- Home

- »

- Medical Devices

- »

-

Oxygen Therapy Market Size, Share & Trends Report, 2030GVR Report cover

![Oxygen Therapy Market Size, Share & Trends Report]()

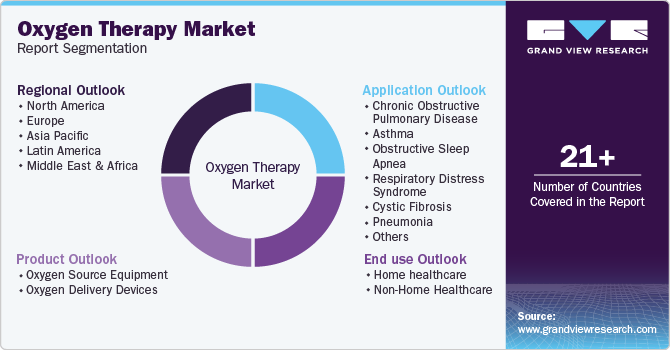

Oxygen Therapy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Oxygen Source Equipment, Oxygen Delivery Devices), By Application, By End-use (Home Healthcare, Non-Home Healthcare), By Region, And Segment Forecasts

- Report ID: 978-1-68038-829-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oxygen Therapy Market Summary

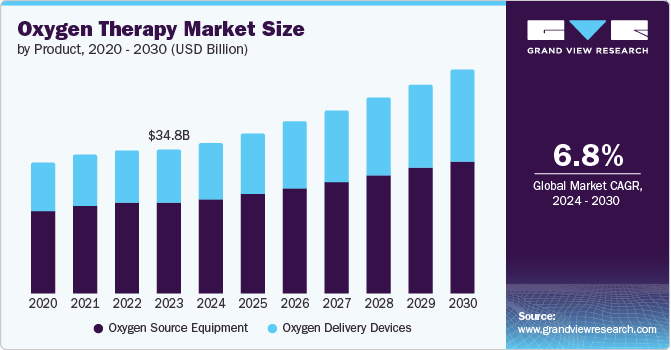

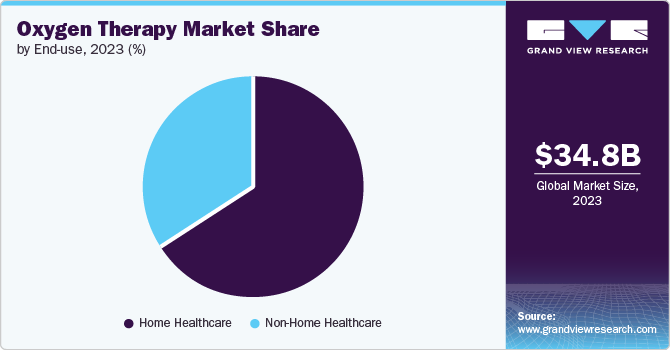

The global oxygen therapy market size was estimated at USD 34.8 billion in 2023 and is projected to reach USD 54.14 billion by 2030, growing at a CAGR of 6.83% from 2024 to 2030. The increasing incidence of chronic respiratory diseases and the rising demand for home healthcare services are a few major market drivers.

Key Market Trends & Insights

- North America dominated the global oxygen therapy market with the largest revenue share of 34.6% in 2023.

- By product, the oxygen source equipment segment led the market, holding the largest revenue share in 2023.

- By application, the COPD segment held the dominant position in the market and accounted for the leading revenue share in 2023.

- By end use, the non-home healthcare segment is expected to grow at a significant CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 34.8 Billion

- 2030 Projected Market Size: USD 54.14 Billion

- CAGR (2024-2030): 6.83%

- North America: Largest market in 2023

According to the Forum of International Respiratory Societies (FIRS) September 2021 report insights, Chronic Obstructive Pulmonary Disorder (COPD) is a predominant non-infectious lung disease globally, impacting around 300 million individuals, accounting for about 4% of the global population. Similarly, according to the Asthma and Allergy Foundation of America (AAFA), asthma claims the lives of 11 Americans daily, with 4,145 deaths recorded in 2020. This marked the first increase in asthma-related deaths in 20 years. The Illinois Department of Central Management Services projected that annual direct costs per asthma patient in the U.S. would exceed USD 3,000 in 2022.

