- Home

- »

- Biotechnology

- »

-

PEGylated Proteins Market Size, Share & Trends Report, 2030GVR Report cover

![PEGylated Proteins Market Size, Share & Trends Report]()

PEGylated Proteins Market (2023 - 2030) Size, Share & Trends Analysis Report By Protein Type (CSF, Interferons), By Application (Cancer, Hepatitis), By Product & Services (Consumables, Services), By End-user, And Segment Forecasts

- Report ID: GVR-4-68039-990-1

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

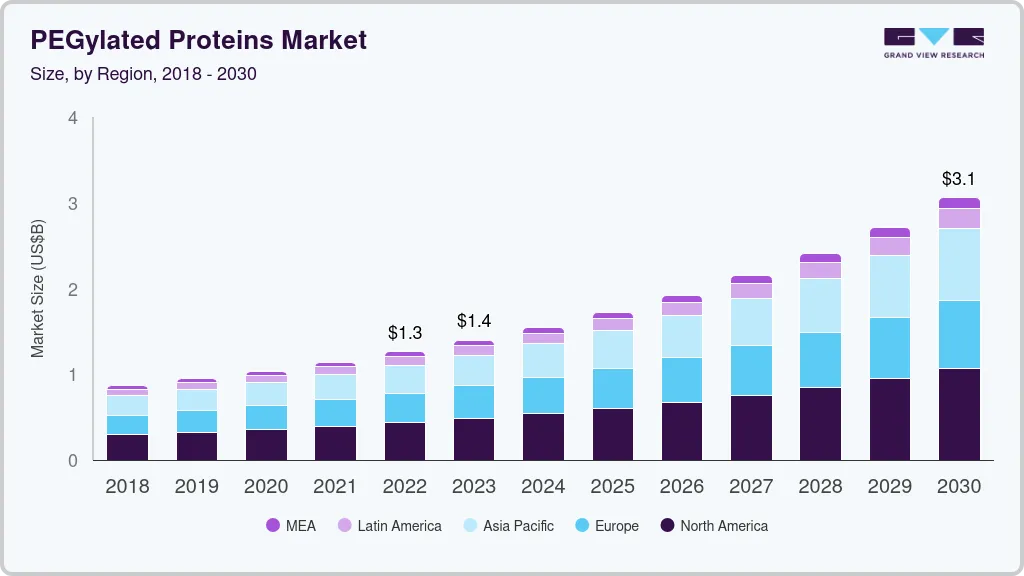

The global PEGylated proteins market size was valued at USD 1.26 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.7% from 2023 to 2030. The growth is majorly driven by factors, such as growing incidence of degenerative & chronic diseases like cancer, kidney diseases, and rheumatoid arthritis; growing demand for protein-based therapies, increase in research activities for the development of novel therapeutics and advantages of PEGylated therapeutic proteins. The COVID-19 pandemic had a positive impact on the industry. There was an increase in spending by the government and key players for the development of novel drug candidates for the preventative treatment of COVID-19.

A rise in investments was directly related to increasing research & development for novel vaccines, diagnostics as well as repurposing of existing therapies. For example, Zydus Cadila, an Indian pharmaceutical manufacturer received an Emergency Use Approval (EUA) in April 2021, for treating moderate cases of COVID-19 patients with its existing drug of PEGylated Interferon alpha 2b. The drug was earlier approved for the treatment of Hepatitis B and was repurposed for COVID-19 after intensive research and clinical trials across India. Moreover, the use of PEGylated lipid nanoparticles to encapsulate the mRNA vaccine by drug makers like Moderna and Pfizer & BioNTech molecule has demonstrated the growth potential for this space.

