- Home

- »

- Animal Health

- »

-

Pet Diapers Market Size And Share, Industry Report, 2030GVR Report cover

![Pet Diapers Market Size, Share & Trends Report]()

Pet Diapers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Disposable, Washable), By Size (Small, Large), By Pet, By Application, By Distribution Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-116-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Diapers Market Size & Trends

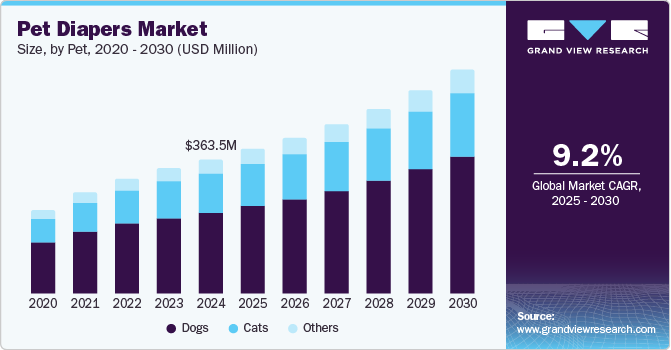

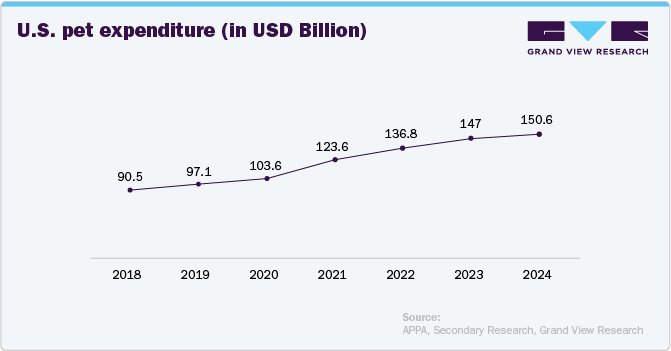

The global pet diapers market size was estimated at USD 363.45 million in 2024 and is projected to grow at a CAGR of 9.15% from 2025 to 2030. Key factors driving market growth include urinary incontinence in dogs and cats, rising companion ownership, growing awareness of health and hygiene, and rising companion humanization. In addition, lifestyle changes such as urban living and smaller homes have increased the need for indoor companion management tools, while conditions such as arthritis, post-surgical recovery, and house training also contribute to the growing adoption of diapers globally.

Dog urine incontinence is commonly managed with the use of diapers. This condition, defined as the involuntary loss of bladder control leading to accidental urine leakage, can occur at any age but is more prevalent in older dogs, particularly those that have been spayed or neutered. As dogs age, they may experience muscle weakening and diminished nerve control, much like humans, which can impact their ability to regulate bodily functions. According to ROYAL CANIN, aging muscles around the urinary tract and decreased muscle control are key contributors to incontinence. The condition is more frequently observed in female dogs than in males, with certain large breeds being more susceptible. Breeds such as Boxers, Dobermans, Giant Schnauzers, Great Danes, and German Shepherds are notably predisposed.

Growing companion humanization is a key driver of the market growth, as more pet owners are treating their companions like family members and prioritizing their comfort, hygiene, and overall well-being. This shift in perception has led to increased spending on premium care products, including diapers that help manage health issues such as incontinence, recovery from surgery, or house training. According to Johns Hopkins University, the COVID-19 pandemic significantly strengthened the human-animal bond, leading to a marked rise in pet-related spending. Several factors fueled this trend, including a surge in pet adoptions and an increased emphasis on companion health. During lockdowns, many individuals and families turned to pets for companionship, driving up demand for companion food, grooming, healthcare products, and services. With more time spent at home, companion owners became more attentive to their pets' health and well-being, contributing to increased investments in pet care.

Moreover, in military dog training programs, Companion diapers are occasionally used as a practical tool for managing hygiene during specific phases of training, especially when dogs are confined for extended periods or recovering from medical procedures. They help maintain cleanliness in controlled environments such as transport vehicles, training facilities, or indoor housing units, where immediate access to outdoor relief may not be feasible. In addition, for female dogs in heat, diapers are used to prevent distractions and maintain sanitary conditions during active training sessions.

