- Home

- »

- Beauty & Personal Care

- »

-

Lipstick Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Lipstick Market Size, Share & Trends Report]()

Lipstick Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Shimmer, Matte, Cream, Long-wearing), By Applicator (Tube/Stick, Pencil, Palette, Liquid), By Age (Under 20, 20-30, 31-50, Over 50), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-167-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lipstick Market Summary

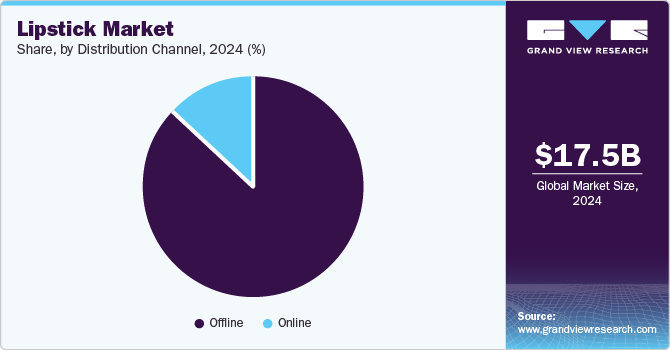

The global lipstick market size was valued at USD 17.49 billion in 2024 and is projected to reach USD 23.77 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. The growing female population globally and their rising focus on improving overall appearance have created a significant demand for beauty and cosmetic items, with lipsticks being a major product.

Key Market Trends & Insights

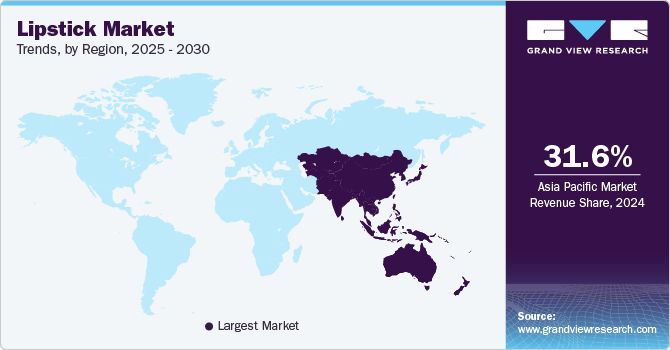

- Asia Pacific led the market with 31.6% of the global revenue share in 2024 and is further expected to expand at the fastest CAGR from 2025 to 2030.

- The U.S. accounted for the largest revenue share in the North American lipstick industry in 2024.

- In terms of products, shimmer lipsticks segment accounted for a leading revenue share of 37.2% in 2024.

- In terms of applicator, the tube/stick segment accounted for a dominant revenue share in 2024.

- In terms of age, the under 20 segment accounted for a leading revenue share in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.49 Billion

- 2030 Projected Market Size: USD 23.77 Billion

- CAGR (2025-2030): 4.7%

- Asia Pacific: Largest market in 2024

Moreover, the increasing use of social media platforms and the expanding influencer marketing trends have contributed to the widespread popularity of lip products. These platforms showcase international fashion and beauty trends that are often embraced by consumers. The growing pace of urbanization in emerging economies and higher disposable income levels have encouraged consumers to spend more on improving their appearance, boosting sales of lipsticks and other cosmetic products.

The increasing popularity of online shopping due to rapid internet proliferation and extensive smartphone usage has compelled leading beauty and cosmetic companies to expand their online presence. There has been a growing demand for unique and bold lipstick shades, with younger demographics frequently experimenting with non-traditional colors such as blue, green, and purple. Additionally, inclusive lipstick collections that cater to a wide range of skin tones are gaining popularity. Countries such as the U.S., China, Germany, the UK, and France remain major markets for lipstick, aided by a strong presence of premium and luxury lipstick brands, as well as rising demand for clean beauty and vegan formulations.

In recent years, there has been a steadily increasing demand for lip products made with natural, vegan, and cruelty-free ingredients. Brands are responding by formulating lipsticks with clean and ethical ingredients, which is positively advancing the industry among environment-conscious consumers. This concept has also extended to the packaging of these products, with many lipstick brands introducing eco-friendly and recyclable packaging solutions. Sustainable options such as refillable lipstick tubes and biodegradable materials are becoming popular among consumers, adding other growth opportunities for market players.

