- Home

- »

- Medical Devices

- »

-

Global Otoscope Market Size & Share Report, 2024-2030GVR Report cover

![Otoscope Market Size, Share & Trends Report]()

Otoscope Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Pocket Otoscope, Full-sized Otoscope, Video Otoscope), By Modality (Wired Digital, Wireless), By Portability, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-977-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

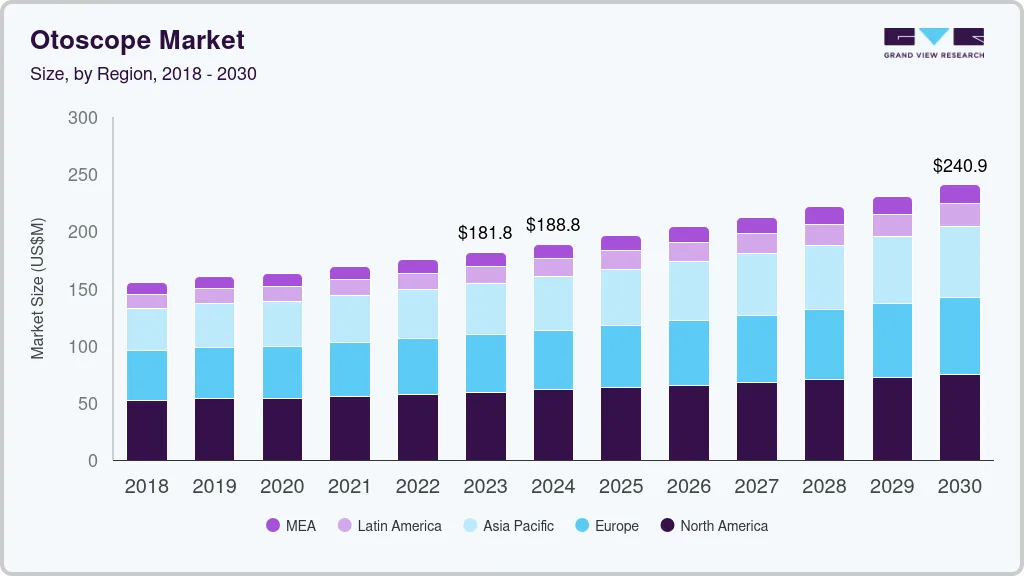

The global otoscope market size was valued at USD 181.8 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030. Key factors driving the market include an increase in the prevalence of ear-related diseases, technological advancements such as LED, Video, or portable otoscopes, and a rise in the elderly population that is susceptible to hearing disorders. Additionally, the rise in the incidence of noise-induced hearing loss is playing an important role in increasing the demand for otoscopes and their diagnostic services. The market is also driven by the availability of rechargeable, easy-to-use pocket otoscopes and the increasing number of otolaryngologists worldwide. Hearing loss or hearing impairment is a global health problem affecting communication skills, independence, well-being, and quality of life. In addition to age-related factors, the increasing prevalence of hearing loss can be attributed to genetic factors, complications during pregnancy, and the spread of highly contagious diseases such as rubella, meningitis, and mumps.

In the year 2020, mass closure of ENT clinics and termination of elective surgical procedures in hospitals due to the outbreak of COVID-19 drove down sales of ENT medical devices including otoscopes. According to a report by the European Annals of Otorhinolaryngology, Head and Neck Diseases, the number of ENT surgeries declined by 84% during the initial months of the pandemic, resulting in a decrease in the demand for otoscopes. ENT surgeons had the highest risk of COVID-19 infection as they typically performed surgeries on areas directly related to the disease. Providers of otoscopes, therefore, faced large financial losses. Till the fourth quarter of 2020 and the first quarter of 2021, the market conditions varied greatly across regions, with surgery volumes recovering quickly in the U.S., China, Germany, and Australia and more slowly in Spain, the U.K., and Italy. As the volume of ENT patient visits resumed, the demand for otoscopes is also expected to rise.