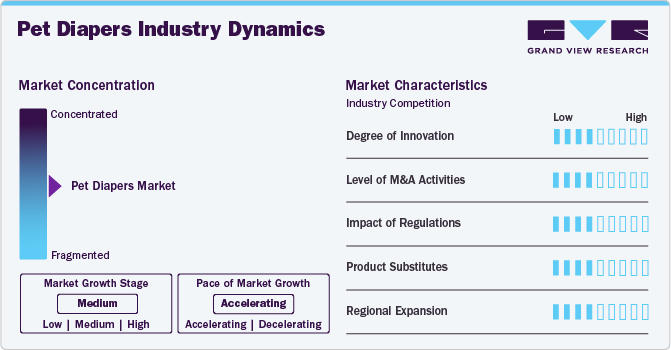

Market Concentration & Characteristics

The market exhibits moderate market concentration, with growth at an accelerating pace. One of the key factors fueling market growth is the increasing companion aging population. For instance, according to an article published by AniCura, in February 2024, in Europe, 31% of dogs are considered senior, compared to just 9% classified as puppies. Similarly, 33% of cats are categorized as senior, while only 10% are categorized as kittens. As companions grow older, they are more prone to incontinence, mobility issues, and health conditions, which can lead to increased need for hygiene products. This rise in demand for diapers is fueled by companion owners seeking ways to maintain their aging pets' comfort and dignity.

The market demonstrates a moderate degree of innovation. New developments in ultra-absorbent materials have improved the comfort and efficiency of diapers. These materials offer enhanced leak protection and quick moisture-wicking capabilities, keeping the companion dry for extended periods. Moreover, some companies are experimenting with smart companion diapers that incorporate sensors to alert companion owners when the diaper is wet. These diapers can connect to apps, offering real-time notifications and better monitoring of companion health conditions like urinary incontinence.

Within the market, there is a moderate level of mergers and acquisitions activity, indicating ongoing consolidation and strategic acquisitions, and partnerships among industry players. Companies may acquire smaller brands to enter growing markets or expand their geographical footprint quickly. This is particularly relevant in regions where companion ownership is rising.

The market experiences a low-to-moderate impact of regulations. The product must meet specific safety guidelines to ensure they are non-toxic, hypoallergenic, and comfortable for animals. Regulatory bodies like the U.S. Food and Drug Administration (FDA) or European Chemicals Agency (ECHA) may have oversight on materials used in production to prevent harm to pets. Many countries emphasize eco-friendly production due to concerns about single-use plastic waste. Regulations may encourage the use of biodegradable materials or impose restrictions on disposable diaper waste.

The market experiences a moderate level of product substitutes. Eco-friendly and reusable, these are often preferred by environmentally conscious consumers. They come in various sizes and designs, and while they require washing, they can be more cost-effective over time. Pee pads are also known as training pads. These absorbent pads are used for indoor elimination training. They can be laid on the floor and replaced frequently, making them a convenient option.

Companies are expanding into new regions, particularly in developing countries where companion ownership is on the rise, and they tap into a growing customer base driven by increasing pet humanization and awareness of pet hygiene. This expansion also allows brands to tailor products to regional preferences, comply with local regulations, and establish partnerships with local retailers and e-commerce platforms.

Product Insights

By product, the disposable segment dominated the market with a share of over 62% in 2024. For pet owners, disposable diapers have a number of advantages, particularly for dogs with specific medical issues or during particular phases of development. Disposable dog diapers promote better hygiene for both pets and their owners, as they are designed for single use and easy disposal. This is especially important when traveling with a dog or dealing with certain medical conditions. Their convenience lies in being easy to pack and discard in regular waste bins, making them ideal for use on the go. In contrast, washable diapers can be more challenging, as they often require access to proper cleaning facilities, which may not always be readily available.

The washable segment is anticipated to grow at the fastest CAGR of about 9.3% from 2025 to 2030. Washable diapers are more environmentally friendly than disposable diapers since they produce less trash overall. Using reusable diapers helps reduce the overall environmental impact and the pressure on landfills. As certain companions may be sensitive to materials or chemicals used in disposable diapers, resulting in skin irritation or allergies, washable diapers minimize the risk of skin irritation. This risk can be reduced by using washable diapers, particularly those made from hypoallergenic materials.

