- Home

- »

- Beauty & Personal Care

- »

-

Liquid Soap Market Size, Share And Trends Report, 2030GVR Report cover

![Liquid Soap Market Size, Share & Trends Report]()

Liquid Soap Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Organic, Conventional), By Distribution Channel, By End Use (Household, Commercial) By Region, And Segment Forecasts

- Report ID: GVR-3-68038-239-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Soap Market Summary

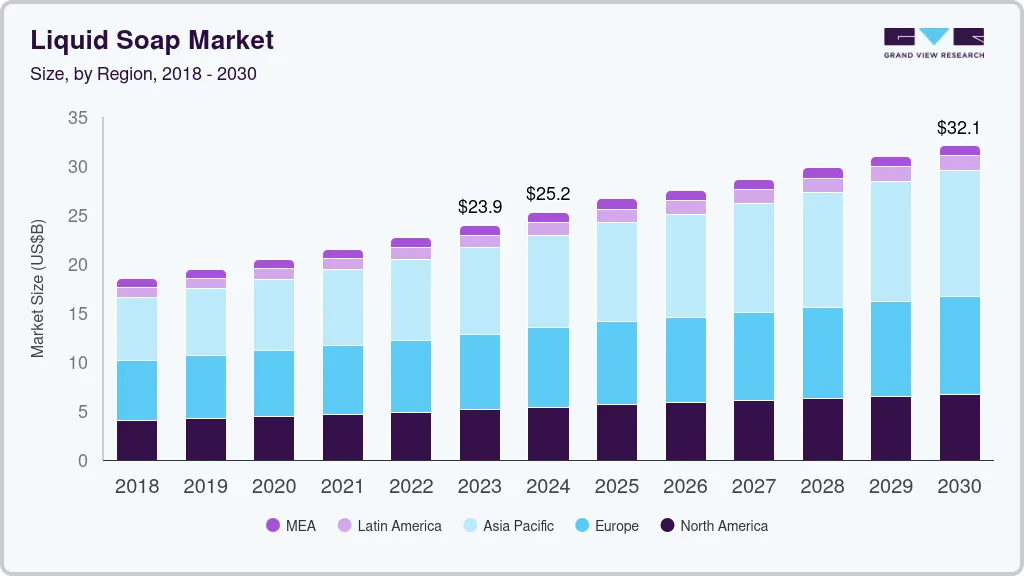

The global liquid soap market size was estimated at USD 23.9 billion in 2023 and is projected to reach USD 32.14 billion by 2030, growing at a CAGR of 4.13% from 2024 to 2030. Lifestyle changes and urbanization have contributed to the popularity of liquid soap.

Key Market Trends & Insights

- Asia Pacific liquid soap market held the largest market revenue share of 36.8% in 2023.

- The U.S. market is anticipated to grow significantly in the coming years.

- The North America liquid soap market is projected to grow rapidly over the forecast period.

- Based on product, conventional segment dominated the market in 2023 and held the largest market revenue share of 71.6%.

- In terms of distribution channel, the hypermarkets & supermarket segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 23.9 billion

- 2030 Projected Market Size: USD 32.14 billion

- CAGR (2024-2030): 4.13%

- Asia Pacific: Largest market in 2023

- India: Fastest growing market

In urban settings, where consumers often seek convenience and efficiency in their daily routines, liquid soap provides a quick and effective way to cleanse hands and bodies. Liquid soap's ease of use and availability in various formulations, including antibacterial and moisturizing variants, further enhances its appeal to different consumer segments. Another factor driving demand is the increasing focus on personal grooming and skincare. Liquid soaps are often formulated with ingredients that cater to specific skin types and conditions, promoting hydration and maintaining skin health. This cosmetic aspect appeals to consumers who prioritize skincare benefits alongside basic hygiene.The retail environment has also played a crucial role in expanding the liquid soap market. Manufacturers have introduced innovative packaging designs and product formulations to differentiate their offerings and capture consumer interest. This includes eco-friendly packaging solutions and products with natural ingredients, responding to growing consumer preferences for sustainability and health-conscious choices.

The rising awareness about preventing bacterial infection among consumers is driving the demand for liquid soap. Liquid soap is utilized to clean hands and other external surfaces such as tiles, floors, clothes, and utensils, which helps prevent bacterial infection. Several countries' governments are taking measurable actions to hold personal hygiene approaches by the common public, such as proper hygiene maintenance at public toilets. In addition, using liquid soaps to prevent health-related problems in hospitals, diagnostic centers, and healthcare institutions increased demand for liquid soap.

