- Home

- »

- Communications Infrastructure

- »

-

Network Automation Market Size & Share Report, 2022-2030GVR Report cover

![Network Automation Market Size, Share & Trends Report]()

Network Automation Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment (On-Premise, Cloud), By Infrastructure, By Enterprise Size, By Vertical, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-986-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

The global network automation market size was valued at USD 2.58 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 22.9% from 2022 to 2030. It encompasses the process of automating the management, configuration, testing, operations, and deployment of virtual and physical devices involved in a network. It utilizes software to automate the network and provides management and security to maximize network functionality and efficiency. It also enables prompt operation units to integrate and configure application services and network infrastructure.

Also, it eliminates manual processes such as logging into switches, firewalls, routers, and load balancers to change configurations to manage the network. It also allows flexible and agile operations that support business demands, reduce errors, improve efficiency, and lower operating expenses. Additionally, automation enables standardization of network processes management and allows operations units to reduce mean time to resolution and deliver services at scale.

The market is projected to witness significant growth attributed to the increasing adoption of connected devices, emerging hybrid workplaces, and 5G-driven services. Additionally, a growing emphasis on usage network virtualization is anticipated to boost the growth of the market. Furthermore, the rising adoption of network automation-enabled services in several verticals, such as BFSI, IT, manufacturing, and retail, among others, is contributing positively to the network automation market growth.

It also increases network uptime and stability. It also provides access to businesses and organizations to automate networks to meet specific requirements efficiently and cost-effectively, replacing command-line instructions for configuring the devices. Moreover, the utilization of advanced technological tools, such as artificial intelligence, machine learning, and big data, is propelling the growth of the market.

Network automation combines network function virtualization (NFV) and software-defined networking (SDN), enabling the configuration of networks to meet the organization's requirements. An automated platform enables ease in network testing, resource provision, and mapping, fueling network automation adoption.

It includes solutions such as network designing and planning, configuration compliance and verification, device testing, data analysis, security compliance, collection of network data, and deployment of physical & virtual devices and services. Moreover, the players in the market are launching advanced solutions which use machine learning, big data, and other advanced technologies, which are expected to provide numerous market opportunities.

COVID-19 Impact on the Network automation market

The COVID-19 pandemic had a favorable impact on the IT and telecommunication sectors owing to the increasing penetration of networking services, growing adoption of internet subscribers, and emerging adoption of remote access services in industries such as manufacturing, BFSI, and others. The gradual shift from conventional business practices to online platforms resulted in the establishment of efficient networking services and solutions for technological advancements in 5G services.

Therefore, the communication service providers played a pivotal role in supporting the network infrastructure. Enterprise virtual private network (VPN) servers became crucially important with the emerging work-from-home and online education during the pandemic.

As the COVID-19 restrictions were alleviated, the communication service providers (CSPs) accelerated investments in network automation infrastructure and solutions. The use cases of network automation, including remote office, remote education, and e-health services, are anticipated to propel the growth of the market.

Moreover, use cases such as remote education, remote office, robotics, and telemedicine, have driven the market demand for network automation solutions during the pandemic. Additionally, the increasing adoption of these solutions utilized to manage the rising network traffic has fueled market growth during the pandemic.

Component Insights

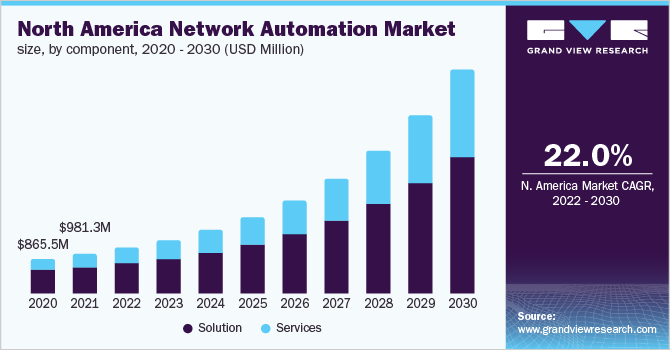

Based on component, the solution segment dominated with the highest revenue share of 69.0% in 2021 and is expected to witness a CAGR of 21.7% during the forecast period. The solution segment comprises SD-WAN and network virtualization tools, intent-based networking solutions/platforms, configuration management tools, and other network automation tools. The growth of the solution segment can be attributed to the adoption of network automation solutions by communication service providers (CSPs) to accelerate the delivery of these software and applications.