Many brands release limited-edition lipstick shades that are made available through both online and offline modes. These exclusive products often create a sense of urgency and exclusivity, appealing to customers to make an instant purchase while visiting the shop or website. Technological advancements are expected to be vital in making lipstick more sustainable, innovative, and appealing to modern consumers. Brands are leveraging new formulas to ensure richer colors, longer wear, and improved moisturizing properties, significantly elevating the user experience. Packaging innovations like sleek designs and magnetic closures have enabled them to create more comprehensive product ranges. Advancements in pigment technology have aided companies in creating novel shades customized according to individual preferences. These trends are expanding to emerging markets such as China, Brazil, and India, thus maintaining a positive industry outlook.

Product Insights

In terms of products, shimmer lipsticks accounted for a leading revenue share of 37.2% in 2024. The demand for these products has steadily risen, particularly among consumers looking to include more diverse and attractive options in their makeup routines. Shimmer lipstick adds radiance and light reflection to the lips, making them appear fuller and more defined. This shift towards radiant finishes reflects broader beauty trends, where highlighter and luminous skin products have become highly popular. Social media platforms play a significant role in further driving the demand for shimmer lipsticks. Beauty influencers and makeup artists often showcase these lipsticks in their makeup tutorials, thus popularizing the product by demonstrating how it can enhance lips and create fashionable looks.

Meanwhile, the matte segment is expected to grow at the fastest CAGR during the forecast period. Matte lipstick offers a velvety and non-shiny finish that is long-lasting and typically more intense in color, which helps offer a more modern and sophisticated appearance. Their high pigmentation helps provide rich and vibrant colors when applied, while they are also long-lasting when compared to glossy lipsticks due to their formula that lacks moisture and shine. Matte lipstick reduces the risk of color transfer, which helps prevent lipstick marks on glasses or other surfaces. Collaborations between beauty & fashion influencers and cosmetic companies are frequent in the market, driving the launch of premium and innovative products. In February 2024, designer Sabyasachi Mukherjee collaborated with Estee Lauder, launching a limited-edition lipstick range with ten shades. The Satin Matte and Ultra Matte Lipsticks product line includes shades such as Bombay Berry, Udaipur Coral, and Calcutta Red.

Applicator Insights

The tube/stick segment accounted for a dominant revenue share in 2024, owing to the easy application and portability features offered by these applicators. Tube applicators are compact, lightweight, and convenient to carry in purses, bags, and pockets, making them ideal for on-the-go applications. They allow users to quickly touch up their lipstick throughout the day during work, between meetings, and at social events. Additionally, since the product is directly dispensed from the tube, it minimizes the need for fingers or brushes to come into contact with the product, reducing the risk of any kind of contamination or entry of bacteria. This is especially important for lip products, as the skin around the mouth can be more prone to irritation or infection. Manufacturers are introducing precise applicator tips that enable better control during application, which is expected to boost segment growth further.

The liquid segment is anticipated to grow at the fastest CAGR during the forecast period. The increasing popularity of glitter finish and matte finish products has driven substantial sales of liquid applicators in recent years. Liquid lipstick applicators have a doe-foot or angled tip that allows for a more defined lip line, which is especially helpful for consumers who prefer creating sharp edges or filling in their lips with high accuracy. Many liquid lipsticks are being formulated to be long-wearing, with matte or transfer-proof options that are ideal for all-day wear. The liquid formula generally dries down to a smudge-proof finish, making it a suitable option for people with busy schedules or those needing lipstick to stay in place through meals, drinks, and meetings.

Age Insights

The under 20 segment accounted for a leading revenue share in the global market in 2024. This consumer age group is highly active on social media platforms such as Instagram and TikTok, as well as on fashion blogs and YouTube channels. Increased subscribers and viewership have made such platforms crucial for lipstick companies to expand their customer base by creating successful marketing campaigns. Moreover, the younger female demographic is interested in experimenting with new products. Teenagers and college-going students are major customers for beauty firms, as these consumers are constantly seeking new trends and product innovations. Beauty brands are introducing lipsticks with natural and eco-friendly ingredients and minimal packaging to reflect the rapidly increasing demand for sustainable offerings in this segment.

