- Home

- »

- Biotechnology

- »

-

Multiplex Assay Market Size & Share, Industry Report, 2030GVR Report cover

![Multiplex Assay Market Size, Share & Trends Report]()

Multiplex Assay Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Instruments), By Type (Protein Multiplex Assays, Nucleic Acid Multiplex Assay), By Technology, By Application, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-984-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Multiplex Assay Market Summary

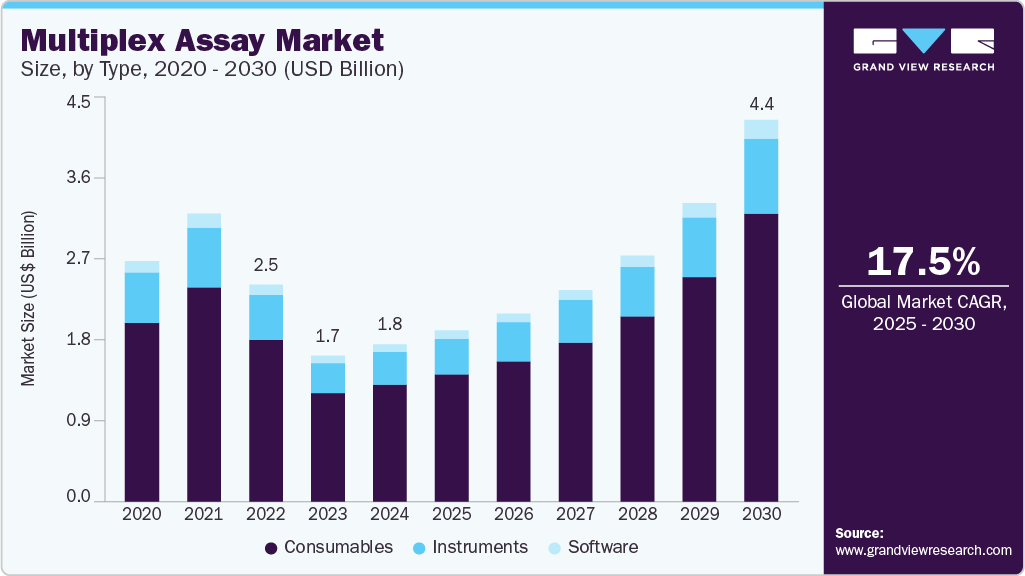

The global multiplex assay market size was estimated at USD 1,817.10 million in 2024 and is projected to reach USD 4,412.72 million by 2030, growing at a CAGR of 17.5% from 2025 to 2030. A multiplex assay is a technique in which various analytes (such as growth factors, chemokines, biomolecules, cytokines, and proteins, among others) are profiled by detecting and quantifying them simultaneously.

