- Home

- »

- Next Generation Technologies

- »

-

Process Spectroscopy Market Size, Industry Report, 2030GVR Report cover

![Process Spectroscopy Market Size, Share & Trends Report]()

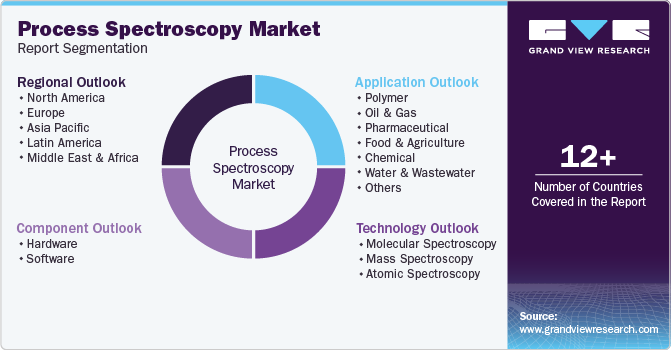

Process Spectroscopy Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (Molecular Spectroscopy, Mass Spectroscopy, Atomic Spectroscopy), By Application (Polymer, Oil & Gas), By Region, And Segment Forecasts

- Report ID: 978-1-68038-561-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Process Spectroscopy Market Summary

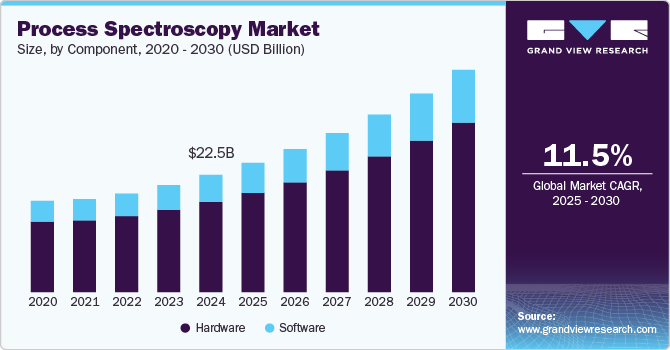

The global process spectroscopy market size was estimated at USD 22,464.0 million in 2024 and is projected to reach USD 42,660.9 million by 2030, growing at a CAGR of 11.5% from 2025 to 2030. The market growth is driven by the increasing adoption of real-time monitoring and automation across industries, enhancing efficiency and compliance.

Key Market Trends & Insights

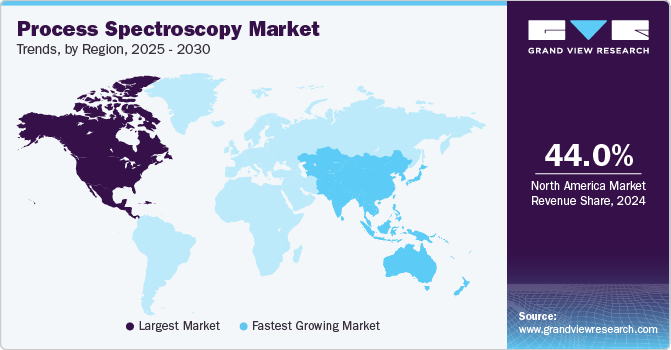

- North America process spectroscopy industry dominated globally in 2024 with a revenue of 44%.

- The U.S. process spectroscopy industry is expected to grow at a CAGR of over 10% from 2025 to 2030.

- By component, the hardware segment held the largest market share of over 76% in 2024.

- By application,the pharmaceutical segment held the largest market share in 2024.

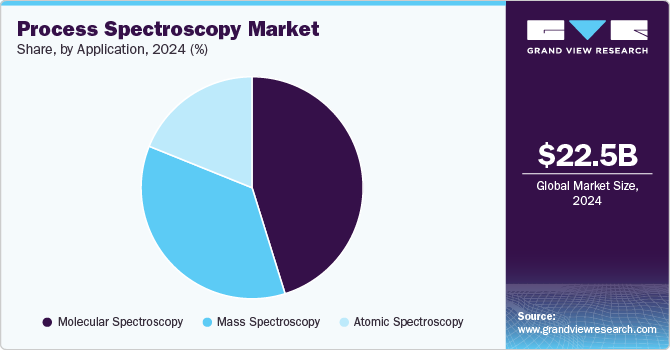

- By technology, the molecular spectroscopy segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 22,464.0 Million

- 2030 Projected Market Size: USD 42,660.9 Million

- CAGR (2025-2030): 11.5%

- North America: Largest market in 2024

In addition, the growing advancements in AI-powered spectral analysis and miniaturized spectroscopy devices are further expanding applications in pharmaceuticals, food safety, and environmental monitoring, thereby driving market expansion.