Additionally, the key market participants are introducing advanced solutions to meet end-users’ requirements. The increasing adoption of connected devices and growing demand for network bandwidth fuel the growth of this market. These solutions avoid service-level agreement (SLA) violations, maximize network uptime, and reduce mean time to repair (MTTR). The aforementioned benefits offered by network automation encourage CSPs to invest in research and development to enable low-cost and effective solutions, which is expected to provide lucrative opportunities for the market.

The services segment is anticipated to witness the fastest CAGR of 25.4% throughout the forecast period. These services ensure effective functioning and improved network operational efficiencies throughout the process. The services segment is further categorized into advisory, analytics, and automation services, deployment & integration services, and training services.

Deployment Insights

The on-premises segment dominated with a revenue share of more than 55% in 2021 and is expected to witness a CAGR of 21.4% during the forecast period. The on-premises automation solutions offer a one-time license fee, an annual service agreement, and a huge scope of customizing network automation depending on business demands due to the deployment of equipment within the organization.

Large enterprises primarily adopt on-premises deployment of network equipment as on-premises deployment requires data centers, dedicated infrastructure, maintenance, and scale hardware and software. This segment allows organizations to analyze the collected data and improve customer services.

The cloud deployment segment is anticipated to witness the fastest growth, growing at a CAGR of 24.6% throughout the forecast period. The growth of this segment is attributed to the rising demand for robust cloud-based solutions and services to enhance productivity by small and medium enterprises.

Cloud deployment mode enables easy deployment, secure & reliable network configuration, and handles massive network application traffic propelling the growth of the segment. It eliminates the need for in-house infrastructure and complex maintenance, making cloud network automation services cost-effective. However, the degree of customization of network automation solutions reduces due to cloud deployment.

Infrastructure Insights

The hybrid infrastructure segment is anticipated to witness a CAGR of 23.4% throughout the forecast period. Hybrid infrastructure comprises an IT infrastructure environment. It is a mix of public/private clouds and data centers, enabling the monitoring and managing of entire infrastructure services. It helps the management and evaluation of physical and cloud-based infrastructure, enabling performance optimization. Hybrid infrastructure service automation offers IT operations automation, IT service support automation, and provisioning and release automation.

The virtual network infrastructure is expected to witness the fastest CAGR of 24.1% during the forecast period. The virtual infrastructure involves virtualization that allows organizations to host a network infrastructure, connecting the servers, data centers, devices, and virtual machines. A virtual network infrastructure creates a flexible virtual software-based environment providing access to enterprise-grade technology, such as applications and servers. Virtual network infrastructure provides flexibility, backup and recovery, scalability, load balancing, and a low total cost of ownership.

Enterprise Size Insights

The large enterprises segment held the dominant revenue share of more than 63% in 2021. It is expected to grow at a CAGR of 21.4% over the forecast period. The rising adoption of network automation, virtualization solutions, and services across large enterprises are expected to drive the segment's growth. Additionally, large enterprises are the early adopters of advanced technologies such as virtualization and automation are driving the demand for network automation solutions and services. However, large enterprises require robust network infrastructure to efficiently manage their resources and increase productivity, contributing largely to on-premises deployment.

