- Home

- »

- Consumer F&B

- »

-

Meat, Poultry & Seafood Market Size Report, 2022-2030GVR Report cover

![Meat, Poultry And Seafood Market Size, Share & Trend Report]()

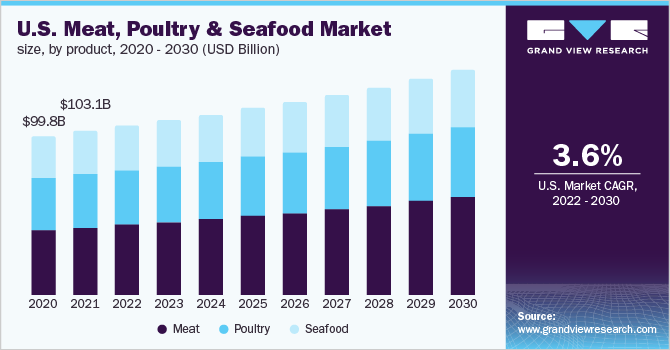

Meat, Poultry And Seafood Market Size, Share & Trend Analysis Report By Product (Meat, Poultry), By Type (Conventional, Organic), By Form (Fresh, Frozen), By Distribution Channel, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-162-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global meat, poultry and seafood market size was valued at USD 1,277.1 billion in 2021 and is expected to register a compound annual growth rate (CAGR) of 2.5% from 2022 to 2030. Meat, seafood & poultry consumption is still prevalent and is even increasing as the population grows, especially in developing economies such as India and China. According to the Organization for Economic Co-operation Development (OECD) and the Food and Agriculture Organization (FAO) report 2020, China is the world's largest provider of meat, with 77.9 million tons in 2020, followed by the U.S. with 48.7 million tons of meat. Such factors are likely to bode well with the future growth of the market.

The COVID-19 pandemic impacted the overall supply chain, resulting in increased prices for poultry, meat, and seafood products, which caused a socio-economic crisis worldwide. Initially, poultry, meat, and seafood product prices increased due to less production and increased demand because of panic buying. Whereas, later, both production and demand were significantly decreased due to lockdown restrictions and lower purchasing power of the consumers. Decrease in the labor force, restrictions in the transport of animals within and across the countries, and changes in the legislation of local and international export markets adversely impacted the overall industry.

The changing lifestyles that encourage on-the-go eating and a growing trend to replace meals with smaller nutritional snacks have led to an increase in the adoption of ready-to-eat and processed meat products. Growing consumer knowledge about protein ingredients and branding efforts undertaken by major manufacturers across the globe is expected to shift consumer perception, that meat, poultry, and seafood are healthier sources of proteins as compared to a vegetarian diet.

The emergence of new home delivery models has also propelled market growth and is expected to become a game changer during the forecast period. Many key supermarkets and companies in the market are collaborating with e-commerce retailers or launching their online delivery portals for at-home delivery services. For instance, in October 2021, Licious, an India-based startup offering fresh meat and seafood products online, raised USD 52 million in new financing funding and became the first direct-to-consumer startup to attain unicorn status and claimed that it’s grown over 500% in the previous year 2020.

The increased popularity of seafood products such as salmon owing to its omega-3 fatty acids, which offer health benefits and high protein-low fat for diet-conscious customers, is also driving the growth. In addition, there is an increased demand for farm-raised seafood attributed to the shifting preference toward sustainable farming and the environmental benefits associated with it. For instance, in August 2020, the Norway-based salmon farming and processing giant Mowi added a U.S.-centric seafood brand to its portfolio.

Growth trends such as product launches, campaigns, mergers & acquisitions result in increased product offering by the manufacturer and growth in overall sales. According to a report by the American Frozen Food Institute (AFFI) in 2021, consumer spending on frozen food spiked in April, and the frozen seafood sales category witnessed a spike of 19.1% through the first quarter of 2020 compared with the same period of 2019. Such facts likely to bode well with the future market growth

Product Insights

The meat segment held the largest market share in 2021. According to an Agriculture and Horticulture Development Board report published in October 2021, the COVID-19 pandemic surged meat consumption and witnessed an increase in volume by 12% in 2020 as compared to 2019. Consumers of meat are increasingly purchasing meat products such as beef and pork for the health benefits they offer, particularly in providing more variety and a less processed meal.

However, seafood is expected to emerge as one of the fastest-growing product segments during the forecast years. Seafood is becoming one of the preferred choices in food consumption owing to its nutritious values, easy availability, and increased awareness among consumers of various age groups across the globe. Furthermore, demand from the Asia Pacific region for premium and high-value fish is expected to fuel the growth in the forecast years.

