- Home

- »

- Animal Health

- »

-

Pet Care E-commerce Market Size And Share Report, 2030GVR Report cover

![Pet Care E-commerce Market Size, Share & Trends Report]()

Pet Care E-commerce Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Food & Treats, Litter Products, Grooming Products, Medicines), By Animal Type (Dogs, Cats), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-784-1

- Number of Report Pages: 157

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Care E-commerce Market Summary

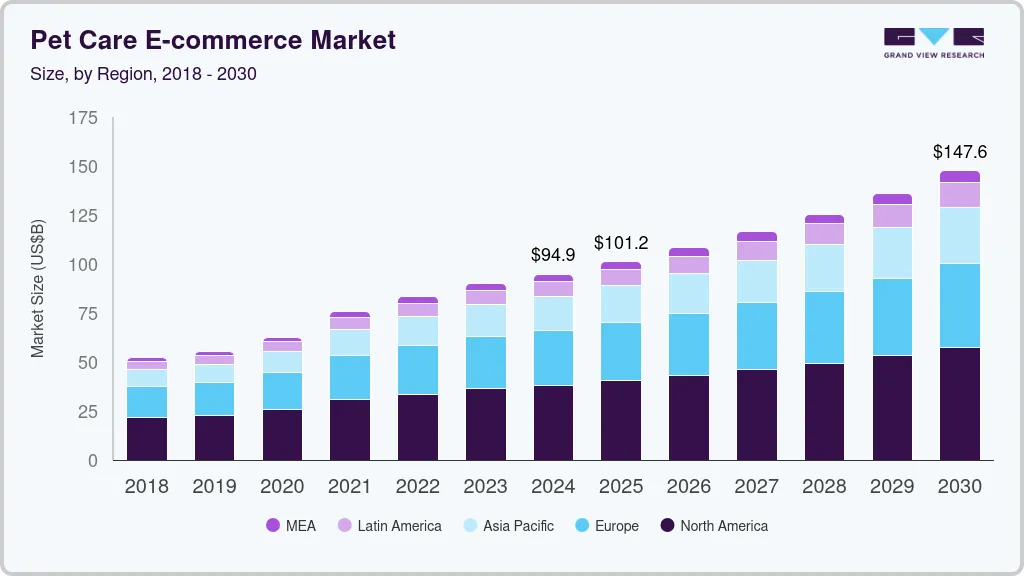

The global pet care e-commerce market size was estimated at USD 94.89 billion in 2024 and is projected to reach USD 147.59 billion by 2030, growing at a CAGR of 7.8% from 2025 to 2030. Increasing pet adoption, rapid technological advancements, and rising access to e-commerce platforms primarily drive market growth. Increased consumer spending on e-commerce platforms and the rise in internet users are expected to propel market growth.

Key Market Trends & Insights

- North America dominated the pet care e-commerce market accounted for a market share of around 40.04% in 2024.

- The pet care e-commerce market in Europe is growing significantly as pet ownership has increased in recent years.

- Based on products, the food & treats segment held the largest revenue share of 34.60% in 2024.

- In terms of animal type, the dogs segment held the highest market share in 2024 and is anticipated to grow at a CAGR of 6.8% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 94.89 billion

- 2030 Projected Market Size: USD 147.59 billion

- CAGR (2025-2030): 7.8%

- North America: Largest market in 2024

For instance, in 2023, U.S. e-commerce accounted for 22.0% of total retail sales in the country. This marked the largest U.S. e-commerce sales in history. Several e-commerce websites are incorporating novel strategies to gain a majority share in the industry. Moreover, in October 2023, Amazon considered offering veterinary telehealth to compete with Walmart as it began offering its subscribers free access to pet telehealth. Rising awareness about pet health and wellness among pet-owning households is a major factor expected to propel the market growth. The demand for pet foods such as wet foods, treats, snacks, and other items is expected to increase, owing to the rising health concerns for pets.

Moreover, various organizations and campaigns have been working to promote adoption from shelters and rescue centers, raising awareness about the benefits of adopting a pet and the challenges homeless animals face. For instance, in January 2023, Zigly, an omnichannel pet care brand, launched a new campaign without compromise. The campaign aimed to spread the message of not compromising on delivering quality pet care services to pet parents.

