- Home

- »

- Petrochemicals

- »

-

Needle Coke Market Size, Share And Growth Report, 2030GVR Report cover

![Needle Coke Market Size, Share & Trends Report]()

Needle Coke Market Size, Share & Trends Analysis Report By Grade (Super-Premium, Premium-Grade, Intermediate Grade), By Application (Electrode, Silicon Metals & Ferroalloys), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-492-5

- Number of Report Pages: 158

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2025

- Industry: Bulk Chemicals

Needle Coke Market Size & Trends

The global needle coke market size was valued at USD 4,556.16 million in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030.There is increasing demand for needle coke in the production of graphite electrodes, which are essential for electric arc furnaces in the steelmaking process.

This demand is being fueled by the expansion of the aluminum and steel sectors, driven primarily by infrastructural development, automotive manufacturing, and increased consumer goods demand. In addition, the market is positively impacted by the rise in strategic collaborations and emerging new markets, which act as market drivers and further boost beneficial opportunities for market growth.

The Asia-Pacific region, with countries such as China, Japan, South Korea, and India, is a major hub for steel production and electric arc furnace (EAF) steelmaking. Needle coke is a critical raw material for producing graphite electrodes used in EAFs. The expansion of steel production capacity in the Asia-Pacific countries has led to an increased demand for the market. In addition, the push for electric vehicles in the region has resulted in a surge in demand for lithium-ion batteries, which require needle coke-derived graphite as an anode material.

The global demand for products is also driven by the rising demand for graphite electrodes and lithium-ion batteries. Needle coke is a crucial raw material for the production of graphite electrodes used in EAFs and lithium-ion batteries. The increasing adoption of electric vehicles and the demand for clean energy are expected to further drive market growth and have a positive impact on the global market.

Drivers, Opportunities & Restraints

The market for needle coke is expanding beyond traditional uses. The development of advanced materials such as carbon fiber and graphene has opened up new opportunities. Carbon fiber is extensively used in industries like aerospace, automotive, and sports equipment, while graphene has promising applications in electronics and energy storage. As research and development in these areas continue, the diversification of needle coke applications is expected to drive market growth.

The market is poised at the intersection of technological innovation and the global shift towards alternative energy sources. Advancements in manufacturing processes and cleaner production methods can help address environmental concerns associated with needle coke production. Companies that invest in research and development to improve the efficiency and sustainability of needle coke production can seize opportunities in the market.

Needle coke production is energy-intensive and can contribute to CO2 emissions, leading to environmental degradation. As a result, there is growing pressure from environmental bodies and governments worldwide to limit production or enforce cleaner production methods. Compliance with stringent environmental regulations can pose challenges for product manufacturers and impact market growth.

Market Dynamics

The market is moderately consolidated, with a few major players dominating the industry. This concentration of market power creates barriers to entry for new players and can stifle competition. The dominance of these major players can also lead to price manipulation and supply instability, which may act as deterrents to overall market growth. Some of the major players in the market include Phillips 66 Company, Liaoning Baolai Bioenergy Co. Ltd, China National Petroleum Corporation (CNPC), Shandong Yida Rongtong Trading Co., and Shandong Jing Yang Technology Co.

Regulatory pressures represent significant challenges for the product industry. These pressures can arise from various factors, such as environmental regulations and government policies aimed at promoting sustainable practices. Compliance with these regulations can impact the production and supply of needle coke, influencing market dynamics and competitiveness.

Regulatory frameworks also play a crucial role in shaping the market for needle coke. Compliance with regulations related to environmental sustainability, safety standards, and quality control is essential for industry players. These regulations ensure that the production and use of needle coke align with global standards and contribute to a sustainable and responsible industry.

Grade Insights & Trends

“Super-Premium Needle Coke segment is expected to witness growth at 11.1% CAGR.”

The super-premium grade was valued at USD 2,123.7 million in 2023 and is projected to reach USD 4,345.6 million by 2030. Super-premium grade product has the highest purity levels, excellent crystalline structure, and optimal physical properties, such as a low coefficient of thermal expansion (CTE).

These characteristics make it ideal for the production of graphite electrodes used in demanding steel and aluminum production scenarios, as well as for lithium-ion battery anode. Premium-grade product is also recognized for its higher quality compared to other grades. It is preferred in the production of high-quality graphite electrodes. Due to its low sulfur content, premium-grade product is commonly preferred in the steel industry.