The adoption of process spectroscopy is steadily increasing across various industries owing to the growing advancements in technology, regulatory requirements, and the growing need for real-time process monitoring. Industries such as pharmaceuticals, food and beverage, chemicals, oil, and gas are integrating spectroscopy techniques such as Near-Infrared (NIR), Raman, and Fourier Transform Infrared (FTIR) spectroscopy to enhance quality control and operational efficiency. This increasing importance of reducing operational expenditure is anticipated to drive the demand for process spectroscopy in the coming years.

In addition, regulatory bodies such as the FDA and EMA are encouraging the use of process analytical technology (PAT), which includes spectroscopy, to ensure product consistency and compliance with safety standards. This has led to a rise in the adoption of spectroscopy for inline and at-line monitoring, reducing the reliance on traditional offline laboratory testing, which is expected to further drive the process spectroscopy industry expansion.

Furthermore, another key trend in the market is the integration of spectroscopy with automation, AI, and IoT. With the increasing availability of smart sensors and cloud-based analytics, industries can now collect, analyze, and interpret spectroscopic data in real time. The miniaturization of spectrometers has also made it easier to incorporate them into production lines, enabling continuous monitoring without disrupting the manufacturing process. These technological advancements are making process spectroscopy more accessible and cost-effective, further driving its adoption.

Moreover, the increasing application of mass spectrometry (MS) in drug discovery and development (DDD) is a significant factor driving the growth of the process spectroscopy industry. Mass spectrometry is widely used in the pharmaceutical industry for analyzing the composition, structure, and purity of chemical compounds, helping researchers identify bioactive molecules and biomarkers in drug discovery. This synergy between MS and process spectroscopy optimizes the drug development process, making it faster, more efficient, and more reliable, thereby fueling the process spectroscopy industry's growth.

Component Insights

The hardware segment held the largest market share of over 76% in 2024. The segment is primarily driven by the increasing demand for real-time analysis and monitoring across various industries. As sectors such as pharmaceuticals, food and beverages, and chemicals face stringent quality control and regulatory requirements, the need for reliable spectroscopic devices has surged. These hardware solutions, including spectrometers and analyzers, enable non-destructive testing and continuous monitoring of chemical compositions during production processes, thereby enhancing product quality and compliance with industry standards.

The software segment is expected to witness the fastest CAGR of 12.0% from 2025 to 2030, driven by the increasing need for efficient data management and analysis capabilities. As industries generate vast amounts of data from spectroscopic measurements, there is a growing demand for software solutions that can streamline workflows, ensure data integrity, and facilitate compliance with regulatory requirements. The integration of advanced analytics tools within spectroscopy software allows for real-time data processing and visualization, enabling organizations to make informed decisions quickly.

Application Insights

The pharmaceutical segment held the largest market share in 2024, owing to stringent regulatory requirements for drug quality and safety. Spectroscopy techniques are essential for real-time monitoring during drug formulation processes, ensuring that products meet the required specifications. The increasing focus on biopharmaceuticals and personalized medicine further emphasizes the need for advanced analytical methods to characterize complex formulations accurately. In addition, the rising adoption of Process Analytical Technology (PAT), which integrates spectroscopic methods into manufacturing processes to enhance product quality control, is a key factor driving the market growth.

The food & agriculture segment is expected to witness the fastest CAGR from 2025 to 2030. The increasing consumer demand for high-quality food products and safety regulations is a key driver behind segmental growth. Spectroscopy enables rapid testing of contaminants, nutritional content, and quality parameters in food production, helping manufacturers maintain compliance with health standards while ensuring consumer safety. In addition, the growing focus on sustainability and traceability within food supply chains is another key trend in the market. Spectroscopic techniques are being utilized to monitor agricultural practices, assess soil health, and optimize crop yields through precise nutrient management.

Technology Insights

The molecular spectroscopy segment held the largest market share in 2024, primarily driven by the increasing demand for advanced analytical techniques across various sectors, particularly pharmaceuticals and biotechnology. These industries rely heavily on molecular spectroscopy for drug development, quality control, and regulatory compliance. For instance, techniques such as Raman spectroscopy are essential for analyzing the molecular composition of drug formulations, ensuring that active pharmaceutical ingredients (APIs) meet stringent quality standards.