The COVID-19 pandemic has significantly impacted various sectors, including the market. With lockdowns and restrictions on movement, many pet owners turned to online platforms to purchase essential supplies such as food, medications, and grooming products. This surge in demand led to a significant boost in the market. Like many other industries, the market faced supply chain and logistics challenges due to disruptions caused by the pandemic. Delays in shipping and shortages of certain products were common, impacting the overall customer experience and potentially leading to shifts in consumer loyalty.

Moreover, increasing investment by key players in technology and digital infrastructure is driving significant market growth. Companies invest heavily in AI, data management, and e-commerce platforms to enhance customer experience, streamline operations, and expand online sales. For instance, In October 2024, Mars Petcare is set to invest US$1 billion over the next three years to strengthen its digital presence and drive market growth. The investment will hire 300 tech workers, enhance artificial intelligence (AI) usage, improve data management, and bolster e-commerce capabilities. Mars aims to double its digital sales by 2030. These investments are focused on meeting rising consumer demand for convenience, personalized services, and faster delivery, enabling companies to capture a larger share of the growing digital pet care market. As a result, the market is experiencing rapid growth fueled by these strategic investments.

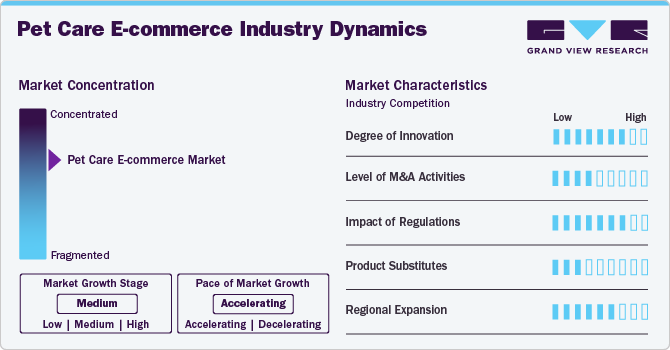

Market Concentration & Characteristics

The market exhibits a moderate to high market concentration. The market growth stage is medium, and the pace is accelerating. One major factor propelling the market growth is the rapid technological advancements. With the increasing development of more intuitive and visually appealing websites & user interfaces, online shopping platforms have become more accessible to navigate. This allows owners to look for various options and make purchases easily. The increase in internet penetration is expected to contribute to market growth. Changes in mobile usage and adaptability, the introduction of single-touch purchase options, and user-friendly web pages have increased the popularity of e-commerce websites, driving market growth.

Moreover, the global market is witnessing a surge in the number of collaborations and strategic partnerships, which include mergers, acquisitions, and investments, creating opportunities for market growth. For instance, in September 2023, Butternut Box announced a USD 280 million investment. This investment aimed to expand its business across Europe and enhance its delivery of fresh, tasty, and healthy meals to pets around the world. Several market participants are geographically expanding their existing businesses to gain a greater share of the market.

The market demonstrates a high degree of innovation, characterized by ongoing partnership and collaboration between market players and supportive initiatives. For instance, in February 2024, PetSmart and Nate + Jeremiah collaborated to offer a chic collection of pet essentials, including beds, bowls, and furniture, blending style with functionality for cat and dog parents. The partnership combines PetSmart's expertise in pet care with Nate Berkus and Jeremiah Brent's design sensibilities, providing affordable, stylish options for integrating pets into home decor.

A moderate level of merger and acquisition activity exists within the market, indicative of ongoing consolidation and strategic partnerships among industry players. For instance, in February 2024, Targeted PetCare (TPC) acquired Pet Brands, a prominent pet treats company, strengthening TPC's pet treat portfolio with enhanced sourcing, design, and packaging capabilities. The strategic move aligned with TPC's goal of expanding its pet consumables offerings through mergers and acquisitions, marking the fifth strategic move under Wind Point ownership.