However, as lockdown restrictions are being lifted in most countries, the supply chains of most healthcare companies are expected to work effectively and smoothly over the forecast period. Thus, the otoscope business and other medical industries are progressively regaining ground as the COVID-19 situation throughout the world normalizes.

Hearing loss/impairment has become one of the most common conditions in patients, especially in developed nations. According to the WHO 2021 report, over 430 million people worldwide, i.e., around 5% of the world’s population are living with disabling hearing loss, and is expected to increase to over 700 million or 1 in 10 people by 2050. In Europe, 34.4 million adults suffer from hearing loss. Furthermore, the WHO 2021 World Report on Hearing estimates that in the WHO region of Europe, 196 million people have some degree of hearing loss and 57.3 million or 6.2% have a moderate or higher grade of hearing loss. By 2050, 236 million people in Europe will have some degree of hearing loss. Similarly, in the United States, approximately 48 million adults report some trouble hearing, and 1 in 5 American teens experiences some degree of hearing loss. Therefore, the increased burden of ENT disease is expected to boost the industry growth over the forecast period and provide lucrative growth opportunities to industry players in the coming years.

Increase in the geriatric population has increased the demand for otoscopes for the primary diagnosis of ENT-related disorders. The prevalence of deafness increases with age. Over 25% of people older than 60 years are affected by disabling hearing loss. It is estimated that one in every three people aged 65 to 74 suffers from some degree of deafness in the U.S. and half of the population above the age of 75 suffers from hearing loss, which can be an opportunity for the market. Similarly, the number of individuals suffering from hearing impairments in the U.S. grew two-fold over the course of the last 3 decades, with around 14% of the region’s adults. Hence, people aged 65 and over are more susceptible to hearing loss due to age-related diseases, thereby contributing to the industry growth over the forecast period.

In addition, infectious diseases such as otitis media, measles, and meningitis are common causes of hearing loss in low-income countries. Different types of ear infections include otitis media, otitis externa, Eustachian tube catarrh, and inner ear infections with ear pain, fever, and hearing loss. As per the WHO, 5% of the global population suffers from hearing loss, which is nearly 432 million adults and 34 million children. By 2050, 2.5 billion people are expected to suffer from hearing loss, of which 700 million will require a hearing aid or surgery, thus increasing the demand for otoscopes. More than 1 billion young people are at risk of permanent and preventable hearing loss from unsafe listening practices. Also, nearly 80% of people with disabling hearing loss live in low- and middle-income countries. Thus, the growing prevalence of ENT disorders that require otoscopes for diagnosis as well as surgery is increasing the demand for otoscopes over the forecast period.

The U.S. dominated the North American market with a revenue share of over 80.0% in 2021. The growing prevalence of ENT-related disorders, the presence of established infrastructure, and favorable reimbursement structure are among the key factors driving the market in the U.S. Otitis media is a type of ENT disease, which causes inflammation in the ear. As per the American Academy of Pediatrics, nearly 90% of doctor-prescribed antibiotic treatments are associated with otitis media, and about 95% of children by the age of 7 will experience an episode of otitis media. Therefore, with the increasing prevalence of ENT diseases. Moreover, rapid technological advancements, the presence of key players, and frequent launch of new and innovative products are among the key factors fueling the industry growth.

Additionally, medical device manufacturers are focused on product development with the adoption of smart sensors that help in the introduction of wireless products with advanced features. Companies are investing in new technologies and launching new products to cater to the growing needs of consumers. These technologies will help cater to the needs of patients suffering from various ear-related disorders in a better way. For instance, Delfino by Inventis is a wireless video telescope that can capture and store high-quality clear images of ear canals on a traditional display or on a computer screen. Similarly, SyncVision Technology Corporation's iO1 OTO is a digital portable otoscope with a built-in LCD screen. A clear image of the ear canal can be instantly viewed by the specialist on the LCD screen. Thus, otoscopes with advanced features and modern technology have the strongest growth potential in the overall market.