As a result of the growing patient population and the need for efficient & effective treatment measures, the market is anticipated to witness significant growth in the coming years. The COVID-19 pandemic significantly disrupted the medical devices market due to lockdown-related restrictions and supply chain disturbances. However, oxygen therapy devices experienced a surge in demand as they were integral to the initial treatment of critically ill COVID-19 patients. The global shortage of ventilators led to increased demand for oxygen concentrators. To address this shortage, biomedical engineers and scientists developed makeshift devices to replicate the basic functions of ventilators using existing equipment such as oxygen concentrators, Positive Airway Pressure (PAP) devices, anesthesia machines, and manual resuscitators.

Furthermore, the U.S. FDA authorized the usage of these concentrators under the Emergency Use Authorization (EUA) scheme, which significantly increased the demand for oxygen concentrators. As most critical COVID-19 cases required some form of artificial ventilation, the demand for canned oxygen and wall-mounted oxygen concentrators also saw a significant rise. Moreover, the growing demand for technologically advanced devices, such as portable oxygen concentrators, has further driven market growth.

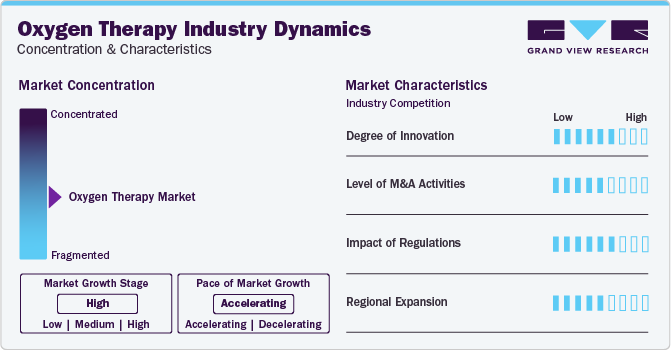

Market Concentration & Characteristics

The industry growth stage is high, and the pace of market growth is accelerating.

The industry is experiencing substantial growth, driven by a high degree of innovation, active M&A activities, significant regulatory impacts, and strategic geographical expansion. Innovations such as portable oxygen concentrators and smart Continuous Positive Airway Pressure (CPAP) devices have revolutionized patient care by enhancing mobility and monitoring capabilities. In June 2024, Inogen, Inc. announced study results published in the Pulmonary Therapy journal, highlighting that portable oxygen concentrators are associated with improved survival rates and a higher cost-effectiveness ratio compared to other long-term oxygen therapies.

The M&A activities and partnerships enable companies to expand geographically, financially, & technologically. Notable players are consolidating their positions through strategic acquisitions. For instance, in February 2023, React Health acquired the respiratory product line of Invacare, which includes HomeFill equipment/cylinders, Platinum 10L Concentrator, oxygen analyzers, P5NXG, Platinum POC, pediatric oxygen flow meter, and service parts & accessories. Ventec Life Systems, Inc., a wholly owned subsidiary of React Health Holdings, is Invacare's new respiratory line holder.

Regulatory impact is a significant factor in the market, with stringent standards in place for ensuring the safety & efficacy of these devices. Compliance with regulations, such as the FDA's requirements in the U.S. or CE marking in Europe, is crucial for market entry. For example, in December 2022, Inogen Inc. received clearance for its 510(k) premarket notification from the U.S. FDA for Rove 4, a new portable oxygen concentrator. This achievement strengthened Inogen's position in the portable oxygen concentrators market.

Geographic expansion significantly drives the industry by increasing market penetration and revenue, enabling access to diverse resources and fostering regulatory compliance & standardization. Asia Pacific, Latin American, and African regions offer immense growth potential to companies due to rising healthcare expenditure and a growing prevalence of respiratory diseases. Companies are entering these markets through partnerships and establishing local manufacturing units.

Product Insights

Oxygen source equipment accounted for the largest share of 63.0% in 2023, primarily due to high availability & utilization in oxygen concentrators, compressed gas systems, cylinders, and liquid oxygen. These devices are essential for initiating oxygen therapy, significantly contributing to industry growth. Within this segment, oxygen concentrators are expected to experience lucrative growth driven by innovations and the introduction of energy-efficient models. For instance, in May 2023, Drive DeVilbiss Healthcare launched the 1060AW, a 10-liter oxygen concentrator designed for rural & semi-urban healthcare settings and known for its reliability, durability, & energy efficiency. The oxygen delivery devices segment is anticipated to grow at the fastest CAGR of 9.0% over the forecast period, driven by the availability of a wide range of devices tailored to different patients' inspiratory and physiological needs.