Key Market Trends & Insights

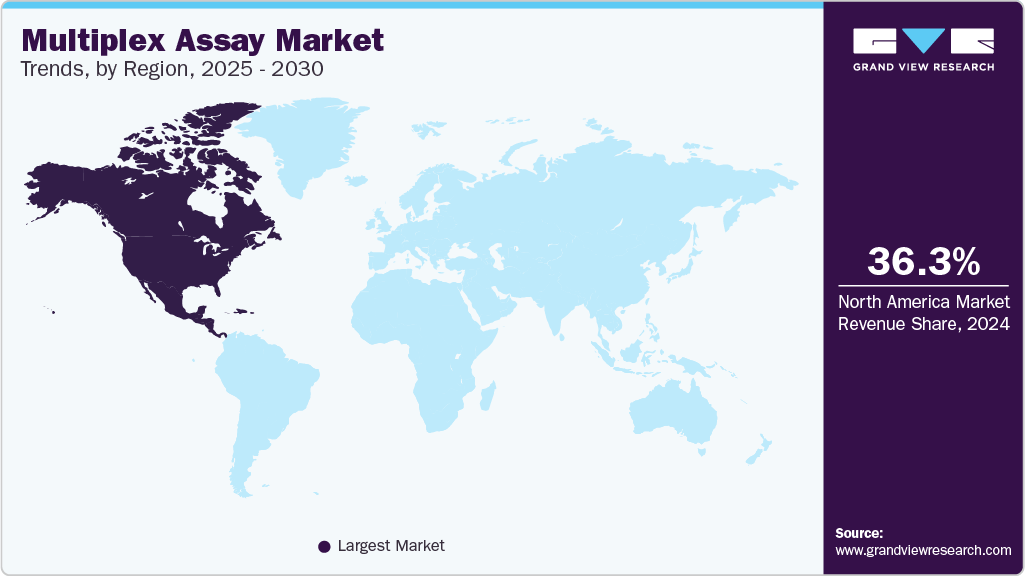

- North America multiplex assay market accounted for the highest revenue share of 36.34% in 2024.

- The U.S. multiplex assay market is experiencing strong growth due to advanced healthcare infrastructure.

- By type, the protein multiplex assay segment dominated with a revenue share of 52.99% in 2024, owing to the focus on proteomics studies.

- By product, the consumables segment held 74.42% of the market share in 2024, driven by recurring purchases.

- In terms of technology, the flow cytometry segment held a 34.97% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,817.10 Million

- 2030 Projected Market Size: USD 4,412.72 Million

- CAGR (2025-2030): 17.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Multiplex assays are broadly used for mutation analysis, linkage analysis, pathogen identification, forensic studies, gene detection analysis, and others. The key market drivers include the growing prevalence of chronic and infectious diseases, significant advantages of multiplex assays over singleplex and traditional assays, increasing applications of multiplex assays in companion diagnostics, and rising awareness of early diagnosis. The shift towards personalized medicine is a significant driver for the multiplex assays market.

Personalized medicine involves tailoring medical treatment to individual patient characteristics, which requires precise and comprehensive diagnostic tools. Multiplex assays enable the simultaneous analysis of multiple biomarkers, essential for developing targeted therapies. According to a report by the Personalized Medicine Coalition, personalized treatments accounted for 42% of new drugs approved by the FDA in 2021, highlighting the increasing reliance on advanced diagnostic tools such as multiplex assays to support these therapies.

The growing prevalence of cancer and infectious diseases is leading to the development of new therapeutics. The drug development and clinical trials are witnessing increased adoption of multiplex assays. These assays can simultaneously determine the presence of infection with multiple pathogens. It also aids in studying and analyzing a particular disease's efficacy and detecting antibodies against various diseases. For instance, according to a report published by the WHO in April 2021, every year about 41 million people die globally, equivalent to 71% of overall deaths globally due to chronic diseases or non-communicable diseases. Thus, the increasing prevalence of diseases is expected to fuel market growth during the forecast period.

Furthermore, the significant advantages of multiplex assays over singleplex and traditional assays can boost the market in the coming years. Numerous benefits these automated tests offer include miniaturization, which reduces sample consumption, high operational efficiency, easy operations, and reduced labor costs. Moreover, various arrays are measured in a single trial, which leads to quicker results in these assays.

For instance, in March 2024, Co-Diagnostics, Inc., a U.S.-based molecular diagnostics company headquartered in Salt Lake City, Utah, announced a key regulatory milestone achieved by its joint venture, CoSara Diagnostics Pvt. Ltd., in India. The company received clearance from the Central Drugs Standard Control Organization (CDSCO) to manufacture and supply its SARAPLEX Influenza Multiplex (IFM) Test Kit to clinical laboratories. This in vitro diagnostic (IVD) test is designed to detect and differentiate Influenza A and Influenza B, marking a significant advancement in respiratory infection diagnostics in the Indian market.