Type Insights

The conventional segment held a larger market share in 2021, due to the availability of a wide range of products in this segment. According to an article published by Sentient Media in March 2021, meat & seafood consumption in the U.S. is growing and on average, Americans consume around 274 pounds of meat per year. Moreover, major retailers are acquiring small conventional suppliers which are likely to bode well for future growth. For instance, in March 2021, British retailer Morrisons acquired Cornish seafood company Falfish in order to improve the product range, quality, and availability of conventional fish and shellfish.

However, the organic segment is projected to register faster growth during the forecast period. The increasing inclination of consumers toward organic products is anticipated to boost the demand for this segment. According to The Organic Trade Association, U.S. sales for organic food products reached USD 50.1 billion in 2019, recording an increase of 4.6% as compared to 2018. Organic meat has gained importance in recent years, witnessing the rising demand for organic food.

Form Insights

The frozen segment held the largest market share during the forecast period. Frozen meat, chicken, and seafood are one of the most commonly purchased grocery items due to their longer shelf-life. Additionally, increased product launches in this segment are likely to favor the overall growth. For instance, in February 2022, the Seara-food brand announced the launch of the marinated frozen chicken product range in the frozen foods category at Gulfood 2022. The new product range includes a frozen marinated whole chicken in three local flavors and the exclusive pre-marinated frozen tender whole chicken.

On the other hand, the fresh product segment is likely to witness moderate growth owing to the increasing trend of DIY meals at home. The outbreak of the pandemic has resulted in increased consumption of home-cooked products by consumers. Thus, in response to increasing demand, many companies and startups have been taking online orders for fresh meat, poultry, and seafood products. Furthermore, third-party retailers also started offering online delivery of meat products in various countries.

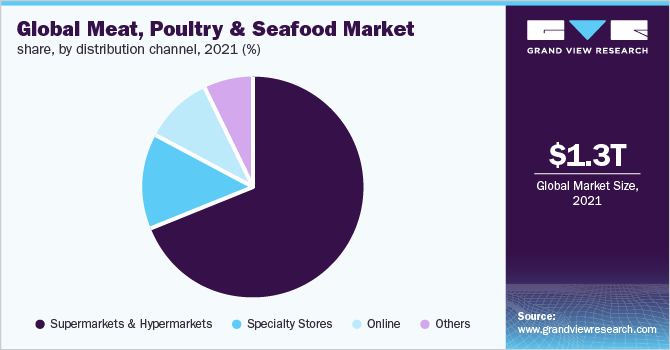

Distribution Channel Insights

Supermarkets and hypermarkets led the market and accounted for the largest revenue share in 2021. Manufacturers and key brands in the market are expanding their product segments by launching fresh, and frozen alternatives for consumers in supermarkets & hypermarkets due to the highest footfall of grocery shoppers at key supermarkets such as Tesco, Aldi, Target, and Walmart. For instance, in May 2020, Tesco launched barbeque focused fire pit meat range, which is a major new range of barbecue-focused marinated fresh meats and sides inspired by the U.S. pitmaster trend in Ireland and Great Britain. The product range includes Fire Pit Piri Piri chicken steaks (300g), Thai chicken steaks (300g), Mexican-style pork shoulder steaks (400g), Bratwurst sausages with spicy seasoning (480g), and a thin-cut beef steak (200g).

The online delivery channel is however expected to show the fastest growth. Customers are becoming more exposed to the advantages of e-commerce in retail environments. Savvy consumer groups such as youngsters and millennials are inclined towards online ordering of food and groceries, especially during the pandemic situation. These customers are incredibly enthusiastic about and comfortable with technology, and internet purchasing is a deeply rooted habit. Witnessing such trends, many manufacturers have been partnering with various third-party e-commerce retailers in order to increase product visibility and overall sales.

For instance, in June 2021, Walmart U.S. launched a premium line of Angus beef under the McClaren Farms label at nearly 500 stores in the Southeast, available online at its website for ordering. The McClaren Farms line includes products such as specialty cuts like the USDA Choice Angus filet mignon, T-bone, porterhouse, ribeye, short ribs, and chuck roast.

Regional Insights

Asia Pacific accounted for the highest share in terms of the total value in 2021 and is expected to witness the fastest growth during the forecast period. This region is primarily characterized by the rising per capita income and the increasing demand for salmon and other seafood products in addition to meat and poultry. Countries such as India, China, Indonesia, the Philippines, and Thailand have witnessed rapid growth in terms of industrial and trade activities. The rise in living standards along with the increasing population has steered the market demand for meat in the region. Consumers are shifting their diet preferences towards natural meat, poultry & seafood products, due to increasing awareness of health and lifestyle.