The SMEs segment is anticipated to grow at a considerable CAGR of 25.2% throughout the forecast period. Network automation allows SMEs to organize their networks, maintain security systems, and monitor employees. SMEs focus on digital transformation to achieve reliable, fast, and secure networks and eliminate hardware connectivity appliances through cloud network automation deployment. The adoption of network automation is higher in SMEs as it improves the quality of services (QoS) and ensures the security of networks. Moreover, advanced network automation technologies such as SDN, IoT, and big data are higher in demand due to affordable cloud services.

Vertical Insights

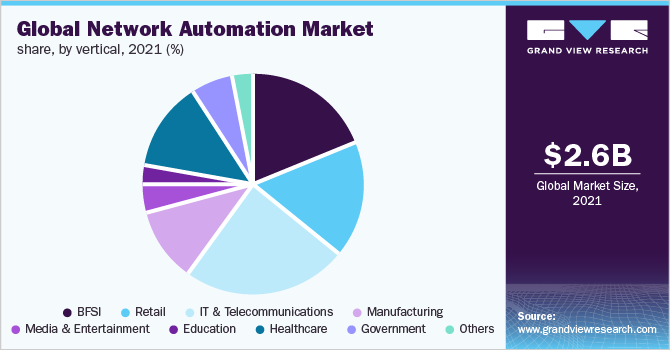

The information technology (IT) segment dominated the overall market with a revenue share of 24% in 2021 and is expected to witness a CAGR of 23.1% during the forecast period. The growth of the IT segment is attributed to the early adoption of network automation solutions and services by IT and telecom service providers. The growth of this segment is attributed to increasing use cases and the adoption of network automation services and IT infrastructure.

Network infrastructure plays a significant role in the IT & telecommunication sector as it minimizes the digital divide by delivering quick network services and minimizing errors at affordable costs. Network automation services are expected to revolutionize the entire IT sector with automated data enrichment and optimized security infrastructure. It enables configuration drift, monitoring & troubleshooting, and firewall policy management, creating highly responsive network infrastructure.

The manufacturing segment is anticipated to witness the fastest CAGR of 24.8% throughout the forecast period. The manufacturing vertical has been witnessing a transformation towards advanced technologies, thereby resulting in smart manufacturing and factory automation. This trend of shifting to smart factory operations results in decentralizing the decision-making processes through interconnected devices.

These devices can sense their environments and cooperate through wireless communication systems, requiring robust, high-speed, and uninterrupted communication. The exceptional benefits such as flexible and agile network operations offered by network automation solutions and services are anticipated to be a catalyst in the manufacturing sector, thereby resulting in the highest growth of network automation in this vertical.

Regional Insights

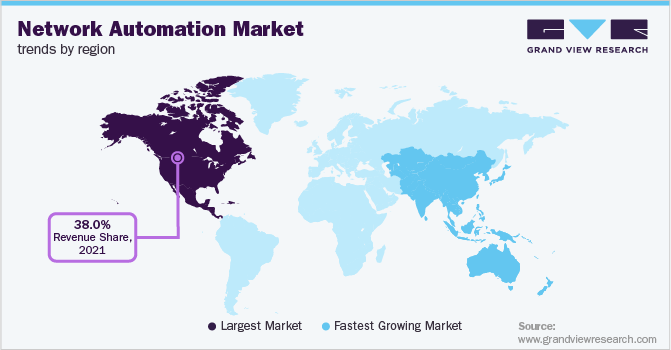

North America led with a market share of 38% in 2o21. The growth is attributed to the rapid adoption of network automation solutions and services. The key factor driving the regional growth is the presence of significant players such as Cisco Systems Inc, and IBM Corporation among others, which have propelled the market growth. Significant companies are investing heavily in the research and development of data centers, and network infrastructure is contributing to network automation growth.

The rising demand for machine learning, big data, and deep learning algorithms enabling remote network equipment control is fueling the growth of the network automation industry. Businesses and organizations are refining their traditional network infrastructure to advanced IT infrastructure, network virtualization solutions, and cloud deployment services. The IT and telecommunication service providers are adopting and implementing network automation to eliminate errors and rising network traffic complexities.