Moreover, the increasing use of multiplex assays in companion diagnostics can accelerate the market growth. Personalized medicines aim to offer customized therapies to individual patients based on the molecular basis of the disease. Companion diagnostics are set to be a crucial part of personalized medicine and are expanding rapidly in terms of number and application in disease areas. Based on the current drug approval scenarios, the rapid growth of companion diagnostics can be seen in the near future. For instance, in August 2021, Roche received FDA approval for a companion diagnostic to detect dMMR solid tumors in patients suitable for anti-PD-1 immunotherapy. Thus, the growth of companion diagnostics can significantly aid in the global market development.

The growing awareness about early diagnosis of various chronic diseases, such as cancer, can increase the quality of patient life with a more than three times higher survival rate when diagnosed at early stages. In addition, early diagnosis can increase the number of treatment options and reduce the costs required for prolonged diseases. For instance, according to an article published in Avalere in July 2021, patients with non-small cell lung cancer, stomach, and pancreatic cancers, between 36% and 53% of patients are diagnosed with stage four cancer, by the time cancer spreads to other parts of the body and decreases the survival chances. If detected at the early stages, the 5-year survival rate for non-small-cell lung cancer, stomach, and pancreatic cancer survival rate can be doubled. These differences create awareness for early diagnosis of various diseases and can considerably drive market growth during the forecast period.

In addition, increasing validation of the biomarkers in molecular & protein diagnostics and rising need for high-throughput assays and automated systems are expected to create lucrative opportunities during the forecast period. Multiple biomarker analysis has a wide range of applications in neurodegenerative diseases, autoimmune diseases, and cancer. Numerous biomarkers are being discovered and validated, and there is a high possibility of developing novel diagnostics. Multiplex assay can be used to quantify proteins in biomarker discovery. These assays allow the measurement of numerous potential protein biomarkers in a statistically significant number of samples and controls. Therefore, multiplex assay in biomarker validation improves the efficiency and speed of delivering accurate results and can fuel the market growth in the near future.

Market Concentration & Characteristics

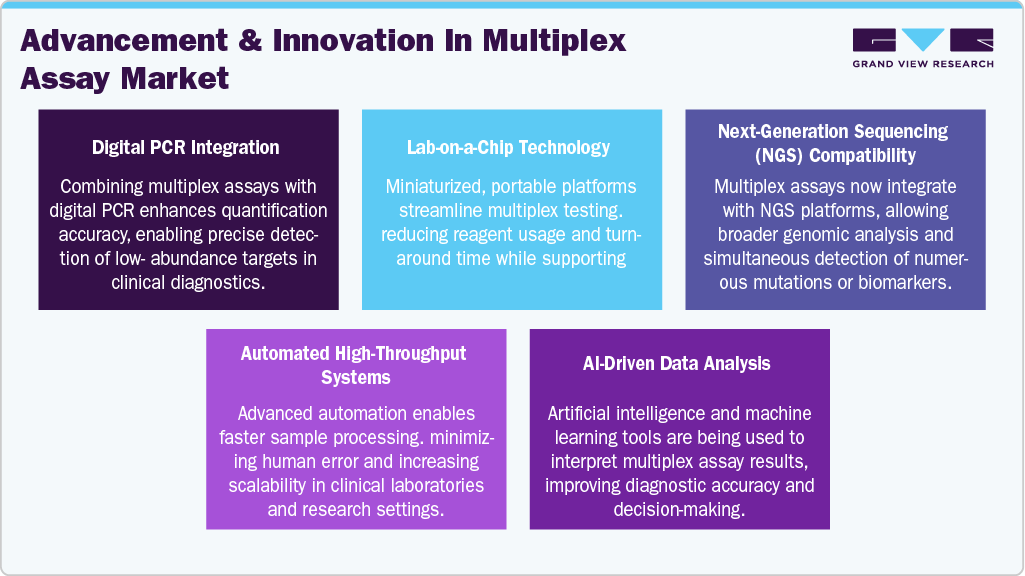

The multiplex assay industry is marked by high innovation, with ongoing developments in assay sensitivity, automation, and integration with next-generation sequencing (NGS) technologies. Innovations like digital multiplexing and lab-on-a-chip platforms enhance throughput and reduce sample volumes. These advancements expanddiagnostics, drug discovery, and biomarker research applications, positioning multiplex assays as critical tools in modern molecular and clinical diagnostics.