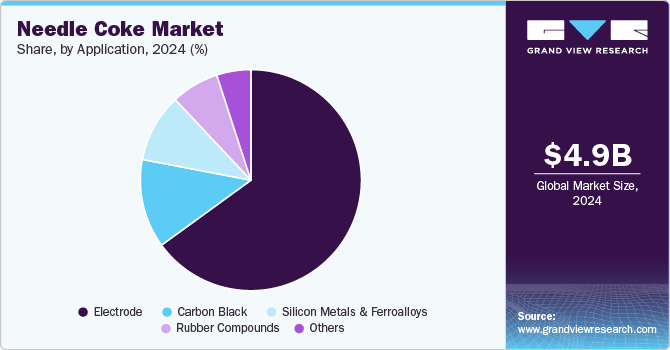

Application Insights & Trends

“Electrode segment is expected to witness growth at 10.8% CAGR.”

Graphite electrodes play a crucial role in electric arc furnaces (EAF) for steel production, silicon metal production, and ferroalloy production. The demand for product in the electrode segment is significant as it constitutes about 40% or more of the raw material costs in the manufacturing of graphite electrodes. The properties of the market, such as high-temperature resistance, high electrical resistance, and optimal structural characteristics, make it an ideal material for producing high-quality graphite electrodes used in demanding steel and aluminum production scenarios.

Needle coke is also used in the production of silicon metals and ferroalloys. The demand for needle coke in this segment is driven by the need for high-quality materials in the manufacturing process. The excellent thermal conductivity and heat resistance of graphite make it a preferred choice for heating elements in electric arc furnaces used in the production of silicon metals and ferroalloys.

Carbon black is another application where the product is utilized. Carbon black is a form of carbon used as a reinforcing filler in tires and other rubber products. The demand for needle coke in the carbon black segment is driven by the need for high-quality carbon black with specific properties, such as good dispersion, high abrasion resistance, and excellent reinforcement capabilities. Needle coke is used in the production of specialty graphite blocks, partially processed graphite, and granular graphite, which are essential components in the manufacturing of carbon black.

Regional Insights & Trends

The needle coke market in North America is driven by factors such as technological advancements, strategic partnerships, and emerging marketplaces. However, challenges such as the high production cost of needle coke and stringent environmental regulations may impact the market.

U.S. Needle Coke Market Trends

The U.S. needle coke market is driven by the high consumption of product by the steel and aluminum industries. Needle coke is used in the manufacturing of graphite electrodes, which are essential for electric arc furnaces used in steel and aluminum production.

Asia Pacific Needle Coke Market Trends

“China to witness market growth of CAGR 10.9%”

Asia Pacific is a prominent consumer of needle coke in the world with revenue share of 63.2% in 2023. The Asia-Pacific region, with countries such as China, Japan, South Korea, and India, is a major hub for steel production and electric arc furnace (EAF) steelmaking. Needle coke is a critical raw material for producing graphite electrodes used in EAFs.

The demand for product in India is driven by the graphite electrode manufacturing industry. Graphite electrodes, which are produced using needle coke, are essential in electric arc furnaces (EAF) for steel production. The growth of the steel industry, coupled with the need for high-quality materials, fuels the demand for product.

Europe Needle Coke Market Trends

The Europe needle coke market is driven by the demand from the steel and automotive sectors. Needle coke is used in the production of graphite electrodes, which are essential for electric arc furnaces used in steel production. The automotive industry also utilizes needle coke in the manufacturing of lithium-ion batteries for electric vehicles.

Germany is one of the major countries where needle coke and graphite electrode manufacturing is based. The presence of manufacturing facilities in Germany indicates the importance of the market in the country.

Central & South America Needle Coke Market Trends

The growth of the steel industry in Central & South America is expected to drive the demand for needle coke. Needle coke is used in the production of graphite electrodes, which are essential for electric arc furnaces used in steel production.

The rising demand for lithium-ion batteries, driven by the growing popularity of electric vehicles and portable electronic devices, is expected to contribute to the demand product in Argentina. Needle coke is used in the manufacturing of graphite electrodes for lithium-ion batteries.

Middle East & Africa Needle Coke Market Trends

The Middle East and Africa (MEA) region is considered an emerging market with growth potential in the needle coke industry. While Europe is at the forefront in terms of demand for product, the Middle East and Africa have untapped potential due to developing industries and potential resources.