In addition, advantages such as constant oxygen flow, elimination of complicated masks, variable pressure demand, and flow dilution are expected to increase market demand in the coming years. However, the oxygen masks segment is expected to grow at a significant rate. These masks ensure accurate O2 concentration delivery, sustained flow & pressure, and patient comfort, which are factors anticipated to drive segment demand. In addition, increasing product launches by various companies are expected to contribute to segment growth. For instance, in June 2023, Airway Management launched the Morf nasal CPAP mask, a sleep therapy product with a silicone-free biodegradable seal that provides a comfortable, irritation-free experience while minimizing environmental impact.

Application Insights

The COPD segment dominated the market in 2023, holding the largest market share. The rising prevalence of COPD is driving the clinical urgency for treatment, contributing to segment growth. According to estimates by the American Lung Association, in 2022, 11.7 million people, or 4.6% of adults, reported a diagnosis of COPD, including chronic bronchitis & emphysema. In addition, the WHO estimates that potentially fatal respiratory diseases, including COPD, lung cancer, and tuberculosis, will account for about one in five deaths worldwide by 2030. However, the sleep apnea segment is anticipated to grow at the fastest CAGR during the forecast period, primarily due to the utilization of nocturnal oxygen therapy as an alternative treatment for Obstructive Sleep Apnea (OSA).

A report published in May 2024 by the National Council on Aging indicates that OSA affects approximately 39 million U.S. adults, with 936 million experiencing mild to severe OSA worldwide. The report also estimates that 33 million U.S. adults use a CPAP machine. Untreated OSA can lead to serious health complications, including kidney, heart, and metabolic issues. Moreover, the CDC found that 3 in 4 U.S. adults experience sleep disorders, with older adults being more likely to develop OSA. Approximately 56% of individuals aged 65 and older are at high risk. Hence, the growing prevalence of this disorder and the administration of supplemental oxygen alongside CPAP devices for improved patient outcomes are expected to drive the segment demand in the coming years. In March 2024, ResMed introduced the AirFit F40, a compact full-face mask designed to enhance compliance in sleep apnea therapy. The mask offers pressure support in a comfortable, low-profile design, catering specifically to side sleepers, individuals with claustrophobia, and those seeking a universally fitting mask with a minimalistic design.

End-use Insights

The home healthcare segment held the largest market share in 2023 and is expected to grow at the fastest CAGR over the forecast period. The increasing adoption of long-term oxygen therapy devices in home settings is expected to drive market growth. Physicians are increasingly prescribing these devices due to their advantages over conventional options, including ease of use, reduced hospitalization rates, and higher convenience and portability, thereby bolstering market growth.

The non-home healthcare segment is expected to grow at a steady rate over the forecast period, driven by the utilization of oxygen therapy equipment and related supplies in non-home healthcare settings. Hospitals offer extensive facilities and a controlled environment, making them preferable for patients with severe disorders, further bolstering growth in this segment.

Regional Insights

The North America oxygen therapy market dominated the global market in 2023, holding a revenue share of over 30.0%. This dominance is driven by substantial R&D investments and clinical trials focused on oxygen therapy. The region's increasing adoption of hyperbaric oxygen therapy and Topical Wound Oxygen (TWO) therapy is further bolstering market demand. Urbanization and occupational hazards contribute significantly to the incidence of respiratory disorders in the region.

U.S. Oxygen Therapy Market Trends

The oxygen therapy market in the U.S. is expected to grow at a lucrative rate over the forecast period, driven by robust healthcare infrastructure, stringent regulatory standards, and a high prevalence of respiratory conditions. According to an April 2024 article by the American Lung Association, over 34 million U.S. residents suffer from chronic lung diseases such as COPD and asthma, serving as a key driver for market expansion in the region.

Europe Oxygen Therapy Market Trends

The oxygen therapy market in Europe is experiencing significant growth driven by various factors, including the rising prevalence of respiratory diseases such as COPD, asthma, and OSA. The rapid approval of medical oxygen concentrator reimbursement in the European region also drives the market. For instance, in January 2023, Inogen, Inc. received European Medical Device Regulation (EU MDR) certification from the British Standards Institution (BSI), its notified body. This certification supports the company’s portable oxygen concentrator products in the U.S. and EU markets.

The oxygen therapy market in Germany held a substantial share in 2023. The rising number of sleep apnea patients and the availability of reimbursement coverage are key factors contributing to market growth in the country. In addition, high patient compliance and prevalence of respiratory diseases is expected to positively impact the oxygen therapy market. For instance, according to the National Institute of Health Research (NIHR), the prevalence of COPD in Germany was around 2.7 million in 2019. Consequently, the presence of a large patient pool is anticipated to increase the demand for oxygen therapy and drive market growth in Germany.