M&A activity in the multiplex assay industry has been robust, driven by the need for companies to expand technological capabilities and global reach. Strategic acquisitions of biotech firms and assay technology developers are helping larger diagnostics companies strengthen their assay portfolios and access new markets. These consolidations accelerate innovation cycles, enabling faster deployment of advanced testing solutions across clinical and research environments.

Regulatory frameworks significantly influence the multiplex assay industry, especially for in vitro diagnostics (IVDs). Approvals from authorities like the FDA, EMA, and CDSCO are essential for market entry, ensuring assay safety, efficacy, and reliability. While stringent, these regulations promote product quality and clinical adoption. Recent regulatory adaptations to support rapid diagnostics, especially post-COVID-19, facilitate faster time-to-market for multiplex platforms.

Manufacturers are rapidly expanding their multiplex assay product lines to address a wider array of diseases, including infectious diseases, oncology, and autoimmune disorders. Enhanced panels now offer simultaneous detection of dozens of targets, improving diagnostic accuracy and efficiency. Companies are also introducing customizable assays for research use, contributing to widespread application across academic, pharmaceutical, and clinical settings. This broadening scope is a key driver of market growth.

The multiplex assay industry is witnessing significant regional expansion, particularly in Asia Pacific and Latin America, fueled by rising healthcare infrastructure, increased government funding, and growing disease awareness. Companies are establishing local manufacturing and distribution partnerships to meet regional demands and navigate regulatory pathways efficiently. This strategic expansion is helping global players tap into high-growth emerging markets while increasing accessibility to advanced diagnostic technologies.

Type Insights

The protein multiplex assay segment accounted for the highest revenue share of 52.99% in 2024, owing to the increasing focus on proteomics studies for biomarker research and clinical diagnostics. The quest for suitable biomarkers has significantly increased in clinical practice, and quantitative measurement of protein is a crucial step in biomarker discovery. Analyzing the huge number of potential protein biomarkers in a large number of samples and controls constitutes a major technical obstacle. Protein multiplex assays offer several advantages regarding the amount of data that can be generated, sample requirement, reagent cost, time, and the amount of data that can be generated. For instance, according to an article published in eClinical Medicine in July 2022, a multiplex protein panel assay was utilized to determine disease severity and prognosis in COVID-19 patients. Thus, increasing applications of protein multiplex assay in proteomics studies are anticipated to boost the market.

The nucleic acid assay is projected to be the fastest-growing segment with CAGR in the coming years. Nucleic acid assay aids in molecular tests to diagnose human disease, such as human genetic markers indicative of disease (autoimmune disease and cancer), genetic markers for predisposition to disease, and tests to identify disease-causing pathogens. For instance, according to an article published by the American Chemical Society in September 2021, a Nucleic acid assay based on lanthanide nanoparticles was used to diagnose SARS-CoV-2 to achieve fast screening with high accuracy. Hence, the increasing prevalence of chronic and infectious diseases is expected to widen the use of nucleic acid multiplex assay in disease diagnosis and drive the market growth during the forecast period.

Product Insights

The consumables segment held 74.42% of the market share in 2024 and is also predicted to be the fastest-growing segment during the forecast period. This is due to the recurring purchase of consumables and the rise in diagnostic tests. In addition, several key market players offer a wide range of consumables with advantages such as cost-effectiveness, customization of analytes, and faster delivery time with robust and reliable data. For instance, Bio-Techne Corporation, a life science reagent manufacturer, offers the most customizable Luminex analyte menu to choose from over 450 analytes and flexible formats. Such advantages are expected to increase the specificity, precision, and stability to ensure consistent and accurate results and broaden the applications of consumables in the market.

