- Home

- »

- Next Generation Technologies

- »

-

Mining Automation Market Size, Share, Industry Report, 2030GVR Report cover

![Mining Automation Market Size, Share & Trends Report]()

Mining Automation Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (Software Automation, Services, Equipment Automation), By Application (Metal Mining, Mineral Mining, Coal Mining), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-386-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mining Automation Market Summary

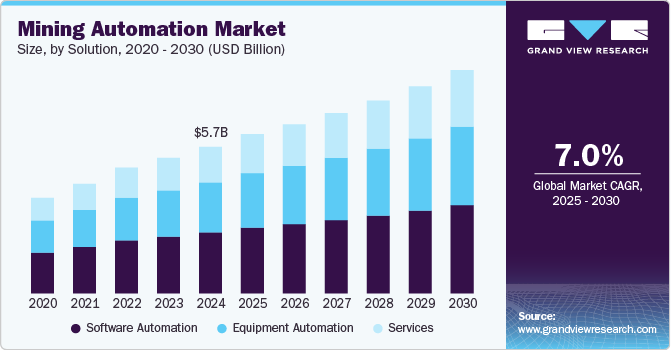

The global mining automation market size was estimated at USD 5,715.7 million in 2024 and is projected to reach USD 8,705.3 million by 2030, growing at a CAGR of 7.0% from 2025 to 2030. This growth is largely fueled by rapid technological advancements, particularly in Artificial Intelligence (AI) and robotics, which are increasingly being adopted to enhance production efficiency.

Key Market Trends & Insights

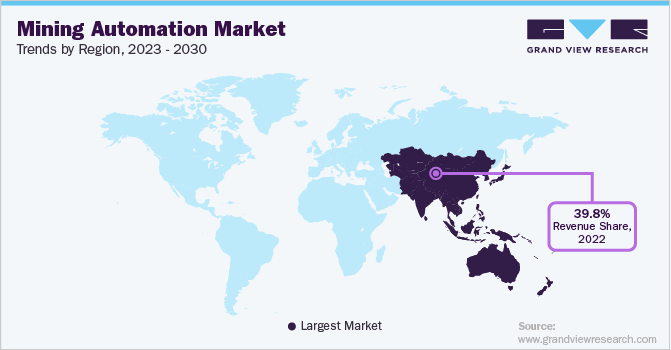

- Asia Pacific mining automation dominated the market with a share of over 40% in 2024.

- The china dominated the market with a share of 32% in 2024.

- By solution, the software automation segment dominated the industry with an industry share of over 41% in 2024.

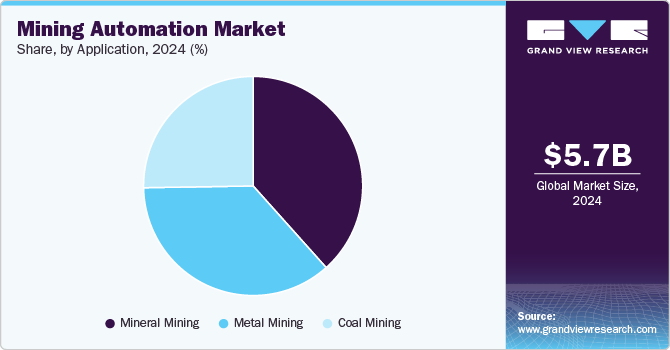

- By application, the mineral mining segment accounted for the largest industry share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,715.7 Million

- 2030 Projected Market Size: USD 8,705.3 Million

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2024

The rising adoption of innovative technologies is a key factor propelling the expansion of the mining automation sector. The integration of the Internet of Things (IoT) is further transforming the industry by providing operators with real-time data and analytics through advanced visualization tools. In addition, several companies are partnering with technology providers to implement wireless networks in underground mining operations, a development that is expected to accelerate market growth in the coming years.

The increasing integration of AI and robotics is transforming the mining automation industry by enabling smarter, safer, and more efficient operations. Mining automation industries are applying AI to optimize drilling and blasting, implement predictive maintenance, and support data-driven decision-making. Robotics is being deployed to perform tasks in hazardous environments, enhancing safety and minimizing operational disruptions. These technologies are driving enhancements in productivity and cost-efficiency, contributing to a more advanced and competitive mining automation landscape.

Moreover, the push for greater productivity is encouraging mining automation industries to adopt automation technologies that streamline operations and minimize downtime. By integrating automated systems into their processes, these companies can enhance efficiency, maintain consistent output, and reduce reliance on manual labor. This drive toward operational excellence is significantly contributing to the growing adoption of mining automation industry solutions.

The integration of IoT in mining operations is transforming how data is gathered and utilized on-site. Enabling real-time monitoring and analytics, IoT empowers operators with timely insights that support smarter decision-making and improved operational oversight. This technological advancement is enhancing efficiency and reliability, further driving the adoption of the automated mining industry.