Size Insights

The small size segment dominated the market in 2024. As young puppies do not have full control over their bladder and bowel movements, using diapers helps manage and contain accidents while they learn where it is appropriate to relieve themselves. Moreover, many small puppies live in apartments or houses without immediate access to a yard or outdoor area for bathroom breaks. Diapers can provide a convenient way to manage their elimination needs indoors. In addition, some small puppies may have health conditions that affect their ability to control their bladder or bowel movements. Diapers can be used to manage these situations and prevent messes around the house.

The medium size segment is anticipated to grow at the fastest CAGR of about 9.9 % over the forecast period. Many commonly owned pets fall within the medium size range, including popular breeds like Cocker Spaniels, Bulldogs, and mixed breeds, increasing the overall demand for this diaper size. In addition, companion owners often prefer medium-sized diapers because they strike a balance between comfort and fit, ensuring better leakage protection and ease of use.

Pet Insights

The dogs segment dominated the market in 2024 and is expected to witness lucrative CAGR during the forecast period. Dogs are frequently maintained as indoor companions, and utilizing diapers can help reduce accidents and messes in the home. Moreover, the rising incidence of injuries in dogs involved in agility competitions is anticipated to be a major driver of segment growth, as it highlights the growing demand for specialized care. For example, a February 2024 study published in Frontiers in Veterinary Science reported that orthopedic injuries were the most prevalent health issue (32.9%) among dogs participating in the Yukon Quest International Sled Dog Race. Hence, pets suffering from issues like spinal or joint injuries may experience incontinence or difficulty moving, making pet diapers a practical solution for maintaining hygiene and comfort.

The cats segment is expected to grow at the fastest CAGR over the forecast period. Older cats or those suffering from medical conditions such as incontinence and post-surgical recovery often require diapers to manage accidents and maintain cleanliness. In addition, as more cat owners treat their pets as family members, they are more willing to invest in products that enhance the cats’ comfort and home hygiene.

Application Insights

The urinary incontinence segment dominated the market in 2024 and is anticipated to grow at the fastest CAGR over the forecast period, as it affects a significant number of aging pets and those with underlying medical conditions such as urinary tract infections, diabetes, or neurological disorders. For instance, according to VCA Animal Hospitals, urinary incontinence is estimated to impact more than 20% of all spayed female dogs and as many as 30% of large-breed dogs. While it can occur in any dog, it is most commonly seen in medium to large-breed female dogs that are middle-aged or older.

An incontinent companion often struggles to control their bladder, leading to frequent indoor accidents that can be stressful for both pets and their owners. Pet diapers offer a practical solution to manage this condition, helping to maintain cleanliness, reduce odor, and improve the quality of life for pets while easing the caregiving burden on owners. As awareness of pet incontinence and available management options grows, so does the demand for effective, comfortable diaper products.

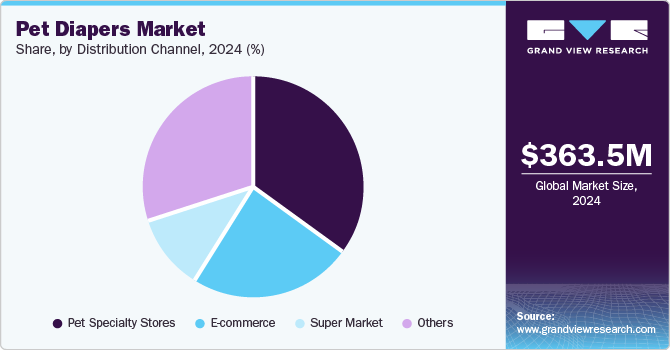

Distribution Channel Insights

By distribution channel, pet specialty stores dominated the market with the largest revenue share in 2024. These stores provide expert advice and personalized service, helping customers choose the most suitable diapers for their pets' health conditions, age, or behavioral issues. The knowledgeable staff can recommend products based on individual requirements, ensuring a better fit and comfort for the pets. In addition, specialty stores often stock premium and specialized products that may not be available in general retail outlets, catering to discerning pet owners seeking high-quality solutions.