The development in the field of biotechnology and molecular biology engineering has led to an increase in the adoption of protein-based therapeutics. The ever-increasing demand for vaccines, hormones, enzymes, growth factors, monoclonal antibodies, and many more recombinant proteins has been established in the past few years. The therapeutic advantages, such as specificity and increased activity, have led to the vast availability and awareness of biologics among the affected population. For example, in April 2020, the U.S. FDA approved a new therapy for hemophilia by LFB (Laboratoire Francais du Fractionnement et des Biotechnologies), a French biotechnology company.

The recombinant factor VIIa, Sevenfact is approved for the treatment of adolescents and adults with congenital disorder of hemophilia A or B. Thus, regulatory support and multiple biologics product approvals are anticipated to further propel the growth of the industry. With the continuous regulatory support demonstrated by approvals of biologics products, there is increased funding for research & development activities of therapeutic proteins. Key drug manufacturers are diverting their spending on biologics R&D to find new and effective approaches, technologies, or formulations for drug delivery.

Therapeutics like PEGylated proteins offer novel advantages, such as increased half-life as well as stability of the circulating drug. Moreover, PEGylated entities are non-toxic, water-soluble or hydrophilic, non-antigenic & non-immunogenic and are thus ‘generally recognized as safe by the U.S. FDA. These features enable PEGylated proteins to retain in the human body for longer, which eventually decreases the dosing frequency and increases patient compliance with the treatment. The successful integration of PEG molecules in biopharmaceuticals and the associated advantages have further deepened the research activities for PEGylation technology and are expected to drive the industry over the forecast period.

Product & Services Insights

The consumables segment dominated the global industry in 2021 and accounted for the largest share of 63.21% of the overall revenue. The never-ending research activities, product developments, and the need to formulate better drugs as well as drug-delivery mechanisms contribute to continuous consumption of PEGylating consumables, such as kits and reagents, and thus result in high revenue generation. Moreover, the presence of major players with numerous product offerings also drives segment growth. The consumables segment is anticipated to expand further at a steady CAGR over the forecasted period.

The advantages and developments in PEGylation technology along with increasing demand for PEGylated products have caused a huge adoption of consumables. The versatile application of PEG in research and drug development programs has bolstered its usage. Furthermore, various custom PEG conjugation services & product-providing companies are continuously employing consumables for delivering the intended products. The fast depletion of consumables due to an upswing in demand for PEGylated proteins along with the presence of multiple product providers will contribute to revenue generation in the years to come.

Protein Type Insights

The Colony-Stimulating Factors (CSFs) segment generated the highest revenue share of 32.14% in 2021. CSFs are growth factors that bind to receptor proteins and stimulate the proliferation & differentiation of hematopoietic stem cells into White Blood Cells (WBCs). As a pharmaceutical agent, CSFs are used to increase the immune function in patients undergoing cancer treatments who are susceptible to infection due to neutropenia (low WBCs). The increasing prevalence of various types of cancer and its associated therapies attributes to the highest revenue generation of this segment. The continuous increase in cases of cancer and new product approvals for CSFs will also result in the fastest growth of the CSFs segment during the forecast period.

It is estimated by the International Agency for Research on Cancer (IARC) that by 2040, globally, new cases of cancer are expected to reach 27.5 million and will cause 16.3 million cancer-related deaths. The global burden will be due to aging, lifestyle choices, and economic transitions. Moreover, the companies are actively researching and developing new or referenced proteins as drugs for treatment. The presence of multiple PEG-GCSF biosimilar approvals by manufacturers like Coherus Biosciences, Inc., Pfizer Inc., Mylan GmbH, Sandoz, and Amneal Pharmaceuticals, Inc. also demonstrates the continuous product developments and market opportunities in the CSF segment in the future.

Application Insights

The cancer application segment dominated the industry in 2021 and is estimated to expand further at the fastest growth rate of 13.26% from 2022 to 2030. The dominance is attributed to the increasing incidence of cancer worldwide and the usage of protein-based therapeutics for cancer therapy. The world of therapeutic drugs, especially cancer therapy, is benefitted from the advancements, such as specificity, stability, and improved distribution of drugs due to the PEGylation process. By utilizing this technique, it is possible to develop non-immunogenic and more stable therapies.