The market experiences a high impact of regulations. Many countries have regulations to ensure pet products' safety, including food, toys, and accessories. E-commerce platforms selling pet products must comply with these regulations to ensure the quality and safety of their products. E-commerce businesses selling pet products may be required to obtain specific licenses or permits to operate legally, especially if they are involved in activities such as pet grooming, boarding, or breeding.

The risk of substitutes is expected to be low. Subscription-based pet care services offer convenience and cost savings for owners who prefer regular food deliveries, treats, toys, and other supplies. These services often provide a curated selection of products based on the pet's specific needs.

Product Insights

Based on products, the food & treats segment held the largest revenue share of 34.60% in 2024. This can be attributed to the growing focus of pet owners on pet health. Online shopping has become more convenient due to the availability of several products, user-friendly websites, and high-quality food. E-commerce websites provide several benefits, including doorstep delivery and advice on the finest available pet food options. Most pet parents of this digital generation prefer to shop online. The availability of different items on internet platforms and specific advertisements on social media websites contribute to the rising demand for snacks & treats. In addition, the extensive product selection and enhanced browsing experience offered by online channels are other key factors expected to drive segment growth over the forecast period. Moreover, advantages such as multiple payment options, hassle-free delivery, product subscriptions, and product savings encourage owners to opt for an e-commerce platform, facilitating market growth. Some popular e-commerce sites include Amazon, Chewy, Petco, PetFlow, and Zooplus.

The supplement segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing demand for supplements is linked to the growing pet humanization, resulting in significant spending on food, supplements, and other related items to keep them active and healthy. Pets with supplements have higher energy, attention, and concentration levels, a more robust immune system, and better heart health. In addition, the demand for supplements that reduce tension & anxiety or promote calmness is increasing, and these supplements are predicted to become more popular among pet owners over the coming decade. The availability of a large variety of pet food and needs and the growing appeal of “Subscribe and Save” programs are expected to drive market expansion.

Animal Type Insights

The dogs segment held the highest market share in 2024 and is anticipated to grow at a CAGR of 6.8% over the forecast period. Dogs are among the most popular pets due to their reputation for intelligence, loyalty, and protection. The canine segment is expected to witness significant growth due to the increasing demand for foods, grooming supplies, and accessories due to more people adopting dogs as pets. The adoption of dogs as pets is expected to increase globally over the forecast period. According to the American Veterinary Medical Association (AVMA) report, the dog population in the U.S. is expected to reach 89.7 million by 2024, showing a consistent rise from 52.9 million in 1996. The demand for pet food, toys, grooming supplies, and other accessories is expected to rise in the upcoming decade due to the increasing adoption of pets, contributing to segment growth.

The cat segment growth is anticipated to be positively impacted by the increasing number of cat owners worldwide. According to Forbes’ Pet Adoption Statistics 2024, around 43% of cat owners reported they obtained their pets from a store, while 40% mentioned they got them from a rescue or animal shelter. In addition, during the past several years, the number of single-person households and the desire to keep a pet has increased, fueling market expansion. According to the same source, around 2.1 million cats are adopted from pet shelters in the U.S. annually.

Regional Insights

North America dominated the pet care e-commerce market accounted for a market share of around 40.04% in 2024. The number of pet owners in North America has been steadily increasing, leading to a more extensive customer base for products and services. Due to an increase in pet-owning households, there has been a consistent surge in demand for pet care products and services. The rise of mobile devices and internet has made it easier for consumers to access online care services & products. Consumers can now order pet food, toys, & other accessories from their smartphones and have them delivered at home. According to the U.S. Department of Homeland Security, there are approximately 200 million smartphones in the U.S. Hence, the rising penetration of smartphones and the internet is expected to positively impact market growth over the forecast period.

U.S. Pet Care E-commerce Market Trends

The pet care e-commerce market in the U.S. is fueled by various factors, primarily the growing popularity of pet ownership and the trend of humanizing pets. More individuals choose small pets, such as cats and dogs, for companionship. The growing trend of pet humanization has led to pet owners’ willingness to invest in quality products, creating a substantial market for products & services and increasing demand for online shopping platforms that offer convenience and a wide range of products.