The software segment is also projected to register considerable CAGR during the forecast period. Certain factors, such as superior software efficiency and increasing product launches, are estimated to leverage the segment's growth during the forecast period. For instance, in August 2022, Bio-Techne Corporation announced the launch of Quantist Luminex data analysis software, which can help researchers extract meaningful insights from complex data.

Technology Insights

The flow cytometry segment dominated the technology segment with a 34.97% share in 2024. Flow cytometry has become an indispensable tool for basic research and clinical diagnostics. It provides rich multiparametric analysis for thousands of single cells per second. In addition, various companies' technological advancements and the launch of novel flow cytometers contribute to market growth. For instance, in June 2021, Thermo Fisher Scientific Inc. launched an innovative flow cytometer with imaging ability that enables users to collect data and better understand the quality and morphology of the cells in these assays.

The multiplex real-time PCR is expected to grow fastest during the forecast years. Multiplex real-time PCR is a modified version of conventional PCR, which amplifies several target sequences using various sets of primers in a single PCR mixture. It controls internal amplification to enhance the accuracy of the negative PCR results. In addition, this technology enables the detection of various pathogens in a single reaction, even from taxonomically different groups. These advantages are anticipated to increase their application in clinical diagnostics and can boost market growth during the forecast period.

End User Insights

The pharmaceutical and biotechnology companies segment captured 41.11% of the market share in 2024. This is due to rising pharma and biotech partnerships and collaborations to increase multiplexing capabilities. For instance, in August 2022, Becton, Dickinson, and Company and Labcorp collaborated to develop flow cytometry-based companion diagnostics for providing patients with efficient treatment options. Flow Cytometry technology can help with multiplexing and offers high sensitivity capabilities in the CDx landscape. Thus, partnerships enhance the growth prospects of multiplex assays and boost the market.

The hospital and diagnostic laboratory segment is likely to project the fastest growth during the forecast period, owing to the growing demand for rapid and accurate diagnosis of numerous chronic diseases. Multiplex assay offers quick results for multiple biomolecule targets in a single run, making it a superior choice for patient disease identification. For instance, according to the CDC, 9.3 to 45 million are infected by influenza annually, 140,000 - 810,000 hospitalizations, and 12,000 - 61,000 deaths. The multiplex assay detects the influenza virus and identifies other pathogens at once to provide a more comprehensive clinical diagnosis for patients with multiple symptoms associated with respiratory viral infections.