Furthermore, the collaboration between mining companies and technology providers is gaining traction as they work together to implement underground wireless networks. These partnerships are essential in building the digital infrastructure required for advanced automation systems. Enabling seamless connectivity and real-time data exchange, these efforts are playing a crucial role in driving the adoption of mining automation and enhancing operational efficiency, thereby driving industry expansion.

Solution Insights

The software automation segment dominated the industry with an industry share of over 41% in 2024, owing to the development of robust technology-based vehicles, such as autonomous trucks, remote control equipment, and teleoperated mining equipment. In addition, rapid advancements in hardware automation technology are expected to persistently streamline the way the large-scale mining industry is undertaken across the globe.

The services segment is expected to witness the highest CAGR of over 7% from 2025 to 2030, fueled by the growing demand for maintenance, consulting, and system integration services as mining companies increasingly adopt automated solutions. As automation technologies become more complex, the need for specialized expertise to install, manage, and maintain these systems is rising. In addition, the focus on minimizing downtime and ensuring seamless operation of automated equipment is driving the demand for end-to-end service offerings.

Application Insights

The mineral mining segment accounted for the largest industry share in 2024, owing to the significant demand for efficiency, safety, and cost optimization in large-scale extraction operations. As mineral mining becomes more complex, companies are using automation to make work easier, rely less on manual labor, and improve accuracy. The adoption of autonomous drilling, haulage systems, and real-time monitoring tools is transforming mineral extraction, making operations more sustainable and productive. Moreover, growing investments in smart mining solutions and the integration of IoT and AI are further strengthening the segment's dominance in the mining automation industry.

The metal mining segment is expected to witness a significant CAGR from 2025 to 2030, driven by the increasing demand for metals such as copper, nickel, lithium, and rare earth elements, which are essential for electric vehicles, renewable energy systems, and advanced electronics. As the global push for decarbonization and clean energy accelerates, metal mining operations are under pressure to boost output while improving efficiency and safety. This has led to a growing adoption of automation technologies, including autonomous haulage systems, automated drilling, and real-time monitoring solutions, which enhance productivity and reduce operational risks.

Regional Insights

North America accounted for a significant share of over 25% in 2024, primarily driven by the region’s strong focus on technological innovation and early adoption of automation in mining operations. The presence of leading mining companies, robust investment in R&D, and widespread implementation of advanced technologies such as AI, IoT, and autonomous equipment have positioned North America at the forefront of mining automation.

U.S. Mining Automation Market Trends

The U.S. mining automation industry dominated the market with a share of over 80% from 2025 to 2030, driven by the country’s strong focus on innovation and technological advancement. In addition, the growth of startups and the increasing adoption of digital transformation strategies by established companies contribute to the rising demand for mining automation in the U.S. Government support for smart mining initiatives and the push for sustainable operations are further accelerating industry expansion.

Europe Mining Automation Market Trends

Europe mining automation market is expected to grow at a CAGR of over 5% from 2025 to 2030, driven by the region’s emphasis on innovation, safety, and environmental compliance. Stringent regulatory frameworks are compelling mining companies to adopt cleaner and more efficient technologies, and the need to enhance productivity and reduce human intervention in hazardous environments is accelerating automation adoption. In addition, the region’s strong industrial base and focus on sustainable resource extraction continue to propel the demand for sophisticated mining automation solutions.

The UK mining automation industry is expected to grow at a significant rate in the coming years, owing to the highly developed industrial base and a strong focus on technological innovation within the mining sector. In addition, the UK’s commitment to sustainability and stringent safety regulations is encouraging mining companies to implement automation to reduce environmental impact and enhance operational efficiency.

The Germany mining automation industry is fueled by the country’s strong engineering expertise, advanced manufacturing infrastructure, and commitment to industrial innovation. In addition, the presence of leading technology providers and strong environmental regulations is encouraging mining companies to invest in intelligent systems that reduce emissions and optimize resource usage. These factors collectively position Germany as a key player in the European mining automation landscape.

Asia Pacific Mining Automation Market Trends

Asia Pacific mining automation dominated the market with a share of over 40% in 2024, driven by rapid industrialization, increasing investments in smart mining technologies, and a strong focus on operational safety and efficiency. Government initiatives promoting digital transformation and infrastructure development are further supporting this growth. In addition, the region’s abundant mineral resources and rising demand for metals across various industries are accelerating the deployment of advanced mining automation solutions in APAC.

The China mining automation market dominated the market with a share of 32% in 2024, fueled by the country’s rapid industrialization and strong push for technological advancement in the mining sector. In addition, China’s focus on enhancing safety standards and improving operational efficiency within its vast mining operations is driving the demand for automated systems.