Europe Pet Care E-commerce Market Trends

The pet care e-commerce market in Europe is growing significantly as pet ownership has increased in recent years. This leads to a rise in the number of pets in households across the continent as more people choose to have pets as companions. This trend is influenced by factors such as changing lifestyles, increased awareness of animal welfare, and the benefits of having pets for mental & physical health. As per a report by the European Pet Food Industry Federation (FEDIAF), the pet population in Europe is expected to reach 352 million in 2024, with 166 million households (50%) owning at least one pet. In addition, the increase in the launch of pet care e-commerce websites across Europe significantly drives the European market. For instance, in February 2024, TRM Pet launched a new e-commerce website in Europe to enhance the online shopping experience for customers in Ireland while also serving as a valuable resource for global visitors. The platform features a modern design, improved functionality, and engaging content on pet nutrition and care, reflecting TRM Pet's commitment to quality and customer service.

Germany pet care e-commerce market is witnessing significant growth due to the changing consumer preferences. Furthermore, the increase in e-commerce platforms in Germany is transforming the market, making it more accessible and tailored to the needs of pet owners, ultimately fueling market growth. For instance, in November 2024, Zooplus, the well-known German online pet supply retailer, will launch its marketplace to expand its product range for pet owners. This initiative follows the earlier expansion of its subscription model into eight markets, allowing customers to automate repeat purchases. The company will enhance customer options by providing a wider selection of high-quality products, contributing to market growth.

Asia Pacific Pet Care E-commerce Market Trends

The pet care e-commerce market in Asia Pacific is expected to witness the highest CAGR during the forecast period. The popularity of cross-border e-commerce allows consumers in Asia Pacific to access international brands and products that may not be readily available in their local markets. This trend contributes to market growth by offering consumers a diverse selection of products. For instance, international pet care brands such as Blue Buffalo Co., Ltd, Nestle Purina PetCare, and The Hartz Mountain Corporation are available through e-commerce platforms such as Amazon, Chewy, and Zooplus.

Japan pet care e-commerce market is expected to grow significantly over the forecast period. Japan has one of the world's most rapidly aging populations, leading to an increase in single-person households. These demographic changes have increased the popularity of companion animals, as pets can provide emotional support and companionship to their owners. As a result, there is a growing demand for pet care products, including food, supplements, and accessories, driving Japan's e-commerce market growth. According to the World Economic Forum article, over one-third of Japan's population, around 36.23 million, are aged 65 or above. In addition, more than one out of ten people in Japan is aged 80 or older.

Latin America Pet Care E-commerce Market Trends

The pet care e-commerce market in Latin America is expected to grow significantly due to the growing use of smartphones and internet connectivity. Mobile apps and online payment methods have made it easier for consumers to shop online securely. The increasing digitalization and technological advancements in Latin America have played a significant role in driving market growth. Improved internet connectivity, smartphone penetration, and secure online payment systems have made shopping easier for consumers.

Brazil pet care e-commerce market is expected to grow significantly as a shift in consumer behavior toward online shopping contributes to the expansion of the Brazilian market. With more consumers embracing digital channels for their shopping needs, including pet products, e-commerce platforms have capitalized on this trend by offering a seamless shopping experience with a wide variety, personalized recommendations, customer reviews, and easy return policies—for instance, Zee.Dog, a prominent Brazilian pet care e-commerce player, offers high-quality pet products with trendy and stylish designs. Zee.Dog’s product range includes collars, leashes, harnesses, toys, and other accessories for dogs & cats.

Middle East & Africa Pet Care E-commerce Market Trends

The pet care e-commerce market in the Middle East & Africa is growing significantly. Expansion of the middle class in many countries across the Middle East and Africa, coupled with rapid urbanization, has played a significant role in driving the growth of e-commerce. As disposable incomes rise and urban populations grow, the demand for convenient shopping options that offer a wide selection of products at competitive prices is also increasing. Online shopping provides consumers access to a diverse range of goods without needing to visit physical stores, making it an attractive option for busy individuals.

