- Home

- »

- Beauty & Personal Care

- »

-

Lip Care Products Market Size, Share, Industry Report, 2030GVR Report cover

![Lip Care Products Market Size, Share & Trends Report]()

Lip Care Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Lip Balm, Lip Scrub), By Distribution Channel (Hypermarket & Supermarket, Specialty Store), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-863-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lip Care Products Market Summary

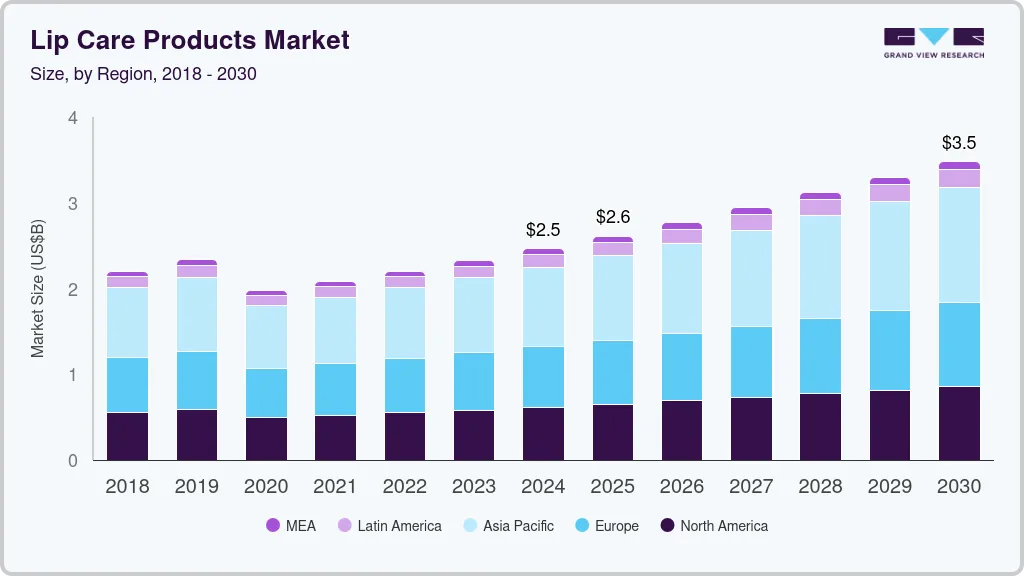

The global lip care products market size was estimated at USD 2.47 billion in 2024 and is projected to reach USD 3.48 Billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The increasing awareness about personal grooming and appearance among consumers has significantly boosted the demand for lip care products.

Key Market Trends & Insights

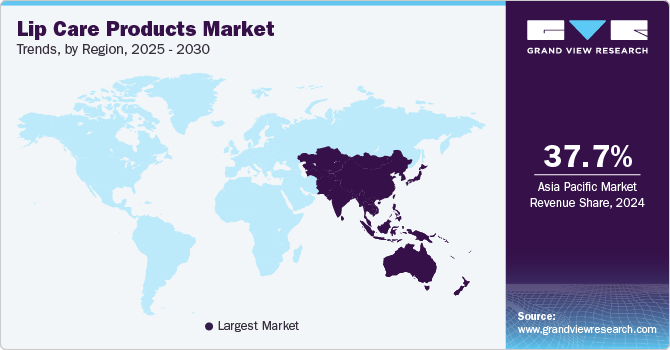

- Asia Pacific lip care products industry dominated the global market with the largest revenue share of 37.7% in 2024.

- The U.S. lip care products industry is expected to grow significantly over the forecast period.

- By product, lip balm dominated the market with the largest revenue share of 44.2% in 2024.

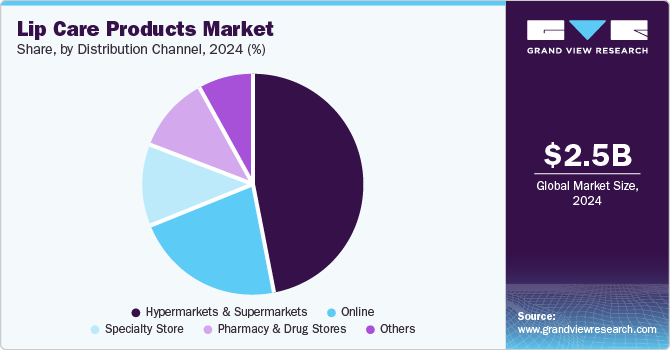

- By distribution channel, hypermarkets & supermarkets dominated the segment with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.47 Billion

- 2030 Projected Market Size: USD 3.48 Billion

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest market in 2024

The rising influence of social media and beauty trends encourages individuals to invest in quality lip care products to maintain smooth and healthy lips. Additionally, the growing prevalence of environmental factors such as pollution, UV radiation, and harsh weather conditions has increased the need for protective lip care solutions

Growing concerns related to prolonged sun exposure, dryness, premature aging, and lip darkening have resulted in an increased demand for high-quality products among consumers. Moreover, there has been an increasing focus on organic and natural lip balms as consumers are seeking safer alternatives that are free from synthetic and toxic chemicals. The ongoing trend of personal grooming and wellness is driving an increasing number of male consumers to adopt these products.