For example, in November 2021, U.S. FDA approved PharmaEssentia Corp.’s mono-pegylated interferon, Besremi, for the treatment of rare blood cancer known as polycythemia vera. As per the American Cancer Society, in the U.S., cancer is considered the second-most common cause of death. As per cancer statistics projections, more than 1.9 million new cases of cancer are likely to occur in the U.S. in 2022. Thus, the rising prevalence of cancer, unceasing research studies, technological developments, and the search for safe & effective protein-based treatments in this segment are anticipated to push the segmental growth.

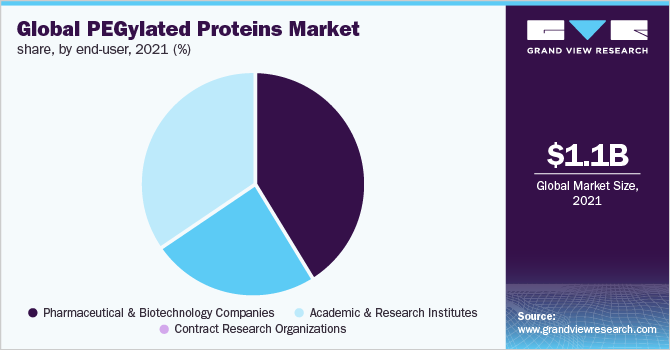

End-user Insights

In 2021, the pharmaceutical & biotechnology companies segment accounted for the largest share of 41.54% of the overall revenue. This is attributed to the increased therapeutic product pipelines via various drug discovery & development programs, increased R&D funding, and supportive government initiatives. Also, the regulatory support for new product approvals shows the dominance of pharmaceutical & biotechnology companies in the industry. For example, in May 2022, Amneal Pharmaceuticals, Inc. announced that it has received approval for Fylnetra, a biosimilar referenced to Neulasta. This PEGylated GCSF (granulocyte colony-stimulating factor) is used for the treatment of neutropenia experienced by chemotherapy patients.

The company also announced that with this product they have achieved three biosimilar approvals in 2022 from the U.S. FDA. The continuous demand for affordable & accessible treatments has led healthcare companies to drive intensive R&D activities. Moreover, the patent expiry of novel PEGylated therapeutics has caused high market competition and caused entry barriers to emerging players. The enormous opportunity has resulted in industry consolidation by some of the key pharmaceutical & biotechnology product manufacturers in the industry. Furthermore, the developments in drug delivery mechanisms as witnessed during mRNA vaccines for COVID-19; PEGylated proteins will cause a new wave of transformation in healthcare. Due to this, pharmaceutical & biotechnology companies are also estimated to witness the fastest growth.

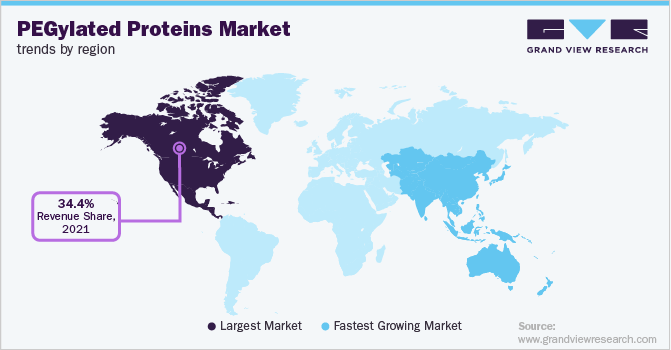

Regional Insights

North America dominated the industry in 2021 and accounted for the maximum share of more than 34.40% of the overall revenue. The prevalence of disorders & diseases, chronic conditions, and awareness about advanced therapeutics among the population have boosted the region’s healthcare settings. The presence of developed infrastructure and better economic conditions contributes to the influx of grants and funding for biologics-based research activities. Moreover, the presence of key players for PEGylated proteins in this region drivesits growth. For example, Takeda Canada announced in November 2021 that the pharmaceutical company has been awarded a tender for its PEGylated recombinant antihemophilic factor, Adynovate for three years by the Canadian Blood Services (CBS).

