- Home

- »

- Clothing, Footwear & Accessories

- »

-

Luxury Apparel Market Size, Share, Industry Report, 2030GVR Report cover

![Luxury Apparel Market Size, Share & Trends Report]()

Luxury Apparel Market (2024 - 2030) Size, Share & Trends Analysis Report By End Use (Men, Women), By Distribution Channel (Online, Offline), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-3-68038-336-2

- Number of Report Pages: 79

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury Apparel Market Summary

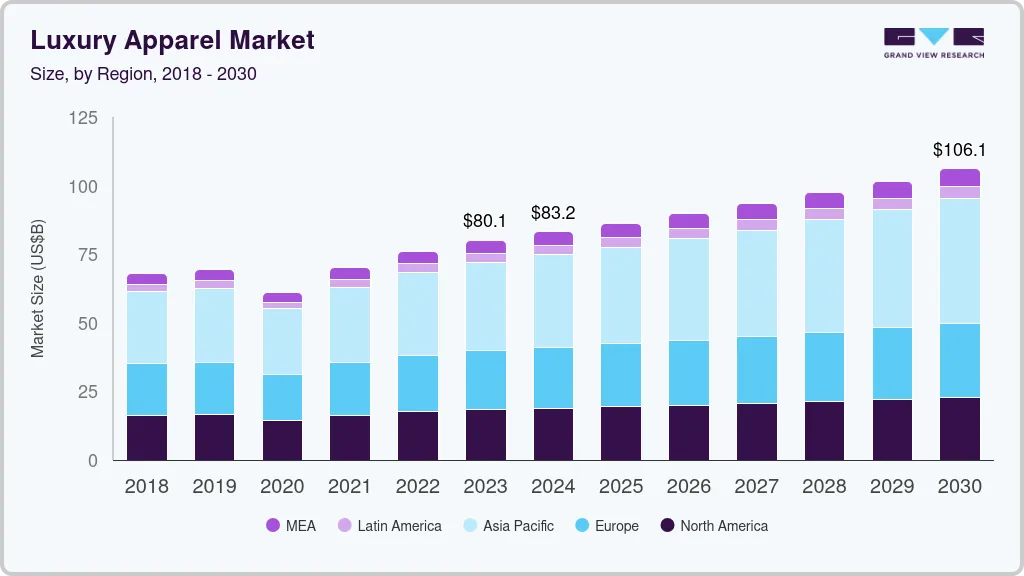

The global luxury apparel market size was estimated at USD 80.13 billion in 2023 and is projected to reach USD 106.10 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. The market growth is attributed to the rise in disposable income and changing lifestyle patterns due to rapid urbanization that have significantly boosted consumer spending on luxury goods.

Key Market Trends & Insights

- Asia Pacific luxury apparel market dominated globally with the largest revenue share of 40.1% in 2023.

- Japan’s luxury apparel market is expected to grow significantly over the forecast period.

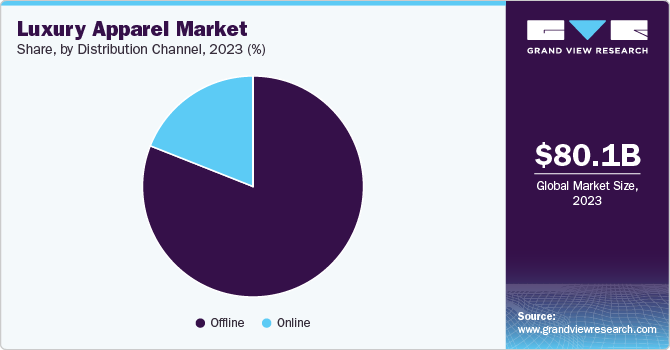

- Based on distribution channel, the offline distribution channel segment is dominated by the largest revenue share in 2023.

