by factors, such as the increased interest in cooking, the growing popularity of cooking shows and social media, changing consumer preferences, and growing demand for premium and innovative products. Furthermore, rising disposable income has led to an increase in demand for premium and innovative products. Consumers are willing to spend more on high-quality kitchen knives that offer superior performance, durability, and convenience.

Kitchen knives are essential tools that offer various advantages over regular knives, such as ease of use, efficient chopping & slicing, and better control. The growing number of people choosing cooking as a career and the adoption of cafeterias in schools, colleges, and workplaces have contributed to the increasing usage of kitchen knives. Manufacturers are also focusing on producing long-lasting, safer, and cost-efficient products, boosting their consumption. The increasing popularity of street food and the growing number of restaurants have also fueled demand for kitchen knives, with many chefs preferring to use them over regular knives.

In addition, consumers are looking for premium and innovative kitchen knives that offer superior performance, durability, and convenience. This is driving manufacturers to develop new and improved products to meet consumer demand. The innovative use of ceramic in manufacturing knives has further increased their consumption, owing to their ability to resist the effect of acidic or juicy surfaces, be rust-proof, and retain sharpness for longer. The COVID-19 pandemic has had a significant impact on the market, with increased demand for high-quality knives as more people cooked at home and shared their creations on social media.

Thus, there was a greater emphasis on the visual presentation of food. This led to a growing interest in kitchen tools and utensils that not only function more efficiently but are also aesthetically pleasing. As a result, there was an increase in demand for premium and high-quality kitchen knives with attractive designs offering superior performance. The market is expected to benefit from the emergence of new materials, most notably in the production of commercial kitchen knives, forcing prominent manufacturers to capitalize on the opportunities existing within this space.

Powdered steel, in particular, is emerging as the most popular material for the manufacture of kitchen knives and has been gaining traction in the market over the past few years. The employment of powdered steel as a raw material is likely to improve the sharpness of the blade of kitchen knives. Consequently, powder metallurgy, a technique used for the production of powdered steel, is likely to gain popularity in the coming years as this technology allows for the use of various grades of steel, including SG2 and R2.

Manufacturing Process Insights

On the basis of manufacturing processes, the industry has been further categorized into hand-forged and stamped blades. The stamped blades segment dominated the industry in 2022 and accounted for the largest share of more than 77.20% of the overall revenue. Stamped blade knives feature lightweight blades with higher flexibility. These features drive the popularity of stamped blades and are widely used in restaurants, hotels, food joints, and even in households.

On the other hand, the hand-forged segment is anticipated to witness the fastest growth rate during the forecast period. Thicker blades with high durability are driving the demand for hand-forged knives in commercial as well as household kitchens. Moreover, the demand for handmade and custom blades has been increasing among chefs across the globe, which is fueling the demand for hand-forged knives, thereby supporting segment growth.

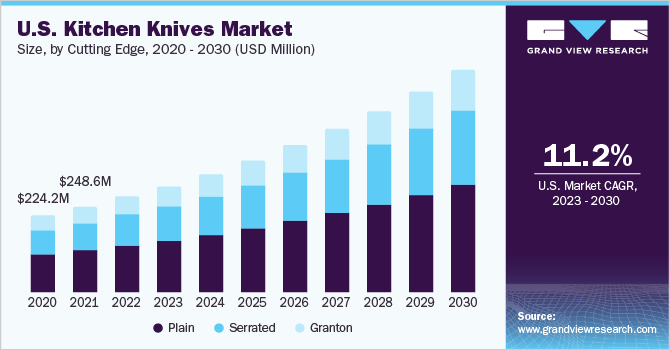

Cutting Edge Insights

On the basis of cutting edge, the market is further segmented into plain, serrated, and Granton. The plain segment dominated the industry in 2022 and accounted for the largest share of more than 48.85% of the overall revenue owing to their wider application scope. Plain kitchen knives are widely used for residential as well as commercial purposes owing to their large scope of functionality, such as chopping, slicing, skinning, dicing, and mincing.

Plain-blade kitchen knives are widely used by homemakers, chefs, and other food makers. On the other hand, the serrated kitchen knives segment is anticipated to exhibit the fastest growth rate during the forecast period. The rapid growth of the segment can be attributed to various features, such as low maintenance in terms of sharpening, and wide application scope in cutting a number of food products with different stiffness levels, such as bread, tomato, and fibrous foods.

Size Insights

On the basis of sizes, the global industry has been further categorized into 3-5 inches, 5-7 inches, 7-9 inches, and 9-12 inches. The 5-7 inches size segment dominated the industry in 2022 and accounted for the largest share of more than 34.95% of the global revenue. The segment is projected to expand further at a significant growth rate, maintaining its dominant industry position throughout the forecast period. This size is ideal for most cutting applications in the kitchen, such as chopping, cutting, slicing, and dicing small and large vegetables & fruits.

These variants are most commonly used in household kitchens. On the other hand, the 7-9 inches size segment is anticipated to exhibit the fastest growth rate over the forecast period. Growing consumption of meat-based meals, owing to increasing interest among global consumers, is propelling the demand for 7-9-inch kitchen knives. These knives have broad and heavy blades, which help in carving various kinds of meat, such as pork, beef, and chicken.

