- Home

- »

- Next Generation Technologies

- »

-

Payment Monitoring Market Size Report, 2030GVR Report cover

![Payment Monitoring Market Size, Share & Trends Report]()

Payment Monitoring Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment, By Enterprise Size, By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-521-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Report Overview

The global payment monitoring market size was valued at USD 16.34 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 16.0% from 2024 to 2030. An increasing demand for real-time payment processing and monitoring globally, a growing need for online payment fraud detection and prevention solutions, and rapid expansion of digital payments and e-commerce infrastructures have fueled market growth. For instance, Mastercard estimated that 2022 e-commerce frauds caused losses of over USD 41 million, and this trend continued, with more losses predicted for 2023.

North America and Europe were among the most vulnerable regions, where many fraud incidences occurred. Such incidents have created an urgent need for payment monitoring solutions. Additionally, stringent Know Your Customer (KYC) regulations levied by government organizations on financial institutions and a need to monitor and prevent anti-money laundering activities are also expected to drive market expansion.

The rapid adoption of digital payments, including mobile wallets, e-commerce transactions, and cryptocurrency, has created complex payment ecosystems. Effective payment monitoring is crucial to manage risks associated with these new payment methods. For instance, the ACI Speedpay Pulse Report 2024, published by ACI Worldwide in August 2024, revealed that about 20% of consumers involved in online payments faced online identity fraud in 2023. Additionally, artificial intelligence (AI), machine learning, and big data analytics innovations enable more sophisticated payment monitoring solutions. These technologies can analyze vast real-time transaction data, identify suspicious patterns, and detect potential threats. For instance, in March 2024, FIS announced the launch of its AI-integrated SecurLOCK card fraud detection and management solution, which is expected to secure consumers from fraudulent transactions and offer a safer card payment experience.

Organizations recognize the importance of proactive risk management in safeguarding their financial operations. Payment monitoring solutions offer valuable insights into payment behaviors, enabling businesses to identify and address potential vulnerabilities. Moreover, the industry is also witnessing a growing focus on customer experience, emphasizing the need for seamless and secure payment processing and monitoring. These factors have collectively caused an increased adoption of payment monitoring solutions in emerging economies of the Asia Pacific and Middle East regions, driving substantial market growth.

Component Insights

The solution segment dominated the market with a revenue share of 67.7% in 2023. This is owing to the increasing demand for comprehensive payment monitoring solutions that can effectively mitigate fraud, ensure compliance, and optimize payment processing. Moreover, a growing need for businesses to implement robust payment monitoring systems to promptly detect and prevent fraudulent transactions has led to segment growth. Comprehensive payment monitoring solutions offer a range of benefits, including improved payment processing efficiency, enhanced customer experience, and reduced operational costs. Furthermore, the increasing adoption of digital payments and e-commerce has created a surge in demand for payment monitoring solutions that can effectively manage and monitor complex payment ecosystems.

The service segment is expected to register the fastest CAGR from 2024 to 2030. It is attributed to the increasing demand for customized and flexible payment monitoring solutions that can adapt to the evolving needs of businesses and organizations. Moreover, a growing requirement for ongoing support and maintenance, implementation, and consulting services to ensure the effective deployment and operation of payment monitoring systems has contributed to segment growth. The increasing complexity of payment ecosystems and a constant need for specialized expertise to navigate emerging threats and adhere to regulatory requirements have driven demand for services such as risk assessment, compliance management, and incident response. Furthermore, the growing adoption of cloud-based payment monitoring solutions has created a need for managed services to ensure optimal system performance and security.

Deployment Insights

On-premise deployment accounted for a larger market share in 2023. This is attributed to its widespread adoption among large enterprises and financial institutions that require high levels of security, control, and customization. This mode of deployment allows organizations to maintain complete ownership and control over their payment monitoring systems, ensuring the highest levels of data security and compliance with regulatory requirements. Additionally, on-premise solutions can be tailored to meet the specific needs of individual organizations, providing a high degree of customization and flexibility. The initial high investment in on-premise deployment is also offset by long-term cost savings and reduced reliance on third-party vendors. Furthermore, several organizations in the payment monitoring market have existing infrastructure and resources invested in on-premise solutions, making it a more practical choice than migrating to cloud-based solutions.