Application Insights

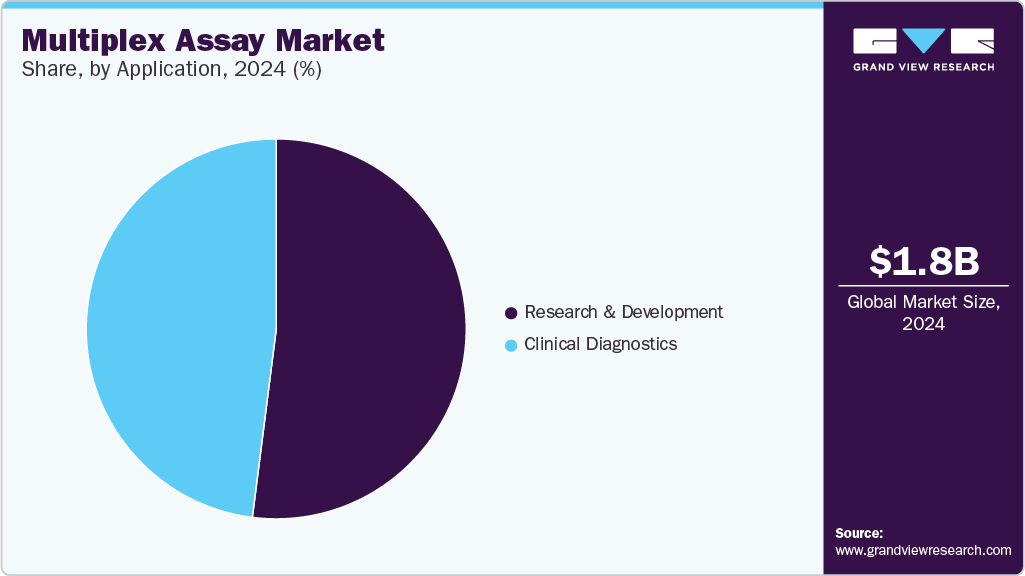

The research and development application segment accounted for 52.01% of the share in 2024. Demand for multiplex assays is steadily increasing in drug discovery. These assays are used in clinical and preclinical stages to evaluate toxicity, immunotherapy success, and drug response biomarkers. In addition, biomarker discovery and validation are important in the current era for healthcare professionals to improve disease diagnosis, cancer detection at initial stages, and monitor therapeutic responses. The validation of a marker candidate is required in each stage of the biomarker pipeline to reach its clinical utility. Such applications of multiplex assay in R&D are expected to fuel market growth.

The clinical diagnostics segment is estimated to witness the fastest growth owing to the increasing prevalence of chronic diseases such as infectious diseases, cancer, autoimmune diseases, and cardiovascular diseases. For instance, according to the CDC, 3.4 million patients require diagnosis for infectious and parasitic diseases in the emergency department. Similarly, according to the CDC in 2022, one person dies every 34 seconds in the US due to cardiovascular disease. Multiplex assay helps identify various biomarkers for cardiovascular disease in a single sample and provides accurate, reproducible, simultaneous measurement of 39 CVD biomarkers in tissue culture samples, plasma, and serum.

Region Insights

North America accounted for the highest revenue share of 36.34% in 2024 due to the growing research & development activities, including developing novel drugs, diagnoses, and treatment options. The increasing incidence of chronic conditions such as stroke & cancer, and the rising government funding for the detection of new biomarkers are anticipated to drive the segment growth. In addition, major key regional players are likely to fuel the segment growth.

U.S. Multiplex Assay Market Trends

The multiplex assay market in the U.S. is experiencing strong growth due to advanced healthcare infrastructure, high R&D investment, and early adoption of cutting-edge diagnostics. The increasing prevalence of chronic and infectious diseases, combined with the country's emphasis on precision medicine, is driving demand for multiplex testing. Moreover, supportive regulatory pathways from the FDA and the presence of major market players contribute to rapid innovation and commercialization. Technological advancements in genomics and proteomics, coupled with a growing need for efficient diagnostic solutions, position the U.S. as a global leader in the market.

Europe Multiplex Assay Market Trends

The multiplex assay market in Europe is expanding steadily, supported by strong academic research, favorable healthcare policies, and rising chronic disease burden. EU initiatives promoting early disease diagnosis and personalized medicine are accelerating the adoption of multiplex platforms. Countries such as France, Italy, and the Netherlands are witnessing increased investment in diagnostic laboratories. In addition, collaboration among pharmaceutical and biotech firms for drug development is boosting multiplex assay applications in clinical trials. Strict but supportive regulatory frameworks ensure high-quality standards and continued regional innovation.

The UK multiplex assay market is growing due to strong government backing for genomics research and NHS initiatives promoting early disease detection. Projects like Genomics England and public-private partnerships are enhancing the use of multiplex assays in personalized healthcare. Increased focus on cancer diagnostics and infectious disease screening is expanding market demand. Furthermore, the UK's vibrant biotech ecosystem and streamlined regulatory environment make it an attractive hub for diagnostics innovation and commercialization.

The multiplex assay market in Germany is driven by its strong medical technology sector, extensive healthcare infrastructure, and robust clinical research landscape. The country’s emphasis on precision diagnostics and laboratory automation has encouraged hospitals and research centers to adopt multiplex testing. Government funding for cancer and infectious disease research, coupled with the presence of leading biotech and pharmaceutical companies, further supports market growth. Germany also benefits from a highly skilled workforce and regulatory efficiency, promoting the development and distribution of advanced diagnostic assays.

