- Home

- »

- Water & Sludge Treatment

- »

-

Membrane Separation Market Size And Share Report, 2030GVR Report cover

![Membrane Separation Market Size, Share & Trends Report]()

Membrane Separation Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Reverse Osmosis, Microfiltration, Ultrafiltration, Nanofiltration), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-268-6

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Membrane Separation Market Size & Trends

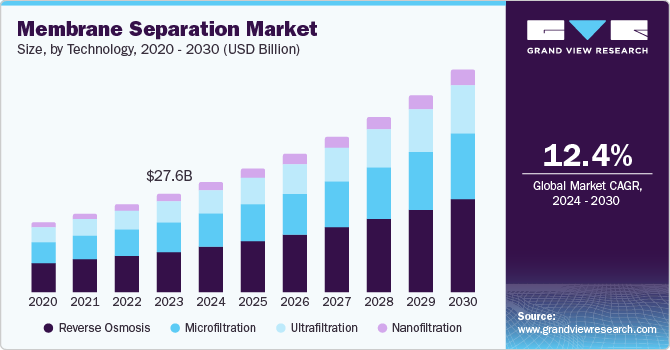

The global membrane separation market size was valued at USD 27.6 billion in 2023 and is projected to grow at a CAGR of 12.4% from 2024 to 2030. Key drivers propelling market expansion include the escalating demand for clean water, stringent wastewater discharge regulations, rapid industrialization in emerging economies, growth within the food and beverage sector, and the global challenge of water scarcity.

Governmental grants for the development of water treatment, particularly for the construction of new wastewater treatment plants in developed countries, are key drivers enhancing the global adoption of membrane separation technology. The rise of sustainability consciousness across industries, leading to the adoption of sustainable measures such as waste minimization and resource recycling through membrane technology integration, also significantly contributes to market growth.

Global issues such as water scarcity have amplified the demand for water reuse, with many nations developing methods for wastewater recycling. This process, facilitated by internal and external membrane separation systems, enables the treatment of municipal and industrial water for reuse. Increasing governmental pressure worldwide for stricter water disposal and waste product management regulations compels industries to adopt advanced wastewater treatment technologies, including membrane separation. These factors present opportunities for industries and are anticipated to significantly drive market growth in the coming years.

The expansion of the food & beverages and healthcare sectors has also influenced market growth due to the extensive use of membrane filtration technologies, such as reverse osmosis, to ensure the safety and quality of food and pharmaceutical products. Consequently, the demand for these technologies is directly impacted by the growth of these industries.

Technology Insights

The reverse osmosis technology segment accounted for a 42.0% revenue share in 2023. The growth of this segment can be attributed to stringent governmental regulations addressing global issues such as water scarcity and continuous innovation in membrane technology that has reduced operational costs and improved efficiency. In addition, the rising industrial applications, the surging demand for this technology in the food & beverage industry, and the increasing number of seawater desalination projects to address freshwater shortages are also contributing to the growth of this segment.

The ultrafiltration technology segment is anticipated to grow at a CAGR of 13.1% from 2024 to 2030. The growth of this segment is influenced by several factors, including the increasing demand for clean water, where this technology plays a vital role in producing high-quality potable water from various sources. The rapid industrialization in APAC countries, leading to heavy investments in water treatment infrastructure, is also driving the demand for this technology. Furthermore, the increasing utilization of this technology in healthcare sectors, such as for dialysis and blood purification, is expected to contribute to the growth of this segment.

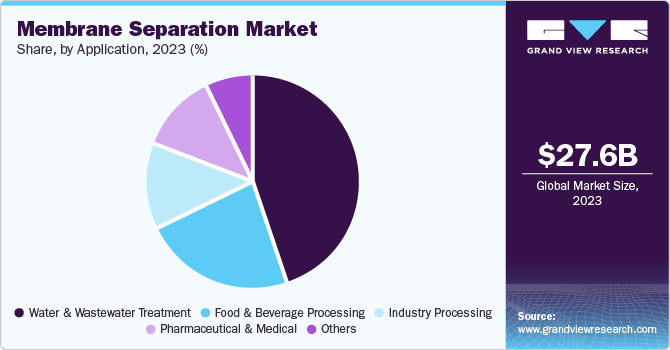

Application Insights

The water & wastewater treatment application segment dominated the market in 2023. The growth of this segment is expected to be driven by the surging demand for water reuse, where these technologies can be utilized for wastewater recycling for industrial and agricultural purposes. Long-term operational savings and reduced energy consumption due to the use of these technologies are encouraging industries to adopt them, attracting developing nations to implement them in their municipal corporations.

The pharmaceutical and medical application segment is expected to grow fastest over the forecast period. This growth is influenced by several factors, including the use of membrane separation in the production of biopharmaceuticals, increased regulatory compliance, advancements in technology, a focus on process integration, an increase in cases of chronic diseases, cost prognosis, sustainability measures, and customized aspects in the pharmaceutical & medical application segment.

Regional Insights

North American membrane separation market was identified as lucrative in 2023. The growth of the market in this region can be attributed to technological advancements that have expanded the applications of these technologies in ceramics, polymers, and other sectors. There is an increasing consumer demand for high-quality filtration solutions in both industrial and residential applications. Moreover, strategic partnerships and collaborations aimed at expanding market reach and enhancing capabilities are also shaping the market in this region.

U.S. Membrane Separation Market Trends

The U.S. dominated the North American market with a share of 72.3% in 2023. This dominance is due to an increasing focus on wastewater reuse, which has amplified the demand for these technologies in industries and municipalities. Rising investment in water infrastructure in the U.S. is further influencing the sales of membrane separation technologies. The growth of the healthcare and food & beverage industries is directly impacting the market in the country.