Product Insights

Conventional segment dominated the market in 2023 and held the largest market revenue share of 71.6%. Conventional liquid soaps typically feature basic formulations that effectively cleanse without specialized ingredients or advanced technologies, making them cost-effective to produce and purchase. This affordability appeals to budget-conscious consumers and those accustomed to traditional hygiene practices. Additionally, the familiarity with conventional liquid soap formulations instills trust and reliability among users, reinforcing their preference for these products over newer, more specialized alternatives.

The organic segment is projected to grow at a significant of over the forecast period. Organic liquid soaps are perceived as safer alternatives to conventional ones, as they are often free from synthetic chemicals, additives, and artificial fragrances that some consumers associate with potential health risks. Moreover, the growing trend towards eco-conscious consumption patterns has fueled demand for products produced using environmentally friendly practices. This shift in consumer preferences is driving manufacturers to expand their offerings in the organic segment of the liquid soap market, expecting to cater to a growing segment of environmentally aware and health-conscious consumers seeking products aligned with their values.

Distribution Channel Insights

The hypermarkets & supermarket segment held the largest market revenue share in 2023. Supermarkets and hypermarkets provide the benefit of selecting from a wide range of alternatives in one place and attractive discounts on bulk purchases and seasonal offers to attract consumers to purchase products, resulting in the market's growth. Many individuals prefer to buy liquid soap from local physical stores because they are convenient for their native places. The rapid development of emerging nations is driving the expansion of supermarkets and hypermarkets. The demand for cleaning products in retail stores, such as supermarkets and hypermarkets, increases as these economies develop, which results in the increased demand for liquid soap.

The online segment is projected to grow at the fastest CAGR during the forecast period. The rapid expansion of e-commerce platforms has contributed to this growth. E-commerce websites offer the convenience of home delivery services, allowing consumers to purchase from their comfort spaces. Consumers can select products according to their preference of brand, size, flavor, and price. E-commerce platforms often offer discounts and coupons, attracting consumers to purchase from online platforms. These factors are driving consumers to purchase liquid soap products from online platforms.

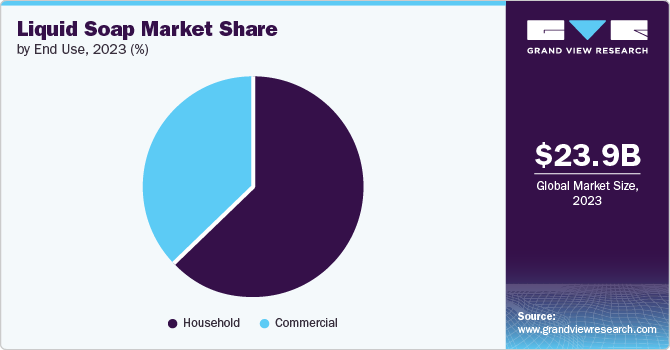

End Use Insights

The household segment dominated the market in 2023. The rising demand for liquid soap in the household segment is primarily driven by shifting consumer preferences towards convenience and hygiene. Liquid soap offers greater convenience than traditional bar soap, as it is easier to use and less messy. As lifestyles become busier, consumers value products that save time and provide enhanced hygiene benefits. Additionally, increasing disposable incomes have allowed consumers to prioritize personal care products like liquid soap, further boosting market growth in the household segment.

The commercial segment is projected to grow with a significant CAGR over the forecast period. Commercial establishments such as offices, hotels, and healthcare facilities prioritize hygiene and cleanliness, driving continuous demand for handwashing products like liquid soap. With a heightened focus on health and sanitation, especially considering recent global health crises, businesses are increasingly adopting stringent cleanliness standards to safeguard customers and employees. Moreover, the convenience and ease of use offered by liquid soap and advancements in formulations that cater to specific needs further bolster its requirement in commercial settings.

Regional Insights

The North America liquid soap market is projected to grow rapidly over the forecast period. Consumer preferences have shifted towards liquid soap over traditional bar soap due to perceived convenience, hygiene, and ease of use, especially in households and public settings. Liquid soap is often seen as more sanitary since it eliminates sharing soap bars, which aligns with heightened awareness of hygiene post-pandemic. Additionally, innovations in product formulations, such as moisturizing and antibacterial properties, appeal to consumers looking for multifunctional hygiene solutions. Moreover, the retail landscape in North America, including widespread availability in supermarkets, pharmacies, and online platforms, has bolstered accessibility and contributed to the market's growth.