Cloud deployment is anticipated to register the fastest growth from 2024 to 2030. This is owing to its increasing adoption as a scalable, flexible, and cost-effective deployment model. The cloud's ability to provide real-time payment monitoring, automated software updates, and enhanced collaboration has made it an attractive option for businesses seeking to optimize their payment processing operations. Additionally, cloud-based payment monitoring solutions offer improved scalability, allowing businesses to quickly adapt to changing payment volumes and evolving regulatory requirements. For instance, in December 2023, FICO announced that prominent Indian banks such as Axis Bank, HDFC Bank, and AU Small Finance Bank had adopted FICO’s cloud-based ‘FICO Platform’ to augment their efforts towards enhanced customer experience and address the rapidly changing payment landscape in the country. The reduced total cost of ownership, minimum infrastructure requirements, and enhanced security features present in the cloud have also contributed to its rapid demand growth.

Enterprise Size Insights

Large enterprises held a leading market revenue share in 2023. Large enterprises, including multinational corporations and financial institutions, require robust payment monitoring solutions to mitigate fraud, ensure compliance, and optimize payment processing. Their high transaction volumes and global operations necessitate advanced payment monitoring capabilities to promptly detect and prevent fraudulent activities. Additionally, they are often subject to rigorous regulatory requirements, such as anti-money laundering (AML) and know-your-customer (KYC) regulations, which necessitate the presence of sophisticated payment monitoring solutions. Furthermore, large enterprises have the resources and budget to invest in comprehensive payment monitoring systems, enabling them to maintain a competitive edge and ensure the security and integrity of their payment operations.

The small and medium enterprises (SMEs) segment is expected to register the fastest growth during the forecast period. SMEs are expanding their online presence and digital payment capabilities, making them more vulnerable to payment fraud and cyber threats. As a result, they are investing in payment monitoring solutions to protect their businesses and customers from fraudulent activities. Additionally, SMEs are seeking cost-effective and scalable payment monitoring solutions that can adapt to their evolving needs, driving demand for cloud-based and software-as-a-service (SaaS) payment monitoring solutions. Furthermore, the growing availability of payment monitoring solutions tailored to their specific needs, combined with increasing awareness regarding payment security risks, has driven product adoption and fueled substantial growth in this segment.

Application Insights

Anti-money laundering (AML) applications accounted for the largest market share in 2023. This share can be attributed to the increasing regulatory requirements implemented by regional authorities and a growing need among financial institutions to prevent and detect money laundering activities. AML applications are essential for identifying and reporting suspicious transactions and ensuring compliance with regulations implemented by government authorities. The rising threat of money laundering, terrorist financing, and other financial crimes has led to a surge in demand for advanced AML solutions that can effectively monitor and analyze large volumes of payment data.

Fraud detection and prevention (FDP) applications are anticipated to register the fastest CAGR over the forecast period. The rise of digital payment activities, e-commerce, and mobile transactions has created new financial vulnerabilities, leading to a surge in fraudulent activities such as identity theft, phishing, and account takeover. In response, financial institutions and payment service providers are investing in advanced FDP solutions that leverage machine learning, artificial intelligence (AI), and analytics to identify and prevent such transactions. Additionally, the increasing adoption of cloud-based and software-as-a-service (SaaS) FDP solutions has made it easier for businesses to access and deploy advanced fraud detection and prevention capabilities, fueling growth in this segment.

End Use Insights

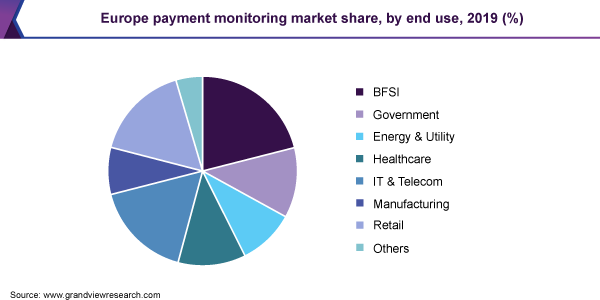

Banking, Financial Services, and Insurance (BFSI) accounted for a leading market share in 2023. As a highly regulated industry, BFSI institutions are required to adhere to stringent payment monitoring and reporting requirements to prevent fraud, money laundering, and terrorist financing. The sector's complex payment ecosystems, high transaction volumes, and presence of substantial amounts of sensitive customer data necessitate advanced payment monitoring solutions to detect and prevent illicit activities. Furthermore, BFSI institutions are increasingly adopting digital payment channels, mobile wallets, and online banking services, creating new vulnerabilities and driving demand for robust payment monitoring capabilities. For instance, in March 2024, FICO announced that its proprietary technology was being used by Nedbank, a prominent South African bank, to form an integrated financial crime risk management framework to enhance its AML and fraud detection abilities.