The E-commerce segment is expected to grow at the fastest CAGR during the forecast period. E-commerce platforms allow pet diaper manufacturers and sellers to reach a global audience. Pet owners from different geographical locations can access a wide range of pet diaper products, irrespective of their location. This convenience makes it easier for pet owners to find and purchase pet diapers, even if they do not have access to physical pet stores nearby. Many e-commerce platforms offer subscription services, where customers can sign up for regular deliveries of pet diapers. This model encourages customer loyalty and ensures a steady revenue stream for pet diaper manufacturers.

End Use Insights

Individual pet owners dominated the market in 2024, as they increasingly sought solutions to ensure their pets’ comfort, hygiene, and well-being. For example, pet owners of senior dogs with mobility issues or incontinence are turning to diapers to prevent accidents in the home and manage their pets' needs more effectively. Similarly, pet owners with cats recovering from surgery or suffering from health conditions, such as urinary tract infections or kidney disease, are opting for diapers to avoid messes and maintain cleanliness. The growing trend of pet humanization has led to a higher willingness among individual pet owners to invest in products that improve their pets’ quality of life, which in turn fuels the demand for pet diapers.

Similarly, pet owners often use diapers to manage post-operative incontinence in pets that have undergone surgery, such as spaying or neutering. Pet owners who travel frequently or take their pets on road trips also find disposable diapers helpful in maintaining hygiene during the journey. In addition, pet owners of young puppies are still being house-trained, or those managing pets with behavioral issues often turn to diapers as a solution. These varied needs highlight the increasing demand for pet diapers as they seek ways to ensure comfort, cleanliness, and health for their pets.

Regional Insights

North America pet diapers industry held the largest share globally of over 38% in 2024. The number of Americans who own dogs is increasing, which is driving up demand for pet diapers. The region's demand for pet diaper products is expected to increase as the prevalence of urinary incontinence in pets rises. Furthermore, rising pet owner concerns have driven up the cost of pet care, which is further boosting the demand for pet diaper products. The pet population in the region has been aging, and elderly pets may experience health problems that cause incontinence.

U.S. Pet Diapers Market Trends

The pet diapers industry in the U.S. is driven by the increased pet ownership in the U.S.. With more households adopting pets, particularly dogs and cats, the demand for products addressing pet hygiene and health is rising. The trend is particularly strong among urban pet owners, where convenience and cleanliness are essential. The rise in pet humanization, where pets are treated as family members, also contributes to this growth, as owners seek better products to ensure their pets' comfort and well-being.

Europe Pet Diapers Market Trends

The Europe pet diapers industry is driven by the key growth factor of the aging pet population. As pets live longer due to improved healthcare, they face age-related issues such as incontinence and other health-related issues. Pet diapers provide a convenient solution for managing these challenges, improving the quality of life for both pets and owners. In addition, the growing awareness of senior pet care and the willingness of owners to invest in products that enhance their pets' comfort contribute to the rising demand for pet diapers in Europe.

The UK pet diapers industry is driven by the rising awareness about pet health. As pet owners become more health-conscious, they are more likely to invest in products that support their pets’ well-being, including diapers for incontinence or post-surgery recovery. Moreover, access to information about pet health has expanded through online platforms, leading to greater understanding of conditions that might require diapers, like urinary incontinence or behavioral issues.

Asia Pacific Pet Diapers Market Trends

The Asia Pacific pet diapers industry is anticipated to grow at the fastest CAGR during the forecast period. This is due to the growing unmet demand for animal health. Among the Southeast Asian countries that have contributed the most to market growth are India, China, and Japan. Moreover, urbanization has led to smaller living spaces and limited access to outdoor areas for pets to relieve themselves. As a result, pet owners in these areas find pet diapers a convenient solution to maintain cleanliness and hygiene inside their homes.

The China pet diapers industry growth is primarily fueled by the increasing number of pet-owning households, particularly in urban areas where space constraints make outdoor bathroom breaks challenging. In addition, the humanization of pets has led owners to seek premium products that enhance their pets' comfort and hygiene. The rise of pet daycare and grooming centers has also contributed to the demand for pet hygiene products, including diapers.

Latin America Pet Diapers Market Trends

Latin America pet diapers industry growth is driven by the increasing pet humanization. As pet owners begin to view their pets as family members, they become more attentive to their needs, including hygiene. This shift encourages the purchase of pet diapers for older pets, those with health issues, or during training. In addition, the growing trend of treating pets as companions fosters a willingness to invest in specialized products, enhancing comfort and care for pets.