Price Insights

On the basis of prices, the industry has been further segmented into low (less than USD 100), medium (USD 100 - USD 200), and high (above USD 200) segments. In 2022, the low (less than USD 100) price segment dominated the market and accounted for the largest share of over 35.45% of the overall revenue. The segment will expand further at a steady CAGR, retaining the leading position throughout the forecast period. The high share of the segment can be attributed to the affordability factor. There is a range of affordable chef knives available in the market.

Several leading brands have started to offer kitchen knives with a demonstrated hardness scale, resistance to deterioration, and an ergonomic design, which can be purchased for less than USD 100. The high-price segment is expected to register the fastest growth rate from 2023 to 2030. High-priced kitchen knives are often made with high-quality materials, such as high-carbon stainless steel or Damascus steel, that are durable and hold a sharp edge for a long time. The craftsmanship and attention to detail in the manufacturing process also contribute to the quality of the knives.

Distribution Channel Insights

Based on distribution channels, the industry has been segmented into direct and indirect selling. The indirect selling segment dominated the market in 2022 and accounted for the largest share of more than 63.80% of the overall revenue. The segment is projected to expand further at a steady growth rate retaining its dominance throughout the forecast period. The presence of small-scale companies with low capital and a lack of brand stores is the major driver for a higher market share of the indirect selling segment. In business-to-business markets, distributors are usually preferred. The catering industry (i.e. restaurants and hotels) purchases its tableware, kitchenware, and other household articles through specialist distributors, as they give a high level of service and low prices in return for a large volume of business.

Easy availability of product varieties in all price segments is likely to attract a considerable number of consumers to supermarkets. Furthermore, consumers are likely to be more selective and observant as a product placed on the shelf can be easily compared with that of other brands before making any purchase decision. The direct selling segment is expected to register the fastest CAGR from 2023 to 2030. To increase profit, companies are focusing on the direct-to-consumer distribution channel. Moreover, growing premiumization in the industry and a shift towards branded products are driving sales of kitchen knives via the direct selling mode.

The online segment in direct selling is estimated to witness strong growth over the forecast period, as companies are increasingly focusing on the direct-to-consumer business model. As the industry is becoming competitive, many manufacturers are trying to lower their costs and business risks by minimizing inventory and shortening order lead time, leading to direct delivery to the consumers. Consumers prefer purchasing through the online platforms of brands to ensure product authenticity.

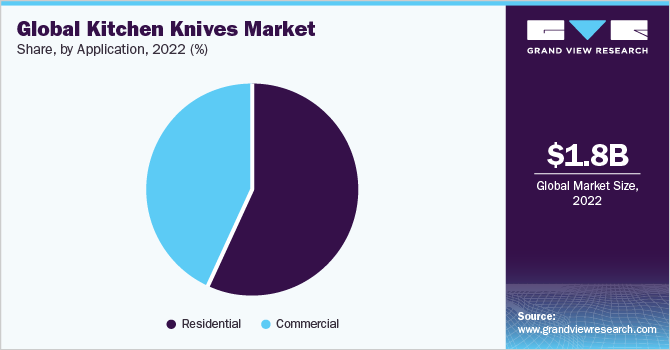

Application Insights

Based on applications, the industry has been further segmented into residential and commercial. In 2022, the residential segment dominated the industry and accounted for the maximum share of more than 57.00% of the overall revenue, owing to an increasing preference for modular kitchens, coupled with rising living standards. High spending by house owners from more affordable markets on kitchen appliances and tools is fueling the demand for kitchen knives in the residential sector.

The commercial application segment, on the other hand, is anticipated to witness the fastest growth rate during the forecast period. Hotels, resorts, and large-scale food joints are anticipated to propel product demand over the forecast period. The rising trend of food away from home is building a lucrative growth opportunity for restaurants and eating joints, and subsequently contributing to the growth of the market in the commercial segment.

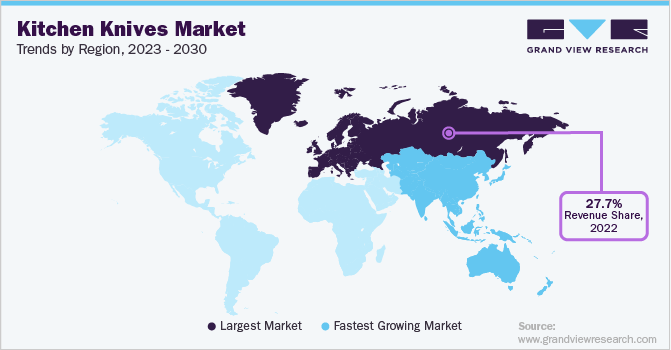

Regional Insights

In terms of revenue, the Europe region dominated the industry in 2022 and accounted for the maximum share of more than 27.65% of the overall revenue. The Europe regional market is also driven by the region’s strong culinary traditions and high demand for quality kitchen tools. Many European consumers are willing to invest in high-end kitchen knives for professional and home use, which further fuels the growth of the industry. Moreover, the increasing popularity of cooking shows and culinary tourism in Europe is contributing to the rising product demand. The region’s emphasis on sustainability and eco-friendliness is also driving the development of innovative kitchen knife materials and designs that are environment-friendly and more efficient. The Asia Pacific region is expected to register the fastest CAGR from 2023 to 2030.