The demand for market in Saudi Arabia is likely driven by various end user industries, including the steel industry, aluminum industry, lithium-ion battery manufacturing, and other applications.

Key Needle Coke Needle Coke Company Insights

Some of the key players operating in the market include Graphite India Limited (GIL), IOCL, Phillips 66, and China National Petroleum Corporation, among others.

-

Graphite India Limited (GIL) is a pioneer in India for the manufacture of Graphite Electrodes as well as Carbon and Graphite Specialty products. The company's manufacturing facilities are spread across six plants in India, and it also has a 100% owned subsidiary in Nuremberg, Germany, called Graphite COVA GmbH.

-

Sumitomo Chemical has a global presence, with subsidiaries and operations in different regions. For example, Sumitomo Chemical America, Inc. serves customers worldwide and operates in areas such as animal nutrition, crop health solutions, environmental health solutions, and more. Sumitomo Chemical Europe N.V./S.A. conducts business in Belgium and manufactures industrial chemical products.

Seadrift Coke L.P., C-Chem Co., Ltd., Baosteel Group, and Sojitz Ject Corp. among others, are some of the emerging market participants in the needle coke industry.

-

The Seadrift coker, built in 1983, is the world's petroleum needle coker. The coker has a current capacity approaching 180,000 metric tons per year. The Seadrift plant is almost entirely self-sufficient, requiring only supplies of feedstock and fresh water to run continuously.

-

Sojitz JECT Corporation is a subsidiary of Nissho Iwai Corporation, which is part of the Sojitz Group. The company was established when Nichimen Corporation transferred its petroleum and carbon business to Sojitz JECT Corporation. It became a subsidiary of Nissho Iwai Corporation.

Key Needle Coke Companies:

The following are the leading companies in the needle coke market. These companies collectively hold the largest market share and dictate industry trends.

- Phillips 66

- Asbury Carbon Inc.

- Seadrift Coke L.P.

- Sumitomo Chemical Company

- Mitsubishi Chemical Corp.

- JXTG Nippon Oil & Energy Corp.

- Indian Oil Corporation Limited

- Graftech International

- Sojitz Ject Corp.

- C-Chem Co., Ltd.

- Baosteel Group

Recent Developments

-

In January 2024, according to data from OilChem, needle coke production in China reached 62,500 tonnes in December, representing a 23.76% increase compared to the previous month. However, it experienced a significant decline of 34.89% compared to the same period last year.

-

In January 2022, Gazprom Neft announced plans to produce needle coke in its Omsk refinery for use in the manufacturing of Li-ion batteries and graphite electrodes. The project is expected to be completed by 2024.

Needle Coke Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4,929.50 million

Revenue forecast in 2030

USD 8,911.75 million

Growth Rate

CAGR of 10.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Germany, UK, Italy, China, India, Japan, Australia, Brazil, Mexico

Key companies profiled

Phillips 66, Asbury Carbon Inc., Seadrift Coke L.P., Sumitomo Chemical Company, Mitsubishi Chemical Corp., JXTG Nippon Oil & Energy Corp., Indian Oil Corporation Limited, Graftech International, Sojitz Ject Corp., C-Chem Co., Ltd., Baosteel Group.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Needle Coke Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global needle coke market report based on grade, application, and region.

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Super-Premium

-

Premium-Grade

-

Intermediate Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electrode

-

Silicon Metals & Ferroalloys

-

Carbon Black

-

Rubber Compounds

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global needle coke market size was estimated at USD 4,556.16 million in 2023 and is expected to reach USD 4,929.50 million in 2024.

b. The global needle coke market is expected to grow at a compound annual growth rate of 10.4% from 2024 to 2030 to reach USD 8,911.75 million by 2030.

b. Asia Pacific dominated the needle coke market with a share of 63.2% in 2023. This is attributable to government initiatives to support domestic manufacturing in key countries such as China and India.

b. Some key players operating in the needle coke market include Phillips 66, Asbury Carbon Inc., Seadrift Coke L.P., Sumitomo Chemical Company, Mitsubishi Chemical Corp., JXTG Nippon Oil & Energy Corp., and Indian Oil Corporation Limited.

b. Key factors that are driving the market growth include rapid expansion of steel industry in developing economies and rising demand for graphite batteries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."