On the other hand, the Europe region is the second-largest region in terms of revenue in 2021. The U.K., France, Germany, and Spain dominated the European market. Demand in the region is expected to rise owing to new product introductions and increasing awareness of organic products. Shifting consumer diet preferences in countries such as Luxembourg, Netherlands, and Belgium are expected to steer demand for such products. Major consumers of poultry, seafood, chicken, and eggs in Germany belong to millennial groups. The growing consumer segment of millennials and the rise in awareness for protein-enriched food among its citizens are anticipated to drive the demand in the country over the next few years.

Key Companies & Market Share Insights

Owing to its significant market growth prospects, the global meat, poultry, and seafood industry is expected to witness substantial competitiveness during the forecast period. The companies in the market have adopted the strategy of mergers and acquisitions to expand their business in the domestic as well as global markets.

-

In December 2021, Organic Prairie launched organic seasoned ground beef, pre-seasoned with organic spices. The ground beef is raised without artificial pesticides, fertilizers, antibiotics, synthetic hormones, GMOs, or other synthetic contaminants and is USDA organic certified

-

In August 2021, Frozen Fish Direct announced the launch of its new e-commerce website offering 200 different varieties of fresh seafood

-

In March 2021, U.K.-based Young's Seafood launched a new line of fish fillet strips at Tesco stores. The new product line includes three different flavors - southern fried, crispy battered, and salt and vinegar

Some of the key players operating in the global meat, poultry and seafood market include:

-

Conagra Brands, Inc.

-

Hormel Foods, LLC

-

Tyson Foods

-

Cremonini Group

-

Sanderson Farms

-

J.M. Sucker

-

Cargill, Inc.

-

Beijing Aosiyun Meat Foodstuff

-

NH Foods Ltd.

-

Baiada Pty. Ltd.

Meat, Poultry And Seafood Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1,303.2 billion

Revenue forecast in 2030

USD 1,601.2 billion

Growth rate

CAGR of 2.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; India; Japan; China; Brazil; UAE; South Africa

Key companies profiled

Conagra Brands, Inc.; Hormel Foods, LLC; Tyson Foods; Cremonini Group; Sanderson Farms; J.M. Sucker; Cargill, Inc.; Beijing Aosiyun Meat Foodstuff; NH Foods Ltd.; Baiada Pty. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meat, Poultry And Seafood Market Segmentation

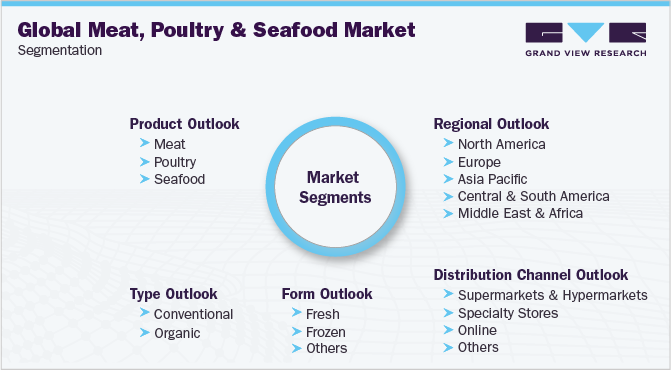

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global meat, poultry & seafood market report based on the product, type, form, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Meat

-

Poultry

-

Seafood

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Conventional

-

Organic

-

-

Form Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fresh

-

Frozen

-

Others

-

-

Distribution channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global meat, poultry and seafood market size was estimated at USD 1,277.1 billion in 2021 and is expected to reach USD 1,303.2 billion in 2022.

b. The global meat, poultry & seafood market is expected to grow at a compound annual growth rate of 2.5% from 2022 to 2030 to reach USD 1,601.2 billion by 2030.

b. The Asia Pacific dominated the meat, poultry and seafood market with a share of 34.3% in 2021. This region is primarily characterized by the rising per capita income and the increasing demand for salmon and other seafood products in addition to meat and poultry.

b. Some key players operating in the meat, poultry & seafood market include Conagra Brands, Inc.; Hormel Foods, LLC; Tyson Foods; Cremonini Group; Sanderson Farms; J.M. Sucker; Cargill, Inc.; Beijing Aosiyun Meat Foodstuff; NH Foods Ltd.; Baiada Pty. Ltd.

b. Key factors that are driving the meat, poultry & seafood market growth include increasing demand for frozen and convenience meat & seafood products owing to their longer shelf life.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."