The India mining automation market is expected to grow at a CAGR of over 11% from 2025 to 2030, due to the country’s expanding mining sector and the increasing adoption of advanced technologies. In addition, the government's focus on digital transformation, coupled with initiatives aimed at improving mining efficiency and sustainability, is driving the demand for automation solutions.

Key Mining Automation Company Insights

Some of the key players operating in the industry include Atlas Copco AB and Caterpillar Inc.

-

Atlas Copco AB is a global player in providing industrial solutions, specializing in compressors, vacuum solutions, generators, and mining equipment. The company offers cutting-edge technologies aimed at improving efficiency and reducing operational costs. The company integrates advanced automation, AI, and digitalization in its products to optimize mining operations and enhance productivity.

-

Caterpillar Inc. is a global manufacturer of heavy equipment and machinery, specializing in construction, mining, and energy solutions. The company is at the forefront of innovation in automation, offering a wide range of products and services designed to optimize operations in the mining sector. Strong commitment to sustainability and operational efficiency, Caterpillar integrates advanced technologies such as autonomous vehicles, IoT, and AI into its equipment.

Sandvik AB and Autonomous Solution Inc. are some of the emerging industry participants in the mining automation industry.

-

Sandvik AB is an engineering company specializing in mining automation and advanced technological solutions. The company offers a wide array of products and services, including automation systems, digital tools, and precision equipment, all powered by advanced technologies such as AI, robotics, and IoT. Sandvik AB’s commitment to enhancing operational efficiency, safety, and sustainability enables clients to optimize production processes and meet evolving industry demands.

-

Autonomous Solution Inc. is an emerging provider of advanced automation and technology solutions, specializing in the development and deployment of autonomous systems for various industries, including mining. With a commitment to innovation and operational efficiency, the company integrates cutting-edge technologies such as AI, robotics, IoT, and machine learning to deliver high-performance solutions.

Key Mining Automation Companies:

The following are the leading companies in the mining automation market. These companies collectively hold the largest market share and dictate industry trends.

- Atlas Copco AB

- Autonomous Solution Inc.

- Caterpillar, Inc.

- The Weir Group PLC

- Epiroc AB

- Hexagon AB

- Hitachi, Construction Machinery Co. Ltd.

- Komatsu Ltd.

- Liebherr Group

- MST (Mine Site Technologies)

- Rio Tinto

- Rockwell Automation, Inc.

- RPM Global Holdings Ltd.

- Sandvik AB

- Siemens AG

- Trimble Inc.

Recent Developments

-

In April 2025, The Weir Group PLC announced the acquisition of Australian software company Micromine. This strategic acquisition aims to enhance Weir's digital platform capabilities across the mining value chain, including exploration, operational management, and processing. The acquisition is expected to expand Weir’s industry opportunities, solidifying its position as a leader in mining automation and technology integration.

-

In March 2025, Caterpillar, Inc. announced a partnership with Luminar to integrate lidar technology into its Cat Command autonomy platform. This collaboration aims to enhance the safety and efficiency of autonomous construction and mining equipment by improving object detection capabilities in challenging environments.

-

In January 2025, Hexagon AB announced a significant investment in Saudi Arabia's mining sector by providing technology and training to King Saud University. This initiative is part of Hexagon's strategy to develop the next generation of mining professionals and promote the adoption of advanced mining technologies in the region.

Mining Automation Market Report Scope

Report Attribute

Details

Industry size value in 2025

USD 6,207.2 million

Revenue forecast in 2030

USD 8,705.3 million

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; Sweden; Turkey; China; India; Japan; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Atlas Copco AB; Autonomous Solution Inc.; Caterpillar, Inc.; The Weir Group PLC; Epiroc AB; Hexagon AB; Hitachi, Construction Machinery Co. Ltd.; Komatsu Ltd.; Liebherr Group; MST (Mine Site Technologies); Rio Tinto; Rockwell Automation, Inc.; RPM Global Holdings Ltd.; Sandvik AB; Siemens AG; Trimble Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Mining Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the mining automation market report based on solution, application, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Software Automation

-

Services

-

Implementation & Maintenance

-

Training

-

Consulting

-

-

Equipment Automation

-

Autonomous Trucks

-

Remote Control Equipment

-

Teleoperated Mining Equipment

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal Mining

-

Mineral Mining

-

Coal Mining

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Sweden

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mining automation market size was estimated at USD 5,715.7 million in 2024 and is estimated to reach USD 6,207.2 million in 2025.

b. The global mining automation market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 8,705.3 million by 2030.

b. The mineral mining application segment dominated the global mining automation market with a share of over 37% in 2024. This is attributable to the increasing adoption of autonomous solutions in metal exploration activities.

b. Some of the key players in the global mining automation market include Caterpillar, Inc.; Rio Tinto Group; Komatsu Ltd.; and Rockwell Automation, Inc.

b. Key factors driving the mining automation market growth include growing concern for mine and labor safety and the introduction of technologically advanced equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.