- Based on end use, the men segment dominated the market with the largest revenue share of 55.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 80.13 Billion

- 2030 Projected Market Size: USD 106.10 Billion

- CAGR (2024-2030): 4.1%%

- Asia Pacific: Largest market in 2023

Furthermore, the growing influence of social media and digital marketing has enhanced brand visibility and consumer engagement, making luxury apparel more accessible and desirable. The rising number of millionaires and brand loyalty among customers are anticipated to fuel the growth.The surge in e-commerce sales has also played a crucial role, providing consumers with convenient access to a wide range of luxury products. Furthermore, the growing acceptance of luxury fashion among millennials and Gen Z, more inclined toward high-end brands and unique fashion statements, has fueled market demand. In addition, emphasizing sustainable and ethically produced luxury apparel has attracted environmentally conscious consumers, further driving market growth.

The growing number of high-net-worth individuals and increasing disposable incomes boost demand for luxury fashion items. Additionally, the rise of digital platforms and social media has amplified brand visibility and consumer engagement, making luxury brands more accessible to a broader audience. The market also benefits from the globalization of fashion, with emerging economies, particularly in Asia Pacific, showing a strong appetite for luxury goods. These factors are anticipated to drive market growth.

Sustainability and ethical fashion have become crucial, with consumers increasingly favoring brands that prioritize eco-friendly practices. Furthermore, integrating advanced technologies like augmented reality enhances the shopping experience, attracting tech-savvy consumers. Lastly, the influence of millennials and Gen Z, who value unique and exclusive products, continues to shape the market dynamics.

End Use Insights

The men segment dominated the market with the largest revenue share of 55.0% in 2023. The segment’s growth is attributed to several factors, including the increasing disposable income among men and a growing inclination towards high-end fashion and premium brands. Men are increasingly seeking luxury apparel not only for its superior quality and craftsmanship but also to express their personal style and status. The segment has witnessed significant innovation, with brands offering a wide range of products, from bespoke suits to casual wear, catering to diverse tastes and preferences. In addition, the rise of online retail and social media has made luxury fashion more accessible, further driving the segment growth.

The women segment is expected to grow at the fastest CAGR of 4.5% over the forecast period. This surge is attributed to several key factors, including the increasing purchasing power of women and their growing preference for high-quality, stylish clothing. As more women enter the workforce and achieve higher income levels, their spending on luxury goods, particularly apparel, has seen a significant uptick. Additionally, the influence of social media and fashion influencers has amplified the desire for premium brands and exclusive designs. Luxury brands respond to this demand by expanding their product lines and offering more diverse and inclusive collections. The rise of e-commerce has also made luxury fashion more accessible to women worldwide, further fueling the segment’s growth.

Distribution Channel

The offline channel segment dominated the market with the largest revenue share in 2023. This dominance is attributed to physical stores' unique shopping experience, which is difficult to replicate online. Customers often prefer to visit brick-and-mortar stores to personally experience luxury apparel's quality, fit, and craftsmanship. Additionally, offline stores provide personalized services, such as bespoke tailoring and styling advice, which enhance the overall shopping experience. The ambiance and exclusivity of luxury boutiques also play a significant role in attracting high-end consumers. Despite the rise of e-commerce, the offline channel remains a crucial part of the luxury apparel market, catering to consumers who value the tangible and immersive aspects of shopping for luxury goods.

The online channel segment is expected to grow at the fastest CAGR over the forecast period. This rapid growth is driven by several factors, including the increasing penetration of the internet and the widespread adoption of smartphones, which make online shopping more accessible and convenient. Consumers are increasingly turning to online platforms for their luxury apparel purchases due to the ease of browsing a wide range of products, comparing prices, and reading reviews from other customers. Additionally, luxury brands are enhancing their online presence by offering virtual try-ons, personalized recommendations, and exclusive online collections. The convenience of home delivery and the ability to shop from anywhere at any time further contribute to the appeal of online shopping. As a result, the online channel is set to become an increasingly significant part of the luxury apparel market, catering to the evolving preferences of modern consumers.

Regional Insights

Asia Pacific luxury apparel market dominated the global market with the largest revenue share of 40.1% in 2023. The region’s burgeoning middle and upper classes, strong affinity for prestigious brands, and rapidly changing consumer preferences play pivotal roles. Countries such as China and Japan play pivotal roles, with their high per capita incomes and significant consumer bases. Additionally, the shift towards digitalization and the increasing popularity of online retail channels have further fueled market growth. As a result, international luxury brands are increasingly focusing on the Asia Pacific region, recognizing its potential for sustained expansion and profitability.

