- Home

- »

- IT Services & Applications

- »

-

RegTech Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![RegTech Market Size, Share & Trends Report]()

RegTech Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Organization (SMEs, Large Enterprises), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-960-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

RegTech Market Summary

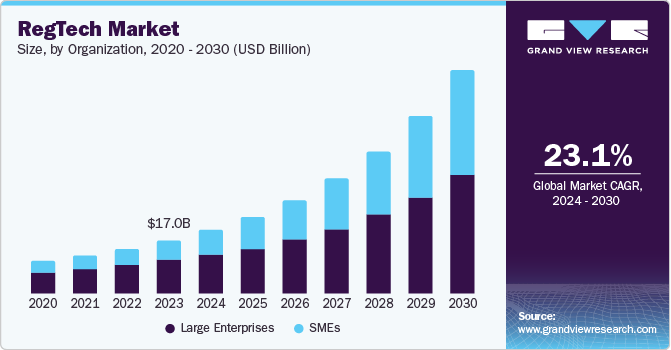

The global RegTech market size was valued at USD 17.02 billion in 2023 and is projected to reach USD 70.64 billion by 2030, growing at a CAGR of 23.1% from 2024 to 2030. The growth of this market is primarily influenced by factors such as rising demand for compliance process automation, increasing requirements for risk management solutions, and rising incidents of data thefts, which lead to growth in demand for improved data management solutions.

Key Market Trends & Insights

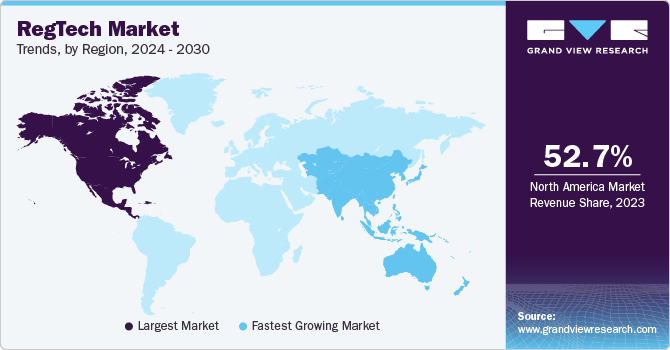

- North America dominated the RegTech market and accounted for a revenue share of 52.7% in 2023.

- The U.S. RegTech market held the largest revenue share of the regional market in 2023

- In terms of deployment, the cloud deployment segment held the largest revenue share of the global market and accounted for 65.5% in 2023.

- By organization, the large enterprise segment dominated the market in 2023.

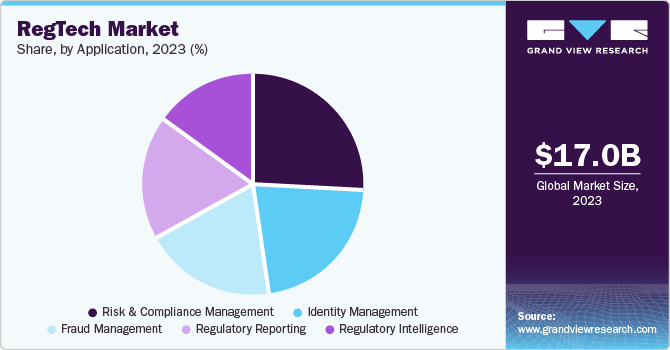

- By application, the risk & compliance management segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 17.02 Billion

- 2030 Projected Market Size: USD 70.64 Billion

- CAGR (2024-2030): 23.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

RegTech market is driven by implementing emerging technologies such as machine learning, artificial intelligence, the Internet of Things, and others to manage the regulatory compliance requirements of organizations. RegTech assists companies in attaining efficiency by reducing regulatory risks and lowering compliance adherence costs. The increasing stringency of regulations and complexity of compliances in multiple industries are expected to develop growth in this market in the coming years.

In May 2024, AMLYZE, a prominent RegTech organization, announced a strategic partnership with Aura Cloud AB, a major company that provides next-generation financial services. A combination of AMLYZE's Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) solutions and Aura Cloud AB's agility and innovation is set to deliver advanced technology solutions, intensifying the ability of multiple businesses to address financial crime through innovation.