Type Insights

In 2021, the pocket otoscope segment captured the largest share of over 65.0%. The advantages offered by a pocket otoscope over a full-sized otoscope could be the driving force behind the growth of the segment. A pocket-sized otoscope is small-sized, which makes it easier to handle. Compared to typical otoscopes, these are less bulky and lighter in weight. Few otoscopes are fitted with a camera or an interface for visualizing images on a computer, making the otoscopy procedure more efficient by providing high-quality images. In developing countries with limited access to advanced medical imaging in rural areas, this otoscope plays an important role in diagnosis. Additionally, wireless/smart otoscopes are not available in all small medical facilities and hospitals in sub-Saharan Africa. These factors are anticipated to boost the demand for pocket otoscopes over the forecast period.

The video otoscopes segment is expected to grow at the highest rate of 4.6% from 2022 to 2030. High patient volume suffering from diseases related to ENT and incorporation of smart technologies such as AI into otoscopes will upsurge the espousal of video otoscopes over the forecast period. For instance, in July 2020, MedRx Inc., an audiometric equipment company, launched a new USB video otoscope, which integrates into software to provide high-quality images. Such technological advancements are expected to boost segment growth during the forecast period. Moreover, continuous investments in R&D to innovate and develop the latest video otoscopes are anticipated to boost industry growth during the forecast period.

Modality Insights

In 2021, the wired digital segment held the largest share of over 60.0%. The introduction of new products, ongoing R&D, geographical expansion by key players, and several government initiatives focusing on the early screening of ear impairment is likely to boost the industry growth during the forecast period. For instance, the Chinese government plans to expand insurance coverage by providing demand subsidies to the rural population by introducing a New Cooperative Medical Scheme to raise care costs for improved and rapid treatment. Furthermore, subsidies, grants, and funding are offered by governments all across the world to prevent and manage hearing disorders. For instance, the New South Wales (NSW) Statewide Infant Screening-Hearing (SWISH) program in Australia aims at identifying babies born with permanent bilateral deafness in NSW. Such initiatives are expected to further boost the demand for wired digital otoscopes globally, thereby supporting segment growth.

The wireless otoscopes segment is expected to expand at the highest rate of 4.3% from 2022 to 2030 on account of factors such as a widening base of immobile patients as well as the geriatric population. The advancement of Bluetooth technology has paved the way for the development of wireless otoscopes. This allows healthcare providers to see patients’ ear canal images without having to make direct contact with them. Wireless otoscopes aid specialists in the contactless examination of patients, shielding them from a variety of infectious pathogens. With the growing demand for teleconsultation services in recent years, wireless otoscopes allow healthcare providers to evaluate and exchange videos and images of the tympanic membrane and ear canal in real-time. Given these factors, the market for wireless transmission system-based otoscopes is expected to expand significantly. These factors are anticipated to drive the segment over the forecast period.

Portability Insights

In 2021, the portable otoscope segment dominated the market with a share of over 70.0%. This growth is due to the availability of several products and the presence of major industry players. Moreover, they are flexible enough to be used across all health facilities. Some of the key players in the market offering portable otoscopes are Welch Allyn, Inc.; American Diagnostic Corporation; Rudolf Riester GmbH; Heine Optotechnik; Midmark Corporation; Prestige Medical; GF Health Products, Inc.; and CellScope, Inc. Portable otoscopes use less space than wall-mounted and are smaller in size. These types of otoscopes not only provide continuous, non-invasive monitoring of health parameters but can also provide real-time updates to healthcare providers through connectivity. Thus, all these aforementioned factors are contributing to the segment growth.

The portable otoscope is anticipated to grow at the fastest rate of 4.2% during the forecast period owing to the growing adoption of these devices in home healthcare services. Home healthcare is a cost-effective option for long-term care of the disabled, chronic diseases, and surgical interventions. As per the U.S. Bureau of Labor Statistics, the rank of home health and personal care aides is expected to increase by 13.0 million in 2020 (a 70.0% increase from 2010). In addition, the increasing number of emergency and ambulatory care services is contributing to the growth of the portable otoscope segment. Moreover, the user-friendly, compact designs offer advantages including point-of-care use. Such advantages are propelling the demand for portable devices.

