- Home

- »

- Medical Devices

- »

-

PEEK Implants Market Size, Share And Growth Report, 2030GVR Report cover

![PEEK Implants Market Size, Share & Trends Report]()

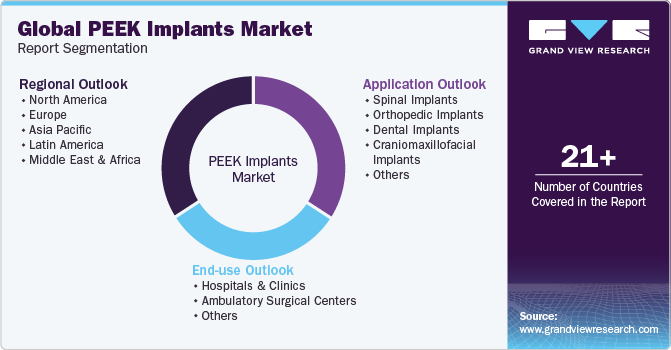

PEEK Implants Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Spinal Implants, Orthopedic Implants, Dental Implants), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-252-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

PEEK Implants Market Size & Trends

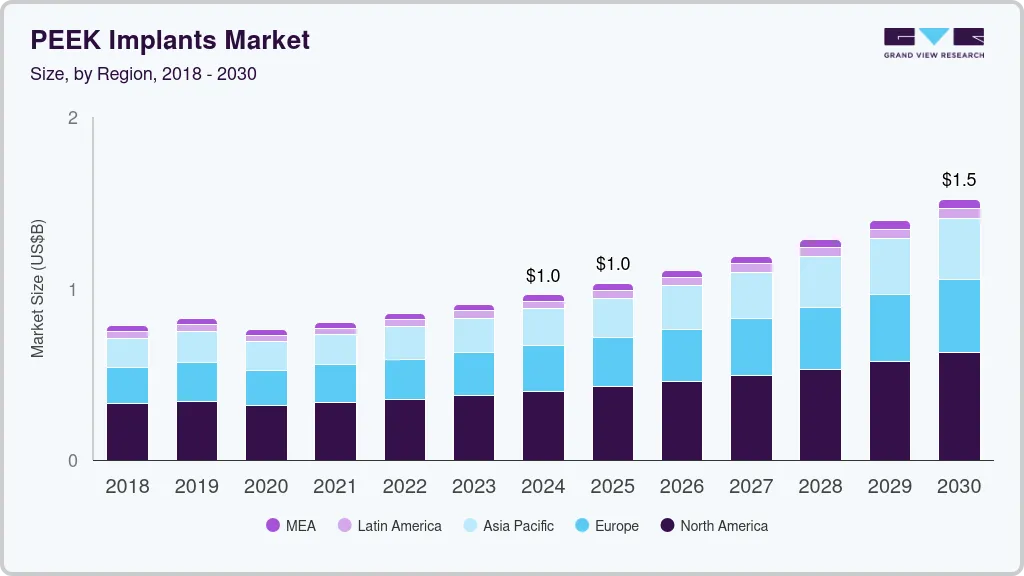

The global peek implants market size was estimated at USD 964.9 million in 2024 and is projected to reach USD 1,520.2 million by 2030, growing at a CAGR of 7.9% from 2025 to 2030. Patient-specific implants are becoming popular as a result of the trend of customized care. Polyetheretherketone (PEEK) is a perfect material for implants that can be personalized to fit the anatomy of each patient since it can be used using additive manufacturing technology. PEEK implants are expected to become more popular in the years to come due to their advantages, including resistance to corrosion, low weight, and biocompatibility. In addition, their demand is increasing due to the demand for minimally invasive surgical techniques.

Numerous studies detail the application of PEEK implants in the fields of neurosurgery, oral implantology and prosthodontics, maxillo-facial surgery, and orthopedics. This material is receiving positive feedback because of its low weight and great biocompatibility. Compared to alternative alloplastic implant materials, PEEK offers several benefits. PEEK does not cause artifacts on radiographic imaging and has radiographic translucency. In addition, PEEK does not undergo exothermic reactions like methyl methacrylate and is neither allergic nor magnetic. Moreover, PEEK's flexibility is similar to that of cortical bone. In facial aesthetic plastic surgery, using PEEK implants has been demonstrated to be a novel approach to modifying the soft tissues and skeleton.