Rising fraudulent activities in different industries, growing demand for automation of compliance processes by numerous businesses and increasing instantaneous nature of financial transactions resulting in the need for real-time compliance solutions are contributing to the growth of this market. In addition, encouragement and support by authorities worldwide to adopt RegTech solutions and the rapid rate of digital transformation activities in regions such as Asia Pacific are expected to fuel further developments and growth in opportunities for the RegTech market during the forecast period. Furthermore, the growing number of start-ups entering this industry is also projected to influence the market positively.

Deployment Insights

The cloud deployment segment held the largest revenue share of the global market and accounted for 65.5% in 2023. This segment is primarily driven by factors such as multiple industries' growing adoption of cloud computing technologies, the remote monitoring capacities offered by cloud deployments, enhanced control through networks, and ease of use. The scalability features, rapid deployment, and faster service deliveries are expected to generate greater demand for this segment in the approaching years.

The on-premise deployment segment is expected to experience a significant CAGR during the forecast period. Businesses that focus on complete control, customized solutions, detailed cost predictions before deployments, and offline access to the infrastructure prefer on-premise deployment of RegTech solutions. Full control over data and infrastructure, enhanced security, and minimized risks of data breaches are expected to assist this segment in growth.

Organization Insights

The large enterprise segment dominated the market in 2023. This is attributed to their exclusive characteristics, such as the availability of multiple resources and investment alternatives, in-house IT teams, collaborations with leading services and solutions suppliers in the industry, an existing set of infrastructures, and more. Large enterprises are inclined towards the adoption of advanced RegTech solutions to ensure comprehensive security infrastructure, establish advanced threat detection and response, develop rigorous control over access to organizational networks, and more.

The SMEs segment is expected to experience the fastest CAGR from 2024 to 2030. Growth in this segment is primarily influenced by the recognition of the alarming need for enhanced security control and the requirement for assistance from expert professionals in the smooth implementation of RegTech, especially in areas such as identity and control management and risk and compliance management solutions.

Application Insights

The risk & compliance management segment accounted for the largest revenue share in 2023. This segment is primarily driven by factors such as growing demand for solutions that assist businesses in the protection of assets, data, and critical information, efforts by industries to ensure operational enhancements through effective response during risk exposure. It is also adopted for compliance status monitoring and due to increasing inclination towards implementation of solutions to avoid the likelihood of risks. Some of its key components include identification, assessment, mitigations, and compliance management.

The regulatory intelligence segment is expected to experience the fastest CAGR during the forecast period. As businesses expand their portfolios and presence across different application industries and geographical areas, complexity related to regulatory compliance requirements increases significantly. Regulatory intelligence solutions assist users in collecting, analyzing, and distributing information regarding regulatory policies, guidelines, and requirements. The changing nature of global markets, data-driven organizational structures, the significance of risk mitigations, and the effort to develop competitive advantage are some of the key growth-driving factors for this segment.

Regional Insights

North America dominated the RegTech market and accounted for a revenue share of 52.7% in 2023. Growth of this market is primarily driven by factors such as stringent regulatory compliances put in place by authorities and nations after the 2008 financial crisis, growing demand for tools and solutions driven by advanced technologies such as Artificial Intelligence (AI), machine learning, and others, and enormous growth cybersecurity concerns in the region. Increasing incidences of ransomware, data extortions, cyber attacks on critical infrastructure management systems, and more are expected to enhance demand for this market during the forecast period.

U.S. RegTech Market Trends

The U.S. RegTech market held the largest revenue share of the regional market in 2023. This market is influenced by the presence of robust industrial infrastructure in the country, the reported incidents of cyberattacks, and the increasing demand for storage and asset protection coupled with the requirement for regulatory compliance solutions. Companies operating in the U.S. are increasingly shifting their focus on core business activities while digitizing other functions, including regulatory compliance management. Ease of availability owing to the presence of multiple information & technology businesses offering similar solutions also contributes to the growth of this market.

Europe RegTech Market Trends

Europe was identified as a lucrative region for the RegTech market in 2023. The rapid rate of digital transformations in industries such as banking, healthcare, financial services, insurance, and others, an evolving regulatory scenario in the region, growth in adoption of advanced technologies such as Artificial intelligence, machine learning, etc., and increasing incidences of data breaches and thefts are expected to drive demand for this market during the forecast period.