U.S. Liquid Soap Market Trends

The U.S. market is anticipated to grow significantly in the coming years. The nation's higher disposable income allows consumers to spend more on personal hygiene products, such as premium liquid soaps with added fragrances. Rising concerns about the spread of infectious diseases and germs are influencing consumers to purchase hygiene products to protect themselves from these situations.

Europe Liquid Soap Market Trends

Europe market is projected to grow with the significant CAGR of the forecast period. The anticipated rise in demand for liquid soap in Europe is expected to be driven by the strong presence of highly industrialized nations. Organic product manufacturers are encouraged by favorable government initiatives, including organic product certification and eco-labels, leading to significant market growth for products made with organic ingredients. Additionally, businesses are increasingly utilizing recycled plastic for packaging due to the growing environmental awareness.

The UK liquid soap market is projected to grow significantly. The rising concerns about bacterial diseases are influencing consumers to spend more on personal hygiene products. The rapidly growing tourism industry in the UK, resulting in the expansion of the hotel industry, is driving the demand for liquid soaps in the commercial sector. Continuous innovations in the liquid soap products, such as improving the product quality, introducing new fragrances in the product line, and innovations in the dispensers, are driving the market growth.

Asia Pacific Liquid Soap Market Trends

Asia Pacific liquid soap market held the largest market revenue share of 36.8% in 2023. Rising disposal income in the region, allowing consumers to purchase personal care and hygiene products such as liquid soaps, is driving the market. Additionally, lifestyle shifts in Asia-Pacific are becoming rapid, with a quick transition to convenient and user-friendly products. Liquid soap, with its easy-to-use packaging and dispensing systems, aligns well with these evolving preferences. Furthermore, the rising recognition of the significance of health and hygiene in the region also contributes to the market's expansion.

India liquid soap market is projected to grow significantly in the coming years. India is the largest populated country in the world. The rapidly increasing population drives the fast-growing demand for hygiene products. Rising health awareness and hygiene consciousness, particularly among the urban population, have driven demand for liquid soaps. Premium liquid soap and liquid body washes are gaining popularity in urban areas. Organic liquid soaps from essential oils and organic ingredients are gaining popularity among eco-conscious consumers.

The growing emphasis on hygiene and cleanliness, driven by heightened health and sanitation awareness, drives the market demand. Liquid soap is perceived as more convenient and hygienic than traditional bar soap, as it minimizes direct contact and ensures consistent dispensing. Moreover, the increasing disposable income among the middle class has increased spending on personal care products, including premium liquid soap variants that offer additional benefits such as moisturizing or antibacterial properties.

Key Liquid Soap Company Insights

Some of the key companies in the liquid soap market include GOJO, Procter & Gamble, Reckitt Benckiser Group plc., Unilever, Godrej Consumer Products.

-

GOJO offers liquid hand soap Purell, a gentle non-antimicrobial soap that effectively eliminates both transient and resident microorganisms on the skin. Foam soap refills are also accessible for healthcare, professional, and foodservice environments.

-

Procter & Gamble with its Safeguard liquid hand soap which has been created to provide a safe, simple, and efficient hand hygiene solution. It is specifically developed with an advanced surfactant formula to effectively remove dirt and bacteria. It is available in various sizes and in both antibacterial and non-antibacterial options.

Key Liquid Soap Companies:

The following are the leading companies in the liquid soap market. These companies collectively hold the largest market share and dictate industry trends.

- Reckitt Benckiser Group plc.

- Procter & Gamble

- Unilever

- 3M

- Lion Corporation

- GOJO Industries, Inc.

- Godrej Consumer Products

- Kao Chemicals

- Bluemoon Bodycare

- NEW AVON LLC.

Recent Developments

-

In March 2023, Lifebuoy announced the launch of a new liquid soap used for dishwashing. The company expanded its product portfolio by entering the dishwash category, aiming to meet the needs of value-conscious consumers. This move reflects Lifebuoy's strategy to diversify its offerings beyond traditional personal care products into household essentials.

-

In May 2024, Dove announced the launch of its most advanced body wash range, emphasizing innovation in skincare. The new body wash line features improved formulas and innovative packaging designed to provide consumers with a superior cleansing experience.

Liquid Soap Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.21 billion

Revenue forecast in 2030

USD 32.14 billion

Growth rate

CAGR of 4.13% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Reckitt Benckiser Group plc.; Procter & Gamble; Unilever; 3M; Lion Corporation; GOJO Industries, Inc.; Godrej Consumer Products; Kao Chemicals; Bluemoon Bodycare; NEW AVON LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Soap Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liquid soap market report based on product, distribution channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Conventional

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U. S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.