Europe Membrane Separation Market Trends

Europe membrane separation market held a 19.7% market share in 2023. The growth of the market in this region can be attributed to the increasing adoption of eco-friendly technologies, such as membrane separation technologies, aimed at reducing environmental impact and enhancing resource recovery. There is a growing demand in the food & beverage industry, where membrane separation technologies play a crucial role in processes such as wine clarification, milk filtration, and juice concentration, thus driving their demand in these sectors.

Asia Pacific Membrane Separation Market Trends

Asia Pacific membrane separation market is anticipated to grow at a CAGR of 11.2% from 2024 to 2030. The growth of the market in this region can be attributed to the expanding economy and emerging markets, which are leading to increased industrialization and, consequently, a surge in demand for advanced separation technologies. Rising concerns about water pollution and water scarcity are also major factors shaping the demand for these products, especially in residential applications.

Latin America Membrane Separation Market Trends

Latin America membrane separation market held the largest revenue share of 36.1% in 2023. The market growth in this region can be attributed to the increasing public-private partnerships fostering investments in water management projects, which in turn enhance the large-scale adoption of these technologies. Stringent government regulations aimed at reducing pollution and encouraging sustainable practices are also driving the demand for these products in the region.

The membrane separation market in Brazil held a significant share of the Latin America in 2023 attributed to the growing demand for clean water and the issues of water scarcity and quality in Brazil, which are creating opportunities for industries to expand their market share. These opportunities are leading to technological advancements, infrastructure development, and the implementation of stringent government policies, thereby driving market growth in the country.

Middle East & Africa Membrane Separation Market Trends

Middle East & Africa membrane separation market is expected to witness the fastest growth at a CAGR of 15.1% from 2024 to 2030. This market expansion is driven by several factors, including increased industrial investment and urbanization, coupled with a rising demand for clean water. In addition, significant investments in water infrastructure aimed at improving wastewater treatment facilities and the adaptability of these technologies across various sectors, such as environmental management, healthcare, and industrial processing, contribute to this growth.

The Saudi Arabia membrane separation market had a significant market share of the Middle East and Africa region in 2023 due to the government’s increasing support for research and development (R&D) on innovative water treatment solutions, collaborations between industry players and academic institutions to advance the technology, and stringent regulations on wastewater discharge for environmental protection. These efforts are part of the broader strategy to address water scarcity issues.

Key Membrane Separation Company Insights

Some of the key companies in the membrane separation market include 3M, Dow, Veolia, H20 Innovation, Merck KgaA, and other companies. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Veolia offers optimized resource management, mainly water, waste, and energy. In the area of membrane separation, Veolia is equipped with developed filtration solutions for processes with water treatment and improvement of the efficiency of the Resource Recovery Program in ultrafiltration and reverse osmosis solutions.

-

Merck KGaA offers an extensive line of sophisticated filtration products applied in biopharmaceutical production, water purification, and the food & beverages industry due to their high efficiency and product quality evidenced by using the newest trends in membrane technologies.

Key Membrane Separation Companies:

The following are the leading companies in the membrane separation market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Air Products and Chemicals, Inc.

- applied membranes, inc.

- Dow

- Evoqua Water Technologies LLC

- GEA Group Aktiengesellschaft

- H2O Innovation.

- Lenntech B.V.

- Merck KGaA

- Nitto Denko Corporation

- PCI Membranes.

- ProMinent GmbH

- Sanborn Technologies

- spi-engineering.com

- SPX Flow Technology

- UBE Corporation

- Veolia

Recent Developments

-

In May 2024, Qatar Free Zones Authority (QFZ) and Evonik signed a MoU to explore investment opportunities in sustainable energy solutions. Evonik's innovative smart materials, including gas separation membranes, are central to this collaboration.

-

In April 2024, Mitsubishi Heavy Industries, Ltd. (MHI) and NGK INSULATORS, LTD. (NGK) announced their collaboration to develop a hydrogen purification system based on membrane separation technology

-

In October 2023, Koch Separation Solutions underwent a corporate rebranding to Kovalus Separation Solutions following its acquisition by an affiliate of Sun Capital Partners Inc.

Membrane Separation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.9 billion

Revenue forecast in 2030

USD 62.4 billion

Growth Rate

CAGR of 12.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

3M; Air Products and Chemicals, Inc.; applied membranes, inc.; Dow; Evoqua Water Technologies LLC; GEA Group Aktiengesellschaft; H2O Innovation.; Lenntech B.V.; Merck KGaA; Nitto Denko Corporation; PCI Membranes.; ProMinent GmbH; Sanborn Technologies; spi-engineering.com; SPX Flow Technology; UBE Corporation; Veolia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Membrane Separation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global membrane separation market report based on technology, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Reverse Osmosis

-

Microfiltration

-

Ultrafiltration

-

Nanofiltration

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Water & Wastewater Treatment

-

Industry Processing

-

Food & Beverage Processing

-

Pharmaceutical & Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global membrane separation market size was estimated at USD 17.19 billion in 2019 and is expected to reach USD 19.87 billion in 2020.

b. The global membrane separation market is expected to grow at a compounded annual growth rate of 11.7% from 2020 to 2027 to reach USD 43.38 billion in 2027.

b. Asia Pacific dominated the membrane separation market with a share of 33.9% in 2019. This can be attributed to rising water pollution and growing environmental concerns driven by growth of industries such as mining, chemicals, and metal processing industries.

b. Some key players operating in the membrane separation market include Merck KGgA; Toray Industries, Inc.; Koch Membrane Systems, Inc.; Pall Corporation; 3M Company; and Corning Incorporated.

b. Key factors driving the membrane separation market growth include rising population leading to the depletion of water resources and the contamination of ground and surface water bodies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.