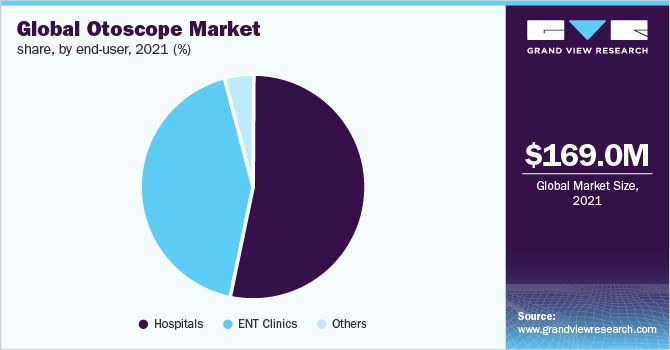

End-user Insights

In 2021, the hospital segment dominated the market with a share of over 50.0%. This is due to the growing number of patient admissions in hospitals for various medical illnesses and treatments for COVID-19. In terms of the sheer volume of otoscopes, hospitals are observed to be the largest consumer of related products and services. In addition, an increase in the number of chronic illnesses that lead to a high rate of hospitalization rate contributes to the high demand for otoscopes in hospitals. This is projected to strengthen segment growth in the coming years. In the worldwide healthcare system, hospitals are the primary treatment facilities, playing an important part in the delivery of care in the ENT specialty. In fact, in many emerging economies, hospitals are the only places where an ENT surgery may be performed.

The ENT clinics segment is expected to grow at the highest rate of 4.4% from 2022 to 2030. With an increase in the prevalence of ear, nose, and throat disorders in geriatric people, the demand for ENT clinics is expected to rise over the upcoming years. People prefer ENT clinics to treat a wide variety of conditions such as oropharyngeal cancer, chronic or fungal sinusitis, hearing loss, and obstructive sleep apnea. Furthermore, rising healthcare awareness among patients and surgical professionals is projected to foster segment growth. The rise in disposable income, increasing affordability for ENT treatment, high prevalence of hearing loss, rapidly growing elderly population, and technological advancements in hearing aid are the major factors driving this market.

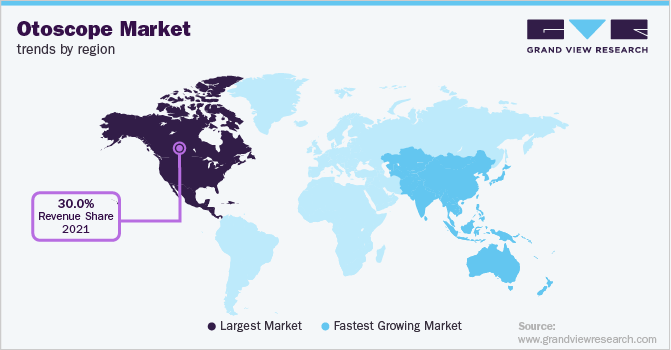

Regional Insights

North America dominated the market in 2021 with a share of over 30.0%. This can be attributed to the high prevalence of ENT-related disorders in the region, the growing geriatric population, the increasing prevalence of hearing loss, the presence of large hospital chains, highly equipped ambulatory facilities, and a significant target population. As per the March 2021 update by the National Institute on Deafness and Other Communication Disorders, around 2 to 3 children out of 1,000 children in the U.S. are born with a discernible level of hearing impairment in one or even both ears, and roughly 15% of American adults that is 37.5 million individuals and aged between 18 and up report some hearing problems. In addition, the local presence of key players, supportive government regulations for portable medical devices, and high adoption of advanced technology are key factors driving the market. As a result of the high incidence of hearing loss in the region, the demand for otoscopes would rise, thereby propelling industry growth in the forecast period.