Asia Pacific Multiplex Assay Market Trends

The multiplex assay market in Asia Pacific is expected to witness the fastest growth during the forecast years. This is due to the rising number of hospitals in emerging countries, the developing R&D sector, growing demand for healthcare infrastructure, and investments by emerging regional players. For instance, in November 2021, QuantuMDx received an investment of USD 10.9 million from Vita Spring and entered into a corporate agreement with Sansure Biotech to develop the multiplexing capabilities in China. In addition, the rising prevalence of cancer is due to tobacco consumption. For instance, half the world’s tobacco is grown and consumed by people in the Asia Pacific. As a result, the gradual rise in the number of people undergoing screenings in the region is anticipated to boost market growth soon.

China multiplex assay market is expanding rapidly, supported by strong government investment in healthcare modernization and biotechnology. The rising prevalence of infectious and chronic diseases fuels demand for rapid, accurate diagnostics. With national programs like “Made in China 2025” promoting biotech innovation, local companies are increasingly developing multiplex technologies. Collaborations between Chinese hospitals and global firms are accelerating clinical application. China’s large population base and ongoing reforms in regulatory approval processes are also aiding market penetration.

The multiplex assay market in Japan is growing steadily due to an aging population, high healthcare standards, and a focus on early disease detection. The country invests heavily in genomic research and personalized medicine, making multiplex assays vital diagnostic tools. Government-backed initiatives and collaborations with academic institutions are driving R&D in molecular diagnostics. Additionally, the Japanese market benefits from a strong domestic pharmaceutical industry and regulatory bodies that encourage innovation while maintaining stringent quality standards.

Latin America Multiplex Assay Market Trends

The multiplex assay market in Latin America is experiencing gradual growth, propelled by rising healthcare investments and growing awareness of advanced diagnostics. Brazil, Mexico, and Argentina are leading markets, driven by improvements in laboratory infrastructure and increasing demand for infectious disease testing. Although regulatory challenges and limited reimbursement structures pose hurdles, partnerships with global diagnostics companies and public health initiatives are helping expand access. Market potential remains high as governments prioritize disease prevention and early diagnosis strategies.

Middle East and Africa Multiplex Assay Market Trends

The multiplex assay market in the Middle East and Africa regions shows emerging growth, fueled by rising healthcare spending and the burden of infectious diseases. Countries like the UAE and Saudi Arabia are investing in diagnostic technologies as part of broader healthcare modernization efforts. In Africa, international aid programs and collaborations with NGOs are facilitating the adoption of multiplex testing, especially for diseases like HIV and tuberculosis. However, limited infrastructure and high costs may restrict growth without continued investment.

Key Multiplex Assay Company Insights

Key companies in the market are implementing numerous strategies such as collaborations, the launch of novel technologies & products, and partnerships to enhance their market presence. For instance, in October 2024, 10x Genomics, Inc. announced the launch of two new Chromium products designed to expand access to single-cell analysis. The newly introduced GEM-X Flex and GEM-X Universal Multiplex offer notable enhancements in performance, workflow efficiency, and cost-effectiveness. These advancements aim to make single-cell analysis more accessible and practical for a broader range of researchers and applications across various scientific fields.

Key Multiplex Assays Companies:

The following are the leading companies in the multiplex assays market. These companies collectively hold the largest market share and dictate industry trends.

- Luminex Corporation

- Bio-Rad Laboratories, Inc.

- Abcam plc.

- Seegene Inc.

- Merck KGaA

- Assay Genie.

- Promega Connections

- QIAGEN N.V.

- Thermo Fisher Scientific

- PerkinElmer Inc.

- Advanced Cell Diagnostics, Inc.

- R&D Systems, Inc.