The 20-30 age group segment is expected to grow at the fastest CAGR during the forecast period in the lipstick industry. Steadily rising women’s participation in the global workforce and increasing consciousness regarding their appearance are major demand drivers. Young working professionals, particularly those with busy schedules, often prefer quick and efficient beauty routines. Lipstick is considered an easy, on-the-go product that can be applied quickly. Products that offer added functionalities, such as lip and cheek tints or those with long-lasting formulas that do not require frequent reapplication, are ideal for this lifestyle. The emergence of niche beauty brands has made it easier for women in this age group to access high-quality and trending products that are also cost-efficient. The expanding use of social media and influencer culture are other notable drivers aiding market expansion through this segment.

Distribution Channel Insights

The offline segment accounted for a dominant revenue share in the global market in 2024. The increasing presence of international and regional cosmetic brands through specialty beauty stores and supermarkets & hypermarkets has made it convenient for customers to view and test different products. Companies aim to improve customer engagement by offering color charts and employing in-store professionals who can recommend the ideal color and shade. Consumers can easily sample different shades, textures, and finish directly on their lips or wrists. Many stores offer testers and sanitary applicators for hygiene purposes, allowing consumers to confidently experiment with different products. Moreover, beauty stores are increasingly leveraging digital or interactive displays where customers can view different lipstick shades on virtual models, enhancing the in-store shopping experience.

The online segment is anticipated to grow rapidly from 2025 to 2030. The increasing use of smartphones and rapid internet proliferation, particularly in emerging economies, has compelled beauty brands to offer their products through online platforms. These brands aim to improve customer service and retention by offering a seamless browsing experience on their websites, providing an extensive product range, and giving significant discounts on these items. They also offer major discounts/sales during festive events and holidays, which further increases website traffic and customer conversion. Moreover, brands are collaborating with influencers who use social media channels to drive awareness about new lipstick shades and colors among their audience. These advantages offered by online shopping platforms have encouraged smaller brands to establish an online presence that can substantially boost their customer base.

Regional Insights

North America accounted for a substantial revenue share in the market in 2024, owing to the extensive presence of major cosmetic brands in the U.S. and Canada, rising awareness regarding innovative beauty products among female consumers, and the well-established e-commerce industry. Additionally, companies are launching various campaigns centered on women’s empowerment and freedom of expression while launching beauty products, which further compel customers to purchase lipsticks, as they are considered an easy way to experiment with personal style. Platforms such as TikTok, YouTube, and Instagram are extremely popular, particularly among teenagers and younger working professionals, which provides a major opportunity for companies to attract a higher customer base through contests, activities, and giveaways.

U.S. Lipstick Market Trends

The U.S. accounted for the largest revenue share in the North American lipstick industry in 2024. The country is well-known globally for its strong celebrity culture, with various Hollywood actors and models promoting products from leading beauty brands such as Maybelline, Revlon, and Estée Lauder. Celebrities are launching their own product lines in partnership with beauty companies, driving further product awareness. For instance, Dolly Parton, an American singer-songwriter and actress, launched Dolly Beauty in collaboration with Scent Beauty in August 2024. The brand was launched online, with physical store availability expected in 2025. Its product range at the time of launch consisted of the Heaven’s Kiss Lipstick collection in four shades: Honey Plum, Jolene Red, Birthday Suit, and Rosebud. Such initiatives have enabled healthy market growth in the economy.

Asia Pacific Lipstick Market Trends

Asia Pacific led the market with 31.6% of the global revenue share in 2024 and is further expected to expand at the fastest CAGR from 2025 to 2030. The continued growth in urbanization in the region, coupled with the steadily increasing demographic of working female professionals, has created substantial demand for lipsticks in economies such as China, India, and Japan. Major brands such as L’Oréal, Revlon, and Maybelline have significantly expanded their presence to benefit from the strong customer base and evolving trends in the beauty and cosmetics sector. The strengthening online marketplace has further encouraged sellers to collaborate with major brands and boost product sales. For instance, in July 2024, India-based lifestyle and beauty retailer Nykaa announced that it would be launching the French luxury fashion brand Yves Saint Laurent’s products in India. The company introduced several offerings, including foundations, lipsticks, mascaras, and eye palettes for Indian customers, making them available on Nykaa’s website and application, as well as select Luxe stores in the country.