The innovative product launches with natural and organic ingredients have gained popularity among health-conscious consumers, further propelling market growth. In January 2025, Lotus Herbals introduced a premium lip balm range targeting Gen Z and millennials. The range includes three variants: Peptide, Café Mocha, and Sugar Delight. The balms offer long-lasting hydration with high-performance active ingredients. With SPF 15, provides UV protection while maintaining a natural sheen. Aligned with Lotus Herbals' Green Beauty commitment, these vegan lip balms are alcohol-and paraben-free, reflecting the brand's dedication to clean, ethical, and natural skincare products.

The expanding e-commerce has facilitated easy accessibility and wider distribution of lip care products, contributing to the market's upward trajectory. The growing demand for celebrity-owned brands is creating a huge impact in the market. For instance, Kriti Sanon’s HYPHEN achieved unprecedented success with its All I Need Lipscreen, going viral on social media within six months of its launch. The product, known for its effective formulation combining SPF 30 and 2% Kojic Acid, has sold out completely online. HYPHEN’s strategic partnerships with beauty retailers such as Nykaa and Amazon have further amplified its reach. The product’s popularity has been bolstered by positive reviews and widespread social media engagement, setting new standards in lip care products.

Product Insights

Lip balm dominated the market with the largest revenue share of 44.2% in 2024. This growth is driven by its widespread use and convenience. Many consumers consider lip balm essential for daily lip care, making it a staple in their personal care routines. The increasing availability of lip balms with various flavors and tints and added benefits like SPF protection have further fueled their popularity. In January 2025, Typology introduced its first refillable lip balm, available in both transparent and tinted versions. Enriched with ceramides and hyaluronic acid, these balms provide subtle to brilliant color while optimizing hydration. The result is supple, enhanced, and plumped-up lips, aligning with Typology's commitment to sustainable beauty solutions. Moreover, the trend towards natural and organic lip balms has attracted a segment of health-conscious consumers, contributing to the product's dominant market position.

The lip scrub segment is expected to grow at a significant CAGR of 5.6% over the forecast period. Lip scrubs, which help remove dead skin cells and enhance the smoothness and appearance of lips, are gaining traction among individuals seeking more comprehensive lip care routines. Additionally, incorporating natural and organic ingredients in lip scrubs resonates well with health-conscious consumers, further driving demand in this segment. For instance, Dot & Key’s sugar lip scrub enriched with Vitamin E is ideal for dark lips. This lip scrub gently exfoliates, evens-tones, and softens & smoothens lips and is made with 35% real sugar cane and cocoa bean.

Distribution Channel Insights

Hypermarkets & supermarkets dominated the segment with the largest revenue share in 2024. These retail formats offer a wide range of lip care products, allowing consumers to compare and choose from various brands and formulations. Furthermore, the convenience of one-stop shopping and the availability of promotional offers and discounts in hypermarkets and supermarkets make them an attractive option for consumers. In addition, the extensive reach and presence of these retail outlets in urban and rural areas ensure easy accessibility for a large consumer base, contributing to their significant market share.

The specialty store segment is expected to grow significantly over the forecast period. The growing consumer preference for personalized, high-quality lip care products drives this anticipated surge. Specialty stores often offer a curated selection of premium and niche brands not readily available in mainstream retail outlets. Furthermore, these stores provide a more engaging and knowledgeable shopping experience, with staff who can offer expert advice and tailored recommendations. The increasing popularity of specialty stores among discerning consumers seeking unique and high-performance lip care products is expected to drive the growth of this segment. For instance, In August 2024, Laneige, a prominent Korean skincare brand, celebrated its launch at Sephora India with an exclusive event at Nexus Select CityWalk Mall in New Delhi. Attended by influencers and media, the event introduced Laneige's hydration-focused products, including new Lip Balms and mini Lip Sleeping Mask flavors. Paul Lee, Country Head of Amore Pacific India, highlighted Laneige's omnichannel expansion strategy, enhancing its online and offline presence in India.

Regional Insights

Asia Pacific lip care products industry dominated the global market with the largest revenue share of 37.7% in 2024. This dominance is primarily attributed to the rising disposable income and increasing awareness about personal care and grooming in countries such as China, India, and Japan. Additionally, the growing urban population and the influence of K-beauty trends have significantly contributed to the high demand for lip care products in this region. The presence of numerous local and international brands offering a wide variety of lip care products also plays a crucial role in the market's strong performance in the Asia Pacific. For instance, in November 2024, Loops, a renowned K-beauty brand, ventured into the lip care category with the launch of Dew Cloud Ultra Hydrating Lip Mask and Dew Cloud Ultra Hydrating Face Mask. These products, termed 'The Ultimate Hydrating Duo,' provide intense hydration and nourishment, addressing common skin concerns like dryness and pollution damage. Developed in South Korea, they are ideal for all skin types, offering water light hydration, barrier protection, and anti-aging benefits.