The mass spectroscopy segment is anticipated to witness the fastest CAGR from 2025 to 2030. The segmental growth is driven by several key factors, including continuous technological advancements that enhance detection limits, accuracy, and analysis speed. The increasing demand from the biotechnology sector, particularly in proteomics and genomics, underscores mass spectrometry's critical role in studying complex biological systems. In addition, regulatory pressures in industries such as pharmaceuticals, food production, and environmental monitoring necessitate reliable analytical methods to comply with stringent quality and safety standards.

Regional Insights

North America process spectroscopy industry dominated globally in 2024 with a revenue of 44%. The integration of AI and machine learning algorithms with process spectroscopy tools is another key trend in North America. AI can improve data analysis accuracy, automate decision-making, and optimize production processes. This is particularly beneficial in industries like pharmaceuticals, where maintaining consistent product quality is essential. The increasing availability of advanced data analytics platforms is pushing manufacturers to adopt AI-powered spectroscopy solutions. Furthermore, North American companies are investing heavily in AI to maintain a competitive edge in global markets.

U.S. Process Spectroscopy Market Trends

The U.S. process spectroscopy industry is expected to grow at a CAGR of over 10% from 2025 to 2030. The chemical and petrochemical industries in the U.S. are increasingly adopting process spectroscopy solutions for optimizing production workflows and enhancing safety protocols. With rising demand for high-purity chemicals and stricter environmental regulations, spectroscopy technologies are becoming essential for real-time quality control, which is further driving the market expansion.

Europe Process Spectroscopy Market Trends

Europe process spectroscopy industry is expected to grow at a CAGR of over 10% from 2025 to 2030. Europe’s pharmaceutical sector is embracing process spectroscopy for its ability to ensure compliance with strict quality standards, reduce production time, and enhance product safety. Spectroscopic techniques like Raman spectroscopy and near-infrared (NIR) spectroscopy are being used to monitor critical manufacturing parameters in real time. The European Medicines Agency (EMA) supports the use of PAT systems, which is fueling growth in this area.

The process spectroscopy industry in the UK is expected to grow at a significant rate in the coming years. The UK is undergoing a significant push toward digital transformation, and process spectroscopy is playing a key role in this shift. In industries such as pharmaceuticals, food and beverage, and chemicals, the digitalization of quality control processes through real-time spectroscopic analysis is gaining momentum. The government’s support for Industry 4.0 initiatives is encouraging manufacturers to adopt advanced analytical technologies to improve productivity and reduce costs.

The Germany process spectroscopy industry is characterized by the rise of smart factories and Industry 4.0 technologies, which is pushing the demand for real-time, high-precision data that can optimize production lines. Spectroscopy is used in conjunction with automated systems for inline measurements of raw materials and finished products. This integration improves overall process efficiency, reduces human error, and ensures high-quality standards are met. German industries are leading the charge in automation, and process spectroscopy plays a central role in this transformation.

Asia Pacific Process Spectroscopy Market Trends

Asia Pacific process spectroscopy industry is expected to grow at the fastest CAGR of over 12% in 2024. Environmental concerns are pushing countries across the Asia Pacific to adopt process spectroscopy for pollution monitoring and regulation compliance. Spectroscopic techniques are used to detect and quantify pollutants in air, water, and soil in real time. As industrialization accelerates in countries such as China and India, there is a heightened need for stringent environmental monitoring to mitigate pollution risks. Governments are tightening regulations, which is driving the adoption of process spectroscopy as an effective tool for maintaining compliance. This trend is expected to grow as environmental awareness increases and regulatory requirements become more stringent.

The Japan process spectroscopy industry is gaining traction as process spectroscopy is becoming increasingly essential for quality control and material analysis in semiconductor manufacturing. Japan is home to several major electronics and semiconductor manufacturers, and the demand for precision in production processes is high. Spectroscopic techniques like Raman spectroscopy and FTIR are being employed for inspecting raw materials, detecting defects in microelectronics, and ensuring consistent quality in final products.

The China process spectroscopy industry is rapidly expanding, driven by the growing demand for safe, high-quality food products is driving the adoption of process spectroscopy. Spectroscopic techniques are being used in agriculture to monitor crop quality and ensure food safety during production. In the food and beverage industry, spectroscopy is used for quality control during production processes to maintain high standards. As food safety regulations become more stringent, the need for precise and reliable analytical tools is rising. This trend is expected to continue, particularly as China seeks to modernize its agricultural and food production sectors.

Key Process Spectroscopy Company Insights

Some of the key players operating in the market include ABB Ltd. and Agilent Technologies, Inc., among others.