South Africa pet care e-commerce market is witnessing significant growth in the MEA region. In recent years, E-commerce platforms in South Africa have improved their payment options, making it easier for people to purchase online. Many platforms now offer a range of payment options, including credit & debit cards, mobile payments, and instant Electronic Funds Transfers (EFT). Payment services such as SnapScan, Zapper, and Masterpass allow users to pay using mobile devices.

Key Pet Care E-commerce Company Insights

Established players in the market are offering a variety of pet care products to meet the various needs of different pets. This also increases the portfolio and product offerings of these players. Multiple key companies undertake strategic partnerships and mergers & acquisitions as a part of their global strategy. For instance, in October 2024, Walmart expanded its offerings by partnering with Pawp. Both companies are launching a new online service to provide Walmart+ members with free virtual veterinary consultations. This initiative aims to enhance affordability and convenience for owners amid rising inflation. Moreover, Walmart is opening five new Pet Services Centers and expanding its Pet Pharmacy services, positioning itself as a comprehensive pet care destination that meets growing consumer demand in the evolving market.

Key Pet Care E-commerce Companies:

The following are the leading companies in the pet care e-commerce Market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon

- Chewy, Inc.

- PetSmart Inc.

- Petco Health and Wellness Company, Inc.

- zooplus SE

- SmartPak Equine LLC (Henry Schein Inc.)

- Walmart

- BARK

- Target Brands, Inc.

- Alibaba

Recent Developments

-

In October 2024, Infosys partnered with Zooplus, a leading European online pet platform, to enhance its e-commerce capabilities by establishing a Global Capability Center (GCC) in Hyderabad, India. The collaboration will utilize Infosys Topaz, an AI-first offering, to drive AI-led innovation, improve marketing, e-commerce, and supply chain operations, and implement a new order management system.

-

In May 2024, Hill's Pet Nutrition launched a new shopping platform, shop.hillspet.com, alongside a donation program benefiting animal shelters through its Hill's Food, Shelter & Love program and organizations like Greater Good Charities.

-

In November 2023, PetSmart offers a wide range of holiday-themed products and pet services, including advent calendars, apparel, treats, toys, and grooming options, starting at affordable rates. In addition, customers can purchase items from the Chance & Friends collection, with $1 from each purchase going to support PetSmart Charities.

-

In August 2023, Petco Health and Wellness Company, Inc. expanded its partnership with DoorDash to offer Petco's products nationally via the DoorDash Marketplace, providing on-demand delivery. Petco also introduced updates to its app, including a streamlined pet profile and Klarna's "Pay in 4" payment option, enhancing the shopping experience for pet parents.

-

In August 2023, Uckele expanded its product line, transitioning sales to SmartPak.com while maintaining formulas under Uckele by SmartPak.

Pet Care E-commerce Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 101.22 billion

Revenue forecast in 2030

USD 147.59 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Amazon; Chewy, Inc.; PetSmart Inc.; Petco Health and Wellness Company, Inc.; zooplus SE; SmartPak Equine LLC (Henry Schein Inc.); Walmart; BARK; Target Brands, Inc.; Alibaba

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Care E-commerce Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Pet Care E-commerce market report based on animal type, Product, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Treats

-

Litter Products

-

Grooming Products

-

Fashion, Toys, & Accessories

-

Medicines

-

Supplements

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pet care e-commerce market size was estimated at USD 94.89 billion in 2024 and is expected to reach USD 101.22 billion in 2025.

b. The global pet care e-commerce market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 147.59 billion by 2030.

b. North America dominated the pet care e-commerce market with a share of 40.04% in 2024. This is attributable to the increasing number of pet owners, leading to a larger customer base for pet care products and services.

b. Some key players operating in the pet care e-commerce market include Amazon, Chewy, Inc., PetSmart Inc., Petco Health and Wellness Company, Inc., zooplus SE , SmartPak Equine LLC (Henry Schein Inc.), Walmart, BARK, Target Brands, Inc., Alibaba.

b. Key factors driving the pet care e-commerce market growth include increasing pet adoption globally, rapid technological advancements, and rising access to e-commerce platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.