Asia Pacific Oxygen Therapy Market Trends

The oxygen therapy market in Asia Pacific is anticipated to witness exponential growth during the forecast period. This growth is driven by significant R&D investments from global players and the increasing commercialization of oxygen therapy equipment developed by these companies. Ongoing technological innovations and increasing collaborations among global players, coupled with the expansion of distribution networks, are propelling the regional market. Furthermore, the rising incidence of chronic disorders is anticipated to contribute directly to the growing prevalence of OSA. According to estimates by the National Library of Medicine, the prevalence of OSA in Asian females ranges from 2.1% to 3.2%, and in males, it ranges from 4.1% to 7.5%. Similarly, estimates by the Asian Pacific Society of Respirology, published in May 2020, indicate that the prevalence of mild OSA in the Asia Pacific region ranges from the lowest in Hong Kong (7.8%) to the highest in Malaysia (77.2%).

The Japan oxygen therapy market had a substantial share in the region in 2023. Japan has one of the world’s fastest-aging populations, which has led to increased investment in healthcare infrastructure, the development of new technologies, and improved access to care. Furthermore, nebulizers, oxygen concentrators, ventilators, and other respiratory devices are in high demand due to the rising prevalence of respiratory diseases.

The oxygen therapy market in India is expected to be driven by strategic pricing by the players. Players adopt competitive pricing as one of their primary strategies in the market. For instance, in April 2021, Koninklijke Philips N.V. announced a 7% price reduction in its oxygen concentrators in India. This move passed the benefits of custom duty reduction by the government to customers, reducing the MRP of its products. As of April 2021, the MRP of the company’s oxygen concentrator was INR 68,120 (USD 940), decreasing from INR 73,311 (USD 1,012).

Key Oxygen Therapy Company Insights

The market is highly competitive, with a limited number of players holding a notable revenue share. The industry's growth is driven by the increasing demand for greater comfort, controlled flow rates tailored to patient needs, enhanced patient response, and reduced gas wastage. Companies are employing strategies such as collaborations, mergers & acquisitions, new product launches, and technological advancements to sustain competition and achieve better market penetration.

For instance, in November 2021, UNICEF partnered with the UK government and Oxygen CoLab to develop a robust oxygen concentrator designed for use in low-resource settings. This initiative aimed to combat the coronavirus crisis and meet the growing demand for oxygen in critical care settings. The rise in industry competition can be attributed to the growing number of players, frequent product approvals, and efficient distribution agreements. Consequently, competitive rivalry in the industry is expected to be high over the forecast period.

Key Oxygen Therapy Companies:

The following are the leading companies in the oxygen therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Ventec Life Systems, Inc. (Subsidiary of React Health - includes the Respiratory Product Line from Invacare Corporation)

- Inogen, Inc.

- ICU Medical (Smiths Medical)

- ResMed

- HERSILL S.L.

- OMRON Healthcare

- GE Healthcare

- Fisher & Paykel Healthcare Limited

- Respironics (a subsidiary of Koninklijke Philips N.V.) {Effective from January 25, 2024, Philips Respironics halted the sale of their POCs, with end of service

- scheduled for January 25, 2029.}

- Tecno-Gaz Industries

- Allied Healthcare Products, Inc.

- Teleflex Incorporated

- Chart Industries

- DeVilbiss Healthcare (a subsidiary of Drive Medical).

- Drägerwerk AG & Co. KGaA

- Linde

- Caire Medical (Acquired by Niterra Co., Ltd. formerly known as NGK SPARK PLUG CO., LTD.)

- Rhythm Healthcare

Recent Developments

-

In April 2024, Fisher & Paykel Healthcare Corporation Limited launched the F&P Solo Nasal mask in the U.S. to treat obstructive sleep apnea. It is the world's first AutoFit mask, which simplifies setup by allowing users to stretch and adjust it with one touch.

-

In July 2023, Canta Medical launched an entire range of oxygen products in the FIME 2023 United States, which is one of the largest international medical exhibitions for the U.S. healthcare market. It attracts over 10,000 healthcare participants and hosts over 500 medical device manufacturers & distributors.

-

In May 2023, Drive DeVilbiss International launched a new energy-efficient 10-liter oxygen concentrator. This device is designed to meet the specific needs of challenging environments. It is intended to provide oxygen therapy at primary and secondary health levels in rural & semiurban areas.