Brazil pet diapers industry is driven by the busy lifestyles of pet households, as pet owners look for convenient solutions to manage their pets' needs. In addition, innovations like flushable and biodegradable diapers have become increasingly popular among environmentally conscious consumers. The availability of these products through various retail channels, including e-commerce platforms, has made pet diapers more accessible to a broader audience, fueling market expansion in Brazil.

MEA Pet Diapers Market Trends

The Middle East & Africa (MEA) pet diapers industry comprises South Africa, Saudi Arabia, the UAE, and Kuwait. House training significantly influences the pet diapers market. Many pet owners use diapers as a tool during the house training process, particularly for puppies or newly adopted pets. Diapers can help manage accidents while the pet learns appropriate bathroom habits. Diapers can be used as a transitional tool for pets that are moving from indoor to outdoor elimination.

South Africa pet diapers industry is significantly influenced by the changing lifestyles, such as busy work schedules and increased urban living. As pet owners seek convenience and ways to manage their pets' needs, products like pet diapers become more appealing. In addition, trends like remote work may lead to more pet owners wanting to accommodate their pets' health and hygiene needs, further driving demand.

Key Pet Diapers Company Insights

The industry is competitive due to the presence of companies offering pet diaper products. These organizations employ a variety of strategies to expand their market presence and share. Partnerships and collaborations, mergers and acquisitions, R&D, regional expansion, product launches, and other activities are some of these initiatives. For instance, Petco Animal Supplies, Inc. offers So Phresh Medium Dry Comfort Disposable Pet Diapers.

Key Pet Diapers Companies:

The following are the leading companies in the pet diapers market. These companies collectively hold the largest market share and dictate industry trends.

- Pet Parents

- The Bramton Company, LLC

- Paw Inspired

- U-PLAY USA LLC

- Simple Solution

- Jack & Jill Dog Diapers

- Four Paws

- Hartz

- Honeycarepets

- OUT! PetCare

Recent Developments

-

In January 2022, Brazilian pet retail giant Petz acquired Petix, a leading manufacturer of premium and sustainable dog pads, in a deal valued at approximately 70 million Reais (around $12.85 million). This acquisition included Petix's U.S. division, WizSmart, which had been experiencing significant growth in the American market.

Pet Diapers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 390.76 million

Revenue forecast in 2030

USD 605.46 million

Growth Rate

CAGR of 9.15% from 2025 to 2030

Historical data

2018 - 2023

Actual data

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, size, application, pet, distribution channel, end use, region

Regions covered

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Pet Parents; The Bramton Company, LLC; Paw Inspired; OUT petcare; U-PLAY USA LLC; Simple Solution; Jack & Jill Dog Diapers; Four Paws; Honeycarepets; Hartz

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Diapers Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global pet diapers market report based on product, pet, size, application, distribution channel, end use, and region:

-

Pet Diapers Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Washable

-

-

Pet Diapers Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

Extra Large

-

-

Pet Diapers Pet Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Pet Diapers Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Urinary Incontinence

-

Females in Heat

-

Post-Surgery Use

-

Others

-

-

Pet Diapers Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Super Market

-

Pet Specialty Stores

-

E-commerce

-

Others

-

-

Pet Diapers End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual Pet Owners

-

Pet Boarding/Day Care Centers

-

Others

-

-

Pet Diapers Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global pet diapers market size was estimated at USD 363.45 million in 2024 and is expected to reach USD 390.76 million in 2025

b. The global pet diapers market is expected to grow at a compound annual growth rate of 9.15% from 2025 to 2030 to reach USD 605.46 million by 2030

b. North America dominated the pet diapers market with a share of over 38.0% in 2024. The number of Americans who own dogs is increasing, which is driving up demand for pet diapers. The region's demand for pet diaper products is expected to increase as the prevalence of diabetes and arthritis in pets rises.

b. Some key players operating in the pet diapers market include Pet Parents, The Bramton Company, LLC, Paw Inspired, OUT petcare, U-PLAY USA LLC, Simple Solution, Jack & Jill Dog Diapers, Four Paws, Honeycarepets, Hartz

b. Key factors that are driving the market growth include the growing pet ownership trend worldwide, the aging pet population, increasing urinary incontinence in pets, and the growing awareness of health and cleanliness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.