PEEK materials are increasingly used in stomatology and orthopedics because of their good mechanical qualities and biocompatibility. Hundreds of thousands of orthopedic procedures are carried out every day, and the usage of orthopedic implants is growing globally. In particular, spinal diseases and orthopedic conditions are becoming more common, which has increased demand for PEEK implants. The material is a great option for interbody fusion devices, spinal cages, and other orthopedic implants because of its radiolucency and biomechanical compatibility.

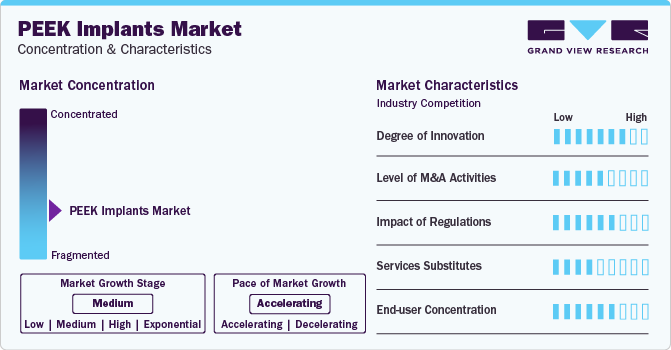

Market Characteristics & Concentration

The market is currently in a moderate-growth stage, with the pace of expansion accelerating. This market is marked by a significant level of innovation, driven by the increasing demand for orthopedic surgeries and a rising geriatric population

PEEK materials have greatly improved as a result of ongoing developments in material science and manufacturing processes. This has improved its resistance, biocompatibility, and mechanical qualities, increasing its prospective uses in a range of medical domains

Furthermore, the growing product acceptance by medical professionals and regulatory agencies has been a major factor in the industry expansion. The product usage is anticipated to increase as more case studies and clinical trials show their efficacy and safety. For instance, in July 2023, Curiteva received clearance for its 3D-printed porous PEEK implant with HAFUSE Technology. This advancement promotes osseointegration, improves radiographic assessment, and delivers superior biomechanics

High number of product launches and company collaborations/acquisitions have been fuelling market growth. For instance, in 2022, Kumovis GmbH, a developer of additive manufacturing solutions for customized healthcare applications located in Munich, Germany, was acquired by 3D Systems Corporation. Kumovis’ solutions are based on their proprietary extrusion process, which was created especially for high-performance, medical-grade polymers like PEEK (polyether ketone) to be printed precisely

Application Insights

The spinal implants segment accounted for the largest revenue share of 36.9% in 2023 owing to the rising cases of spinal disorders. The rising prevalence of spinal disorders, fractures, & injuries and the demand for advanced medical technology and implants are estimated to boost market growth over the forecast period. For instance, according to the WHO statistics, approximately 250,000 to 500,000 SCI cases are reported worldwide annually. Preventable causes like falls, auto mishaps, and violence cause most SCIs.

The WHO estimates that there are 40 to 80 instances of SCI per million adults globally every year. However, the dentistry field is expected to have significant growth in the market. PEEK may be a good substitute for well-known dental materials in CAD-CAM fixed and detachable dental prostheses. Clinical trials are required to evaluate the long-term performance of PEEK prostheses because clinical data are scarce.

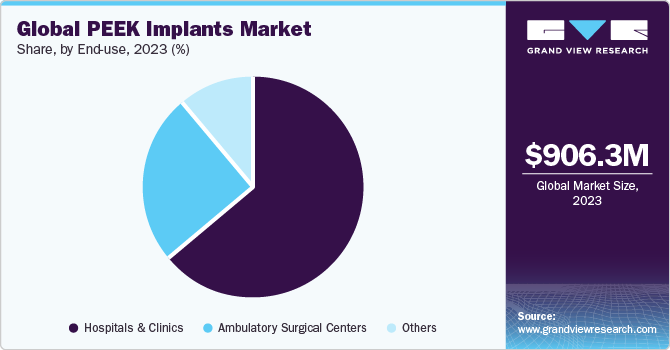

End-use Insights

The hospitals and clinics segment dominated the market with a revenue share of 64.1% in 2023. Hospitals offer a wide range of medical services to individuals within the communities. Hospitals employ multidisciplinary teams of healthcare professionals, including doctors, nurses, therapists, technicians, and support staff. This collaborative approach enables comprehensive assessment, diagnosis, and treatment of patients' medical needs.