Meanwhile, the retail segment is expected to register the fastest growth over the forecast period. This is owing to the sector’s rapid digital transformation, increasing adoption of e-commerce and mobile payments, and growing need for secure payment processing. The retail industry's shift towards online commerce, contactless payments, and digital wallets has created a range of payment vulnerabilities, driving demand for advanced solutions to detect and prevent fraud, chargebacks, and revenue losses. Additionally, the rising popularity of online shopping, mobile payments, and social commerce has led to an exponential increase in payment transactions, necessitating robust payment monitoring capabilities to ensure seamless and secure payment experiences for customers. Retailers are investing in payment monitoring solutions to enhance consumer trust, reduce false positives, and improve operational efficiency.

Regional Insights

North America dominated the market with a 34.4% revenue share of the global market in 2023. The region's leading financial institutions, payment processors, and retailers have driven demand for advanced payment monitoring solutions to mitigate fraud, ensure compliance, and optimize payment processing. The widespread adoption of credit and debit cards, online banking, and mobile payments in North America has created a high volume of payment transactions, necessitating robust payment monitoring capabilities to detect and prevent fraudulent activities. Additionally, the region's stringent regulatory environment has compelled financial institutions and payment service providers to invest in payment monitoring solutions.

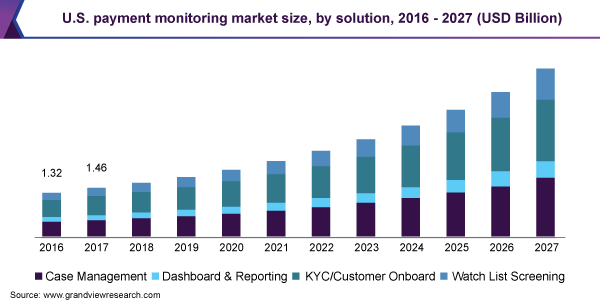

U.S. Payment Monitoring Market Trends

The U.S. accounted for the largest share of the regional market in 2023. As a global leader in payment processing, the U.S. has a large and complex payment ecosystem with a high volume of transactions, driving demand for advanced payment monitoring solutions to detect and prevent frauds and scams and improve the payment processing ecosystem. The presence of major financial institutions, payment processors, and technology companies has contributed to the country's prominent position in this market, with many leading payment monitoring vendors and innovative fintech companies based in the U.S.

Europe Payment Monitoring Market Trends

Europe held a significant share of the global market in 2023. This is owing to its well-established financial sector, high adoption of digital payment technologies, and stringent regulatory environment. The region's financial institutions, payment processors, and retailers have invested heavily in payment monitoring solutions to minimize the risk of fraud and enhance the efficiency of payment processing. The European Union's (EU) Payment Services Directive (PSD2) and General Data Protection Regulation (GDPR) have highlighted the demand for advanced payment monitoring capabilities to detect and prevent illicit activities, ensure data security, and protect consumer rights.

The UK accounted for a notable share of the European market in 2023. The high volume of cross-border transactions and the presence of global financial hubs such as London have necessitated robust payment monitoring solutions to manage complex payment ecosystems. The country's leading payment monitoring vendors and their partnerships with innovative fintech companies have further contributed to the UK's significant share in the regional payment monitoring market, driving growth and revenue. For instance, in April 2024, Atto, a credit risk solutions provider, announced its collaboration with FICO to build a credit scoring model that leverages Open Banking data in the UK. The ongoing migration to real-time payments, contactless transactions, and digital wallets is expected to continue driving demand for payment monitoring solutions in the UK.