Europe Lip Care Products Market Trends

Europe lip care products industry held a considerable share in 2024. This rapid growth is attributed to the strong emphasis on personal care and grooming among European consumers. The presence of well-established beauty and personal care brands, along with a growing demand for natural and organic lip care products, has further driven market growth in the region. For instance, In May 2024, Marks & Spencer expanded its Percy Pig brand into the beauty sector by collaborating with Dr. PawPaw to launch a 'Percy pink' tinted lip oil. The product is available at M&S stores across the UK. The lip oil offers subtle color, hydration, and nourishment, using natural pawpaw ingredients and the signature Percy Pig scent. This strategic collaboration aims to leverage Percy Pig's strong brand recognition and enhance customer engagement through innovative product development. Additionally, the increasing awareness about the harmful effects of environmental factors on skin and lips has led to a higher adoption of protective and restorative lip care solutions, contributing to the market's significant share in Europe.

North America Lip Care Products Market Trends

North America lip care products industry is expected to grow at a significant CAGR of 5.7% over the forecast period. Increasing consumer awareness about the importance of lip care and the rising demand for natural and organic products are the key drivers in the region. Additionally, the growing influence of social media and beauty influencers in promoting lip care routines and products has fueled the market. The availability of innovative and multifunctional lip care products, such as those offering hydration, protection, and color, also contributes to the market's expansion in North America. For instance, in November 2024, Albéa Cosmetics launched a new North America Collection featuring sustainable packaging for lipsticks, mascaras, and more. Produced at Albéa Matamoros in Mexico, the collection supports greater efficiency for the American market, offering faster delivery times and reduced transportation emissions. The Bloom stick and On Fleek stick provide versatile options for lipsticks, balms, and face sticks. This collection underscores Albéa’s commitment to sustainability and innovation, reducing its carbon footprint and strengthening customer relationships through local manufacturing.

U.S. Lip Care Products Market Trends

The U.S. lip care products industry is expected to grow significantly over the forecast period. The country's growth is attributed to the growing consumer demand for organic, natural, and healthier lip care solutions. Furthermore, the high spending capacity of the population and growing awareness of self-care are expected to drive market growth. For instance, in September 2024, Bubble Skincare entered the lip care market with the Tell-All Juicy Secret Lip Balm, its first lip care product since the brand's 2020 launch. Priced at USD 9, this balm features a hydrating, non-sticky formula for plump lips and comes as a keychain with five customizable charms (USD 8-USD 15).

Key Lip Care Products Company Insights

Some key companies in the lip care products market include L'Oreal S.A., Johnson & Johnson Services, Inc., Colgate-Palmolive Company, Procter & Gamble, Beiersdorf, and others.

-

L'Oréal S.A. is a global leader in beauty and personal care products, including a wide range of lip care items. Company’s lip care line products including L'Oréal Paris Glow Paradise Hydrating Lip Balm-in-Gloss, which is infused with pomegranate extract and hyaluronic acid to provide hydration and a natural, sheer color. It also offer L'Oréal Paris Color Riche lipsticks and Infallible Matte lipsticks, known for their long-lasting color and moisturizing properties

Key Lip Care Products Companies:

The following are the leading companies in the lip care products market. These companies collectively hold the largest market share and dictate industry trends.

- L'Oreal S.A.

- Johnson & Johnson Services, Inc.

- Colgate-Palmolive Company

- Procter & Gamble

- Beiersdorf

- The Estée Lauder Companies

- Unilever

- Avon

- Shiseido Company

- Revlon

Recent Developments

-

In October 2024, NIVEA launched its renowned NIVEA Caring Beauty Lip & Cheek tint in India. This multifunctional product provides 24-hour moisture and SPF 30 UV protection while offering a buildable color for both lips and cheeks. Formulated with Vitamin E and Organic Almond Oil, it nourishes the skin and ensures smooth application. Available in three shades-Red, Pink, and Rose-the tint is designed for the modern Indian woman's fast-paced beauty routine.

Lip Care Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.61 billion

Revenue forecast in 2030

USD 3.48 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Australia, South Africa, Saudi Arabia

Key companies profiled

L'Oreal S.A.; Johnson & Johnson Services, Inc.; Colgate-Palmolive Company; Procter & Gamble; Beiersdorf; The Estée Lauder Companies; Unilever; Avon; Shiseido Company; Revlon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lip Care Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lip care products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Lip Balm

-

Lip Scrub

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drug Store

-

Specialty Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.