Adynovate is intended to be used in the treatment of Canadian hemophilia patients. Initiatives like these will drive the region’s growth in the years to come. The APAC region will exhibit the fastest growth rate during the forecast. This region is still developing and is always associated to be focused on decreased costs of labor as well as research. The low-cost-centered research in highly populated countries like India, China, and Japan is estimated to boost the region’s growth. The presence of older citizens and increased demand for proteins-based drugs for treatment is contributing to the fastest growth of this region. Also, the increased government funds and incentives for the development of better healthcare plans will contribute to the growth.

Key Companies & Market Share Insights

The industry is observing a trend of consolidation for generating revenue, relevance, and dominance. Business strategies, such as acquisition, partnership, and collaboration, by the key players are aimed to strengthen their industry foothold. For example, Merck KGaA announced in February 2022 that it has acquired Exelead, a CDMO for USD 780 million. The acquisition has boosted the company’s mRNA and lipid capabilities. Exelead is a full-service biopharmaceutical CDMO, which specializes in complex formulations and PEGylated products. Merck KGaA also announced that it has planned to invest over USD 485.67 (EUR 500 million) to scale up the technologies over the upcoming years. Such strategic initiatives increase the global presence of key players while also boosting the competition, thus driving industry growth. Some of the key players in the global PEGylated proteins market include:

-

Thermo Fisher Scientific, Inc.

-

Abcam plc.

-

Enzon Pharmaceuticals, Inc.

-

Merck KGaA

-

Celares GmbH

-

Profacgen

-

Creative PEGworks

-

NOF America Corp.

-

Aurigene Pharmaceutical Services Ltd.

-

Laysan Bio, Inc.

PEGylated Proteins Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.55 billion

Revenue forecast in 2030

USD 3.06 billion

Growth rate

CAGR of 11.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, protein type, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Thermo Fisher Scientific, Inc.; Abcam plc; Enzon Pharmaceuticals, Inc.; Merck KGaA; Celares GmbH; Profacgen; Creative PEGworks; NOF America Corp.; Aurigene Pharmaceutical Services Ltd.; Laysan Bio, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PEGylated Proteins Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global PEGylated proteins market report on the basis of product & services, protein type, application, end-user, and region:

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Services

-

-

Protein Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Colony-stimulating Factor

-

Interferons

-

Erythropoietin

-

Recombinant Factor VII

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Autoimmune Diseases

-

Hepatitis

-

Multiple Sclerosis

-

Hemophilia

-

Gastrointestinal Disorders

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global PEGylated proteins market size was estimated at USD 1.14 billion in 2021 and is expected to reach USD 1.26 billion in 2022.

b. The global PEGylated proteins market is expected to grow at a compound annual growth rate of 11.71% from 2022 to 2030 to reach USD 3.06 billion by 2030.

b. Consumables segment dominated the PEGylated proteins market with a share of 63.21% in 2021. The never-ending research activities, product developments and the strive to formulate better drugs as well as drug-delivery mechanisms contributes to continuous consumption of PEGylating consumables such as kits and reagents, and thus results in high revenue generation.

b. Some key players operating in the PEGylated proteins market include Thermo Fisher Scientific, Inc., Abcam plc, Enzon Pharmaceuticals, Inc., Merck KGaA, celares GmbH, Profacgen, Creative PEGworks and others.

b. Key factors that are driving the market growth include growing incidence of degenerative & chronic diseases, growing demand for protein-based therapies, increase in research activities for development of novel therapeutics, along with the advantages of PEGylated therapeutic proteins.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.