Asia Pacific Payment Monitoring Market Trends

Asia Pacific is expected to register the fastest growth rate over the forecast period. This is attributed to its rapid digital transformation, increasing adoption of mobile payments among the general population, and growing need for secure payment processing. The region's fast-growing middle-class population, coupled with the increasing penetration of smartphones and internet connectivity, has driven the adoption of digital payment channels such as mobile wallets, online banking, and contactless payments. This shift has opened avenues for fraudsters to target payment vulnerabilities, necessitating the presence of advanced payment monitoring solutions to mitigate such situations and enhance the robustness of the payment’s ecosystem.

India’s rapidly growing e-commerce market, increasing rate of cross-border transactions, and rising demand for real-time payments have fueled the demand for payment monitoring solutions. For instance, recent data from the National Informatics Centre (NIC) revealed that Unified Payments Interface (UPI)-based transactions in the country have increased exponentially over the past five years, and in 2023, the total UPI transaction volume stood at USD 83.75 billion. Additionally, significant government efforts towards streamlining online transactions for consumers have propelled market expansion. For instance, the ‘DigiDhan Dashboard’ is a government platform that monitors the usage of digital payments in India. It provides real-time information on the number, value, type, and platform of digital transactions being carried out.

Key Companies & Market Share Insights

Some key companies involved in the payment monitoring market include FICO, ACI Worldwide, and FIS, among others.

-

ACI Worldwide is a payment systems company that specializes in developing software for real-time electronic payments. This software is used worldwide by banks, payment intermediaries, and businesses to facilitate transactions through ATMs, POS terminals, mobile phones, and other devices. Its payment monitoring solutions include Proactive Risk Manager, ReD Shield, Case Management, Merchant Fraud Monitor, Payment Risk Management, and Compliance Solutions, which utilize machine learning and analytics to identify and prevent payment fraud, reduce false positives, and ensure compliance with regulations such as anti-money laundering (AML) and know-your-customer (KYC). In September 2023, ACI announced its partnership with Microsoft to enable faster instant payments for financial institutions and technology service providers via the former’s Real-Time Payments Cloud platform.

-

FIS is a leading financial technology solutions company offering a comprehensive range of payment monitoring solutions to financial institutions, merchants, and governments. The company’s payment monitoring solutions enable real-time transaction tracking, fraud detection, and risk management through its cutting-edge platforms, such as Atelio. Additionally, FIS provides payment processing, tokenization, and encryption solutions, as well as compliance and regulatory reporting tools, to ensure secure, reliable, and compliant payment transactions. In May 2024, the company announced the launch of a new version of its mobile application, called the ‘FIS Digital One Flex Mobile 6.0,’ to address changing requirements of financial institutions and consumers during financial transaction activities.

Key Payment Monitoring Companies:

The following are the leading companies in the payment monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- FICO

- ACI Worldwide

- Fiserv, Inc.

- Oracle

- SAS Institute Inc.

- FIS

- NICE

- Software AG

- Thomson Reuters

Recent Developments

-

In July 2024, ACI Worldwide announced the extension of its partnership with Worldpay, a prominent payment processing solutions provider. Through this strategic move, both companies would continue to leverage each other’s expertise to provide an enhanced user experience to merchants in payment processing solutions. The development would allow Worldpay to access innovative technologies developed by ACI and accelerate its presence in new markets by creating regional hubs.

-

In April 2024, Oracle announced the launch of its new AI-powered cloud service ‘Oracle Financial Services Compliance Agent’ for banks in India. The new service will leverage AI technologies to help banks mitigate financial fraud and anti-money laundering risks while also helping them meet compliance requirements more effectively.

Payment Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.87 billion

Revenue Forecast in 2030

USD 46.03 billion

Growth rate

CAGR of 16.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, deployment, enterprise size, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

BAE Systems; FICO; ACI Worldwide; Fiserv, Inc.; Oracle; SAS Institute Inc.; FIS; NICE; Software AG; Thomson Reuters

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Payment Monitoring Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global payment monitoring market report based on component, deployment, enterprise size, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Case Management

-

Dashboard & Reporting

-

KYC/Customer Onboarding

-

Watch List Screening

-

-

Service

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-Money Laundering

-

Compliance Management

-

Customer Identity Management

-

Fraud Detection & Prevention

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

Energy & Utility

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."