Specialized clinics often focus on providing patient-centered care that is tailored to the unique needs of individuals with specific health conditions. This approach emphasizes personalized treatment plans, holistic care, and ongoing support to optimize patient outcomes. Overall, the growth of specialized clinics reflects evolving healthcare needs, advances in medical science and technology, and a shift towards patient-centered, value-based care models. These clinics play a vital role in meeting the diverse healthcare needs of populations and improving health outcomes across a wide range of medical specialties.

Regional Insights

The North America PEEK implants market accounted for the highest revenue share of 41.5% in 2023. The market's expansion in North America is ascribed to the existence of significant industry participants, an increase in orthopedic disorders, and government endorsements of novel products. There is growing investment in specialized healthcare services, including the establishment of new clinics, expansion of existing facilities, and investment in research and development in the region.

U.S. PEEK Implants Market Trends

The PEEK implants market in the U.S. is expected to witness lucrative growth due to high disposable income and growing awareness about the availability of advanced procedures. The American Academy of Orthopedic Surgeons reports that over 900,000 Americans have knee replacement surgery annually. The need for sophisticated surgical instruments and painless processes to carry out these difficult treatments is a major contributing factor to this.

Europe PEEK Implants Market Trends

The Europe PEEK implants market held a share of more than 27.6% in 2023, making it the second-largest regional market. The market is expected to rise as a result of an aging population, availability of qualified healthcare workers, and an increase in trauma and accident cases. Moreover, injuries continue to be a serious public health concern throughout Europe, which is also another key factor contributing to market growth.

The PEEK implants market in the UK held the second-largest revenue share in 2023. About 22,000 cases of "major trauma" occur in the UK each year, and it continues to be the greatest cause of death for both adults and children up until the mid-40s. Cases of severe injury are increasingly becoming a major burden for older individuals. This factor is boosting the demand for advanced devices and surgeries. The primary purpose of PEEK implants is to stabilize and repair severe fractures and dislocated bones. An increasing number of traffic accidents are causing these injuries, which has prompted advancements in trauma fixation technologies, such as drug-releasing, nano-coated, and bioresorbable implants.

The France PEEK implants market will grow at a CAGR of 8.2% from 2024 to 2030. Over the past 20 years, the cases of shoulder surgeries have grown significantly, and it currently accounts for a sizable portion of orthopedic surgical practice. With the population of France aging and growing steadily, more and more people are turning to orthopedic surgery, and hence likely to augment the market growth.

The PEEK implants market in Germany accounted for the largest revenue share in 2023. Various factors, such as the rising popularity of cosmetic procedures, technological advancements, and increased beauty consciousness, are driving market growth. Furthermore, the growing urban population, novel product approvals, advancements in noninvasive procedures, and availability of skilled professionals are expected to propel market growth. However, the high cost of aesthetic procedures is likely to impede this growth.

Asia Pacific PEEK Implants Market Trends

The Asia Pacific PEEK implants market is expected to register the fastest CAGR of around 8.7% from 2024 to 2030 due to the rising cases of traffic accidents and injuries as well as an increased use of technologically advanced facilities. Among the most impacted areas is South-East Asia, there are 20.7 road traffic fatalities per 100,000 people. In emerging economies where there is significant economic expansion accompanied by urbanization and motorization, the proportion of fatalities is higher.

The PEEK implants market in China held the largest revenue market share of 23.9%. Although the population of many nations is aging, China now has the greatest number of elderly people worldwide. In China, 254 million people were aged 60 years or older in 2019. This figure is anticipated to rise to 402 million by 2040, or almost 28% of the total population. The rising aging population is fueling the demand for effective management of disorders and surgeries.

The Japan PEEK implants market is anticipated to grow significantly over the forecast period. Japan is one of the countries with a high geriatric population pool. Owing to the reduced mortality rate, this segment of the population is increasing year over year. This has made people more susceptible to developing orthopedic conditions. The incidence of traumatic fractures and joint injuries in Japan is on the rise, which will help boost the nation's output of orthopedic devices. These devices are only used in complex instances involving various surgical procedures, like hip, shoulder, and knee arthritis.