Japan Luxury Apparel Market Trends

Japan’s luxury apparel market is expected to grow significantly over the forecast period. The country’s growth is attributed to the robust economy, high disposable incomes, and a strong cultural appreciation for high-quality, branded goods, drive this anticipated expansion. Additionally, the increasing influence of younger, fashion-conscious consumers and the rise of e-commerce platforms are expected to boost market growth further.

Europe Luxury Apparel Market Trends

Europe's luxury apparel market was identified as a lucrative region in 2023. Europe's luxury apparel market was identified as a lucrative region in 2023. This is largely due to the continent's rich fashion heritage, strong economic stability, and a discerning consumer base that values high-quality, branded clothing. Major fashion capitals such as Paris, Milan, and London continue to drive trends and attract significant investments from global luxury brands. Additionally, the rise of tourism and the increasing spending power of international visitors have further bolstered the market.

The UK luxury apparel market is anticipated to grow significantly over the forecast period owing to a strong tradition of fashion excellence, a high concentration of affluent consumers, and a thriving tourism industry. Additionally, the increasing influence of digital marketing and e-commerce platforms is expected to be crucial in reaching a broader audience. As international luxury brands continue investing in the UK, it is expected to witness innovative trends and a heightened focus on sustainability and ethical fashion practices.

North America Luxury Apparel Market Trends

North America luxury apparel market is expected to grow significantly with a CAGR of 3.2% over the forecast period. Several factors drive this growth, including a strong economy, high consumer spending power, and a growing preference for premium and high-quality fashion items. Additionally, the increasing impact of social media and endorsements from celebrities is crucial in shaping consumer preferences and stimulating demand.

The U.S. luxury apparel market is anticipated to grow significantly over the forecast period. The influence of social media and celebrity endorsements plays a significant role in shaping consumer preferences and driving demand. The rise in consumer spending capacity and high demand for trendy fashion among the population is projected to drive market growth.

Key Luxury Apparel Company Insights

Some key companies in the luxury apparel market include Giorgio Armani, Burberry, Dolce & Gabbana, Prada, Kate Spade, and others. Companies are focusing on launching new fashion designs and increasing product ranges. Moreover, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Giorgio Armani plays a pivotal role in shaping the luxury apparel market. Armani designs are renowned for their minimalist yet luxurious aesthetic, focusing on high quality materials and meticulous craftsmanship.

Key Luxury Apparel Companies:

The following are the leading companies in the luxury apparel market. These companies collectively hold the largest market share and dictate industry trends.

- Burberry

- Calvin Klein

- Dolce & Gabbana

- Giorgio Armani

- Prada

- Kate Spade

- 3.1 Phillip Lim

- Valentino S.p.A.

- Gucci

- Coach

Recent Developments

-

In July 2024, Giorgio Armani recently launched the Mare 2024 Collection at an exclusive cocktail event held at Little Beach House Malibu, marking the commencement of a weeklong pop-up. The event, characterized by a sophisticated summer theme, captivated guests with a decor featuring tropical palm patterns in turquoise and accents in wood and light gold, reflecting the collection's luxurious essence against the Pacific Ocean backdrop. This gathering showcased the collection's elegance and offered an immersive experience of Armani's vision of summer allure.

-

In November 2022, Burberry and Minecraft collaborated to introduce a distinctive game and fashion collection that combines creativity, exploration, and self-expression. Players can explore a specially designed Burberry x Minecraft world and access exclusive digital outfits as part of this collaboration.

Luxury Apparel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 83.17 billion

Revenue forecast in 2030

USD 106.10 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End Use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, and UAE

Key companies profiled

Giorgio Armani; Burberry; Dolce & Gabbana; Prada; Kate Spade; 3.1 Phillip Lim; Calvin Klein; Valentino S.p.A.; Gucci; Coach

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Architectural Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury apparel market report based on end use, distribution channel and region:

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.