China lipstick market accounted for the largest revenue share in the Asia Pacific lipstick industry in 2024 and is expected to retain its position from 2025 to 2030. This demand has been driven by strong government support to encourage women’s participation in the workforce, exponential growth of e-commerce platforms, and rising social media influence among Chinese consumers. Local market players have substantially expanded their presence in this industry by introducing innovative technologies and products. For instance, in October 2023, Perfect Diary, a Chinese brand, launched its novel ‘BioLip Essence Lipstick.’ The company leveraged its proprietary ‘biolip’ technology, which has been stated to provide lip essence and lip mask benefits.

Key Lipstick Company Insights

Some key companies involved in the lipstick industry include L’Oréal SA, Revlon, and Procter & Gamble. To expand their business, companies are focusing on strategic mergers and acquisitions, product development, and innovative packaging.

-

L’Oréal SA is a personal care company specializing in manufacturing and marketing cosmetic products, hair care, skincare, sun care, perfumes, and colouring solutions. The company operates through four major divisions, including L’Oréal Luxe, Professional Products, Consumer Products, and Dermatological Beauty. L’Oréal produces several well-known lipstick lines, including Color Riche, Infallible Pro-Matte, Rouge Signature Matte Liquid Lipstick, and Le Matte Lip Crayon. It is known for introducing new technologies and formulations in lipsticks that cater to modern beauty demands.

-

Revlon is a U.S.-based multinational company that manufactures and sells cosmetics, skincare, and personal care products, deodorants and perfumes, and men’s grooming products, among others. The company offers products through notable brands, including Revlon, Elizabeth Arden, Almay, American Crew, CND, Sinful Colors, Mitchum, and John Varvatos. Revlon’s lipstick portfolio includes several different formulations, including matte, creamy, glossy, liquid lipsticks, and lip balms & stains. Notable lipstick lines include Revlon Super Lustrous Lipstick, Revlon ColorStay Ultimate Suede Lipstick, Revlon Ultra HD Matte Lipcolor, and Revlon Kiss Balm and Lipstick Stains.

Key Lipstick Companies:

The following are the leading companies in the lipstick market. These companies collectively hold the largest market share and dictate industry trends.

- L’Oréal S.A.

- Estée Lauder Inc

- Revlon

- Coty Inc.

- Procter & Gamble

- Shiseido Co.,Ltd.

- Unilever

- Chanel S.A.

- Parfums Christian Dior

- Beiersdorf AG

Recent Developments

-

In September 2024, L’Oréal announced its partnership with Abolis Biotechnologies, an innovative biotech company, and Evonik, a specialty products manufacturer. The collaboration would involve discovering, developing, and manufacturing sustainable and innovative ingredients for beauty products and other applications. Through this initiative, purpose-made and sustainable ingredients would be produced at a global scale to address the need for responsible beauty. Furthermore, it would help speed up the company’s ‘L’Oréal for the Future’ sustainability projects that prioritize using bio-based ingredients in the brand’s beauty formulations.

-

In September 2023, Shiseido announced that it had developed the “Water Sensing Technology” for lipsticks that offer long-lasting color and adhesion-less effects.

Lipstick Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.85 billion

Revenue Forecast in 2030

USD 23.77 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, applicator, age, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

L’Oréal S.A.; Estée Lauder Inc; Revlon; Coty Inc.; Procter & Gamble; Shiseido Co.,Ltd.; Unilever; Chanel S.A.; Parfums Christian Dior; Beiersdorf AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lipstick Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lipstick market report based on product, applicator, age, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shimmer

-

Matte

-

Cream

-

Long-wearing

-

-

Applicator Outlook (Revenue, USD Million, 2018 - 2030)

-

Palette

-

Pencil

-

Tube/Stick

-

Liquid

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

Under 20

-

20-30

-

31-50

-

Over 50

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.