UK RegTech market held a significant revenue share of the regional industry in 2023. This market is mainly driven by the presence of multiple service providers, increasing demand for regulatory compliance management solutions backed by innovation and advanced technologies, and an increase in ransomware attacks, data thefts, cyber-attacks, and other cybersecurity concerns. Laws and regulations regarding data management and security in the country, such as the General Data Protection Regulation, Data Protection Act 2018 (DPA), and Privacy and Electronic Communications Regulations (PECR), are expected to drive demand for effective regulatory compliance management solutions.

Asia Pacific RegTech Market Trends

Asia Pacific RegTech market is expected to experience the fastest CAGR of 26.9 % in 2023. It is attributed to rapid digitization in the region, government encouragement and support for adopting effective technology solutions for operation excellence, growing demand for efficient RegTech solutions to ensure risk management and regulatory intelligence collection, and businesses' increasing dependability on data-driven decision-making. Complexities in terms of regulations, especially financial industry compliances and data privacy concerns, are expected to influence the growth of this market in the approaching years.

India RegTech market held significant revenue share of regional industry. This market is primarily driven by the regulatory complexities, digital transformations undergoing in numerous industries in the country, and regulations and rules presented by authorities in India, such as the Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI), and Reserve Bank of India (RBI).

Key RegTech Company Insights

Some of the key companies operating in the global RegTech market include ACTICO GmbH, Adenza, ComplyAdvantage, Fenergo, MetricStream and others. To address the industry's growing complexity, major market participants have adopted strategies such as advancements in technology adoption, new product launches, portfolio enhancements, and more.

-

CUBE, a major industry participant, offers business intelligence solutions and services regarding multiple areas such as regulatory inventory, policy and control mapping, regulatory change management, regulatory profiling, obligation management, and more. It serves industries such as banking, asset management, insurance, FinTech, technology, corporate, and highly regulated industries.

-

ComplyAdvantage, one of the emerging key companies in the RegTech industry, offers risk detection and management solutions. Its solutions portfolio includes ComplyAdvantage Mesh, FinCrime Risk Intelligence, and more. Key areas of its excellence include comprehensive fincrime tracking, Customer Screening, Transaction Monitoring, Fraud Detection, Company Screening, Payment Screening, and others.

Key RegTech Companies:

The following are the leading companies in the RegTech market. These companies collectively hold the largest market share and dictate industry trends.

- ACTICO GmbH

- Adenza

- ComplyAdvantage

- Fenergo

- MetricStream

- NICE Actimize

- OneTrust, LLC

- LSEG Data & Analytics

- CUBE Content Governance Global Limited (Thomson Reuters)

- Trulioo

Recent Developments

- In May 2024, CUBE, one of the prominent companies in the RegTech industry, including Automated Regulatory Intelligence (ARI), announced that it had acquired Thomson Reuters’ RegTech business. This acquisition has expanded the company’s customer base substantially while also strengthening its human resources talent pool.

RegTech Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.32 billion

Revenue forecast in 2030

USD 70.64 billion

Growth rate

CAGR of 23.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, organization, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

ACTICO GmbH; Adenza; ComplyAdvantage; Fenergo; MetricStream; NICE Actimize; OneTrust, LLC; LSEG Data & Analytics; nCUBE Content Governance Global Limited (Thomson Reuters); Trulioo

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

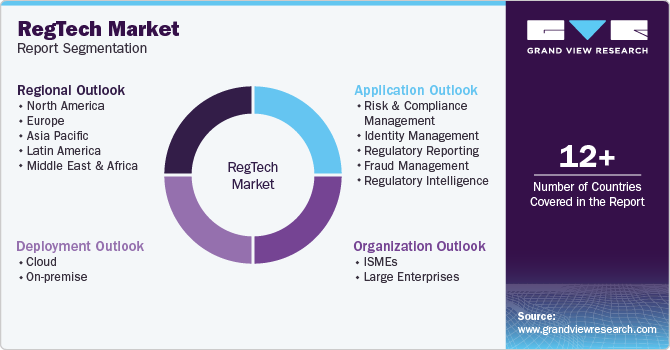

Global RegTech Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the RegTech Market report based on deployment, organization, application, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Organization Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Risk & Compliance Management

-

Identity Management

-

Regulatory Reporting

-

Fraud Management

-

Regulatory Intelligence

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.