Middle East & Africa PEEK Implants Market Trends

The PEEK implants market in Middle East & Africa is expected to witness considerable growth in the future. Technological advancements and high prevalence of orthopedic conditions, resulting in a spike in the volume of hip & knee surgeries, are anticipated to boost the growth of the hip & knee reconstruction devices market. Furthermore, increasing cases of lifestyle disorders and rising target population are fueling market growth. According to the International Journal of Clinical Rheumatology, as of 2018, the prevalence of osteoporosis in Turkey was 15.1% in women and 10.7% in men.

The Saudi Arabia PEEK implants market held the second largest revenue share of 18.8% in 2023. There has been a notable expansion of healthcare services in Saudi Arabia, with a focus on increasing the availability of primary care, specialty services, and advanced medical treatments. This expansion includes the recruitment of healthcare. Furthermore, there is a growing emphasis on preventive care and public health initiatives in Saudi Arabia, including health education, disease prevention programs, and vaccination campaigns. These initiatives aim to promote healthy behaviors, reduce the burden of chronic diseases, and improve population health outcomes.

Key PEEK Implants Company Insights

Companies are focusing on strategic initiatives, such as the introduction of novel products through customization according to consumers’ needs, partnerships, collaborations, and mergers & acquisitions, to expand their product portfolio and extend leadership positions in the field of medical device industry. Moreover, the competition between key players will turn intense in the coming years as they are focusing more on geographical expansion, strategic collaborations, and partnerships through mergers & acquisitions.

Key PEEK Implants Companies:

The following are the leading companies in the PEEK Implants market. These companies collectively hold the largest market share and dictate industry trends.

- Invibio

- Johnson & Johnson MedTech

- Evonik

- Solvay

- In2Bones Global, Inc.

- HAPPE Spine

- NuVasive, Inc.

- Cavendish Implants Ltd.

- Xilloc Medical Int B.V.

- Dental Technology Services

- 3D Systems, Inc.

- INNOVASIS

- SINTX Technologies, Inc.

- Quick Implants NZ Ltd.

Recent Developments

-

In March 2023, Invibio launched implantable PEEK filament for 3D printing. This offers hospital facilities to customize PEEK devices in-house, bringing various advantages to patients as well as healthcare professionals

-

In September 2020, Evonik launched a novel osteoconductive polyether ether ketone (PEEK) for the medical technology sector that promotes bone-implant fusion

PEEK Implants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,030.6 million

Revenue forecast in 2030

USD 1,520.2 million

Growth rate

CAGR of 7.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark, Sweden; Norway; Japan; China; India; South Korea; Thailand; Australia; Brazil; Mexico; South Africa; Saudi Arabia; UAE; Kuwait; Argentina

Key companies profiled

Invibio; Johnson & Johnson MedTech; Evonik; Solvay; In2Bones Global, Inc; HAPPE Spine; NuVasive, Inc.; Cavendish Implants Ltd.; Xilloc Medical Int B.V.; Dental Technology Services; 3D Systems, Inc.; INNOVASIS; SINTX Technologies, Inc.; Quick Implants NZ Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PEEK Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the PEEK implants market report on the basis of application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Spinal Implants

-

Orthopedic Implants

-

Dental Implants

-

Craniomaxillofacial Implants

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global PEEK implants market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 1,520.4 million by 2030.

b. The global PEEK implants market size was estimated at USD 906.3 million in 2023 and is expected to reach USD 964.9 million in 2024

b. Some key players are Invibio; Johnson & Johnson MedTech; Evonik; Solvay; In2Bones Global, Inc; HAPPE Spine; NuVasive, Inc.; Cavendish Implants Ltd.; Xilloc Medical Int B.V.; Dental Technology Services; 3D Systems, Inc.; INNOVASIS; SINTX Technologies, Inc.; Quick Implants NZ Limited.

b. PEEK implants are expected to become more popular during the projected period due to a number of advantages, including their resistance to corrosion, lightweight nature, and biocompatibility. Additionally, there is a greater need for PEEK implants due to the trend toward minimally invasive surgical techniques.

b. With more than 41.5% of the market share in 2023, North America is anticipated to be the largest market for peek implants during the course of the projected period. The market's expansion in North America is ascribed to the existence of significant industry participants, an increase in orthopedic disorders, and government endorsements of novel products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.