-

ABB Ltd. is a multinational electrical engineering corporation that specializes in electrification, automation, and robotics, providing innovative solutions to enhance efficiency and sustainability across various industries. The company leverages its extensive engineering expertise to offer advanced automation solutions and digital services, positioning itself to meet the growing demand for cost-effective and efficient engineering solutions amid increasing competition in the sector.

-

Agilent Technologies, Inc. is a global player in the fields of life sciences, diagnostics, and applied markets. The company aims to enhance the quality of life by focusing on six key markets: food safety, environmental monitoring, pharmaceuticals, diagnostics, chemicals and advanced materials, and research. The company offers a comprehensive portfolio of spectroscopy instruments and software designed to meet the specific needs of industries such as pharmaceuticals, chemicals, food and beverage, and environmental monitoring.

HORIBA Group and Yokogawa Electric Corporation are some of the emerging market participants in the process spectroscopy industry.

-

HORIBA Group is a prominent manufacturer of precision instruments for measurement and analysis, widely recognized for its significant contributions across various sectors, including automotive testing, environmental monitoring, medical diagnostics, semiconductor manufacturing, and scientific research.

-

Yokogawa Electric Corporation specializes in providing advanced solutions for various industries, including oil and gas, chemicals, pharmaceuticals, and food processing. The company offers innovative products such as Tunable Diode Laser Spectrometers (TDLS) and process gas chromatographs that enable real-time analysis of gases and liquids, enhancing operational efficiency and safety.

Key Process Spectroscopy Companies:

The following are the leading companies in the process spectroscopy market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Agilent Technologies, Inc.

- Bruker Corporation

- BÜCHI Labortechnik AG

- Danaher Corporation

- Endress+Hauser Group Services AG

- FOSS

- HORIBA Group

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

Recent Developments

-

In January 2025, Yokogawa Electric Corporation introduced the AQ6377E Optical Spectrum Analyzer, which provides fast and accurate mid-wave infrared measurements. This release further emphasizes Yokogawa's focus on innovative measurement solutions that support diverse industries and applications. These developments underscore the company's ongoing efforts to lead in the field of analytical instrumentation and contribute to advancements in technology for industrial processes.

-

In January 2025, ABB Ltd. partnered with Sage Geosystems to explore and develop geothermal energy opportunities, aiming to advance sustainable energy solutions. This collaboration focuses on integrating ABB's expertise in electrification and automation with Sage Geosystems' innovative geothermal technologies.

-

In February 2024, Unity’s digital twin professional services arm was acquired by Capgemini Services SAS to accelerate enterprises' digital transformation through real-time 3D technology. This acquisition will enhance Capgemini's capabilities in helping businesses leverage digital twins, which are virtual representations of physical assets, to improve operations, optimize processes, and create new business models using immersive and interactive experiences.

Process Spectroscopy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.78 billion

Revenue forecast in 2030

USD 42.66 billion

Growth rate

CAGR of 11.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

ABB Ltd.; Agilent Technologies; Inc.; Bruker Corporation; BÜCHI Labortechnik AG; Danaher Corporation; Endress+Hauser Group Services AG; FOSS; HORIBA Group; Sartorius AG; Shimadzu Corporation; Thermo Fisher Scientific Inc.; Yokogawa Electric Corporation.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Process Spectroscopy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global process spectroscopy market report based on component, technology, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Spectroscopy

-

NIR

-

FT-IR

-

Raman

-

NMR

-

Others

-

-

Mass Spectroscopy

-

Atomic Spectroscopy

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymer

-

Oil & Gas

-

Pharmaceutical

-

Food & Agriculture

-

Chemical

-

Water & Wastewater

-

Pulp & Paper

-

Metal & Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global process spectroscopy market size was estimated at USD 22.46 billion in 2024 and is expected to reach USD 24.78 billion in 2025.

b. The global process spectroscopy market is expected to grow at a compound annual growth rate of 11.5% from 2025 to 2030 to reach USD 42.66 billion by 2030.

b. North America dominated the process spectroscopy market with a share of over 44% in 2024. This is attributable to increased shale gas production in countries present in the region, such as the U.S. and Canada. Moreover, the growing need for process optimization in pharmaceuticals, chemicals, food, beverages, and oil and gas industries is boosting the market growth in the region.

b. Some key players operating in the process spectroscopy market include Bruker, ABB Group, Buchi Labortechnik AG, Danaher Corporation, Sartorius AG, and Shimadzu Corporation.

b. Key drivers of market expansion include increasing awareness of the importance of quality food and drugs and implementing government regulations and standards by relevant organizations. Spectroscopy-enabled solutions offer the capability to analyze, monitor accurately, and control processes while also enabling the identification of defects in product materials

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.