Asia Pacific is anticipated to grow at a considerable CAGR of 24.2% throughout the forecast period. The growth is attributed to the increasing penetration of network automation solutions and services and the emergence of start-ups adopting network automation in the region. India and China have an extensive and distributed customer base driving the demand and creating new regional opportunities.

The growth is prominently due to improving network infrastructure and increasing requirements to reduce CAPEX across the region. Furthermore, the region's untapped potential is generating new investment opportunities for advanced network automation utilizing big data, machine learning (ML), and artificial intelligence (AI). Multinational companies are expanding their presence across the APAC region, resulting in a broad customer base and internet subscribers that provides lucrative opportunities for the market.

Key Companies & Market Share Insights

The network automation landscape is consolidated and is anticipated to witness increased competition due to several players' strong presence. Some prominent players in the market include Anuta Networks, IBM Corporation, Vmware, Juniper Networks, Cisco Systems Inc, and Fortinet, Inc, among others. These companies are also collaborating with telecom operators, advertisers, and local & regional players to gain a competitive edge over their peers and capture a significant market share.

Players operating in the automation market are adopting different key strategies and developments to occupy a substantial market share. For instance, in November 2021, VMware, Inc. announced a collaboration with Vodafone Group to deliver orchestration and automation services through a single platform on its core networks across the European region. Some prominent players in the global network automation market include:

-

Anuta Networks

-

Apstra

-

BlueCat

-

BMC Software

-

Cisco Systems Inc

-

Entuity

-

Forward Networks

-

Fortinet, Inc

-

IBM Corporation

-

Juniper Networks

-

Micro Focus

-

NetBrain

-

Riverbed

-

Solar Winds

-

Veriflow

-

Vmware

Network Automation Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.99 billion

Revenue forecast in 2030

USD 15.60 billion

Growth Rate

CAGR of 22.9% from 2022 to 2030

Base year for estimation

2021

Historical Year

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and network automation trends

Segments covered

Component, deployment, infrastructure, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Brazil; Mexico

Key companies profiled

Anuta Networks; BlueCat; Apstra; Cisco Systems Inc.; Entuity; IBM Corporation; BMC Software; Forward Networks; Fortinet, Inc.; Juniper Networks; Micro Focus; NetBrain; Solar Winds; Riverbed; Veriflow; Vmware

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Automation Market Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global network automation market report based on component, deployment, infrastructure, enterprise size, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

SD-Wan and Network Virtualization Tools

-

Intent-Based Networking Solutions/Platforms

-

Configuration Management Tools

-

Other Network Automation Tools

-

-

Services

-

Advisory, Analytics & Automation Services

-

Deployment & Integration Services

-

Training Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premises

-

Cloud

-

-

Infrastructure Outlook (Revenue, USD Million, 2017 - 2030)

-

Physical

-

Virtual

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Retail

-

IT & Telecommunications

-

Manufacturing

-

Media & Entertainment

-

Education

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global network automation market size was estimated at USD 2.58 billion in 2021 and is expected to reach USD 2.99 billion in 2022.

b. The global network automation market is expected to grow at a compound annual growth rate of 22.9% from 2022 to 2030 to reach USD 15.60 billion by 2030.

b. The Solutions/Software segment accounted for the largest revenue share of over 69.0% in 2021 in the network automation market due to the increased adoption of various virtualization technologies such as NFV and SD-WAN across the globe.

b. Some key players operating in the network as s service market include Anuta Networks, Apstra, BlueCat, BMC Software, Cisco Systems Inc, Entuity, Forward Networks, Fortinet, Inc, IBM Corporation, Juniper Networks, Micro Focus, NetBrain, Riverbed, Solar Winds, Veriflow, Vmware.

b. The increasing adoption of connected devices, emerging hybrid workplaces, and 5G-driven services are expected to drive the growth of the Network Automation Market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."