The Asia Pacific is anticipated to exhibit a lucrative growth rate of 4.7% during the forecast period. Factors such as the increasing prevalence of hearing disorders and the introduction of advanced products by the key players are attributed to supporting industry growth. According to an article by hearing-it, in 2021, about 401 million people in the South-East Asia region suffered from some degree of hearing loss, and this number is estimated to reach to 666 million by 2050. This factor is anticipated to significantly increase the demand for otoscopes in the Asia Pacific. Moreover, increasing government spending, investment by key players operating in the industry, and awareness programs by various organizations are expected to facilitate growth over the forecast period.

Key Companies & Market Share Insights

Key players are adopting strategies such as mergers & acquisitions, partnerships, and new product launches to strengthen their foothold in the market. For instance, in 2017, hearX Group launched a smartphone otoscope hearScope. It is an FDA-approved digital otoscope that works with a smartphone and includes artificial intelligence (AI) image classification feature to enable ENT specialists to accurately diagnose ear diseases. Similarly, in April 2021, Hill-Rom launched the new Welch Allyn MacroView Plus Otoscope, which features LumiView clear ear speculum, with four times the brightness of an adult speculum when compared to a standard ear speculum. Advancements such as these are anticipated to boost industry growth during the forecast period.

Furthermore, numerous manufacturers in the otoscope industry collaborate with major medical device distributors to market and supply their products globally or in certain countries. Strategic alliances are therefore quite common among manufacturers and medical device distributors. Such alliances not only help the manufacturers acquire the license to market their products but also reduce their liabilities in case of product recall and adverse events. Some prominent players in the global otoscope market include:

-

3M

-

Welch Allyn, Inc.

-

American Diagnostic Corporation

-

Orlvision GmbH

-

SyncVision Technology Corporation

-

Rudolf Riester GmbH

-

Heine Optotechnik

-

Mindmark Corporation

-

Olympus Corporation

-

Inventis SRL

-

Prestige Medical

-

GF Health Products, Inc.

-

CellScope, Inc.

Otoscope Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 188.8 million

Revenue forecast in 2030

USD 240.9 million

Growth Rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, modality, portability, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

3M; Welch Allyn, Inc.; American Diagnostic Corporation; Orlvision GmbH; SyncVision Technology Corporation; Rudolf Riester GmbH; Heine Optotechnik; Mindmark Corporation; Olympus Corporation; Inventis SRL; Prestige Medical; GF Health Products, Inc; CellScope, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Otoscope Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global otoscope market report based on type, modality, portability, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pocket Otoscope

-

Full-sized Otoscope

-

Video Otoscope

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired Digital

-

Wireless

-

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Wall-mounted

-

Portable

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

ENT Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global otoscope market size was estimated at USD 169.03 million in 2021 and is expected to reach USD 175.25 million in 2022.

b. The global otoscope market is expected to grow at a compound annual growth rate of 4.1% from 2022 to 2030 to reach USD 240.90 million by 2030.

b. North America dominated the otoscope market with a share of 33.05% in 2021. This is attributable to the high prevalence of ENT-related disorders, growing geriatric population and presence of large hospitals chains, highly equipped ambulatory facilities, and a significant target population in the region.

b. Some key players operating in the otoscope market include Welch Allyn, Inc., American Diagnostic Corporation, Orlvision GmbH, SyncVision Technology Corporation, Rudolf Riester GmbH, Heine Optotechnik, Mindmark Corporation, Olympus Corporation, Inventis SRL, Prestige Medical, GF Health Products, Inc, and CellScope, Inc., among other players.

b. Key factors driving the otoscope market growth include increase in prevalence of ear related diseases, technological advancement like LED, Video, or portable otoscopes, and rise in elderly population that is susceptible to hearing disorder. Market growth is also driven by the availability of rechargeable, easy-to-use pocket otoscopes and the increasing number of otolaryngologists worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.