This is owing to the growing tourism industry, the increasing number of food outlets, and the rising availability of kitchen knives in various stores. The tourism industry in the Asia Pacific region has been experiencing rapid growth in recent years, with many visitors coming from different parts of the world to explore the region's diverse cultures and cuisines. As a result, the number of food outlets, including hotels, restaurants, and cafes has been increasing rapidly, which, in turn, drives product demand. In addition, the rising number of fast-food outlets in the Asia Pacific region plays a crucial role in the growing demand for kitchen knives. Fast-food restaurants require efficient and durable tools for food preparation, and kitchen knives are one of the essential tools for their daily operations.

Key Companies & Market Share Insights

The global industry is highly competitive, with many key players and innovators, offering a wide range of product portfolios to consumers around the world. This competition is driving innovation and product development, with many companies introducing new products to meet changing consumer demands and stay ahead of the competition. Manufacturers are focused on bringing new products to the market to gain a competitive edge and increase their sales. This includes introducing new materials, designs, and features that offer superior performance, durability, and convenience. For instance, in April 2021, Victorinox launched Damast Bread- and Pastry Knife, made from Damast steel, which is produced in layers to create a resilient and durable blade.

The blade features an intricate pattern known as “Thor”, which combines corrosion resistance and exceptional strength. In 2022, Klein Tools announced a partnership with Trade Hounds, a social network platform for skilled tradespeople in the U.S. Through this partnership, Klein Tools aims to connect with skilled trade workers. As part of the partnership, Klein Tools will share educational resources and career opportunities with Trade Hounds members, while also providing feedback on the development of new products based on the needs of workers. The key companies operating in the global kitchen knives market are:

-

Friedr. Dick GmbH & Co. KG

-

MAC Knife

-

Masamoto Sohonten Co., Ltd.

-

Victorinox AG

-

Wüsthof

-

Zwilling J. A. Henckels

-

Kyocera

-

Dexter-Russell, Inc.

-

Messermeister, Inc.

-

Misen, LLC

-

Calphalon

Kitchen Knives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.96 billion

Revenue forecast in 2030

USD 4.12 billion

Growth rate

CAGR of 11.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Manufacturing process, cutting edge, application, size, price, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Friedr. Dick GmbH & Co. KG; MAC Knife; Masamoto Sohonten Co., Ltd.; Victorinox AG; Wüsthof; Zwilling J. A. Henckels; Kyocera; Dexter-Russell, Inc.; Messermeister, Inc.; Misen, LLC; Calphalon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kitchen Knives Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global kitchen knives market report based on the manufacturing process, cutting edge, application, size, price, distribution channel, and region:

-

Manufacturing Process Outlook (Revenue, USD Million, 2017 - 2030)

-

Hand Forged

-

Stamped Blades

-

-

Cutting Edge Outlook (Revenue, USD Million, 2017 - 2030)

-

Plain

-

Granton

-

Serrated

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Size Outlook (Revenue, USD Million, 2017 - 2030)

-

3-5 Inches

-

5-7 Inches

-

7-9 Inches

-

9-12 Inches

-

-

Price Outlook (Revenue, USD Million, 2017 - 2030)

-

Low (less than USD 100)

-

Medium (USD 100 – USD 200)

-

High (above USD 200)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Direct Selling

-

Brand Owned Stores

-

Online

-

-

Indirect Selling

-

Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global kitchen knives market size was estimated at USD 1.76 billion in 2022 and is expected to reach USD 1.96 billion in 2023.

b. The kitchen knives market is expected to grow at a compound annual growth rate of 11.2% from 2023 to 2030 to reach USD 4.12 billion by 2030

b. Europe region dominated the market with a revenue share of over 27.67% in 2022. The European market for kitchen knives is also driven by the region's strong culinary traditions and high demand for quality kitchen tools. Many European consumers are willing to invest in high-end kitchen knives for professional and home use, which further fuels the growth of the market.

b. Some of the key market players in the kitchen knives market are Friedr. Dick GmbH & Co. KG ; MAC Knife; Masamoto Sohonten Co., Ltd.; Victorinox AG Wüsthof;Zwilling J. A. Henckels ;Kyocera ;Dexter-Russell, Inc.;Messermeister, Inc.;Misen, LLC;Calphalon

b. Key factors that are driving the kitchen knives market growth include the increased interest in cooking, the growing popularity of cooking shows and social media, the changing consumer preferences, and the growing demand for premium and innovative products. Furthermore, the rising disposable income has led to an increase in demand for premium and innovative products. Consumers are willing to spend more on high-quality kitchen knives that offer superior performance, durability, and convenience.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."