Recent Development

-

In March 2025, Sphere Bio, a leading innovator in picodroplet-based microfluidics for functional single-cell analysis and isolation, announced the launch of its Cyto-Cellect Human IgG Kappa and Viability Assay Kit. This marks the first multiplexed assay specifically designed for the company’s newly introduced Cyto-Mine Chroma platform, representing a significant advancement in high-throughput single-cell screening capabilities.

-

In January 2025, QIAGEN announced a major enhancement to its QIAcuity Digital PCR (dPCR) system, doubling the number of targets that can be simultaneously analyzed from a single biological sample. This upgrade significantly boosts the system's analytical power, enabling broader and more efficient multiplex testing.

-

In November 2024, Augurex Life Sciences Corp. announced the launch of its Anti-14-3-3eta Multiplex Analyte Specific Reagents (ASRs), supporting the creation of a first-in-class diagnostic test for axial spondyloarthritis (axSpA). Developed by New Day Diagnostics in Knoxville, TN, the test incorporates these ASRs and is available exclusively through physician orders. Designed to aid in earlier axSpA detection, the test aims to reduce diagnostic delays and enhance patient outcomes by enabling more timely clinical intervention.

-

In April 2024, Bio-Rad Laboratories, Inc. announced the launch of its first ultrasensitive multiplexed digital PCR assay—the ddPLEX ESR1 Mutation Detection Kit. This new assay expands Bio-Rad’s Droplet Digital PCR (ddPCR) portfolio in the oncology space, supporting applications in translational research, therapy selection, and disease monitoring through highly sensitive and multiplexed mutation detection capabilities.

Multiplex Assay Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,974.64 million

Revenue forecast in 2030

USD 4,412.72 million

Growth rate

CAGR of 17.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, technology, application, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bio-Rad Laboratories, Inc.; Abcam plc.; R&D Systems, Inc.; Merck KGaA; Assay Genie; Promega Connections; QIAGEN N.V.; Thermo Fisher Scientific; Luminex Corporation; Perkin Elmer Inc.; Advanced Cell Diagnostics, Inc.; Seegene Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Multiplex Assays Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global multiplex assays based on product, type, technology, application, end user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Instruments

-

Software

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Multiplex Assays

-

Planar Protein Assays

-

Bead-Based Protein Assays

-

-

Nucleic Acid Multiplex Assays

-

Planar Protein Assays

-

Bead-Based Protein Assays

-

-

Cell-Based Multiplex Assays

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Flow Cytometry

-

Fluorescence Detection

-

Luminescence

-

Multiplex Real-Time PCR

-

Other Technologies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research & Development

-

Drug Discovery & Development

-

Biomarker Discovery & Validation

-

-

Clinical Diagnostics

-

Infectious Diseases

-

Cancer

-

Cardiovascular Diseases

-

Autoimmune Diseases

-

Nervous System Disorders

-

Metabolism & Endocrinology Disorders

-

Other Diseases

-

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Diagnostic Laboratories

-

Research & Academic Institutes

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global multiplex assay market size was estimated at USD 2.05 billion in 2022 and is expected to reach USD 1.47 billion in 2023.

b. The global multiplex assay market is expected to witness a compound annual growth rate of 14.77% from 2023 to 2030 to reach USD 3.87 billion in 2030.

b. The consumables segment held the dominant share of the market. This is due to the recurring purchase of consumables along with the rise in number of diagnostic tests.

b. The key market players key competing in the multiplex assay market include Bio-Rad Laboratories, Inc. Thermo Fisher Scientific, Seegene Inc., Luminex Corporation, Abcam plc., Promega Connections, QIAGEN N.V., Perkin Elmer Inc.

b. The key factors driving the multiplex assay market include the growing prevalence of chronic and infectious diseases, significant advantages of multiplex assays over singleplex and traditional assays, increasing applications of multiplex assays in companion diagnostics and rising awareness of early diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.