-

In January 2023, Inogen, Inc. announced that it achieved key regulatory milestones in the U.S. and Europe to strengthen its portable oxygen concentrator products. This accomplishment signifies its continued commitment to meeting regulatory requirements and underscores the company's focus on ensuring its products meet the highest standards of quality & safety.

-

In November 2022, the Bolivian government selected CANTA oxygen concentrators for La Paz, the highest capital city in the world. This decision was based on the quality and reliability of the CANTA oxygen concentrators.

-

In October 2022, O2 Concepts, a provider of portable oxygen concentrator solutions, launched its latest advanced technology, Oxlife Liberty. The company aims to revolutionize the delivery of oxygen therapy with its innovative products. Oxlife Liberty is built on the successful format of Oxlife Freedom, further demonstrating the company's commitment to advancing its technology.

-

In July 2022, OMRON Corporation announced advancement in the oxygen therapy segment with the launch of a novel portable oxygen concentrator. This medical device, based on molecular sieve technology, offers a continuous supply of high-purity oxygen (5 liters/minute), with an above-90% concentration. It is designed to assist homecare providers in managing the therapy and lifestyle needs of patients with respiratory & COPD problems.

Oxygen Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 36.42 billion

Revenue forecast in 2030

USD 54.14 billion

Growth rate

CAGR of 6.83% from 2024 to 2030

Actual estimates/historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; South Korea; Singapore; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ventec Life Systems, Inc. (Subsidiary of React Health—includes the Respiratory Product Line from Invacare Corporation); Inogen, Inc.; ICU Medical (Smiths Medical); HERSILL S.L.; OMRON Healthcare; GE Healthcare; Fisher & Paykel Healthcare Limited; Respironics (a subsidiary of Koninklijke Philips N.V.); Tecno-Gaz Industries; Allied Healthcare Products, Inc.; Teleflex Incorporated; Chart Industries; DeVilbiss Healthcare (a subsidiary of Drive Medical); Drägerwerk AG & Co. KGaA; Linde; Caire Medical (Acquired by Niterra Co., Ltd. formerly known as NGK SPARK PLUG CO., LTD.); Rhythm Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oxygen Therapy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunitiesin each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oxygen therapy market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oxygen Source Equipment

-

Oxygen Cylinders

-

Fixed

-

Portable

-

-

Oxygen Concentrators

-

Fixed

-

Portable

-

-

Liquid Oxygen Devices

-

PAP Devices

-

CPAP

-

APAP

-

Bi-PAP

-

-

-

Oxygen Delivery Devices

-

Oxygen Masks

-

Nasal Cannula

-

Venturi Masks

-

Non-rebreather Masks

-

Bag Valve Masks

-

CPAP Masks

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Obstructive Pulmonary Disease

-

Asthma

-

Obstructive Sleep Apnea

-

Respiratory Distress Syndrome

-

Cystic Fibrosis

-

Pneumonia

-

Others

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home healthcare

-

Non-Home Healthcare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Singapore

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oxygen therapy market size was estimated at USD 34.8 billion in 2023 and is expected to reach USD 36.42 billion in 2024.

b. The global oxygen therapy market is expected to grow at a compound annual growth rate of 6.83% from 2024 to 2030 to reach USD 54.14 billion by 2030.

b. North America dominated the oxygen therapy market with a share of 30% in 2023. This is attributable to high R&D investments and trials pertaining to oxygen therapy.

b. Some key players operating in the oxygen therapy market include Ventec Life Systems, Inc. (Subsidiary of React Health - includes the Respiratory Product Line from Invacare Corporation); Inogen, Inc.; IUC Medical (Smiths Medical); HERSILL S.L.; OMRON Healthcare; GE Healthcare; Fisher & Paykel Healthcare Limited; Respironics (a subsidiary of Koninklijke Philips N.V.); Tecno-Gaz Industries; Allied Healthcare Products, Inc.; Teleflex Incorporated; Chart Industries; DeVilbiss Healthcare (a subsidiary of Drive Medical); Drägerwerk AG & Co. KGaA; Linde; Caire Medical (Acquired by Niterra Co., Ltd. formerly known as NGK SPARK PLUG CO., LTD.); Rhythm Healthcare

b. Key factors that are driving the oxygen therapy market growth include the rising prevalence of respiratory diseases, the launch of new generation products and increasing business expansion, growing preference towards home-based oxygen therapy, and rising initiatives by organizations regarding respiratory diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.